Investor Relationships

Market figures: Cellnex on the stock market

On 20 June 2016, the IBEX 35 Technical Advisory Committee approved Cellnex Telecom’s (CLNX: SM) inclusion in the benchmark index of Spain’s stock exchange, the IBEX 35, which brings together the principal companies on the Spanish stock exchange in terms of capitalisation and turnover. This milestone brought with it a broadening of the shareholder base, giving Cellnex higher liquidity and making it more attractive to investors. At present Cellnex has a solid shareholder base and the majority consensus of analysts who follow our company +70% - is a recommendation to buy.

As at 31 December 2020, the share capital of Cellnex Telecom increased by EUR 25,345 thousand to EUR 121,677 thousand (EUR 96,332 thousand at the end of 2019), represented by 486,708,669 cumulative and indivisible ordinary registered shares of EUR 0.25 par value each, fully subscribed and paid (see Note 14.a of the accompanying consolidated financial statements).

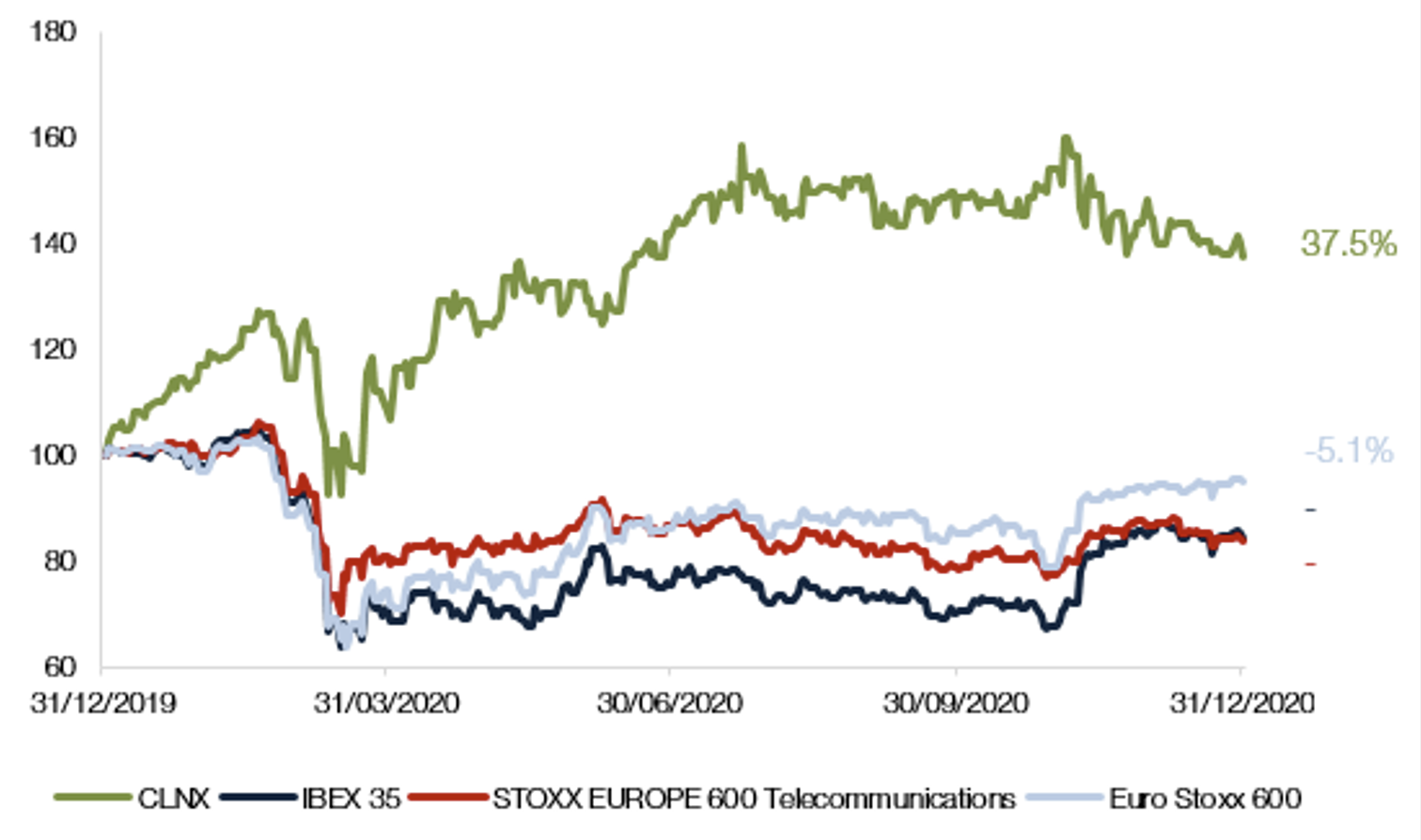

Cellnex’s share price experienced a 38% increase during 2020, closing at EUR 49.1 per share. The average volume traded has been approximately 1,318 thousand shares a day. The IBEX 35, STOXX Europe 600 and the STOXX Europe 600 Telecom decreased by 15.5%, 5.1% and 16.1% during the same period.

Cellnex's market capitalization stood at EUR 23,907 million at the year ended on 31 December 2020, 637% higher than at start of trading on 7 May 2015, compared to a 28% drop in the IBEX 35 in the same period.

The evolution of Cellnex shares during 2020, compared to the evolution of IBEX 35, STOXX Europe 600 and STOXX Europe 600 Telecom, is as follows:

Detail of the main stock market indicators of Cellnex as of 31 December 2020 and 2019

|

31 December 2020 |

31 December 2019 |

|

|

Number of shares |

486,708,669 |

385,326,529 |

|

Stock market capitalisation at period/year end (EUR million) |

23,907 |

14,784 |

|

Share price at close (EUR/share) |

49.12 |

38.37 |

|

Maximum share price for the period (EUR/share) |

57.06 |

41.29 |

|

Date |

04/11/2020 |

16/10/2019 |

|

Minimum share price for the period (EUR/share) |

33.05 |

19.9 |

|

Date |

16/03/2020 |

02/01/2019 |

|

Average share price for the period (EUR/share) |

47.33 |

30.24 |

|

Average daily volume (shares) |

1,317,890 |

1,039,628 |

Treasury shares

In accordance with the authorisation approved by the Board of Directors, on 31 December 2020 the Company held 200,320 treasury shares (0.041% of its share capital). It has not been decided to what use the treasury shares will be put and will depend on such decisions as may be adopted by the Group's governing bodies.

