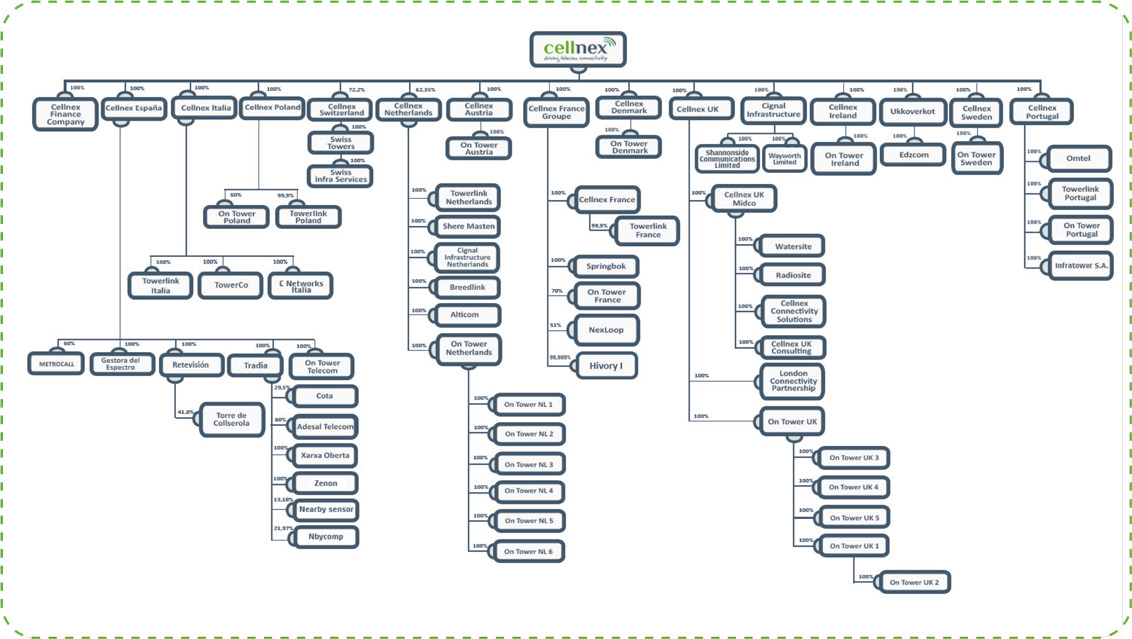

Cellnex is the main neutral1 infrastructure operator for wireless telecommunication in Europe. Cellnex Telecom, S.A. (a company listed on the Barcelona, Bilbao, Madrid and Valencia stock exchanges) is the parent company of a group in which it is the sole shareholder and the majority shareholder of the companies operating in the various business lines and geographical markets.

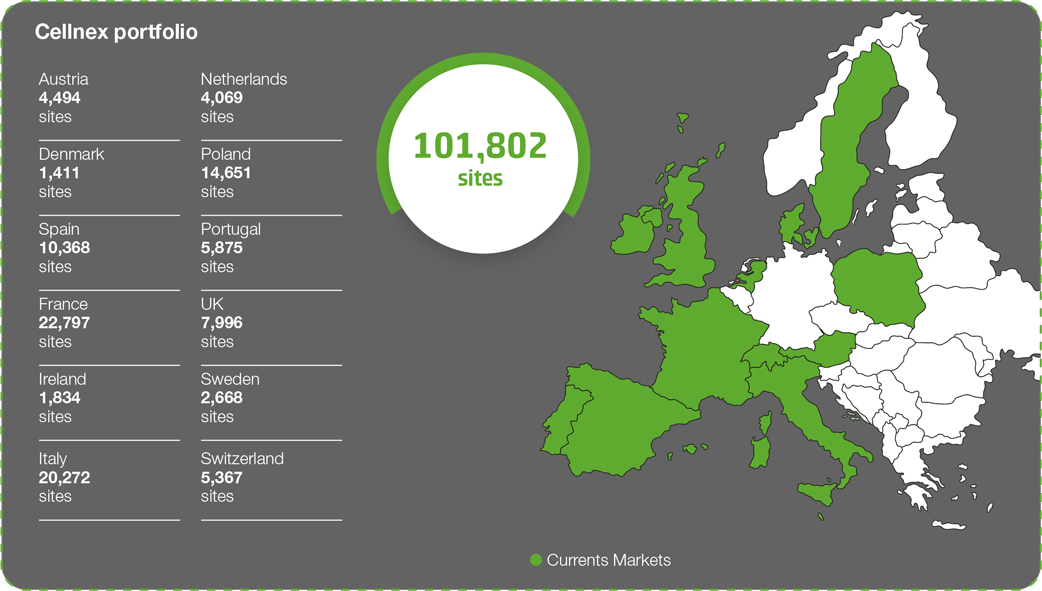

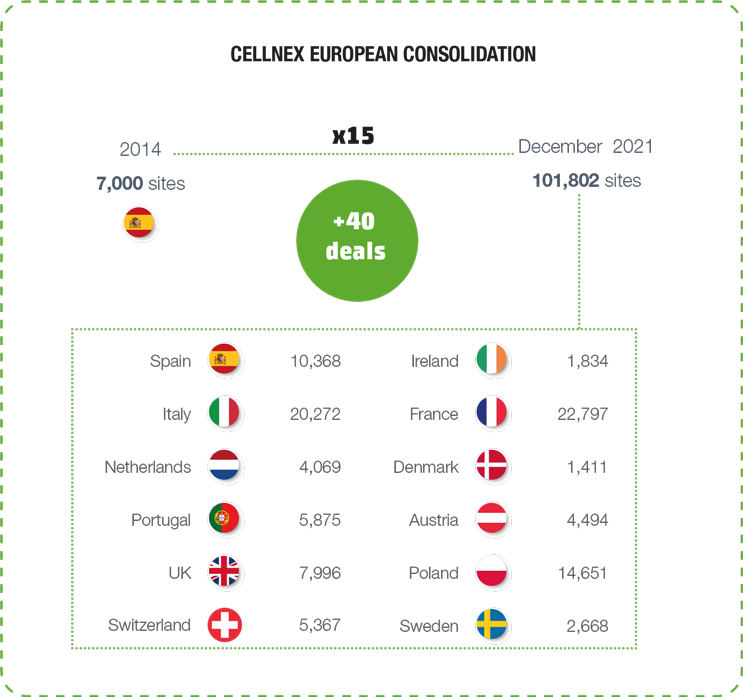

Cellnex has commited up to 125,098 sites, 101,802 of them already in the portfolio and the rest in the process of completion orwith planned roll-outs up to 2030, and positions the Company in the development of new generation networks. Cellnex provides services in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden and Switzerland, as a result of its investment efforts to promote its transformation and internationalisation.

The Company is listed on the continuous market of the Spanish stock exchange and is included in the selective IBEX 35, and EuroStoxx 100 indices. It is also present in the main sustainability indexes, such as CDP (Carbon Disclosure Project), Sustainalytics, FTSE4Good, MSCI and Vigeo Eiris.

Cellnex’s reference shareholders include Edizione, GIC, TCI, Blackrock, Canada Pension Plan, CriteriaCaixa, Wellington Management Group, Capital Group, Fidelity and Norges Bank.

The Group's organisational structure is presented below.

