Economic performance

Milestones and main figures for the year 2020

Business performance and results

The year that ended on 31 December 2020 highlighted a unique combination of defensive and high quality structural growth with limited exposure to COVID-19, which is possible through consistent and sustainable organic growth, solid financial performance and a tireless focus on integration.

Alternative Performance Measures

An Alternative Performance Measure (APM) is a financial measure of historical or future financial performance, financial position, or cash flows, other than a financial measure defined or specified in the applicable financial reporting framework.

Cellnex believes that there are certain APMs, which are used by the Group’s Management in making financial, operational and planning decisions, which provide useful financial information that should be considered in addition to the financial statements prepared in accordance with the applicable accounting regulations (IFRS-EU), in assessing its performance. These APMs are consistent with the main indicators used by the community of analysts and investors in the capital markets.

In accordance with the provisions of the Guide issued by the European Securities and Markets Authority (ESMA), in force since 3 July, 2016, on the transparency of Alternative Performance Measures, Cellnex below provides information concerning the APMs it considers significant: Adjusted EBITDA; Adjusted EBITDA Margin; Gross and Net Financial Debt; Maintenance, Expansion and M&A CAPEX; and Recurring leveraged free cash flow.

The definition and determination of the aforementioned APMs are disclosed in the accompanying consolidated financial statements and are therefore validated by the Group auditor (Deloitte).

The Company presents comparative financial information from the previous year as detailed in Note 2.f of the accompanying consolidated financial statements.

Adjusted EBITDA

This relates to the “Operating profit” before “Depreciation and amortisation charge” (after adoption of IFRS 16) and after adding back (i) certain non-recurring items (such as COVID donations, redundancy provision, extra compensation and benefit costs, and costs and taxes related to acquisitions) or (ii) certain non-cash items (such as advances to customers, and LTIP remuneration payable in shares).

The Company uses Adjusted EBITDA as an operating performance indicator of its business units and is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders. At the same time, it is important to highlight that Adjusted EBITDA is not a measure adopted in accounting standards and, therefore, should not be considered an alternative to cash flow as an indicator of liquidity. Adjusted EBITDA does not have a standardised meaning and, therefore, cannot be compared to the Adjusted EBITDA of other companies.

As at 31 December 2020 and 2019, respectively, the amounts are as follows:

Adjusted EBITDA (Thousands of Euros)

|

|

31 December 2020 |

31 December 2019 restated |

|

Telecom Infrastructure Services |

1,272,583 |

694,248 |

|

Broadcasting infrastructure |

227,257 |

235,383 |

|

Other Network Services |

104,932 |

101,214 |

|

Operating income |

1,604,772 |

1,030,845 |

|

|

|

|

|

Staff costs |

(165,861) |

(144,171) |

|

Repairs and maintenance |

(50,783) |

(35,596) |

|

Leases |

(11,118) |

(11,102) |

|

Utilities |

(102,359) |

(84,798) |

|

General and other services |

(142,297) |

(111,872) |

|

Depreciation and amortisation charge |

(974,064) |

(501,841) |

|

Operating profit |

158,290 |

141,465 |

|

|

|

|

|

Depreciation and amortisation |

974,064 |

501,841 |

|

Non-recurring and non-cash expenses |

45,712 |

38,461 |

|

Advances to customers |

3,659 |

3,790 |

|

Adjusted operating profit before depreciation and amortisation charge (Adjusted EBITDA) |

1,181,725 |

685,557 |

Non-recurring and non-cash expenses, and advances to customers at 31 December 2020 and 2019 are set out below (see Note 20.d of the accompanying consolidated financial statements):

- COVID donations, which relate to a financial contribution by Cellnex to different institutions in the context of the Coronavirus Pandemic (non-recurring item), amounted to EUR 5,620 thousand.

- Redundancy provision, which mainly includes the impact in 2020 and 2019 year-end derived from the reorganisation plan detailed in Note 19.a of the accompanying consolidated financial statements (non-recurring item), amounted to EUR 4,912 thousand (EUR 5,552 thousand at 2019 year-end).

- LTIP remuneration payable in shares, which corresponds to the LTIP remuneration accrued at the year-end, which is payable in Cellnex shares (See Note 19.a of the accompanying consolidated financial statements, non-cash item), amounted to EUR 8,455 thousand (EUR 5,962 thousand at 2019 year-end), and extra compensation and benefits costs, which corresponds to extra non-conventional bonus for the employees (non-recurring item), amounted to EUR 316 thousand (EUR 5,117 thousand at 2019 year-end).

- Service contract cancellation cost, which related to the cancellation expense concerning the change of the administration and treasury services provider, amounted to EUR 1,545 thousand at 2019 year-end. This change took place in order to implement a new industrial model at Group level, to guarantee the optimisation and standardisation of policies, processes and procedures in all the countries (non-recurring item).

- Advances to customers, which Includes the amortisation of amounts paid for sites to be dismantled and their corresponding dismantling costs, amounted to EUR 3,659 thousand (EUR 3,790 thousand at 2019 year-end). These costs are treated as advances to customers in relation to the subsequent services agreement entered into with the customer (mobile telecommunications operators). These amounts are deferred over the life of the service contract with the operator as they are expected to generate future economic benefits in existing infrastructures (non-cash item).

- Costs and taxes related to acquisitions, which mainly includes expenses incurred during acquisition processes (non-recurring item), amounted to EUR 26,409 thousand (EUR 20,285 thousand at 2019 year-end).