The treasury shares transactions carried out in 2020 are disclosed in Note 14.a of the accompanying consolidated financial statements.

Shareholder remuneration

The Parent Company intends the dividends to be distributed against distributable reserves and/or against the net profit attributable to the Parent Company for the year ending on 31 December 2020, to be equivalent to the dividend distributed corresponding to the year ending 31 December 2019, increased by 10%.

Approved shareholders’ remuneration policy, which is amended from time to time, aims to keep the appropriate balance between shareholder remuneration, the Parent Company’s profit generation and the Parent Company’s growth strategy, pursuing an adequate capital structure. In the implementation of the Shareholders’ Remuneration Policy, the Company is focused on distributing an annual dividend by an amount increased by 10% with respect to the dividend distributed the year. As a result, each year the Parent Company distributes dividends against either net profit or distributable reserves attributable to the Company for the respective financial year.

On 31 May 2018, the Annual Shareholders’ Meeting approved the distribution of a dividend charged to the share premium reserve to a maximum of €63 million, payable in one or more instalments during the years 2018, 2019 and 2020. It was also agreed to delegate to the Board of Directors the authority to establish, if appropriate, the amount and the exact date of each payment during said period, while always respecting the maximum overall amount stipulated.

On 21 July 2020, the Annual Shareholders’ Meeting approved the distribution of a dividend charged to the share premium reserve to a maximum of €109 million, to be paid upfront or through instalments during the years 2020, 2021, 2022 and 2023. It was also agreed to delegate to the Board of Directors the authority to establish, if appropriate, the amount and the exact date of each payment during said period, while always respecting the maximum overall amount stipulated.

According to the aforementioned Shareholders’ Remuneration Policy, the shareholder remuneration corresponding to fiscal year 2020 will be equivalent to that of 2019 (€26.6 million) increased by 10% (to €29.3 million); the shareholder remuneration corresponding to fiscal year 2021 will be equivalent to that of 2020, increased by 10% (to €32.2 million); and (iii) the shareholder remuneration corresponding to fiscal year 2022 will be equivalent to that of 2021, increased by 10% (to €35.4 million).