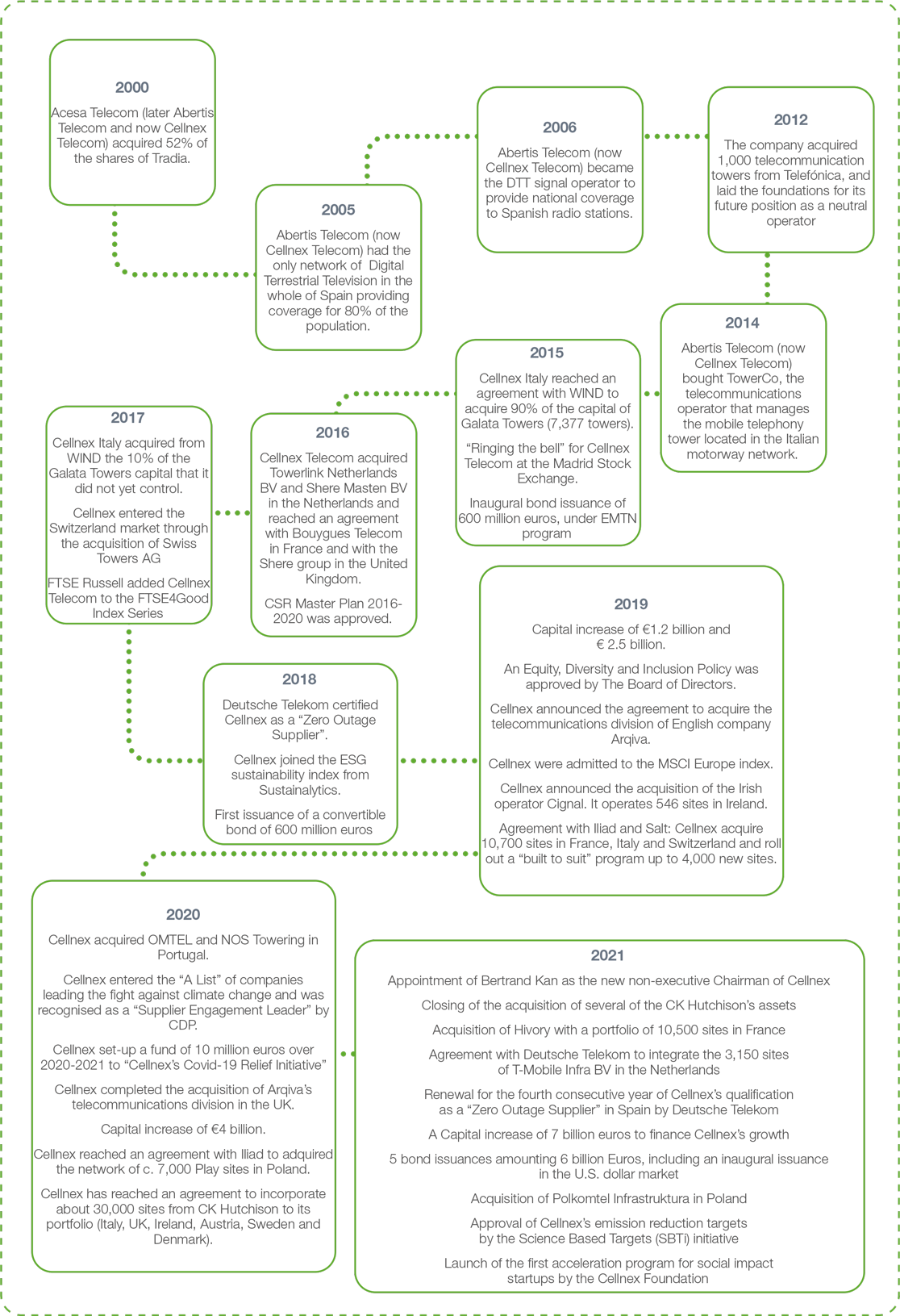

The Cellnex Group achieved many milestones during 2021: the appointment of a new Chairman, the completion of the acquisition of several of the CK Hutchison's assets, the acquisition of 100% of Hivory with a portfolio of 10,500 sites in France, the agreement with Deutsche Telekom to integrate the 3,150 sites of T-Mobile Infra BV in the Netherlands, the renewal for the fifth consecutive year of Cellnex's qualification as a "Zero Outage Supplier" in Spain by Deutsche Telekom, a capital increase of €7 billion to finance Cellnex's growth, the acquisition of Polkomtel Infrastruktura in Poland, the approval of Cellnex's emission reduction targets by the Science Based Targets (SBTi) initiative and the launch of the first acceleration programme for social-impact startups by the Cellnex Foundation.

There follows a historical timeline of Cellnex's business model from 2015 to 2021.

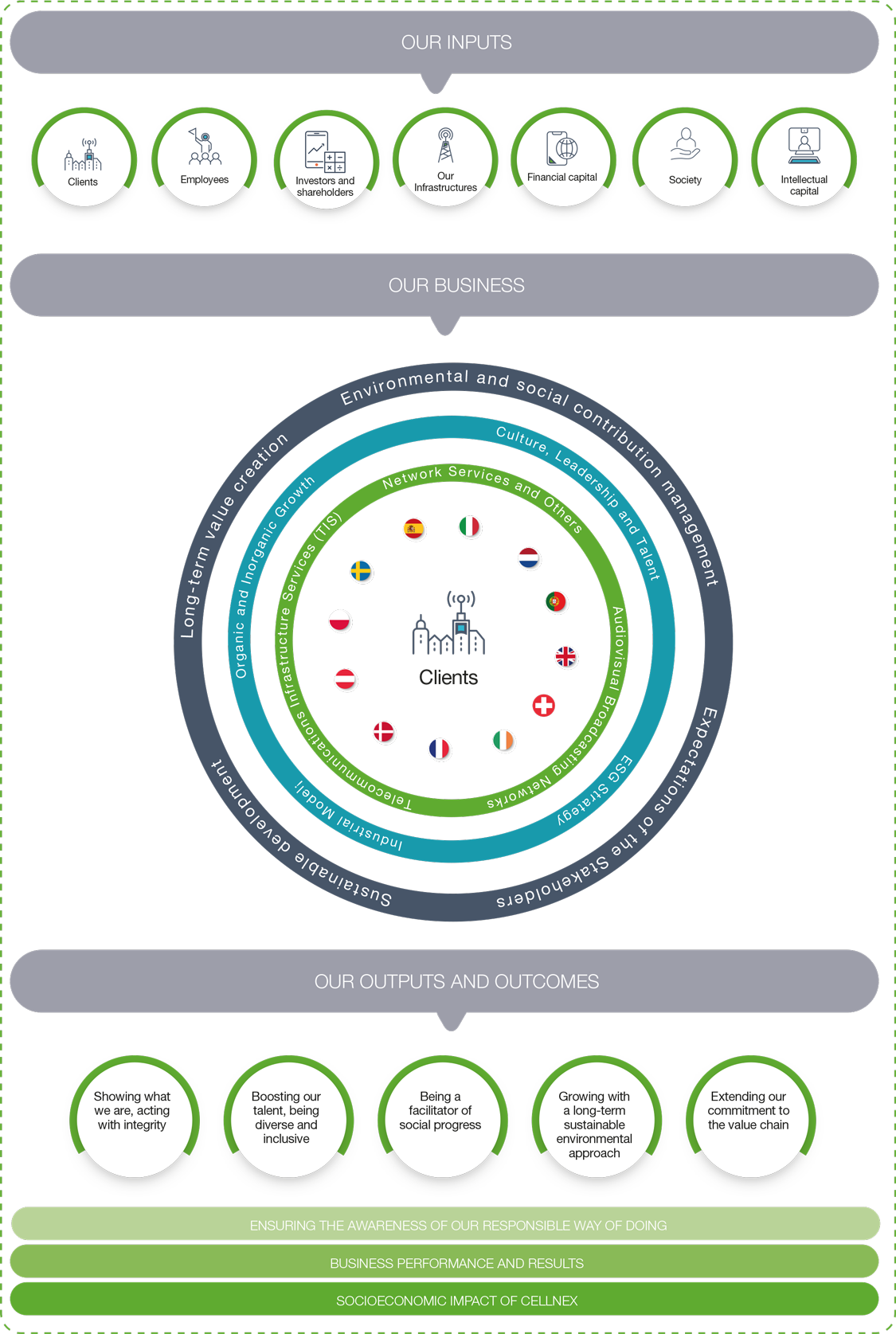

Through the ESG Strategy, Cellnex analyses, measures and manages its impacts as a company on society and its environment. The Company's own value creation model, focusing on the shared management of telecommunications infrastructures, fosters sustainability, efficiency – and thus responsibility – in the use of the resources with which it works. By building partnerships with its customers, Cellnex has a long-term relationship with them and manages the Company with the long cycle in mind, aware of the principles of ethics, good governance, respect for human rights and dialogue with its stakeholders, which should govern Cellnex's actions.

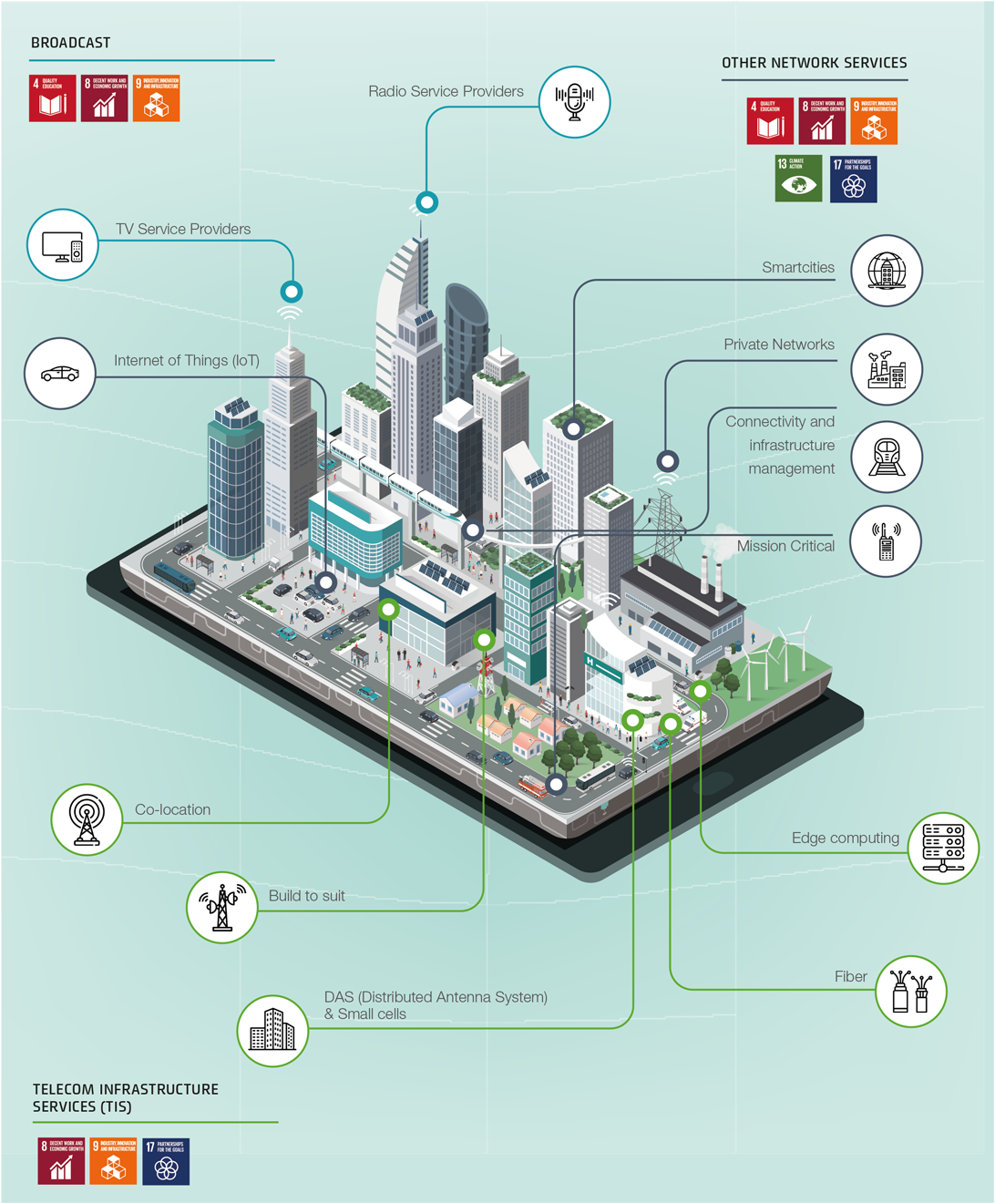

Cellnex offers its customers a range of services aimed at ensuring the conditions for reliable and high-quality transmission for wireless broadcasting of content, including voice, data or audiovisual content.

