The year that ended on 31 December 2021 highlighted a unique combination of defensive and high quality structural growth with limited exposure to COVID-19, which is possible through consistent and sustainable organic growth, solid financial performance and a tireless focus on integration.

An Alternative Performance Measure (APM) is a financial measure of historical or future financial performance, financial position, or cash flows, other than a financial measure defined or specified in the applicable financial reporting framework.

Cellnex believes that there are certain APMs, which are used by the Group’s Management in making financial, operational and planning decisions, which provide useful financial information that should be considered in addition to the financial statements prepared in accordance with the applicable accounting regulations (IFRS-EU), in assessing its performance. These APMs are consistent with the main indicators used by the community of analysts and investors in the capital markets.

In accordance with the provisions of the Guide issued by the European Securities and Markets Authority (ESMA), in force since 3 July 2016, on the transparency of Alternative Performance Measures, Cellnex provides below information on the APMs it considers significant: Adjusted EBITDA; Adjusted EBITDA Margin; Gross and Net Financial Debt; Maintenance, Expansion and M&A CAPEX; Net payment of interest; Available liquidity and Recurring leveraged free cash flow.

Adjusted EBITDA, Recurring Leveraged Free Cash Flow and Capex indicators are Alternative Performance Measures (“APM”) as defined in the guidelines issued by the European Securities and Markets Authority on October 5, 2015 on alternative performance measures (the “ESMA Guidelines”).

The definition and determination of the aforementioned APMs are disclosed in the accompanying consolidated financial statements and are therefore validated by the Group auditor (Deloitte).

The Company presents comparative financial information from the previous year as detailed in Note 2.e to the accompanying consolidated financial statements.

This relates to the “Operating profit” before “Depreciation and amortisation charge” (after adoption of IFRS 16) and after adding back (i) certain non-recurring items (such as COVID donations, redundancy provision, extra compensation and benefit costs, and costs and taxes related to acquisitions) or (ii) certain non-cash items (such as advances to customers, and LTIP remuneration payable in shares).

The Group uses Adjusted EBITDA as an indicator of the operating performance of its business units and is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders. At the same time, it is important to highlight that Adjusted EBITDA is not a measure adopted in accounting standards and, therefore, should not be considered an alternative to cash flow as an indicator of liquidity. Adjusted EBITDA does not have a standardised meaning and cannot therefore, cannot be compared with the Adjusted EBITDA of other companies.

As at 31 December 2021 and 2020, respectively, the amounts were as follows:

|

Adjusted EBITDA (€ thousand) |

||

|

|

31 December 2021 |

31 December 2020 |

|

Broadcasting infrastructure |

218,290 |

227,257 |

|

Telecom Infrastructure Services |

2,211,789 |

1,272,583 |

|

Other Network Services |

102,720 |

104,932 |

|

Operating income (5) |

2,532,799 |

1,604,772 |

|

|

|

|

|

Staff costs (6) |

(300,357) |

(165,861) |

|

Repairs and maintenance (7) |

(79,708) |

(50,783) |

|

Utilities (7) |

(159,080) |

(102,359) |

|

General and other services (7) |

(249,153) |

(153,415) |

|

Depreciation and amortisation charge (8) |

(1,687,564) |

(973,971) |

|

Operating profit |

56,937 |

158,383 |

|

|

|

|

|

Depreciation and amortisation (8) |

1,687,564 |

973,971 |

|

Non-recurring expenses (9) |

172,941 |

45,712 |

|

Advances to customers (9) |

3,269 |

3,659 |

|

Adjusted operating profit before depreciation and amortisation charge (Adjusted EBITDA) |

1,920,711 |

1,181,725 |

Non-recurring and non-cash expenses, and advances to customers at 31 December 2021 and 2020 are set out below (see Note 20.d of the accompanying consolidated financial statements):

During 2021 Cellnex performed several business combinations. If all the business combinations carried out during 2021, had been completed on 1 January 2021 and had been fully consolidated for the full year ended on 31 December 2021, the Adjusted EBITDA would have reached approximately the value of EUR 2,483 million and the payments of lease instalments in the ordinary course of business would have been approximately EUR 736 million.