Adjusted EBITDA Margin

Corresponds to Adjusted EBITDA divided by total revenues excluding elements pass-through to customers (mostly electricity) from both expenses and revenues.

According to the above, the Adjusted EBITDA Margin as at 31 December 2020 and 2019 was 75% and 68%, respectively.

Cellnex Telecom

Gross financial debt

The Gross financial debt corresponds to “Bond issues and other loans”, “Loans and credit facilities” and “Lease liabilities”, but does not include any debt held by Group companies registered using the equity method of consolidation, “Derivative financial instruments” or “Other financial liabilities”.

According to the above, its value as at 31 December 2020 and 2019, respectively, is as follows:

Gross financial debt (Thousands of Euros)

|

|

31 December 2020 |

31 December 2019 restated |

|

Bond issues and other loans (Note 15) |

7,534,957 |

3,501,124 |

|

Loans and credit facilities (Note 15) |

1,854,488 |

1,636,450 |

|

Lease liabilities (Note 16) |

1,762,819 |

1,140,188 |

|

Gross financial debt |

11,152,264 |

6,277,762 |

Net financial debt

Relates to “Gross financial debt” minus “Cash and cash equivalents”

Together with “Gross financial debt”, the Company uses “Net financial debt” as a measure of its solvency and liquidity as it indicates the current cash and equivalents in relation to its total debt liabilities. From the net financial debt, common used metrics are calculated such as the “Annualised Net Debt/12-month forward looking Adjusted EBITDA” which is frequently used by analysts, investors and rating agencies as an indication of financial leverage.

The “Net financial debt” on 31 December 2020 and 2019 is detailed in Section “Liquidity and Capital Resources” of this Consolidated Management Report.

Capital expenditures

Maintenance capital expenditures

Corresponds to investments in existing tangible or intangible assets, such as investment in infrastructure, equipment and information technology systems, and are primarily linked to keeping sites in good working order, but excludes investment in increasing the capacity of sites.

Expansion (or organic growth) capital expenditures

Includes site adaptation for new tenants, ground leases (cash advances), and efficiency measures associated with energy and connectivity, and early site adaptation to increase the capacity of sites. Thus, it corresponds to investments related to business expansion that generates additional Recurring Leveraged Free Cash Flow (including decommissioning, telecom site adaptation for new tenants and prepayments of land leases).

Expansion capital expenditures (Build to Suit programmes)

Corresponds to committed build-to-suit programmes (consisting of sites, backhaul, backbone, edge computer centres, DAS nodes or any other type of telecommunication infrastructure as well as any advanced payment related to it) as well as Engineering Services with different customers. Any ad-hoc maintenance capital expenditure that might be required by any service line may be included.

M&A capital expenditure

Corresponds to investments in shareholdings of companies (excluding the amount of deferred payments in business combinations that are payable in subsequent periods) as well as significant investments in acquiring portfolios of sites or lands (asset purchases).

Total capital expenditure for the year ended 31 December 2020 and 2019, including property, plant and equipment, intangible assets, advance payments on land leases and business combinations are summarised as follows:

Capital expenditures (Thousands of Euros)

|

31 December 2020 |

31 December 2019 |

|

|

Maintenance capital expenditures |

52,381 |

40,556 |

|

Expansion (or organic growth) capital expenditures |

145,618 |

97,110 |

|

Expansion capital expenditures (Build to Suit programmes) |

559,417 |

229,500 |

|

M&A capital expenditures |

5,619,565 |

3,663,285 |

|

Total Investment |

6,376,981 |

4,030,451 |

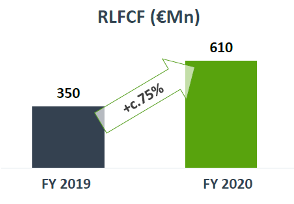

Recurring leveraged free cash flow

The Company considers recurring leveraged free cash flow to be one of the most important indicators of its ability to generate stable and growing cash flows which allows it to guarantee the creation of value, sustained over time, for its shareholders. The criteria used to calculate the Recurring leveraged free cash flow is the same as the previous year.

At 31 December 2020 and 2019 the Recurring Leveraged Free Cash Flow (“RLFCF”) was calculated as follows:

Recurring Leveraged Free Cash Flow (Thousands of Euros)

|

31 December 2020 |

31 December 2019 |

|

|

Adjusted EBTIDA (1) |

1,181,725 |

685,557 |

|

Payments of lease instalments in the ordinary course of business and interest payments (2) |

(365,483) |

(192,038) |

|

Maintenance capital expenditures (3) |

(52,381) |

(40,556) |

|

Changes in current assets/current liabilities (4) |

(10,426) |

(99) |

|

Net payment of interest (without including interest payments on lease liabilities) (5) |