During 2020, and in compliance with the Company´s dividend policy, the Board of Directors, pursuant to the authority granted by resolution of the Annual Shareholders’ Meeting of 31 May 2018, approved the distribution of a cash pay-out charged to the share premium reserve of €11,818 thousand which represented €0.03067 for each existing and outstanding share with the right to receive such cash pay-out. In addition, on 3 November 2020, the Board of Directors, pursuant to the authority granted by resolution of the Annual Shareholders’ Meeting of 21 July 2020, approved the distribution of a cash pay-out charged to the share premium reserve of €17,463 thousand which represented €0.03588 for each existing and outstanding share with the right to receive such cash pay-out.

Thus, the total cash pay-out to shareholders distributed for the 2019 financial year was €0.06909 gross per share, which represents €26,622 thousand (€24,211 thousand corresponding to the distribution for the 2018 financial year).

Dividends will be paid on the specific dates to be determined in each case and will be duly announced.

Notwithstanding the above, the Company’s ability to distribute dividends depends on several circumstances and factors including, but not limited to, net profit attributable to the Company, any limitations included in financing agreements and the Company’s growth strategy. As a result of such circumstances and factors (or others), the Company may amend the Shareholders’ Remuneration Policy or may not pay dividends in accordance with the Shareholders’ Remuneration Policy at any given time. In any case, the Company will duly announce any future amendment to the Shareholders’ Remuneration Policy.

Cellnex Telecom

Shareholders

Cellnex works continuously to maintain a good two-way relationship with its shareholders. To this end, there is a Policy for communication and contact, where it is stated that the Board of Directors will be responsible for providing suitable channels for shareholders to find any information in relation to the management of the Company, and for establishing mechanisms for the regular exchange of information with institutional investors that hold shares in the Company.

The Company has several communication channels to ensure effective compliance with the principles of the above-mentioned Policy, some of which are general channels, intended to disseminate information to the public, while others are private and primarily intended for shareholders, institutional investors and proxy advisors.

The general channels are the Website of the Spanish Stock Exchange Commission (CNMV) and other bodies, as well as the Cellnex Corporate website. The private channels for shareholders and investors to use are the various social networks on which Cellnex has an account (such as YouTube, Flickr, LinkedIn, Twitter, SlideShare or RSS), as well as the “Shareholders and Investors” section on the Company website and the Investor Relations Area. Concerns can also be expressed at the General Shareholders' Meeting.

Cellnex's participation in Sustainability Indices and initiatives

In recent years, there has been increased interest and demand for the promotion of ESG activities, projects and operations in companies. Above all, investors are increasingly taking the social, environmental and good governance contribution of a company into account when considering whether to invest in it. To this end, Sustainability Indexes and other initiatives have been developed to evaluate the ESG-minded business practices of a company.