Adjusted EBITDA Margin corresponds to Adjusted EBITDA (as defined above), divided by operating income excluding elements passed through10 to customers from both expenses and revenues, mostly electricity costs (this concept only includes Services and Advances to customers and does not take into account Other operating income10). The Company uses Adjusted EBITDA margin as an operating performance indicator and it is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders.

Accordingly, the Adjusted EBITDA Margin as at 31 December 2021 and 2020 was 79% and 75%, respectively.

The Gross financial debt corresponds to “Bond issues and other loans”12, “Loans and credit facilities”12 and “Lease liabilities”13, but does not include any debt held by Group companies registered using the equity method of consolidation, “Derivative financial instruments”14 or “Other financial liabilities”12.

According to the above, its value as at 31 December 2021 and 2020, respectively, is as follows:

|

|

Thousands of Euros |

|

|

|

31 December 2021 |

31 December 2020 restated |

|

Bond issues and other loans (15) |

13,565,690 |

7,534,957 |

|

Loans and credit facilities (15) |

2,064,351 |

1,854,488 |

|

Lease liabilities (16) |

2,836,084 |

1,756,045 |

|

Gross financial debt |

18,466,125 |

11,145,490 |

Net financial debt

Relates to “Gross financial debt” minus “Cash and cash equivalents”.17

Together with “Gross financial debt”, the Company uses “Net financial debt” as a measure of its solvency and liquidity as it indicates the current cash and equivalents in relation to its total debt liabilities. From the net financial debt, common used metrics are calculated such as the “Annualised Net Debt/12-month forward looking Adjusted EBITDA” which is frequently used by analysts, investors and rating agencies as an indication of financial leverage.

The “Net financial debt” on 31 December 2021 and 2020 is detailed in Section “Liquidity and Capital Resources” of this Consolidated Management Report.

Net payment of interest corresponds to i) “interest payments on lease liabilities”18 plus ii) “Net payment of interest (not including interest payments on lease liabilities)” and iii) non-recurring financing costs related to M&A projects19.

The Group considers as available liquidity the available cash and available credit lines at year-end closing.

The Group considers capital expenditures as an important indicator of its operating performance in terms of investment in assets, including their maintenance, organic and Build-to-suit expansion, and acquisition. This indicator is widely used in the industry in which the Company operates as an evaluation metric among analysts, investors, rating agencies and other stakeholders.

The Group classifies its capital expenditures in four main categories:

Corresponds to investments in existing tangible or intangible assets, such as investment in infrastructure, equipment and information technology systems, and are primarily linked to keeping sites in good working order, but which excludes investment in increasing the capacity of sites.

Includes site adaptation for new tenants, ground leases (cash advances), and efficiency measures associated with energy and connectivity, and early site adaptation to increase the capacity of sites, or specific engineering services. Thus, it corresponds to investments related to business expansion that generates additional Recurring Leveraged Free Cash Flow (including decommissioning, telecom site adaptation for new tenants and prepayments of land leases).

Corresponds to committed Build-to-suit programs (consisting of sites, backhaul, backbone, edge computer centers, DAS nodes or any other type of telecommunication infrastructure as well as any advanced payment related to it) as well as Engineering Services with different clients. Ad-hoc maintenance capital expenditure required eventually may be included.

Corresponds to investments in shareholdings of companies (excluding the amount of deferred payments in business combinations that are payable in subsequent periods) as well as significant investments in acquiring portfolios of sites or land (asset purchases).

