connect

people

Annual

Report

2015

Three areas of business for present and future telecommunications

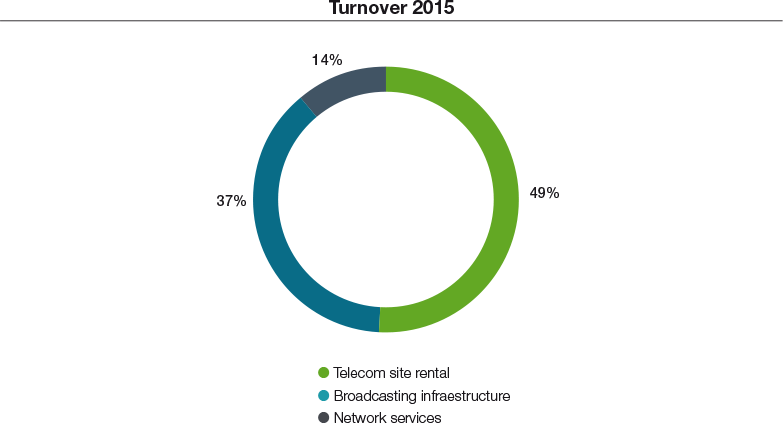

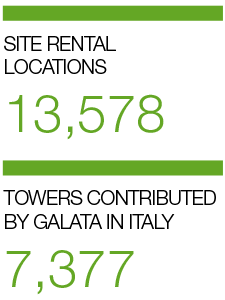

Three areas of business for present and future telecommunicationsThe Group provides its infrastructure management services for telecommunications services in three main business areas: mobile telephony infrastructure, broadcasting networks and Smart Cities, IoT and security (network services). The incorporation of Galata in 2015 (nine months of business) led to infrastructure sharing becoming the main area of business in 2015 in terms of revenue.