(104,593) |

(76,925) |

|

Income tax payment (6) |

(38,577) |

(25,262) |

|

Net dividends to non-controlling interests (7) |

- |

(699) |

|

Recurring leveraged free cash flow (RLFCF) |

610,265 |

349,978 |

|

Expansion (or organic growth) capital expenditures (8) |

(145,618) |

(97,110) |

|

Expansion capital expenditures (Build to Suit programmes) (9) |

(559,417) |

(229,500) |

|

M&A capital expenditures (cash only) (10) |

(5,509,513) |

(3,659,031) |

|

Non-Recurrent Items (cash only) (11) |

(36,941) |

(30,827) |

|

Net Cash Flow from Financing Activities (12) |

7,909,446 |

5,597,960 |

|

Other Net Cash Out Flows (13) |

32,250 |

(35,785) |

|

Net Increase of Cash (14) |

2,300,472 |

1,895,685 |

Revenues and Results

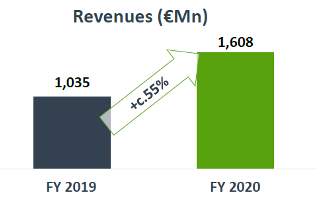

Income from operations for the year ended on 31 December 2020 was EUR 1,605 million, which represents a 55% increase over 2019 year-end. This increase was due mainly to the consolidation of the business combinations and asset acquisitions performed in the second half of 2019 in France and Italy (Iliad), Switzerland (Salt), the UK (BT), Ireland (Cignal) and Spain (Orange), as well as the acquisition of Omtel, Edzcom, On Tower UK subgroup and On Tower Portugal during 2020 (see Note 6 of the accompanying consolidated financial statements).

Telecom Infrastructure Services income increased by 83% to EUR 1,273 million due to both the organic growth achieved and the acquisitions performed during the second half of 2019 and during 2020, as mentioned above. This business segment is characterised by solid growth driven by increasing demand for wireless data communication services, and by the growing interest of mobile network operators (MNO) in developing high-quality networks that fulfil their consumers' needs for uninterrupted coverage and availability of wireless bandwidth (based on new Long-Term Evolution “LTE” technologies), in the most efficient way. In recent years the Group has consolidated its infrastructure network and long-term strategic relationships with its main customers, the mobile network operators. In addition to its current portfolio, the Group’s Management has identified several potential acquisitions which are currently being analysed using its demanding capital deployment criteria. The Group owns a high-quality asset portfolio made up of selective assets and performs the subsequent streamlining and optimisation of the tower infrastructure for Telecom Infrastructure Services. Its main added value proposals in this business segment consist of providing services to additional mobile network operators in its towers and therefore streamlining the customer’s network. By increasing the ratio of customers to infrastructures, the Group will generate additional income with little additional costs. This network streamlining may generate significant efficiencies for the Group and for the MNOs. In this context, the Group’s organic growth strategy is based on four different business models: (i) multiple allocation, (ii) build-to-suit, (iii) rationalisation, and (iv) tower-adjacent assets.

Income from the Broadcasting Infrastructure business amounted to EUR 227 million, which represents a 3% decrease compared with 2019 year-end. It should be noted that Cellnex completed last year a general cycle of renewal of contracts with customers in the broadcasting area, although in recent years the relative weight of this segment has decreased significantly. The strategy in this business segment is to maintain its strong market position while capturing potential organic growth. Cellnex plans to maintain its leading position in the Spanish national digital TV sector (in which it is the sole operator of national TV MUXs) by leveraging its technical knowledge of infrastructure and network infrastructure, its market understanding and the technical expertise of its staff. A significant portion of the contracts of the Group with operators are inflation-linked and some do not have a minimum limit or floor. The Group experienced, in the past, a high rate of renewal for the contracts in this business segment, although price pressure from customers can be possible when renegotiating contracts. The Group plans to continue working closely with regulatory authorities in relation to technological developments in both the TV and radio broadcasting markets and to leverage its existing infrastructure and customer relationships to obtain business in adjacent areas where it benefits from competitive advantages.

Other Network Services increased its income by 4%, to EUR 105 million. This constitutes a specialised business that generates stable cash flows with attractive potential for growth. Considering the critical nature of the services in which the Group collaborates, its customers require in-depth technical know-how that is reflected in the demanding service level agreements. The Group considers that it has a privileged market presence and geographical distribution, established relationships with government agencies and excellent infrastructure for emergencies and public services. The Group aims to expand and increase its data transmission connectivity services, for both MNOs backhaul and corporate data access, by focusing on services and solutions where its valuable network can be leveraged to differentiate its proposition from its competitors, and by taking advantage of its favourable position to provide mutualised high speed data transmission to MNOs in its infrastructures. The Company plans to leverage its infrastructure and frequency planning know-how to design, roll out and operate advanced telecom services for public administrations in the field of PPDR networks, including TETRA and LTE services networks. The Company aims to be a frontrunner in new types of infrastructure services including urban telecom infrastructure solutions. In addition, Cellnex provides fibre connectivity in Spain following the acquisition of XOC. Its main customer is the public administration.

The transactions performed during 2019 and 2020, especially in the Telecom Infrastructure Services business segment, has helped boost operating income and operating profit, with the latter also impacted by the measures to improve efficiency and optimise operating costs.

In line with the increase in revenue, Adjusted EBITDA was 72% higher than 2019 year-end, reflecting the Group’s capacity to generate cash flows on a continuous basis.

In this context of intense growth, the “Depreciation and amortisation” expense has increased substantially, by 94% compared to the 2019 year-end, as a result of the higher fixed assets (property, plant and equipment, and intangible assets) in the accompanying consolidated balance sheet, after the business combinations undertaken during the second half of 2019 and during 2020.

Moreover, the net financial loss increased by 83%, derived largely from the new bond issuances carried out during 2020. Likewise, income tax for 2019 included the effect of updating the tax rate of certain subsidiaries, which resulted in a positive impact of €19 million in the consolidated income statement of the previous year.