Total capital expenditure for the year ended 31 December 2021 and 2020, including property, plant and equipment, intangible assets, advance payments on land leases and business combinations are summarised as follows:

|

|

Thousands of Euros |

|

|

|

31 December 2021 |

31 December 2020 restated |

|

Maintenance capital expenditures |

76,799 |

52,381 |

|

Expansion (or organic growth) capital expenditures |

233,107 |

145,618 |

|

Expansion capital expenditures (Build to Suit programs) |

1,346,136 |

559,417 |

|

M&A capital expenditures |

12,741,420 |

5,618,195 |

|

Total investment (1) |

14,397,463 |

6,375,611 |

(1)“Total Investment”, amounting to EUR 14,397 million (EUR 6,376 million in 2020), corresponds to “Total net cash flow from investing activities” of the accompanying Consolidated Statement of Cash Flows amounting to EUR 13,904 million (EUR 5,895 million in 2020), plus i) “Cash and cash equivalents” of the acquired companies in business combinations amounting to EUR 211 million (EUR 111 million in 2020, see Note 6 of the accompanying consolidated financial statements); plus ii) "Cash advances to landlords" amounting to EUR 71 million (EUR 264 million in 2020, see Note 16 of the accompanying Consolidated Financial Statements); plus iii) "Others" amounting to EUR 210 million (EUR 106 million in 2020), which includes the substitute tax paid (see Note 18.b of the accompanying consolidated financial statements), financial investments, timing effects related to assets purchases and the contribution of minority shareholders.

The Company considers recurring leveraged free cash flow to be one of the most important indicators of its ability to generate stable and growing cash flows which allows it to guarantee the creation of value, sustained over time, for its shareholders. The criteria used to calculate the Recurring leveraged free cash flow is the same as the previous year.

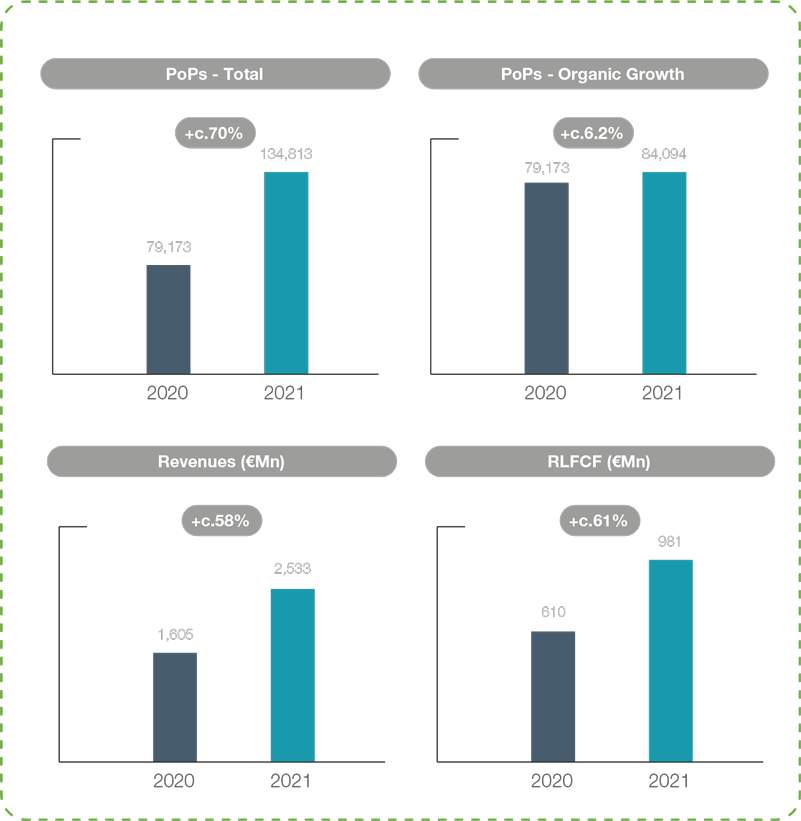

At 31 December 2021 and 2020 the Recurring Leveraged Free Cash Flow (“RLFCF”) was calculated as follows:

|

|

Thousands of Euros |

|

|

|

31 December 2021 |

31 December 2020 restated |

|

Adjusted EBITDA(1) |

1,920,711 |

1,181,725 |

|

Payments of lease installments in the ordinary course of business and interest payments(2) |

(593,598) |

(365,483) |

|

Maintenance capital expenditures(3) |

(76,799) |

(52,381) |

|

Changes in current assets/current liabilities(4) |

(68) |

(10,426) |

|

Net payment of interest (without including interest payments on lease liabilities)(5) |