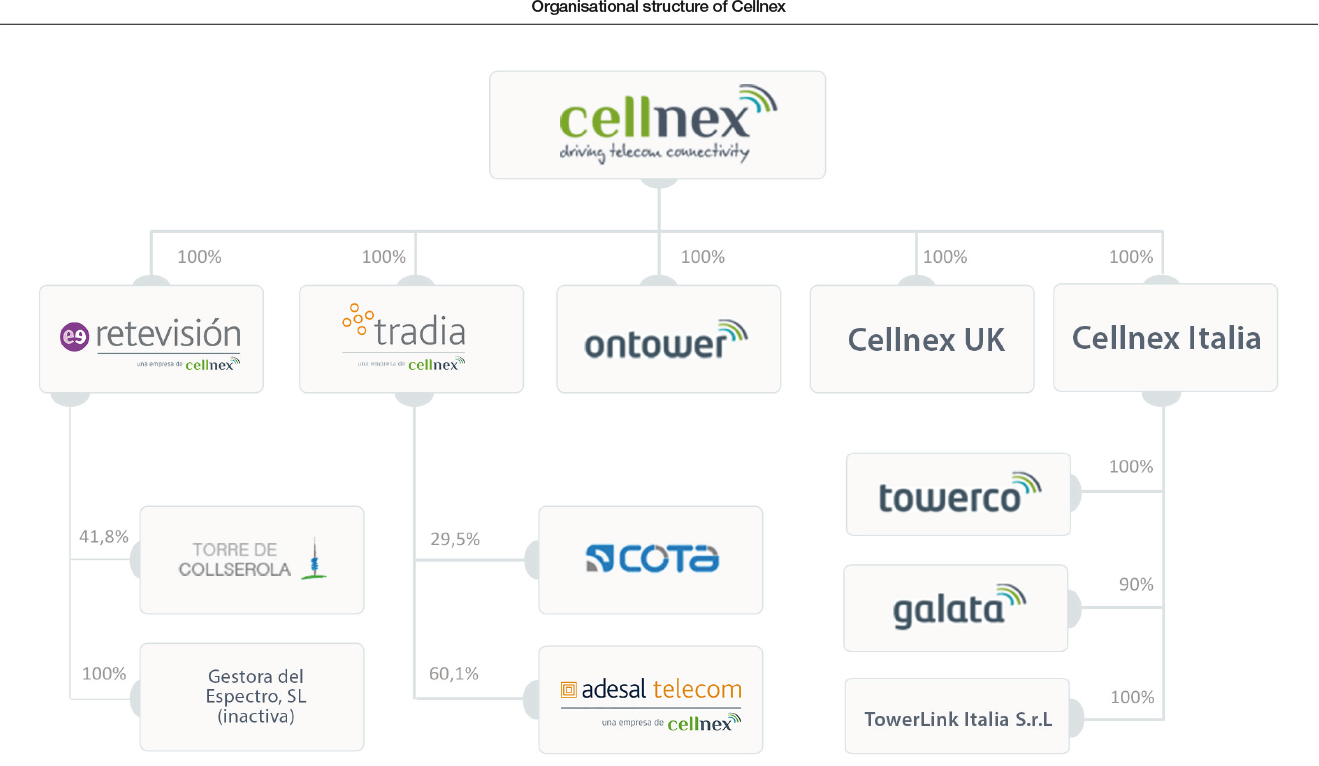

Cellnex provides its services primarily through its subsidiaries and indirectly participates in other companies involved in the telecommunications business.

Telecom site rental

Telecom site rental Collocation of mobile operators’ telecommunications equipment. This is the Company’s main business by turnover. It offers co-location services in its infrastructure to enable mobile operators to install their telecommunications equipment, and provides associated operation and maintenance services. This infrastructure, which is located to provide maximum coverage, is used for different technological needs: mobile communications, wireless broadband or point-to-point connections.

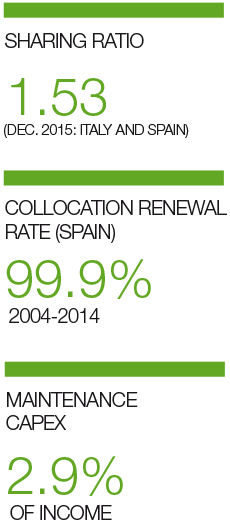

The value creation model involves increasing the sharing ratio of its infrastructure, by incorporating new customers who do not have their own network and view an independent infrastructure operator as the ideal partner for deploying its services, reducing barriers to entry; or by agreements for rationalising existing networks run by a number of telephone operators. Network rationalisation creates efficiencies for the Company itself and for mobile operators.

Most of Cellnex’s revenue comes from co-location services on its infrastructure for customers. These services have historically generated a steady growth of income and have shown low volatility owing to the following characteristics:

Most of Cellnex’s revenue comes from co-location services on its infrastructure for customers. These services have historically generated a steady growth of income and have shown low volatility owing to the following characteristics:

Consistent demand for its sites. Cellnex has been able to incorporate new customers and new equipment for existing customers at its sites, thereby increasing revenue. The current Cellnex portfolio of sites and customers is a robust platform for new business opportunities.

Medium- and long-term co-locations with increasing income from contracts. Cellnex operates on the basis of medium- and long-term collocation contracts, with income normally linked to annual inflation rates.

Capability to create operational synergies. Incorporating new customers into an existing communications site generates additional costs, although their marginal operating costs have remained relatively low.

Contained maintenance investment. Cellnex requires a very small annual investment to maintain its communications sites.

Broadcasting infrastructure

Broadcasting infrastructureThe broadcasting infrastructure business is the Company’s second area of activity by turnover, and the largest in Spain. Its services consist of distribution and transmission of television and radio signals, and the operation and maintenance of broadcasting networks, provision of connectivity for media content, over the top (OTT) broadcasting and other services. Through the provision of broadcasting services, Cellnex has developed a unique know-how that has helped to develop its other activities.

The value-generation model

The value-generation model, in the broadcasting infrastructure business, is characterised by predictable, recurrent and stable cash flows. Economies of scale are key in this activity, and it is a value-creation model based on sharing the transmission network between broadcasters who do not have their own networks, such as mobile operators.