Cellnex also develops solutions in the field of "smart cities" projects, which optimise services for citizens through networks and services that facilitate municipal management. In this field, Cellnex is deploying smart communications networks in several countries, based on various IoT technologies (Sigfox, LoRaWAN...), that enable objects to be connected and, therefore, the development of a robust ecosystem for the Internet of Things (IoT).

Also relevant is the Group's role in the deployment of security and emergency networks for law enforcement agencies, known as Terrestrial Trunked Radio (TETRA) networks or by their acronym PPDR (Public Protection and Disaster Relief). This company business line embodies the skill levels of the human team that manages them and the resilience and reliability of the architecture of the networks themselves and the equipment that make them up. Cellnex also participates in the deployment of Private Network services for business environments where service continuity is critical (such as ports, nuclear power plants, petrochemicals, etc.) and dedicated radio communications networks designed to suit customers’ needs.

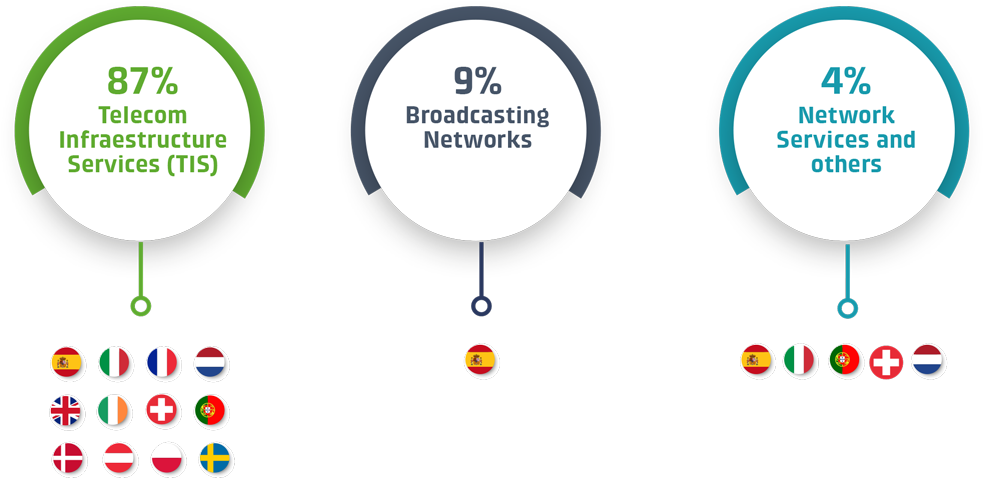

The services provided by Cellnex in each geographical territory in the field of infrastructure management for wireless telecommunications are presented below. In this regard, Telecommunications Infrastructure Services is still relatively the most significant item in the Group's 2021 income statement owing to the acquisition and integration of new telecommunications sites.

As Cellnex expands its presence in the territory, the Company also increases its portfolio of services. For example, with the integration of Poland, Cellnex has incorporated the provision of active equipment services into its business.

Cellnex operates in more than 134,813 Point of Presence (PoPs), has a portfolio of nearly 101,802 sites, including BTS committed deployments and is committed to the development of new generation networks.

Cellnex offers co-location services in its infrastructure for mobile operators to install their telecommunications and wireless broadcasting equipment there. This infrastructure is designed to suit the needs of various technologies (broadband, point-to-point connections or mobile communications) in both urban and rural areas. This service involves adapting sites for new co-locations or multiple network modifications required by the operators (installation of new technologies, equipment changes, reconfigurations...). The objective is to meet and improve the SLAs (service level agreements) offered by Cellnex, which are of two main types:

Augmented TowerCo

From pure Co-location services to the most developed Site as a Service concept, Cellnex offers to its clients telecom infrastructure services for sustainable connectivity that relief them from the burden of managing the infrastructures and networks over which their systems operate.

The neutral host nature makes Cellnex’s model the most efficient possible, as developing multi-operator sites which means decreasing costs to the clients, increasing sustainability to telecom and connectivity ecosystem and rapidly meeting all stakeholders expectations as services are quickly deployed.

In this regard, it is worth highlighting the efforts and achievements in terms of security, duration and cost achieved in the campaign to negotiate rental contracts with landlords. In the case of Spain, for example, at the end of the year the percentage of sites secured was over 80%, this is a significant level and guarantees the continuity of this line of business in the future.

Jumping project

During 2021, Cellnex Spain's sites have been adapted to facilitate the deployment of the "Jumping" project (sharing of active network equipment in less populated areas) promoted by two of its customers, Orange and Vodafone, thus helping operators to implement this project.

Cellnex also offers a wide range of services for the distribution of television and radio signals via satellite or teleport (Arganda), as well as data distribution via VSAT stations (Very Small Aperture Terminals or private satellite data communication networks). Cellnex combines terrestrial and satellite solutions to offer each customer the best solution in each case.

In addition, Cellnex offers advanced Ethernet and IP transport services, both for the audiovisual sector and for telecommunications operators, thanks to a fibre optic network that currently consists of 40 MPLS nodes. Cellnex has 163 points of presence interconnecting all broadcasters, audiovisual agents, operators, public administrations, TETRA networks (for critical sectors such as emergency services) and the first IoT (Internet of Things) network in Spain with more than 1,300 UNB stations.

Cellnex Netherlands wins bid for management and expansion of ProRail telecom infrastructure

Cellnex Netherlands was selected in 2021 by ProRail as the passive infrastructure provider (PIP). Cellnex will be responsible for managing and expanding the telecom sites for mobile connectivity along the Dutch railway tracks. For implementation, Cellnex works together with VolkerWessels Telecom, a specialist in designing, building and managing digital infrastructure. In addition to its role as a neutral telecomms infrastructure provider for ProRail, Cellnex has exclusive rights for any BTS development along the whole rail network.

Distributed Antenna Systems or DAS is a network of spatially separated antenna nodes connected to a common source via a transport medium that provides wireless services in a geographical area or structure. A DAS can be installed inside a building to boost the internal wireless signal. Cellnex uses DAS systems to provide DASaaS services (DAS as a Service) with an end-to-end approach. In addition, DAS systems and Small Cells are one of the base infrastructures from which the new 5G communication standard will be deployed.

DAS projects developed by Cellnex Spain

In Spain, the entire deployment of the 4G network has been completed in the 300 km and 300 stations of the Madrid metro, thus providing connectivity continuity throughout the underground. In addition, agreements and deployments in various football stadiums in the country, such as the Benito Villamarín stadium of Real Betis Balompié in Seville and the Ciudad de Valencia stadium of Levante Unión Deportiva, are also worth mentioning.

Also noteworthy in the field of data centres is the opening of the first data centre in Barcelona, on Paseo de la Zona Franca, in the area of industrial estates (Pedrosa and Zona Franca) and the Fira II exhibition centre. The data centre has several fibre connectivity routes and has been successfully marketed to one of the four mobile telephone operators, among other customers.

During 2021, DAS coverage solutions have been developed to provide connectivity in spaces or venues with a high volume of public that require simultaneous voice and mobile data services.

Grand Paris Express

Cellnex France has been commissioned by the Société du Grand Paris (SGP) to deploy a DAS (Distributed Antenna System) network on the new lines 16 and 17 of the Grand Paris Express metro.

Cellnex France will deploy a DAS (Distributed Antenna System) coverage system on lines 16 and 17 to offer mobile operators an uninterrupted and optimal voice and data service with connectivity in all stations and tunnels between Saint- Denis Pleyel and Noisy Champs (Line 16) and between Charles de Gaulle Airport and Le Mesnil Amelot (Line 17).

Cellnex Portugal becomes a referent in the Portuguese DAS market

Cellnex strengthens its position in Portugal with the purchase of towers from the Altice group. During 2021 Cellnex Portugal has closed a second transaction with the Altice group comprising 687 assets, including 223 macro sites and 464 DAS and Small- Cells. Because of these acquisitions, 3 new DAS solutions have been implemented, therefore positioning Cellnex as a referent in the Portuguese DAS market.

Cellnex Italia helps reduce the territorial digital divide in the historic center of Erice

The municipal administration of Erice has long been committed to winning the great challenge of overcoming any outstanding issues regarding the territorial digital divide. The administration’s philosophy is to combine the need for modernity and respect for the historical heritage, in order to provide a service not only to the inhabitants but also to tourists. However, its mountain-top position reduces, if not eliminates, the signal coming from the macro sites of the operators serving the internal streets of the centre.

To achieve a solution meeting Erice’s needs, Cellnex has installed an Outdoor Distributed Antenna System. To that end, Cellnex created an optical infrastructure within the 3 km of historic centre, to connect the active equipment distributed through the medieval town.

In order to offer a modern system that respects the historic heritage, the antennas chosen for covering the areas are passive panels which have been discreetly positioned with custom fitted brackets in ideal locations to achieve a very low aesthetic impact. The system provides for the use of a total of 25 antennas.

Accordingly, to offer a high-quality service to people in the historic centre of Erice, this multi-operator system comprises a total of 48 sectors dedicated to providing a high-quality performance to residents and tourists in these areas. The system is supervised 24/7 from Cellnex’s Network Operation Centre, equipped with all the necessary hardware and software, and an appropriate complement of expert staff.