Therefore, the net loss attributable to the Parent Company on 31 December 2020 amounted to EUR 133 million due to the substantial effect of higher amortisations and financial costs associated with the intense acquisition process and the consequent geographic footprint expansion, as mentioned above. This scenario remains consistent with the current strong growth that the Group continues to experience and, as mentioned in the 2019 Annual Results Presentation, the group expects to continue experimenting a net loss attributable to the parent company in the coming quarters.

Consolidated Balance Sheet

Total assets on 31 December 2020 stood at EUR 24,070 million, a 85% increase compared with the 2019 year-end, mainly as a result of the acquisition of Omtel, Edzcom, On Tower UK subgroup, On Tower Portugal, CK Hutchison Networks (Austria), CK Hutchison Networks (Ireland) and On Tower Denmark. Around 70% of total assets concern property, plant and equipment and other intangible assets, in line with the nature of the Group’s business related to the management of terrestrial telecommunications infrastructure. The increase in property, plant and equipment and intangible assets is due mainly to the aforementioned acquisitions.

Total investments executed in 2020 amounted to EUR 6,377 million, in part for investments linked to generating new revenue streams, for the incorporation of new assets in Portugal, the UK, Finland, Austria, Denmark and Ireland, for the continued integration and roll-out of new sites in France, as well as improvements in efficiency, and maintenance of installed capacity.

Consolidated net equity on 31 December 2020 stood at EUR 8,933 million, a 77% increase compared with the 2019 year-end, due largely to the capital increase of EUR 4,000 million carried out in July 2020.

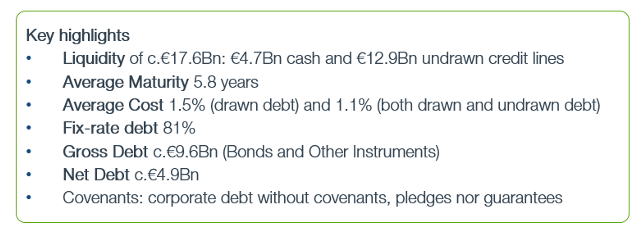

In relation to bank borrowings and bond issues, on 31 December 2020, Cellnex’s debt structure is marked by flexibility, low cost and high average life. The average life of debt is 5.8 years, the approximate average cost is 1.6% (drawn debt), and 81% at a fixed rate.

The Group's net financial debt as of 31 December 2020 stood at EUR 6,500 million compared to EUR 3,926 million at the end of 2019 (restated). Likewise, on 31 December 2020, Cellnex had access to immediate liquidity (cash & undrawn debt) to the tune of approximately EUR 17.6 billion (EUR 6.6 billion at the end of 2019).

Cellnex holds a long-term “BBB-” (Investment Grade) with stable outlook according to the international credit rating agency Fitch Ratings Ltd as confirmed by a report issued on 15 April 2020 and a long-term “BB+” with stable outlook according to the international credit rating agency Standard & Poor’s Financial Services LLC as confirmed by a report issued on 17 November 2020.

Consolidated cash flow generation

Net Payment of Interest

The reconciliation of the caption “Net payment of interest” from the Consolidated Statement of Cash Flows corresponding to the year ended on 31 December 2020 and 2019, with the “Net financial loss” in the Consolidated Income Statement is as follows:

|

|

31 December 2020 |

31 December 2019 restated |

|

Interest Income |

4,969 |

1,254 |

|

Interest Expense |

(362,771) |

(197,193) |

|

Bond & loan interest accrued not paid |

89,260 |

54,462 |

|

Amortised costs – non-cash |

64,075 |

38,726 |

|

Interest accrued in prior year paid in current year |

(54,462) |

(44,582) |

|

Net payment of interest as per the Consolidated Statement of Cash Flows (1) |

(258,929) |

(147,333) |

Income Tax Payment

The reconciliation of the caption “Payment of income tax” from the Consolidated Statement of Cash Flows corresponding to the year ended on 31 December 2020 and 2019, with the “Income tax” in the Consolidated Income Statement is as follows:

|

|

31 December 2020 |

31 December 2019 |

|

Current tax expense |

(31,828) |

(14,555) |

|

Payment of income tax previous year |

(5,689) |

(3,950) |

|

Receivable of income tax previous year |

- |

1,048 |

|

Income tax (receivable)/payable |

3,176 |

(5,997) |

|

Others |

(4,236) |

(1,808) |

|

Payment of income tax as per the Consolidated Statement of Cash Flows |

(38,577) |

(25,262) |

Business indicators

Information relating to the deferment of payments to suppliers

See Note 17 of the accompanying consolidated financial statements.

Use of financial instruments.

See Note 4 of the accompanying consolidated financial statements.

Sustained value creation

Creating value in the company

Cellnex´s Financial Structure

Cellnex’s borrowing is represented by a combination of loans, credit facilities and bond issues. At 31 December 2020, the total limit of loans and credit facilities available was €14,783,715 thousand (€5,877,303 as of 31 December 2019), of which €3,324,205 thousand in credit facilities and €11,459,225 thousand in loans (€2,290,227 in credit facilities and €3,587,076 thousand in loans as of 31 December 2019).