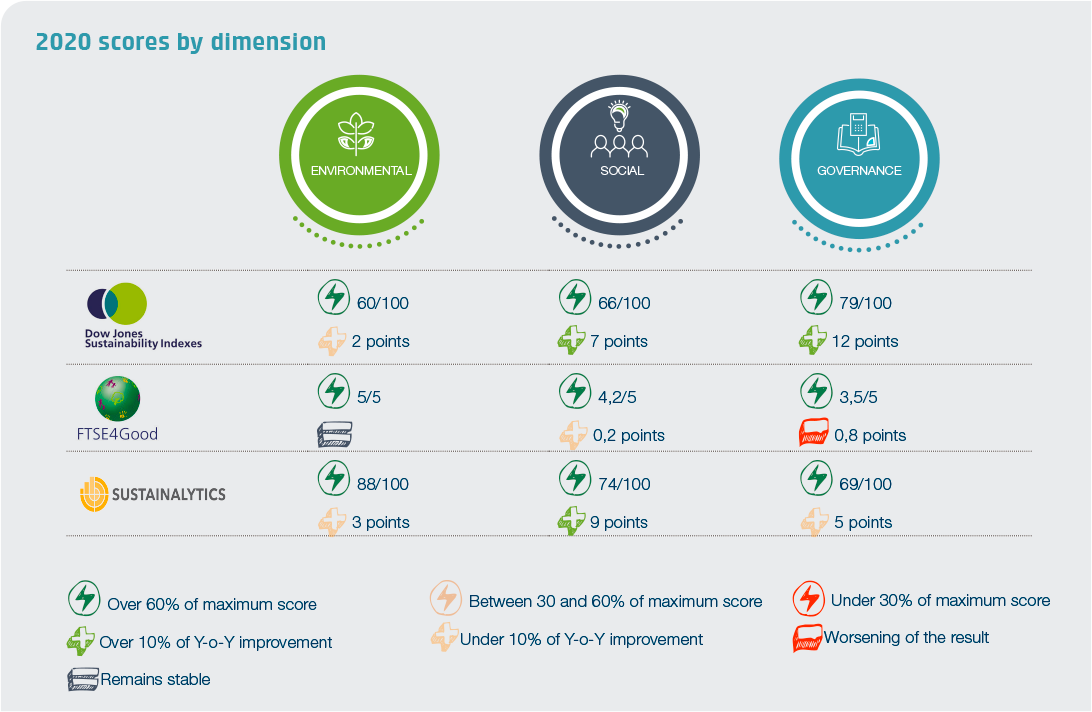

The results of the main indexes in which Cellnex participates, such as DJSI index, FTSE4Good and Sustainalytics, recognize the efforts made by the company in the last four years in ESG matters, improving the overall score in all of them compared to 2017.

Besides these indexes, Cellnex participates in various ESG indexes that are presented below.

Dow Jones Sustainability Index

Each year Cellnex participates in the DJSI index as a guest company, obtaining good results and ranking above the industry average in the three areas evaluated: economic, environmental and social. While the industry’s average score dropped in all dimensions in 2020, Cellnex’s score increased across the board.

Moreover, in 2020, Cellnex has improved its score in the three dimensions compared to the results obtained in 2019. In short, Cellnex has increased its sustainability score for two consecutive years, reaching an overall score of 66 points (+6 compared to 2019, +9 comparing to 2018, and +14 comparing to 2017). This result has allowed Cellnex to stay ahead of industry average by 24 points (+14 than 2019). By dimension, Cellnex has improved in all dimensions; Environmental (+12 than 2019), Social (+7 than 2019) and Economic (+2 than 2019).

CDP (formerly Carbon Disclosure Project)

The CDP is a global gold standard for measuring and rating corporate transparency in environmental and sustainability matters. CDP’s annual environmental disclosure and scoring process is widely recognised as the gold standard of corporate environmental transparency, where the organisation prepares the rankings based on the information submitted by the companies.

A detailed and independent methodology is used by CDP to assess the companies, allocating a score of A to D- based on the comprehensiveness of disclosure, awareness and management of environmental risks and demonstration of best practices associated with environmental leadership, such as setting ambitious and meaningful targets. Those that don’t disclose or provide insufficient information are marked with an F.

In 2020 Cellnex continued in the “A List” of companies leading the fight against climate change. The “A” score, the highest score allocated by the CDP means the company is still a Leadership Brand. Only 273 companies are part of the “A” List” of more than 8.400 companies and organisations analysed worldwide.

Furthermore, Cellnex was rated the “A-” score on CDP Supplier Engagement Rating. This is higher than the Europe regional average of B-, and higher than the Trading, wholesale, distribution, rental & leasing sector average of B-.

United Nations Global Compact

Cellnex has been a participant of the United Nations Global Compact since November 2015, as an expression of its commitment to including the corporate social responsibility concept into its operational strategy and organisational culture. Each year, the company publishes its COP (Communication of Progress) on the official Global Compact website.

The 2020 Progress Report includes:

- A declaration from the top management with the commitment to comply with the 10 Principles of the Global Compact.

- A detailed report on the entity's commitment to support and respect the protection of human rights. For example, information on training or awareness-raising for employees in aspects related to Human Rights, with special attention to employees with a direct impact on human rights or who carry out their activity in countries at risk in this area. It also specifies that the company has a complaints channel where anyone can report cases of human rights violations.

- An indication of projects and activities with which the company contributes to local development, through actions to foster employment, economic growth and relationships with other actors in the surrounding area.