A summary of the portfolio of Telecommunications Infrastructure Services sites as at 31 December 2021 is presented below.

|

Framework Agreement |

Project |

Nº of Sites acquired |

Beginning of the contract |

Initial Terms + Renewals (1) |

|

Telefónica |

Babel |

1,000 |

2012 |

10+10+5 |

|

Telefónica and Yoigo (Xfera |

Volta I |

1,211 |

2013 |

10+10+5 (Telefónica) |

|

Until 2030+8 (Yoigo) |

||||

|

Telefónica |

Volta II |

530 |

2014 |

10+10+5 |

|

Business combination |

TowerCo Acquisition |

321 |

2014 |

Until 2038 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta III |

113 |

2014 |

10+10+5 (Telefonica) Until 2030+8 (Yoigo) |

|

Telefónica |

Volta Extended I |

1,090 |

2014 |

10+10+5 |

|

Neosky |

Neosky |

10 |

2014 |

10+10+5 |

|

Telefónica |

Volta Extended II |

300 |

2015 |

10+10+5 |

|

Business combination |

Galata Acquisition |

8,459 |

2015 |

15+15 (Wind) (2) |

|

Business combination |

Protelindo Acquisition |

261 |

2012 |

+15 (KPN) |

|

2016 |

+12 (T-Mobile) |

|||

|

Bouygues |

Asset purchase |

4,539 |

2016 - 2017 |

20+5+5+5 / 25+5+5 (3) |

|

31 |

2018 |

20+5 (3) |

||

|

Business combination |

Shere Group Acquisition |

1,042 |

2011 |

+15 (KPN) |

|

2015 |

+10 (T-Mobile) |

|||

|

2015 |

+15 (Tele2) |

|||

|

Business combination |

On Tower Italia Acquisition |

11 |

2014 |

9+9 (Wind) |

|

2015 |

9+9 (Vodafone) |

|||

|

K2W |

Asset purchase |

32 |

2017 |

Various |

|

Business combination |

Swiss Towers Acquisition |

2,239 |

2017 |

20+10+10 (Sunrise Telecommunications) (4) |

|

294 |

2019 |

20+10+10 (Sunrise Telecommunications) (4) |

||

|

Business combination |

Infracapital Alticom subgroup |

30 |

2017 |

Various |

|

Others Spain |

Asset purchase |

45 |

2017 |

15+10 |

|

36 |

2018 |

15+10 |

||

|

375 |

2018 |

20+10 |

||

|

Masmovil Spain |

Asset purchase |

551 |

2017 |

18+3 |

|

85 |

2018 |

6+7 |

||

|

Linkem |

Asset purchase |

426 |

2018 |

10+10 |

|

Business combination |

TMI Acquisition |

3 |

2018 |

Various |

|

Business combination |

Sintel Acquisition |

15 |

2018 |

Various |

|

Business combination |

BRT Tower Acquisition |

30 |

2018 |

Various |

|

Business combination |

DFA Acquisition |

9 |

2018 |

Various |

|

Business combination |

Video Press Acquisition |

8 |

2019 |

Various |

|

Business combination |

On Tower Netherlands Acquisition |

114 |

2019 |

7 (5) |

|

Business combination |

Swiss Infra Acquisition |

2,834 |

2019 |

20+10 (6) |

|

Business combination |

Cignal Acquisition |

698 |

2019 |

20 (7) |

|

Business combination |

Business unit from Iliad Italia, S.p.A. |

2,586 |

2019 |

20+10 (6) |

|

Business combination |

On Tower France Acquisition |

7,537 |

2019 |

20+10 (6) |

|

Orange Spain |

Asset purchase |

1,500 |

2019 |

10+10+1 (8) |

|

Business combination |

Omtel Acquisition |

3,222 |

2018 |

20+5 (9) |

|

Business combination |

Arqiva Acquisition |

7,385 |

2020 |

10+1+1+4 (MBNL/EE) (10) |

|

2014 |

2024 (CTIL) (10) |

|||

|

Business combination |

NOS Towering Acquisition |

1,966 |

2020 |

15+15 (11) |

|

Business combination |

Hutchison Austria Acquisition |

4,494 |

2020 |

15+15+5 (12) |

|

Business combination |

Hutchison Ireland Acquisition |

1,136 |

2020 |

15+15+5 (12) |

|

Business combination |

Hutchison Denmark Acquisition |

1,411 |

2020 |

15+15+5 (12) |

|

Business combination |

Small M&A |

9 |

2020 |

Various |

|

Business combination |

Hutchison Sweden Acquisition |

2,668 |

2021 |

15+15+5 (12) |

|

T-Infra BV |

T-Mobile Netherlands |

3,137 |

2021 |

15+10 (13) |

|

Play |

Play |

7,616 |

2021 |

20+10 (14) |

|

Business combination |

Hutchison Italy Acquisition |

9,140 |

2021 |

15+15+5 (12) |

|

Cyfrowy Polsat |

Cyfrowy Polsat |

7,035 |

2021 |

25+15 (15) |

|

Hivory |

Hivory |

10,690 |

2021 |

18+5+5+5 (16) |

|

Omtel |

MEO |

687 |

2021 |

20+5+5+5 (17) |

|

Business combination |

Iaso Acquisition |

5 |

2021 |

Various |

|

Shared with broadcasting business |

1,682 |

|||

|

Others |

92 |

(1) Renewals: most of these contracts have clauses prohibiting partial cancellation and can therefore be cancelled only for the entire portfolio of sites (typically termed “all or nothing” clauses), and some of them have pre agreed pricing (positive/negative).

(2) The initial term of the MSA with Wind is 15 years, to be extended for an additional 15-year period (previously confirmed), on an “all-or-nothing” basis. The fees under the MSA with Wind are CPI-linked.

(3) In accordance with the agreements reached with Bouygues during 2016 – 2020, at 31 December 2020 Cellnex had committed to acquire and build up to 5,400 sites that will be gradually transferred to Cellnex up to 2024 (see Note 7 of the accompanying consolidated financial statements). Of the proceeding 5,400 sites, a total of 4,078 sites have been transferred to Cellnex as of 31 December 2020 (as detailed in the previous table). Note that all Bouygues transactions, like most of the BTS programmes Cellnex has in place with other MNOs, have a common characteristic “up to” as Bouygues does not have the obligation to reach the highest number of sites. During 2016 – 2017 have been signed different MSA’s with Bouygues in accordance with the different transactions completed (Glénan, Belle-Ille, Noirmoutier). All MSAs have an initial term of 20/25 years with subsequent renewable three/two 5-year periods, on an “all-or-nothing” basis. In relation to the MSA signed with Bouygues in 2018 (Quiberon transaction) the initial term is 20 years with subsequent renewable 5-year periods (undefined maturity).

(4) The MSA with Sunrise have an initial term of 20 years with two 10-year periods (undefined maturity), on an all-or-nothing basis.

(5) Contracts with customers are index-linked to the CPI and have an average duration of approximately seven years to be automatically extended (undefined maturity).

(6) The MSAs with Iliad and Salt have an initial term of 20 years, to be automatically extended for 10-year periods, on an all-or-nothing basis, with undefined maturity.

(7) Contracts with customers are index-linked to the CPI, have an average duration of c.20 years and a significant probability of renewal due to the portfolio’s strong commercial appeal and limited overlap with third party sites.

(8) Orange Spain is the main customer of this portfolio of telecom sites, with which Cellnex has signed an inflation-linked Master Lease Agreement for an initial period of 10 years that can be extended by one subsequent period of 10 years and subsequent automatic one-year periods, on an “all-or-nothing” basis.

(9) The initial term of the Omtel MSA is 20 years, subject to automatic extensions for additional five-year periods, unless cancelled, on an “all-or-nothing” basis, with undefined maturity. The fees under the Omtel MSA are CPI-linked.

(10) The initial term of the MSA with MBNL and EE is 10 years with three extension rights. The duration of the MSA with CTIL is until 2024 (at least two years before, extension to be discussed).

(11) The NOS Towering MLA have an initial duration of 15 years, to be automatically extended for additional 15-year periods, on an “all-or-nothing” basis, with undefined maturity. The fees under the NOS Towering MLA will be CPI-linked.

(12) The initial term of each CK Hutchison Continental Europe MSA is 15 years, with possible extensions for a further 15-year period and subsequent 5-year periods, on an “all-or-nothing” basis (same duration for all countries). The fees under the CK Hutchison Continental Europe MSA are CPI-linked.

(13) InitiaI term of 15 years + subsequent automatic renewals of 10 year periods (all or nothing, undefined maturity basis).

(14) Initial term of 20 years to be automatically extended for subsequent 10 year periods (on an all or nothing basis)

(15) 25 years with automatic 15 year renewals.

(16) 18 years with automatic 5 year renewals. All-or-nothing renewal clause, undefined maturity

(17) MLA with 20 + automatic 5 year renewals. All-or-nothing renewal clause, undefined maturity

Cellnex is the leading operator of broadcasting infrastructures in Spain, with more than 1,700 sites exclusively dedicated to transmitting audiovisual and radio signals. Cellnex offers a comprehensive network operation and radio spectrum management service. Ensuring the distribution and broadcasting of digital television, radio and multi-screen content to the main private and public audiovisual groups in the country.

For digital television content, Cellnex has led the implementation of DTT in Spain. The solutions offered by Cellnex include signal distribution, encoding in the most innovative formats and broadcasting of Ultra High Definition (UHD) content. For radio services, Cellnex offers configurable sound quality, data services capacity, flexibility in multiple channel composition, spectrum efficiency and cost efficiency.

In 2021, these DTT and FM services were provided with a very high level of service (SLA - Service Level Agreement), and, despite inclement weather, without any significant incident thanks to the operational excellence of the organisation, resources, processes, procedures and people.

In 2021, these DTT and FM services were provided with a very high level of service (SLA - Service Level Agreement), and, despite inclement weather, without any significant incident thanks to the operational excellence of the organisation, resources, processes, procedures and people.