Cellnex Financial Structure (1) (Thousands of Euros):

|

Notional as of 31 December 2020 (*) |

Notional as of 31 December 2019 (*) |

|||||

|

Limit |

Drawn |

Undrawn |

Limit |

Drawn |

Undrawn |

|

|

Bond issues and other loans |

7,729,340 |

7,729,340 |

- |

3,600,500 |

3,600,500 |

- |

|

Loans and credit facilities |

14,783,431 |

1,864,215 |

12,919,216 |

5,877,303 |

1,643,971 |

4,233,332 |

|

Total |

22,512,771 |

9,590,901 |

12,919,216 |

9,477,803 |

5,244,471 |

4,233,332 |

As of 31 December 2020, Cellnex weighted average cost of debt (considering both the drawn and undrawn borrowings) was 1.1% (1.5% as at 31 December 2019) and the weighted average cost of debt (considering only the drawn down borrowings) was 1.6% (1.7% as at 31 December 2019).

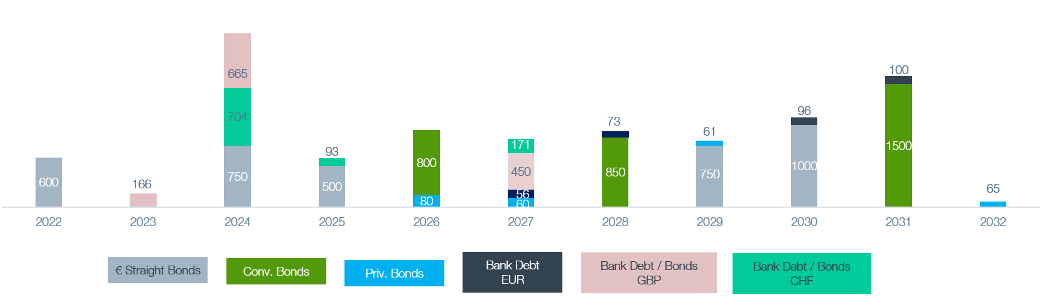

The following graph sets out Cellnex’s notional contractual obligations in relation to borrowings as of 31 December 2020 (€ million):

In accordance with the financial policy approved by the Board of Directors, the Group prioritises securing sources of financing at Parent Company level. The aim of this policy is to secure financing at a lower cost and longer maturities while diversifying its funding sources. In addition, this encourages access to capital markets and allows greater flexibility in financing contracts to promote the Group’s growth strategy.

Liquidity and Capital Resources

Net financial debt

“Net financial debt” on 31 December 2020 and 2019 is as follows:

Net financial debt (Thousands of Euros)

|

31 December 2020 |

31 December 2019 restated |

|

|

Gross financial debt (1) |

11,152,264 |

6,277,762 |

|

Cash and cash equivalents (Note 11) |

(4,652,027) |

(2,351,555) |

|

Net financial debt |

6,500,237 |

3,926,207 |

On 31 December 2020, net financial debt amounted to EUR 6,500 million (EUR 3,926 million in 2019 restated), including a consolidated cash and cash equivalents position of EUR 4,652 million (EUR 2,352 million in 2019).

Net financial debt evolution

Net financial debt evolution (Thousands of Euros)

|

31 December 2020 |

31 December 2019 restated |

|

|

Beginning of Period |

3,926,207 |

3,166,204 |

|

Recurring leveraged free cash flow |

(610,265) |

(349,978) |

|

Expansion (or organic growth) capital expenditures |

145,618 |

97,110 |

|

Expansion capital expenditures (Build to Suit programmes) |

559,417 |

229,500 |

|

M&A capital expenditures (cash only) |

5,509,513 |

3,659,031 |

|

Non-recurrent Items (cash only) |

36,941 |

30,827 |

|

Other net cash out flows |

(32,250) |

35,785 |

|

Payment of dividends (1) |

29,281 |

26,620 |

|

Treasury shares (2) |

6,509 |

- |

|

Issue of equity instruments |

(4,018,436) |

(3,683,375) |

|

Net repayment of other borrowings (3) |

1,014 |

26,978 |

|

Changes in lease liabilities (4) |

622,631 |

613,851 |

|

Accrued interest not paid and others (5) |

324,057 |

73,654 |

|

End of Period |

6,500,237 |

3,926,207 |

Liquidity availability

The breakdown of the available liquidity on 31 December 2020 and 2019 is as follows:

|

31 December 2020 |

31 December 2019 |

|

|

Available in credit facilities (Note 13) |

12,919,216 |

4,233,332 |

|

Cash and cash equivalents (Note 11) |

4,652,027 |

2,351,555 |

|

Available liquidity |

17,571,243 |

6,584,887 |

Regarding the Corporate Rating, on 31 December 2020, Cellnex holds a long-term “BBB-” (Investment Grade) with stable outlook according to the international credit rating agency Fitch Ratings Ltd as confirmed by a report issued on 15 April 2020 and a long-term “BB+” with stable outlook according to the international credit rating agency Standard & Poor’s Financial Services LLC as confirmed by a report issued on 17 November 2020.

Cellnex’s tax contribution

The Cellnex group’s tax strategy policy establishes the fundamental guidelines governing the decisions and actions of the Cellnex Group in tax matters in line with the basic principle of regulatory compliance, i.e. compliance with the tax obligations the group is required to meet in each of the countries and territories where it does business. For this purpose, the group fosters relationships with tax administrations based on the duties of transparency, good faith and loyalty, and mutual trust. The Group's Tax Strategy was approved by the Board of Directors of Cellnex Telecom in 2016

The Cellnex Group Audit Committee is the body responsible for periodically reviewing this Policy, making any observations or proposals for modification and improvement it deems appropriate to the Board of Directors.