- Information on the supply chain impact assessment.

- The report specifies policies and practices for the achievement of effective equality between women and men, as well as measures related to the work-life balance.

- Internal measures to promote inclusion and accessibility for people with disabilities.

- The measures developed by the company to tackle climate change. For example, CO2 emissions, measures related to circular economy and sustainable use of resources.

- The entity details the values, principles, standards and norms of conduct of the organisation, paying special attention to those focused on identifying unethical or illegal conduct through the creation of a complaints channel.

- The report includes a commitment from the entity to contribute to the SDGs, as well as an identification of which SDGs are a priority for the company.

FTSE4Good

The FTSE4Good index series is designed to measure the degree of compliance of companies that show a high level of competence in their environmental, social and governance practices. These indices are used by many financial market players as they create and evaluate so-called responsible investment funds and other products that integrate environmental, social and corporate governance factors into their investment decisions.

The indices identify which companies best manage the risks associated with these factors and are used to track indexed funds, structured financial products and as a reference indicator. They are also the benchmark for establishing comparisons between investments.

The ESG ratings, which mark the entry and ratification in the FTSE4Good indices, are used by investors wishing to incorporate environmental, social and corporate governance factors into their investment selection processes. They are also used as a reference framework to evaluate corporate commitment and to qualify corporate governance.

Cellnex was selected to become part of this index in January 2017. In terms of the overall assessment in the ESG Rating, Cellnex obtained a slightly lower score than in 2019 (4.2 in 2020, -0.2 than 2019). In any case, it should be noted that this has been a common trend, as both the subsector and industry averages followed a similar tendency.

Likewise, Cellnex’s overall score far exceeded the average of the telecommunications sector, and the mobile telecommunications sub-sector, both of which obtained 2.8 out of 5. Cellnex also outperformed the average of the Spanish companies present in the index (3.2 out of 5).

Cellnex obtained the maximum score (5 out of 5) in the aspects related to corporate governance, anti-corruption measures, labour standards, and climate change. Aspects related to human rights and the community, as well as social aspects throughout its value chain, scored 4 out of 5. However, there is some room for improvement in environmental management throughout its supply chain (which scored 3 out of 5).

Standard Ethics

Standard Ethics Indices are a benchmark to measure, over time, the appreciation in financial markets of the principles and guidelines from the European Union, the OECD and the United Nations on sustainability, corporate governance and corporate social responsibility issues.

Cellnex has taken part in the Standard Ethics sustainability index since 2017, obtaining an “EE-” this year, the same as last year, equivalent to an adequate level for good compliance in governance, sustainability and social responsibility.

In March 2019, Standard Ethics performed the last review of Cellnex’s score. However, companies Outlook was reviewed in 2020 and Standard Ethics raised Cellnex’s Outlook to Positive.

Sustainalytics

Cellnex is evaluated by Sustainalytics, an environmental, social and corporate governance (ESG) research and rating company for investors worldwide.

Cellnex made a qualitative leap in the Sustainalytics evaluation this year, rising in category in terms of “Market Cap” ($6bn to $12- $15bn), as well as in evaluation level (from Average Performer to Outstanding). This has placed the company is 7th in the Global Telecommunications Ranking.

This year its average score was 76 points, up from 70 in 2019. In this regard, Cellnex has improved its overall score in all the three dimensions, particularly in social issues, due to the actions developed regarding Diversity Programmes, Health & Safety Certifications and Community Involvement Programmes, and environmental issues, with the Environmental Policy and new Eco-Design requirements.

MSCI ESG Rating

MSCI ESG Ratings aim to measure a company's resilience to long-term ESG risks. Companies are scored on an industry-relative AAA-CCC scale across the most relevant Key Issues based on a company's business model.

Cellnex joined the MSCI Europe index in 2019. For 2020, Cellnex has earned a "BBB" ESG Rating, improving its assessment from the previous year (“BB”). The company has undertaken initiatives to improve its labour management and ethics policies over the last two years, however there is still progress to be achieved on adopting industry best practices. Within the Rating, Cellnex falls into the highest scoring range on the Corporate Governance dimension relative to global peers, reflecting that the company's corporate governance practices are generally well aligned with investor interests.