The tasks associated with the Second Digital Dividend were also completed, a process initiated in 2020 aimed at freeing up the 700 MHz frequency band to facilitate the deployment of 5G. To that end, multiple actions were carried out in national, regional and local DTT broadcasting networks, with channel changes, adaptation of elements such as radiating systems, multiplexes, etc., always in coordination with the administration and broadcasters. At the business level, all contracts that were due to expire during the year were successfully renewed.

Cellnex also provides innovative services for the management and distribution of paid and free-to-air Internet content for multi-screen environments. For example, Online Business Support Services is a practical and efficient solution to manage all the processes involved in a customer's complete lifecycle, from first contact to billing and collection, through subscription service management, data modification and customer management.

Cellnex offers integrated and adaptable solutions to develop a connected society and make the smart concept a tangible reality in both urban and rural areas. Cellnex provides end-to-end network services for Public Administrations and large companies, integrating and adapting the required solutions. These include: Mission Critical Private Networks (MCPN) services, Business Critical Private Networks (BCPN) services, connectivity services, Operation and Maintenance services and IoT and Smart services.

In recent years, Cellnex's business has grown exponentially through inorganic operations, which has resulted in a significant expansion of its European presence, increasing complexity both in management and in new products and services.

The resulting total amount of infrastructure (sites and nodes), as at 31 December 2021, built and acquired by Cellnex is presented below.

Cellnex Austria joined the Group in 2020, as part of the agreement between Cellnex Group and CK Hutchison. Cellnex Austria operates more than 4,470 telecommunications sites located in urban, peripheral and rural areas throughout Austria. In addition, several dozen Cellnex sites have been deployed in areas considered dead spots to provide mobile coverage for the first time to isolated rural towns. Cellnex Austria provides services ranging from accommodation and co-location to electrical connections, security and alarm detection to corrective and preventive maintenance, among many others. As a result of this transaction, Cellnex entered Austria, reaching 25% of the market and becoming the main independent operator of telecommunications towers in the country. All this was achieved by Cellnex Austria's employees, a team that has years of experience in the sector, and that provides efficient and quality solutions to customers.

At the end of 2020, the telecommunications company HI3G Networks Denmark officially transferred the ownership of its towers and sites, together with the corresponding passive equipment, to Cellnex, operating thereafter under the name Cellnex Denmark. Cellnex Denmark owns more than 1,300 sites throughout Denmark, serving telecommunications operators and technology companies through state-of-the-art telecommunications infrastructure. In addition, Cellnex Denmark maintains the goal of building more than 500 new sites in the next few years with a view to the deployment of 5G in the country. At the forefront of these services is a team of professionals with extensive experience in telecommunications, committed to providing infrastructure services for telecommunications for the benefit of all interested parties and always with a proactive attitude.

Cellnex has an important telecommunications infrastructure network in Spain with more than 10,000 operational sites distributed throughout the territory, which provide a wide geographical coverage and allow it to offer services to mobile operators, broadcasters and administrations. Cellnex, as a neutral operator, offers all mobile operators in the country the services necessary for the wireless transmission of data and content, allowing its clients a high degree of efficiency in the deployment of networks and positioning itself advantageously in the development of the networks. 5G networks. Public and private broadcasters entrust the distribution and broadcast of their signal to Cellnex, which boasts high-quality parameters and extensive experience in spectrum management. At the same time, Cellnex is collaborating with state, regional and local public administrations, to develop networks and services that contribute to improving the administration-citizen relationship and pave the way for the Smart City.

The Cellnex France Group, which in turn is part of the Cellnex Group, is made up of five companies: Cellnex France, On Tower France, Nexloop France, Springbok mobility, and Hivory. Cellnex in France was founded in July 2016 as part of an initial agreement to purchase more than 600 telecommunications sites from Bouygues Telecom. The vast majority of the sites occupy quality locations in densely populated areas, an ideal situation for the future deployment of 5G. On Tower France was founded in December 2019 after the acquisition by the Cellnex France Group of 70% of the Iliad subsidiary that manages Free Mobile's passive infrastructure. On Tower France currently manages more than 5,700 sites throughout France. Nexloop France was created in May 2020 under a strategic partnership between Bouygues and the Cellnex France Group. Nexloop designs, implements, owns, manages, operates and maintains fiber optic infrastructure networks and numerous regional collection sites, as well as marketing services related to these activities. Springbok Mobility has been 100% subsidiary of the Cellnex France group since 2019. Springbok Mobility develops and operates dedicated indoor infrastructures for companies and real estate businesses, in existing or planned buildings, under its Mobile Inside global service contract, which is based on ensuring that buildings are 100% connected. In addition, in 2021 Cellnex closed the purchase of 100% of Hivory from Altice France and Starlight Holdco. Hivory manages the 10,500 sites that mainly serve the French mobile phone operator SFR.

Through the acquisition of Cignal in 2019, Cellnex Ireland is the country's newest telecommunications infrastructure provider, focusing primarily on the development and management of fiber infrastructure and tower sites to meet the requirements of the wireless communications industry. Cellnex's portfolio of sites in Ireland consists of more than 550 towers located throughout the country, plus the CK Hutchison sites, for which an agreement was reached in 2020. In addition, Cellnex Ireland is committed to providing the necessary infrastructure to support the improvement and availability of high-speed wireless broadband in rural areas and to help mobile operators address coverage in these communities.

Cellnex manages more than 24,000 sites in Italy which form a dense and far-reaching network covering the whole of Italy, and are therefore of great strategic value for mobile telecommunications, as well as for developing the current ultra-fast mobile 4-4.5G networks and the new 5G technology. Cellnex Italy provides multiple services in multi-operator mode, a key concept for the development of wireless networks and services, for optimizing investments and ensuring more rational and efficient use both in operation and in terms of the environmental impact of the reach of the existing and future network. In addition, TowerCo, a company 100% controlled by Cellnex Italy, manages more than 500 infrastructure assets spread over the entire Italian motorway network, operating in multi-operator and multi-service mode.

Cellnex Netherlands emerged from the acquisitions of Alticom BV (in 2017), Towerlink Netherlands BV (in 2016), Shere Masten BV (in 2016), Cignal Infrastructure Netherlands BV (originally T-Mobile Infra BV) (integrated in 2021) and Media Gateway (purchased in 2021). Cellnex's telecommunications infrastructure in the Netherlands consists of antenna masts, broadcasting towers, data centers and advertising masts strategically located in both urban and rural areas. Cellnex Netherlands' infrastructure is managed by a team of professionals from the Utrecht offices in The Hague. All the specialists have years of knowledge and experience in data and telecommunications.

In 2016 Cellnex entered the British market through the acquisition of Shere Group. In December 2019, Cellnex UK acquired the marketing rights of 220 tall towers from BT, and in July 2020 it acquired Arqiva Services Limited. From this acquisition “On Tower UK Limited” was born to be integrated into the current structure of Cellnex United Kingdom. Cellnex UK has over 9,000 sites and has access to hundreds of thousands of street-level assets essential for outdoor Small Cells and 5G deployments in dense urban areas. Responsible for leading Cellnex's business in the UK, the management team is committed to developing collaborative partnerships with clients, portfolio partners and stakeholders across the industry, driving innovation and growth, and creating value for everyone in today's connected world. In addition, pursuant to a sale and purchase agreement dated 12 November 2020, Hutchison agreed to sell to Cellnex UK the 100% of the share capital of CK Hutchison Networks (UK) Limited. The completion of the CK Hutchison Holdings Transaction in respect of the United Kingdom is subject to the satisfaction or waiver of applicable conditions precedent, including in relation to anti-trust and national security clearances, as required. On 16 December 2021, the United Kingdom Competition and Markets Authority (“CMA”), published its provisional findings and notice of possible remedies in relation to the CK Hutchison Holdings Transaction in respect of the United Kingdom, whereby it provisionally found that the CK Hutchison Holdings Transaction in respect of the United Kingdom would lead to a substantial lessening of competition in the market for the supply of access to developed macro sites and ancillary services to mobile network operators and other wireless communication providers in the United Kingdom. The Group publicly responded to the provisional findings and notice of possible remedies in January 2022 and, whilst the Group maintains that the CK Hutchison Holdings Transaction in respect of the United Kingdom will not result in any substantial lessening of competition, it has proposed a divestment remedy comprised of a limited subset of the infrastructures currently operated by Cellnex in the United Kingdom to resolve any potential concerns the CMA may continue to have at the time of its final decision. The deadline for publication of the CMA’s final decision is 7 March 2022. If the CK Hutchison Holdings Transaction in respect of the United Kingdom is cleared subject to remedies, the deadline for implementation of remedies is 30 May 2022 (which may be extended by the CMA to 11 July 2022).

In October 2020, Cellnex reached an agreement with Iliad to acquire a 60% majority stake in Play Communications' portfolio of towers in Poland. On September 2020, Iliad launched a takeover bid for Play, agreed with its two main shareholders, which concluded at the end of November 2020. After receiving the green light from the Polish Office for Competition and Consumer Protection, Cellnex formalized the acquisition announced in October to acquire a 60% majority stake in the company. Furthermore, in February 2021 Cellnex announced a transaction with Cyfrowy Polsat Group for the acquisition of 99.9% of its telecommunications infrastructure subsidiary, Polkomtel Infrastruktura. In July 2021, the Polish competition authority (UOKiK) authorized the acquisition of Polkomtel Infrastruktura by Cellnex, formalizing the acquisition at that time. Cellnex Poland operates 7,250 sites distributed throughout Poland, mainly consisting of towers that provide telecommunications operators and technology companies with a state-of-the-art telecommunications infrastructure.