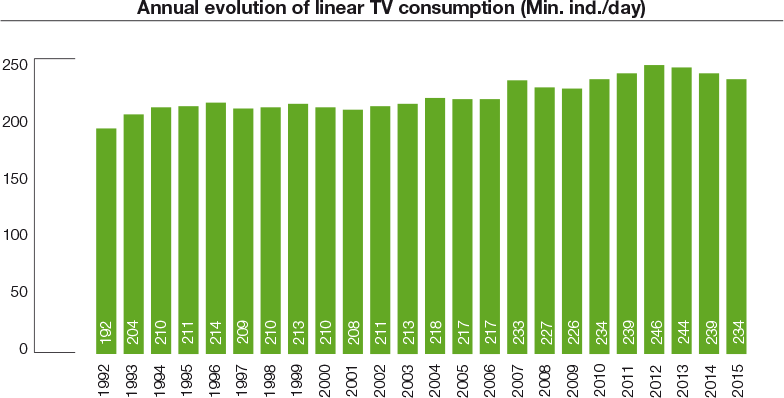

Although it is a mature business in Spain, broadcasting has shown considerable resilience to the adverse economic climate in Spain in recent years. This is because the Company’s income is not directly dependent on macroeconomic factors but rather on demand for radio and television broadcast by broadcasting companies; these services are of particular interest to end-users, as they offer free television and radio.

Digital Dividend

Digital Dividend

In 2015, broadcasting was affected by a number of changes in the industry, mainly the so-called Digital Dividend, and changes in the national broadcasting map. The main regulatory change was Royal Decree 805/2014 of 19 September 2014 approving the National Technical Digital Terrestrial Television Plan, governing certain aspects for the release of the Digital Dividend, consolidating seven national digital terrestrial television multiplexers.

The Digital Dividend is the process of migrating services into the 800 MHz band. Broadcasting services have been discontinued in this frequency band, making it available for mobile services, which has required extensive planning and adaptation in Cellnex’s centres. The process was successfully completed on 31 March 2015. The changes in the broadcasting map, which began with the shutdown of nine national DTT channels, resulted in six new licence contracts being put out to tender and awarded (three of standard definition (SD) and three in high definition (HD).

Cellnex is also the provider for all State broadcasters and is the only operator offering the DTT service nationwide.

Network and other services

Network and other servicesCellnex classifies network and other services into four groups: Connectivity services; public protection and disaster relief (PPDR) services; operation and maintenance; and urban telecommunications infrastructure and other services, notably including the Internet of Things (IoT) and Smart Cities projects.

As an infrastructure operator, Cellnex can facilitate, streamline and accelerate the deployment of these services through efficient connectivity of objects and people, in both rural and urban environments.

Cellnex operates the following networks in Spain: RESCAT, COMDES, Navarra, Secora (Seville), Radiecarm (Murcia), TETRA Galicia, Canal de Isabel II, Ascó nuclear power station, Torremolinos administration, and the motorway concession operators AVASA, AUMAR and AUCAT.

The network and other services activity is a specialised business that creates value through innovative solutions and stable financial flows with attractive growth potential. Given the critical nature of these services - especially those linked to rescue, security and emergency networks - customers of this activity require in-depth technical know-how that is reflected in demanding service-level agreements.

Expansion of the COMDES network in Valencia

In November 2015 an agreement was signed to extend the Valencian Government’s security and emergency network, operated since 2007 by Adesal (in which Cellnex and Aguas de Valencia have a stake). This expansion will improve network coverage in urban areas, including coastal zones and underground spaces such as the metro and tunnels, traffic capacity and access for user applications. The network is currently used by over 140 different fleets; it is equipped with 120 base stations and covers more than 97% of the Valencia region territory for mobile terminals and 87% for portable terminals. The contract allows for the expansion to 172 base stations and an increase in network users from the current 8,000 to 10,000. The network’s voice and data channels have also increased from 837 to 909.

First IoT network in Spain

In 2015 we also succeeded in completing the deployment of the first IoT network with Sigfox technology, which enabled us to conclude an agreement with Securitas Direct for the incorporation of an alarm system into this network and hence to have an alternative communication channel to the conventional GSM network. This solution is a response to the growing threat of frequency inhibitors that neutralise the alarm signals in security equipment. This new infrastructure, known as the alarm transmission network (ATN) which offers national coverage through 1,500 antennas, is the first network to be developed in Europe for private security applications. Some 250,000 alarms are now connected to this innovative network.

Intelligent solutions for Barcelona

Barcelona City Council is one of the main customers of the Smart Cities services under an eight-year contract signed in February 2014 to provide smart solutions as well as the installation of a wireless network throughout the city. This network was rated the fourth best urban public network in the world by the BuzzCity blog in January 2015. Moreover, Barcelona was named the world’s best Smart City in February 2015 (according to ranking published by Juniper Research).

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analysing your browsing habits. If you continue to browse, we understand that you accept the use of these cookies. You can change your configuration or obtain further information here. Accept