The Fiscal Risk Management and Control Framework is coordinated and centralized by the Fiscal Department and replicates a model of three lines of defense.

In its goal to gain public interest and generate value for its shareholders, it is important that Cellnex always observes this basic principle of respecting and complying with tax regulations when making business decisions to avoid tax risks and inefficiencies.

In this regard, Cellnex has adhered to the Code of Good Tax Practices of the Spanish Tax Agency. This Code contains recommendations voluntarily followed by the companies, to improve the application of the Spanish tax system by raising legal certainty, reciprocal co-operation based on good faith and well-placed trust between the Spanish Tax Agency and companies, and the application of responsible tax policies in companies with the consent of the board of directors.

Also in 2020 there was an update of a new version of the Internal Control System Over Financial Information that was rolled out to provide reasonable assurance regarding the reliability of the financial information published in the markets.

For 2021, a proposal is being prepared for the improvement and adaptation of the Tax Policy and an expansion of its scope, as well as its management model.

Moreover, the deployment and international roll-out to countries of the structure and methodology of the Tax Control Framework that exists in Corporate will continue in 2021, with special focus on the possible requirements in tax matters of the different countries (in the case of the UK, for example, there are specific requirements such as the appointment of a Senior Accounting Officer, specific policies and processes).

In accordance with the above, Cellnex is currently analysing UNE standard 19602 to identify existing gaps and improvements between Cellnex tax compliance management system and the UNE standard to develop the necessary actions for a possible certification in the future.

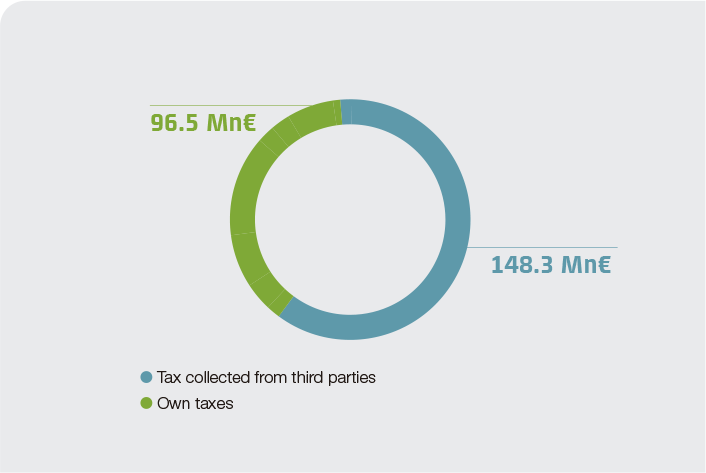

Cellnex is also sensitive to and aware of its responsibility in the economic development of the territories in which it operates, helping to create economic value by paying taxes, both on its own account and those collected from third parties. Accordingly, it makes a substantial effort and pays great attention to fulfilling its tax obligations, in accordance with the applicable rules in each territory.

Following OECD methodology on cash basis accounting, Cellnex's total tax contribution in 2020 was € 244.8 million (106.5 in FY 2019). Own taxes are those paid by the company and third-party taxes are those collected and paid into the various tax offices on behalf of such third parties, therefore they are not a cost to the company.

Cellnex’s Tax Contribution (Mn €)

|

|

31 December 2020 |

31 December 2019 |

||||

|

Own taxes(1) |

Tax collected from third parties (2) |

Total |

Own taxes(1) |

Tax collected from third parties (2) |

Total |

|

|

Spain |

33.4 |

36.3 |

69.7 |

25.5 |

64.2 |

89.7 |

|

Italy |

19.2 |

37.8 |

57.1 |

38.7 |

27.6 |

66.3 |

|

France |

7.5 |

20.0 |

27.5 |

2.7 |

1.0 |

3.7 |

|

Netherlands |

7.7 |

10.4 |

18.1 |

4.6 |

9.9 |

14.5 |

|

United Kingdom |

22.3 |

4.7 |

27.0 |

1.0 |

1.6 |

2.6 |

|

Switzerland |

4.3 |

8.0 |

12.2 |

9.2 |

1.3 |

10.5 |

|

Ireland |

0.6 |

1.9 |

2.5 |

0.1 |

0.8 |

0.9 |

|

Portugal |

1.5 |

29.2 |

30.8 |

- |

- |

- |

|

Total |

96.5 |

148.3 |

244.8 |

81.7 |

106.5 |

188.2 |

Income tax payment

The breakdown of the income tax payment by country for the 2020 financial year is as follows:

Breakdown of the income tax payment by country (Thousands of Euros)

|

|

31 December 2020 |

31 December 2019(1) |

||||||

|

|

Income from sales to third parties |

Income from intra-group operations with other tax jurisdictions |

Tangible assets other than cash and cash equivalents |

Corporate income tax accrued on gains / losses |

Income from sales to third parties |

Income from intra-group operations with other tax jurisdictions |

Tangible assets other than cash and cash equivalents |

Corporate income tax accrued on gains / losses(2) |

|

Spain |

530,328 |

55,397 |

865,317 |

23,878 |

- |

- |

- |

1,567 |

|

Italy |

336,296 |

521 |

507,655 |

5,369 |

- |

- |

- |

16,616 |

|

France |

309,759 |

0 |

1,815,502 |

11,817 |

- |

- |

- |

- |

|

Switzerland |

137,467 |

0 |

193,190 |

3,813 |

- |

- |

- |

2,100 |

|

Ireland & Netherlands |

77,297 |

0 |

276,779 |

324 |

- |

- |

- |

3,831 |

|

United Kingdom |

144,339 |

377 |

198,107 |

-1,805 |

- |

- |

- |

806 |

|

Portugal |

69,286 |

0 |

222,457 |

5,327 |

- |

- |

- |

- |

|

Total |

1,605,498 |

56,295 |

4,079,007 |

48,723 |

- |

- |

- |

24,920 |

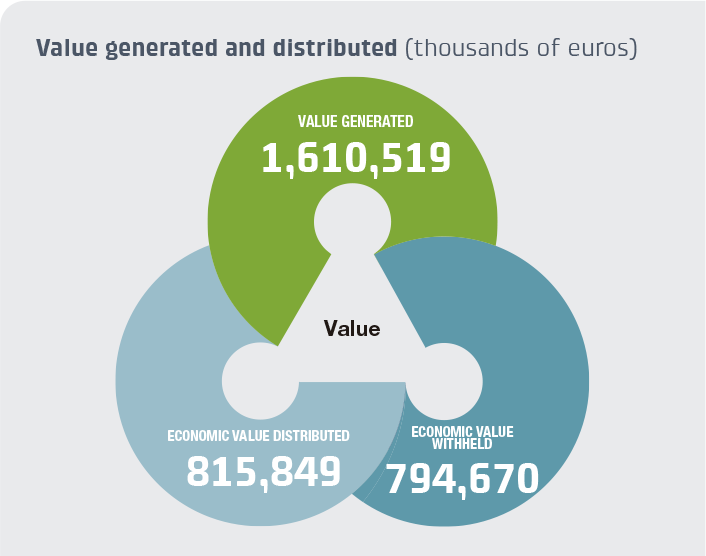

Value generated and distributed

Value generated in 2020 by Cellnex was 1,610,519 thousands of Euros (1,302,181 thousands of Euros FY 2019), distributed mainly to suppliers, employees, shareholders and public administration.

Post balance sheet events

T-Mobile Infra Acquisition

On 21 January 2021, Cellnex and Cellnex Netherlands, B.V. (“Cellnex Netherlands”) signed a framework agreement with Deutsche Telekom A.G. (“DTAG”), Deutsche Telecom Europe, B.V. (“DTEU”) and Digital Infrastructure Vehicle 1 SCSp (“DIV”), which sets forth among others, the conditions to and the steps and arrangements to achieve the contribution in kind, through DIV, of 100% of the share capital of T-Mobile Infra, B.V. (“T-Mobile Infra”) to Cellnex Netherlands, which owns approximately 3,150 sites with an initial tenancy ratio of c.1.2 per site, in exchange for a stake of 37.65% in the share capital of Cellnex Netherlands (the “T-Mobile Infra Acquisition”). Additionally, pursuant to the T-Mobile Infra MLA, T-Mobile Infra and T-Mobile Netherlands, B.V. (“T-Mobile”) have agreed to the deployment of approximately up to 180 additional sites in the Netherlands, over a seven-year term. DIV is an investment fund, with a mandate to invest mainly into European digital infrastructure assets, which upon closing will have DTAG and Cellnex (through a carry vehicle) as limited partners, and Cellnex will have the right to co-invest with a stake of 51%, subject to certain conditions, in opportunities originated by DIV in relation to towers, rooftops, masts, small cells or build-to-suit programs. The T-Mobile Infra Acquisition strengthens the Group’s industrial project in the Netherlands, and Cellnex will thus execute a second step cooperation with the Deutsche Telekom group following the precedent partnership in Switzerland.

The closing of the T-Mobile Infra Acquisition is expected to take place in the first half of 2021, following receipt of among others, customary regulatory authorizations. In accordance with IFRS 3, given that the T-Mobile Infra Acquisition was not completed as of 31 December 2020 it was not accounted for in the accompanying consolidated financial statements for the year ended 31 December 2020.

The T-Mobile Infra Acquisition, together with the up to approximately 180 additional new sites to be deployed in the Netherlands, are expected to contribute up to an estimated approximately EUR 63 million of annual Adjusted EBITDA once the sites are deployed. This expected annual Adjusted EBITDA is based on management’s estimates, and is therefore subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the projects’ actual annual Adjusted EBITDA to materially differ from that expressed in, or suggested by, this forward-looking metric. “Adjusted EBITDA” is an APM (as defined in section “Economic performance” of the accompanying Consolidated Management Report).

CK Hutchison Holdings Swedish Transaction

On 26 January 2021, the CK Hutchison Holdings Swedish Transaction has been completed and, consequently, the Group has acquired Hutchison’s European tower business and assets in Sweden, comprised of approximately 2,300 sites. Cellnex also anticipates the further deployment of up to 2,880 new sites in Sweden by 2026. See Note 21.b of the accompanying consolidated financial statements.

In accordance with IFRS 3, given that the CK Hutchison Holdings Swedish Transaction had not been completed as of 31 December 2020, it was not accounted for in the accompanying consolidated financial statements for the year ended 31 December 2020.