In Portugal, Cellnex owns the companies Omtel (Omtel, Estruturas de Comunicações, S.A.), On Tower Portugal (On Tower Portugal, S.A.), Towerlink (Towerlink Portugal, S.A.) and Infratower (Infratower, S.A.). In 2019, Cellnex incorporated Towerlink, a company that owns and operates a SIGFOX IoT network. In January 2020, Cellnex acquired the full share capital of Omtel, the first independent Portuguese tower company. In September 2020, Cellnex acquired the full share capital of Nos Towering - Gestâo de Torres de Telecomunicaçôes, S.A., which changed its corporate name on that date to On Tower Portugal, S.A. In the last quarter of 2021, Cellnex acquired 100% of the share capital of Infratower S.A., owner of approximately 223 macro-sites and 464 micro-sites (DAS and Small Cells) in Portugal. Through Omtel, On Tower and Infratower, in Portugal, Cellnex already owns more than 5,000 telecommunications sites located in urban, suburban and rural areas throughout mainland Portugal and the islands of Madeira and Azores. Of these, a few dozen Cellnex sites were deployed to strategic point areas to bring mobile coverage to remote rural areas for the first time. Cellnex has a highly experienced and diversified team in Portugal, totally independent from the telecommunications operators, dedicated to efficiently supporting its growth and commitment to service excellence.

On Tower Sweden was incorporated in January 2021, from the acquisition of the assets of CK Hutchison. This company has more than 2,500 sites and its portfolio is distributed throughout the country and includes everything from 72-meter towers to highly complex interior space systems, which allowsenabling it to offer operators very cost-effective and respectful installation environments with the environment.environmentally- friendly installations. On Tower Sweden provides a full range of services, deploys and optimizesoptimises sites, provides installation services, as well as operation and maintenance. On Tower Sweden is an infrastructure co-location partner of the main Swedish wireless operators. The company provides secure and well-maintained sites for mobile, broadcast, IoT, Wi-Fi and fiberfibre operators. On Tower Sweden (formerly HI3G) has agreed to conditionally grant a call option (the “Swedish Call Option”) to Cellnex to purchase from HI3G interests in certain tower Assetsassets owned and operated by 3GIS but which, upon termination or expiry of the 3GIS Joint Venture Agreement, are transferred to HI3G (the “Swedish Option Towers”). The Swedish Call Option may only be exercised only if, amongst other things, the 3GIS Joint Venture Agreement is terminated or expires no later than 31 December 2030. Such terms of termination of the 3GIS Joint Venture Agreement are subject to agreement by HI3G, and HI3G is not under any obligation to agree to such terms or accept the transfer of the Swedish Option Towers.

In Switzerland, Cellnex is made up of the companies Swiss Towers AG and Swiss Infra Services SA. Swiss Towers AG was acquired in 2017 by acquiring the infrastructure of Sunrise Communications AG. In 2019, Swiss Infra Services SA was created by taking over the infrastructure of Salt Mobile (90%). In the first quarter of 2021, Cellnex (through Cellnex Switzerland AG), entered into an agreement with Matterhorn Telecom SA to acquire 10% of the share capital of Swiss Infra Services SA from Matterhorn, as described in Note 2.h.II of the accompanying consolidated financial statements. Pursuant to this acquisition, Swiss Towers AG held 100% of Swiss Infra as of 31 December 2021, as in the first half of 2019, the Group entered into a long-term industrial alliance with Matterhorn by virtue of which Swiss Towers purchased 90% of the share capital of Swiss Infra for a total amount of approximately EUR 770 million (see Note 6 of the Consolidated Financial Statements for the year ended on 31 December 2019). Cellnex Switzerland creates added value for society, its customers and all stakeholders. With a team of experienced industry experts, the company operates a dense network of more than 6,000 telecommunications sites across the country. Cellnex Switzerland is the leading independent, national and neutral telecommunications infrastructure and services operator.

In 2021 the following significant events took place regarding corporate operations at Cellnex Group.

Following the various agreements reached in 2020 between Cellnex and CK Hutchison, 2021 has been a year of completing a large part of the agreements and integration of the different acquisitions made. Thus, in December 2020 the assets of Denmark, Austria and Ireland were incorporated and in 2021 those of Sweden and Italy. Currently, the transaction in the UK is still active in 2022. In this regard, Cellnex is working together with the British Competition and Markets Authority (CMA), in relation to the ongoing analysis of Cellnex's acquisition of CK Hutchison's passive infrastructure assets in the United Kingdom. The consideration for the CK Hutchison Holdings Transaction in respect of the United Kingdom is expected to be settled upon closing partly in cash and partly by the issue to Hutchison of new Shares and (if applicable) the transfer to Hutchison of treasury Shares. On 29 March 2021, the general shareholders’ meeting of Cellnex (the “General Shareholder’s Meeting”) approved (delegating its execution on the Board of Directors) a share capital increase by means of an in-kind contribution for the payment of the portion of the consideration to be settled in Shares, as described in the item 10 on the agenda of the resolutions passed by the 2021 General Shareholder’s Meeting. Hutchison is expected to receive approximately EUR 1.4 billion in Shares (with the exact number of Shares to be received by Hutchison based on the Cellnex Share price at closing[2]).'Hutchison is expected to receive approximately 27 million new Shares, depending on the Cellnex's share price as explained below, with Cellnex expecting to transfer such number of additional treasury Shares as is necessary to reach the number of the Shares consideration payable to Hutchison pursuant to the CK Hutchison Holdings Transaction in respect of the United Kingdom. The aggregate number of Shares to be delivered to Hutchison at completion is also subject to adjustment in the event that certain events (same adjustments events as in the EUR 850Mn 2028 convertible bond) relating to Cellnex’s share capital occur prior to completion of the CK Hutchison Holdings Transaction in respect of the United Kingdom, including, among others, issues of Shares in Cellnex by way of conferring subscription or purchase rights (such as the issuance of Shares by Cellnex that occurred on 23 April 2021). As described in item 10, paragraph 10, of the Resolutions passed by the 2021 General Shareholder’s Meeting, the General Shareholders' Meeting acknowledged that the potential differences in value between (i) the implicit value attributed to Cellnex's shares which will be issued in the context of the share capital Increase resolution; and (ii) the volume weighted average price of Cellnex's shares on a date which is close to the date where the share capital increase will be executed (subject to a collar mechanism limiting, exclusively to this purpose, the potential fluctuations in the share price(2)) will be adjusted. Such adjustment, which has a purely contractual significance and does not affect in any way the terms of the share capital increase, will be effected, if applicable, by means of Cellnex's shares transfer and/or, if agreed between Cellnex and Hutchison, by cash payment. Hutchison is expected to hold at closing of the CK Hutchison Holdings Transaction in respect of the United Kingdom an interest of between approximately 3.4% and 4.8%(2) in Cellnex’s share capital, depending on the Cellnex's share price as explained in the presentation to the market of 12 November 2020 as well as the capital increase prospectus of 30 March 2021, assuming that no further adjustment events occur. However, in the event that the Cellnex shareholder approval to issue new Shares expires and is not renewed before completion, payment of the total consideration for the CK Hutchison Holdings Transaction in respect of the United Kingdom can be made fully in cash, unless otherwise agreed between the parties. In relation to the consideration for the CK Hutchison Holdings Transaction in respect of the United Kingdom that is expected to be partially settled through the issuance to Hutchison of new Shares and (if applicable) the transfer to Hutchison of treasury Shares, if as a result of a takeover bid prior to closing of such transaction a third party (alone or in concert with another person) acquires the majority of the votes in Cellnex, instead of delivering Shares, Cellnex shall procure that Hutchison receives at completion such equivalent consideration as Hutchison would have received had it been a shareholder of Cellnex at the time of the takeover bid.

In Italy, the closing of the purchase of CK Hutchison's telecommunications tower assets in the country (9,100 sites) was completed in June 2021, following the green light from the Italian competition authority (Autorità Garante della Concorrenza). In this sense, during the second half of 2021 and during 2022, work will be done to integrate Hutchison into Cellnex Italia.

In Ireland, the completion of the asset purchase was announced in December 2020. Thus, during that year the focus was on integrating the Hutchison team into Cellnex Ireland and understanding the assets, challenges and opportunities to operate as a just business.

In the case of Austria, Sweden and Denmark, representing new markets, the challenge in 2021 has been to enter a new market and to create the team and integrate it into the Cellnex model. In the case of Sweden and Denmark, a Shared Services team has been set up to support both countries and in the case of Austria, a Shared Services team has been established with Switzerland. In both cases, the Shared Services centers carry out business support functions such as Finance, IT or People amongst others.

In June 2021, the agreement announced in January of that same year was signed whereby Cellnex had reached an agreement with Deutsche Telekom to integrate the 3,150 telecommunications sites of T-Mobile Infra BV’s in the Netherlands. This operation allows Cellnex to operate a total of 4,314 sites in the country and to play an important role as a telecommunications infrastructure operator in the Netherlands. Likewise, Cellnex and T-Mobile Netherlands BV will sign a long-term service contract of 15 years, automatically renewable for periods of 10 years. The agreement also includes the deployment of 180 new sites. In addition, Cellnex, DIV and a Dutch foundation entered into an agreement upon closing, which set forth the right of DIV to sell its 37.65% non-controlling interest to Cellnex, at a price to be calculated pursuant to said agreement. Thus, Cellnex, as a consequence of the terms set forth in paragraph 23 of IAS 32, recorded a liability in the amount of EUR 296 million (see Note 19.b.VI.) corresponding to the contingent commitment to purchase the 25.10% of the Cellnex Netherlands’ shares from third-party shareholders, whose interests in this consolidated company are reflected as of 31 December 2021 under “Non-controlling interests".

The agreement with Iliad announced in October 2020 was completed in March 2021, whereby Cellnex would now have a 60% controlling stake in the company that operates the nearly 7,000 Play telecommunications sites in Poland. Thus, the remaining 40% will continue to be owned by Play (Iliad), following the model agreed upon by Cellnex and Iliad in the case of the sites that Free (Iliad) operates in France. This new Polish telecommunications infrastructure company controlled by Cellnex plans to invest up to 1,300 million euros between now and 2030 in the deployment of up to c. 5,000 new sites.

In July 2021, the completion of the transaction with Cyfrowy Polsat Group was announced, in relation to the agreement to acquire 99.9% of its telecommunications infrastructure subsidiary, Polkomtel Infrastruktura. Polkomtel operates the passive infrastructure assets (7,000 towers and telecommunications sites) and active infrastructures (37,000 radio carriers covering all the bands used by 2G, 3G, 4G and 5G, a backbone network of 11,300 km of fiber - backbone– and fiber to the tower –backhaul– and a national network of microwave radio links). The agreement represents an investment of 1,600 million euros for Cellnex, accompanied by an additional deployment program of up to 1,500 sites, as well as investments in active equipment, mainly for the deployment of 5G, for another 600 million euros in the next 9 years.

Upon completion of the Polkomtel Acquisition, Polkomtel Infrastruktura, Polkomtel and Aero 2 sp. z.o.o., a MNO within the Polkomtel Group (“Aero”, and together with Polkomtel, the “Polkomtel Customers”), entered into a master services agreement whereby Polkomtel Infrastruktura provides access to its passive infrastructures, render the services necessary to maintain the technical conditions that are necessary to provide the transmission of radio signals of a cellular telecommunication network and provide transmission “backhaul”, among other ancillary services, to the Polkomtel Customers (the “Polkomtel MSA”). The Polkomtel MSA is following a business model consisting in a long-term revenue that ensures the profitability and return on investment (Capex) executed by Cellnex on behalf of the customer, encouraging investment in the expansion and modernization of client infrastructure and allowing better customer quality services owing to new investments (Capex). The revenue of any year according to the MSA is composed mainly by the addition of the following items: i) a Capex payback (which tend to be 10 years) ii) an industrial margin on the Capex payback, iii) an agreed opex required to run the Capex, (iv) electricity pass through, and (v) other opex items. This long term revenue model presents a tariff scheme that allow Cellnex to increase items ii), iii) and v) on year basis following the Polish CPI. Item i) will follow inflation as new capex cycles are considered in the long term revenue model. This business model presents similar characteristics to the BTS programs, as Cellnex is remunerated when Cellnex invests on the new Capex programmeagreed with the client. Also, Cellnex i) can share the infrastructure with third parties, ii) has operating leverage, iii) strong backlog and iv) maintenance capex higher to its c. 3% of total Revenues.

The acquisition of Polkomtel Infrastruktura places Cellnex in a strategic position in Poland while incorporating a new service within Cellnex's business portfolio: Active Team management. This marks an unprecedented event at Cellnex, where the challenge from now on is to expand the active team management service throughout the Company's portfolio.

In October 2021, Cellnex's purchase, announced in February of that year, of 100% of Hivory from Altice France and Starlight Holdco in France by Cellnex was completed. Hivory manages the 10,500 sites that mainly serve the French mobile phone operator SFR. The agreement represents an investment of €5,200 million for the company, which will be accompanied by an eight-year programmefor another €900 million for the deployment, among other projects, of up to 2,500 new sites. The authorization of this operation by the French competition authority also establishes that Cellnex will have to divest approximately 3,200 urban sites of the total number of sites that the Group will be managing in France after the integration of Hivory.

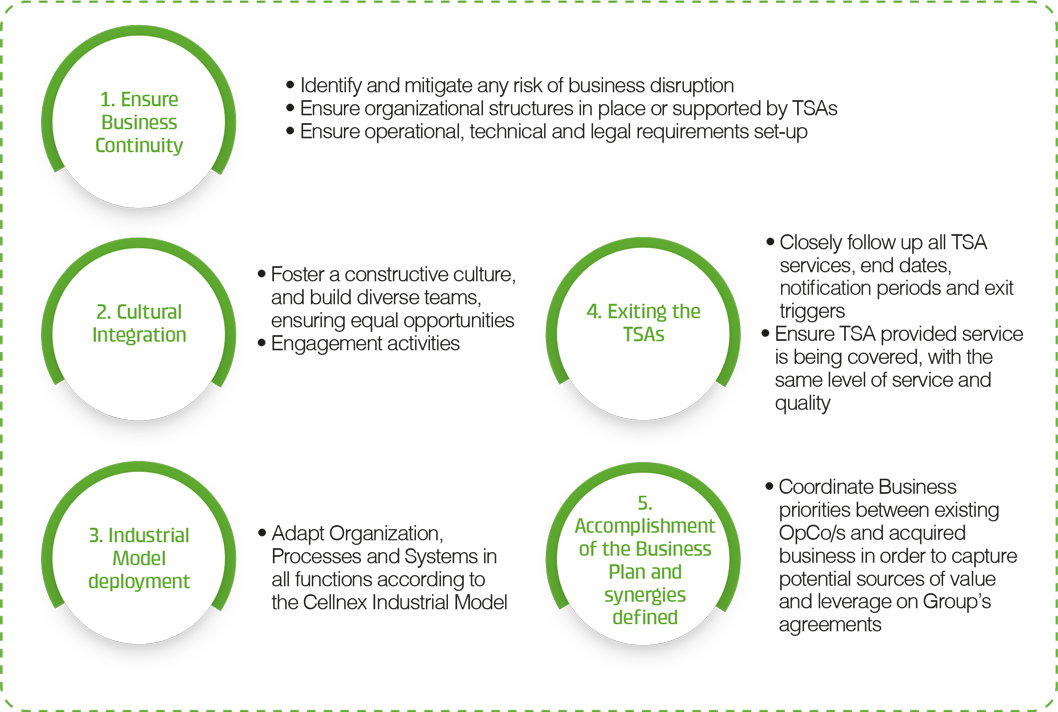

Integrating the companies that are acquired and absorbing growth in an agile and efficient way, while at the same time ensuring business continuity is not an easy task. Achieving both of these and maintaining high quality standards represents a challenge for Cellnex. The the mission of the Integration team is therefore to lead the integration processes while preserving the existing value of the acquired business and guaranteeing coordination between local and corporate teams. During the projects, the processes of the acquired company are evaluated, the defined priorities are carried out and implementation plans are defined, thus ensuring the deployment of Cellnex's Industrial Model.

Cellnex has demonstrated its ability to grow, ensuring business continuity, optimizing synergies and maintaining a high level of team commitment. This is possible by the definition of an integration framework, which allows the process to be carried out in a more agile, flexible and efficient way.

Below are the main challenges Cellnex faces during an integration process.

The Business Development Team is in charge of developing the business side of mergers and acquisitions (M&A) projects. They identify targets for possible deals that fit with the geographical areas and businesses in the countries where Cellnex operates, participate in the definition of the business plan, preparation of bids, Due Diligence procedures and the signature for the acquisition of business and/or assets. Also, once the operation has been completed, they transfer all the information collected to the relevant corporate departments so that the integration process of the company and/or assets can begin.

Before starting the integration process, there is a Pre-closing phase, which runs from the signature to the completion of the acquisition. This phase begins with the transfer of information from the M&A team to the Integration team. Based on the information available, the Integration team analyzes and defines the best integration strategy in coordination with the rest of the areas, and prepares the necessary actions to, once the transaction is closed, ensure the continuity of the service of the acquired company.

Each integration is divided into three phases:

As each integration takes place, Cellnex adjusts its Integration Framework based on experience and lessons learned. To that end, during 2021 the Integration Team improved and adapted its Integration methodology on the basis of the lessons learned from previous integrations, and their context, always with the speed, scalability and flexibility that the organization requires. The main actions carried out in 2021 were:

To ensure that integration projects are properly carried out, together with monitoring and control, a similar governance structure has been defined and is being implemented in all projects. The resulting structure for integration projects is as follows:

In 2021, 15 integration projects were managed, 12 of them simultaneously. Each project involves the participation of about 90 people from 12 different areas. As a result of these integrations, approximately 550 new employees have been incorporated into Cellnex, more than 35,000 locations and new service lines.

The Integration Buddy project is the informal point of contact during the integration process. The objective is to help understand the culture and the formal and informal structures of the company, as well as to act as an informal link between the headquarters and the country.

Therefore, the Integration Buddy has the following functions:

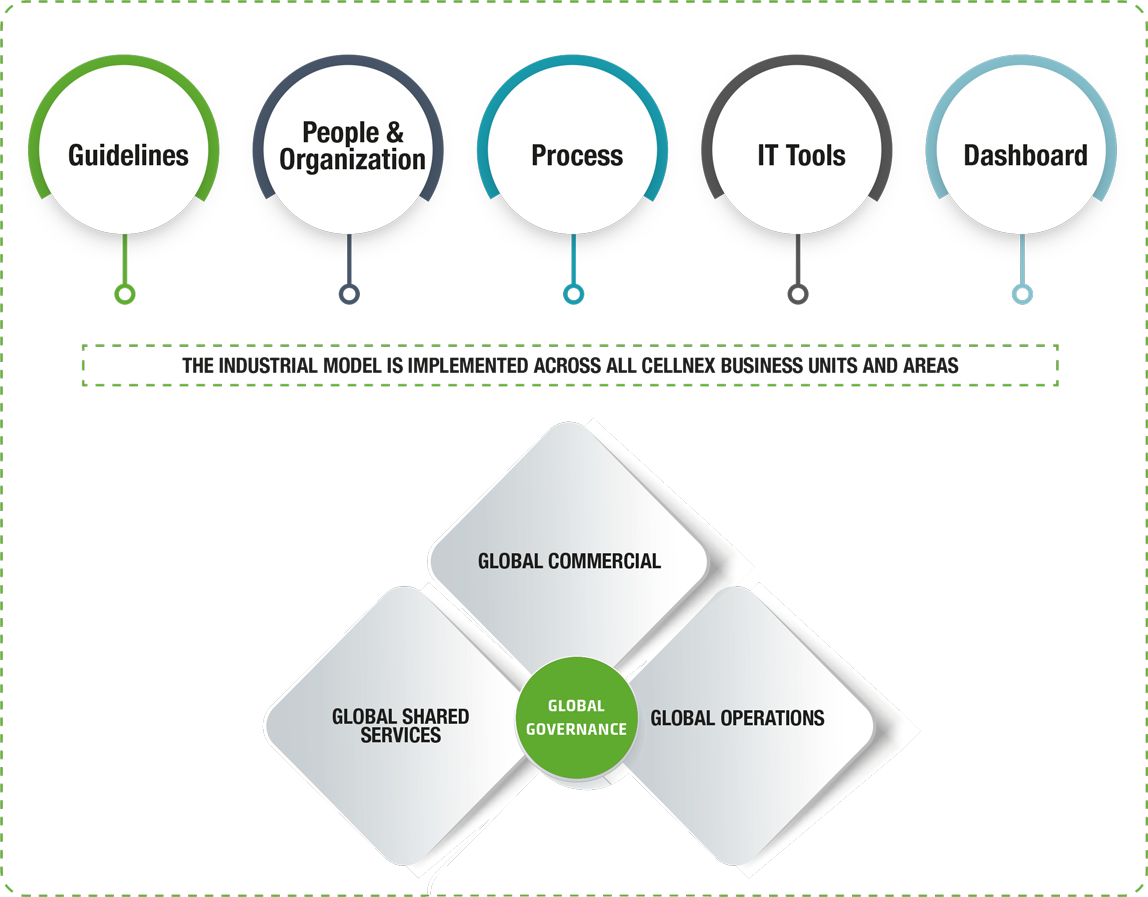

The Cellnex Industrial Model is the key tool for supporting the Cellnex strategy and ensuring sustainable and scalable growth.

This model consists of a common way of working, that is replicable, scalable, homogeneous and that allows rapid growth, but not proportional in costs or consumption of resources. The deployment of the Industrial Model is deployed both through integration projects for new acquisitions, as well as through value creation or continuous improvement projects, always under an Integrated Management Model. Cellnex's industrial model is applied to all Cellnex business units and departments.

Global Governance is based on the Cellnex Industrial Model being supervised by Cellnex's Senior Management at corporate and country levels, through a common Management Model for monitoring the strategy, objectives and results, and support for making the appropriate decisions in this regard. To that end, a scalable standard organizational structure has been formally defined for all Business Units, embodying basic general functions.

In this sense, the model defined by Cellnex has a matrix structure to facilitate joint working between corporate departments and countries, combining a global and local vision. Consequently, in each country the various departments report to the relevant General Manager (who, in turn, reports to the Corporate Deputy General Manager) and have a functional relationship with the corresponding Corporate departments.

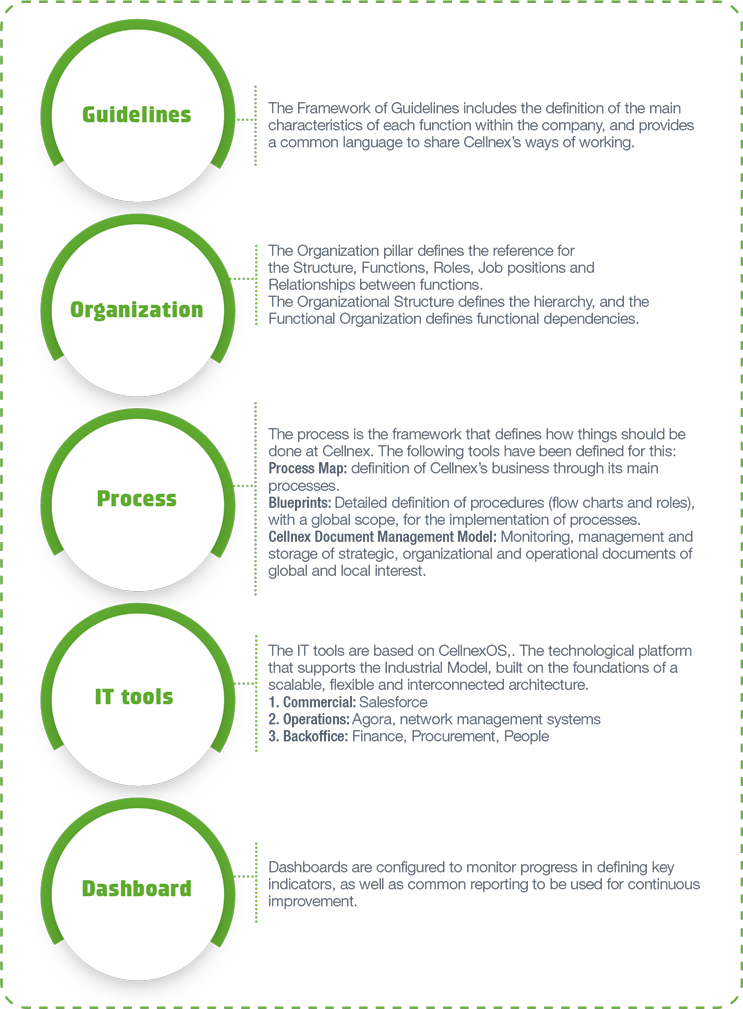

The Industrial Model is implemented through the following five elements and evolves for each department according to its needs.

For the progressive implementation of the Cellnex Industrial Model in each new Business Unit, there is a Change Management Methodology, which covers the following stages:

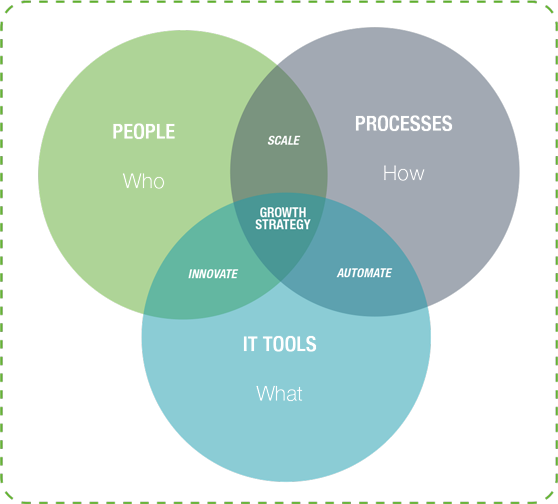

People, Processes and IT Tools are the three central elements that support the implementation of the Industrial Model. In the case of People, it is essential to develop and implement a Corporate Culture built on the values that best define the Company and its employees. Cellnex wants to ensure that it is a reference as well as a great place to work in all the markets in which it operates.

With the Processes, Cellnex adds value to customers and employees, facilitating growth, change management and continuous improvement, through standardized processes and best practices. And, finally, the IT Tools allow information technology services that support the Industrial Model to be planned, implemented and provided, leveraging the Group's sustainable growth, with the highest quality, efficiency and commitment to service.

Cellnex has the necessary levers to guarantee the expected response to the business strategy and provide the necessary capacities to support growth and business transformation.

The Global Governance section of Cellnex’s transformation program includes the PRIME Project initiative, which has the main objective of defining and implementing the new industrial model for the Group’s accounting and administrative functions. The PRIME Project defines a homogeneous and scalable model for all the countries so that efficiencies can be captured and the Group's fast growth absorbed.

The project started in 2018 by defining the common target model from a processes, policies, systems and organization perspective. The defined model includes the outsourcing of administrative and lower value-added activities to an external partner, while keeping the activities with the highest added-value related to administration and accounting and controlling them inside the organisation. The implementation of the model started in 2020, led by a transversal team from Finance, IT and Organization and Integrations from both corporate and country levels. In 2020 the model was implemented in six countries of the Cellnex Group (Spain, the Netherlands, the United Kingdom, France, Switzerland and Italy) and during 2021, the model was successfully implemented in five other countries, namely Portugal, Austria, Ireland, Denmark and Sweden. The deployment of the project is expected to continue during 2022, incorporating new countries such as Poland and other companies recently added to the Group.

At the end of 2020, the integration of Omtel into Cellnex Portugal was completed, since then the Portugal team has focused on launching Cellnex's industrial model, mainly using SAP, Agora and Prime, and achieving compliance with more 90% of the milestones of the integration project.

Recurring Leveraged Free Cash Flow (please see section 2.3 of this Consolidated Management Report) organic growth generation in the year ended December 31, 2021 amounted to 125 million euros (please see full year 2021 results presentation), driven by a number of contributors: i) BTS programme execution (approximately 58 million euros), ii) escalators or inflation (approximately 18 million euros), iii) Operating expenses, ground lease efficiencies and synergies (approximately 15 million euros) and, iv) New colocations and associated revenues (approximately 34 million euros). These are the assumptions that the management has taken into account:

1 Neutral: without the mobile network operator holding as a shareholder (i) more than 50% of the voting rights or (ii) the right to appoint or remove a majority of the members of the Board of Directors. The loss of the Group's neutral position (i.e. by having one or more mobile network operators as a major shareholder) may make sellers of infrastructure assets reluctant to enter into new joint ventures, mergers, divestitures or other arrangements with the Group (which also affects the organic growth of the business). As the Group grows, management expects that large network operators may become open to collaborating with the Group in various ways, such as by selling their sites or other infrastructure assets to Cellnex, including in exchange for shares, which could adversely affect the Group's business and future prospects, as this type of transaction could affect the perceived neutrality of the Group.

2 As such, the minimum and the maximum number of shares to be issued and delivered to Hutchison amounts to 23.7 million and 34.1 million, respectively, in the event the arithmetic average of the Volume Weighted Average Price on each of the 20 consecutive trading days ending on and including the date which is five trading days prior to the completion date of the CKH Hutchison Holdings Transactions in respect of the United Kingdom equals to or is above €57.0 per share and equals to or is below €39.6 per share, respectively.

Before starting...

We use our own and third-party cookies for analytical purposes and to show you personalized advertising based on a profile prepared from your browsing habits (for example, pages visited). Click HERE for more information. You can accept all cookies by pressing the "Accept" button or configure or reject their use by pressing the "Configure" button.

ACCEPT AND CONTINUE Configure cookies