Hivory Acquisition

On 3 February 2021, Cellnex (through its subsidiary Cellnex France) entered into a put option agreement with Altice France, S.A.S. (“Altice”) and Starlight HoldCo S.à r.l (“Starlight HoldCo”), which gives the right to Altice and Starlight HoldCo to require the Group to purchase, on an exclusivity basis, their respective direct and indirect ownerships in the share capital of Hivory, S.A.S. (“Hivory”), which in aggregate amounts to approximately 100% of Hivory’s share capital, for an estimated consideration (Enterprise Value) of approximately EUR 5.2 billion to be paid by Cellnex (the “Hivory Acquisition”). Hivory owns and operates approximately 10,535 sites in France. Additionally, Hivory has agreed to the deployment of 2,500 sites in France by 2029, and other agreed initiatives, with an estimated investment of approximately EUR 0.9 billion.

Completion of the Hivory Acquisition is subject to certain conditions precedent, and closing is expected in the second half of 2021. In accordance with IFRS 3, given that the Hivory Acquisition was not completed as of 31 December 2020 it was not accounted for in the accompanying consolidated financial statements for the year ended 31 December 2020.

On 24 February 2021, the Group amended the EUR 7,500,000 thousand bridge loan of the M&A Financing (see Note 15 of the accompanying consolidated financial statements) and cancelled an amount of EUR 1,600,000 thousand of such bridge loan. As of the date of the accompanying consolidated management report, no amounts have been drawn thereunder. Such financing will bear interest at a margin above EURIBOR, will be unsecured and unsubordinated.

New Bond Issuance in 2021

On 15 February 2021, Cellnex successfully completed a triple-tranche EUR-denominated bond issuance for an aggregate amount of EUR 2,500 million (with ratings of BBB-by Fitch Ratings and BB+ by Standard&Poor’s) aimed at qualified investors. The transaction included a bond for EUR 500 million maturing in November 2026 at a coupon of 0.75%; a bond for EUR 750 million maturing in January 2029 at a coupon of 1.25%; and a 12-year bond for EUR 1,250 million maturing in February 2033 at a coupon of 2%. Cellnex took advantage of favorable market conditions to maintain its average cost of debt and increase its average debt maturity. The net proceeds from the issues will be used for general corporate purposes.

Iliad Poland Acquisition

On 23 February 2021, following the signing of the Iliad Poland Acquisition (in October 2020), Iliad, Play and Cellnex have further discussed the structuring of the Iliad Poland Acquisition and agreed on an alternative structure. Under this structure, on the Completion Date (i) Play will sell to Cellnex Poland and Iliad Purple, respectively, 60% and 40% of the share capital of Play Tower; and (ii) immediately following such share acquisition, P4 will sell the passive infrastructure business of P4 to Play Tower. The parties expect to finance the business unit transaction with a mix of equity and shareholder loans. The completion of the Iliad Poland Acquisition is expected to take place in the first quarter of 2021, following receipt of customary regulatory authorizations.

Business outlook

In terms of business prospects, during 2021 the Group will continue to focus on executing organic growth (leveraging its neutral operator character), integrating assets resulting from inorganic agreements already signed and seeking new inorganic opportunities to continue to remain a benchmark independent tower operator in Europe.

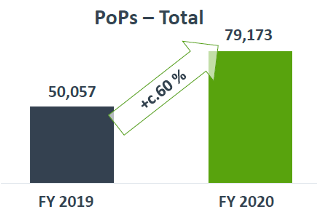

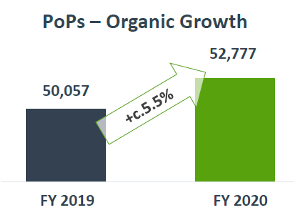

Thus, as a result of the organic growth expected along with assets and companies acquired, especially during the year ended on 31 December 2020, and their progressive integration into the Group as a whole, the Group expects to increase various key indicators by at least 50% for the year ending on 31 December 2021.

The Group expects its Adjusted EBITDA for the year ending on 31 December 2021 to be in the range of EUR 1,815 million to EUR 1,855 million following the incremental contribution from the Arqiva Acquisition (six and a half months, approximately), and the NOS Towering Acquisition (nine months approximately), and the inclusion of the contribution from the transactions closed to date or expected to be closed during 2021, being these perimeters: CK Hutchison Austria (twelve months approximately), CK Hutchison Ireland (twelve months approximately), CK Hutchison Denmark (twelve months approximately), CK Hutchison Sweden (eleven months approximately), Play (expected nine months), T-Infra B.V. (expected eight months), CK Hutchison Italy (expected six months) and SFR (expected three months). The guidance also considers the new economic terms of contracts in the Broadcasting Infrastructure segment, following the contract renewal cycle that was completed last year, and Group adaptation costs (corporate functions).The Group also expects its Recurring Leveraged Free Cash Flow (RLFCF) for the year ending on 31 December 2021 to be in the range of EUR 905 million to EUR 925 million (to grow by approximately 50%), based on the following assumptions: maintenance capital expenditures to revenues to be approximately 3%-4% of the Operating Income, change in working capital tending to neutral, interest cost according to around 1.5% cost of debt and corporate taxes paid to be approximately 3% of the Operating Income.

The Group also expected an increase in organic PoPs above 5%.

The above Profit Forecasts are based on some assumptions, that relate to factors which are outside the full control of the Board of Directors. The Profit Forecasts have been compiled and prepared on a basis which is both comparable with the historical financial information and consistent with the Group’s accounting policies.