(182,533) |

(104,593) |

|

Income tax payment(6) |

(87,170) |

(38,577) |

|

Recurring leveraged free cash flow (RLFCF) |

980,543 |

610,265 |

|

Expansion (or organic growth) capital expenditures(7) |

(233,107) |

(145,618) |

|

Expansion capital expenditures (Build to Suit programs) (8) |

(1,346,136) |

(559,417) |

|

M&A capital expenditures (cash only) (9) |

(12,529,294) |

(5,508,144) |

|

Non-Recurrent Items (cash only)(10) |

(81,346) |

(36,941) |

|

Net Cash Flow from Financing Activities(11) |

12,485,240 |

7,909,446 |

|

Other Net Cash Out Flows (12) |

(1,349) |

30,881 |

|

Net Increase of Cash (13) |

(725,449) |

2,300,472 |

1. Adjusted EBITDA: Profit from operations before D&A (after IFRS 16 adoption) and after adding back (i) certain non-recurring items (such as COVID donations (€4Mn), redundancy provision (€81Mn), extra compensation and benefits costs (€2Mn) and mainly tax and ancillary costs related to M&A (€76Mn)) and/or (ii) certain non-cash items (such as advances to customers (€3Mn) which include the amortisation of amounts paid for sites to be dismantled and their corresponding dismantling

costs, and LTIP remuneration payable in shares and others (€11Mn)).

2. Corresponds to i) payments of lease installments (€377Mn) in the ordinary course of business and; ii) interest payments on lease liabilities (€217Mn). See Note 16 of the accompanying consolidated financial statements.

3. Maintenance capital expenditures: investment in existing tangible or intangible assets, such as investment in infrastructure, equipment and information technology systems, which are primarily linked to keeping sites in good working order, but which excludes investment in increasing the capacity of sites.

4. Changes in current assets/current liabilities (see the relevant section in the Consolidated Statement of Cash Flows for the period ended on 31 December 2021).

5. Corresponds to the net of “Interest paid” and “interest received” in the accompanying Consolidated Statement of Cash Flows for the period ended on 31 December 2021, excluding “Interest payments on lease liabilities” (€217Mn) (see Note 16 of the accompanying consolidated financial statements) and non-recurring financing costs related to M&A projects (see caption "Net Payment of Interest").

6. Corresponds to the "Income Tax received/(paid)" in the accompanying Consolidated Statement of Cash Flows for the period ended on 31 December 2021. It does not include the "Non-recurring Income tax paid" (€78Mn) regarding the substitutive tax paid (see Note 18.b of the accompanying consolidated financial statements).

7. Corresponds to cash advances to landlords (€71Mn), efficiency measures associated with energy and connectivity (€35Mn), and others (€127Mn, including early site adaptation to increase the capacity of sites). Thus, it corresponds to investments related to business expansion that generates additional Recurring leveraged free cash flow.

8. Committed Build to Suit Programs and further initiatives (consisting of sites, backhaul, backbone, edge computing centers, DAS nodes or any other type of telecommunication infrastructure as well as any advanced payment in relation to them). It also includes Engineering Services or work and studies that have been contractualised with different customers, including ad-hoc capex eventually required.

9. Corresponds to investments in shareholdings of companies as well as significant investments in acquiring portfolios of sites or land (asset purchases), after integrating into the consolidated balance sheet mainly the "Cash and cash equivalents" of the acquired companies. Mainly correspond to the acquisition of SFR France, Hutchison Italy, Hutchison Sweden, Iliad Poland and Polkomtel.

The amount resulting from (3)+(8)+(9)+(10), hereinafter the “Total Capex” (€14,185Mn), corresponds to “Total Investment” (€14,397Mn, see caption “Capital Expenditures” in the accompanying Consolidated Directors’ Report for the period ended on 31 December 2021) minus the “Cash and cash equivalents” of the acquired companies (€211Mn, see Note 6 of the accompanying consolidated financial statements).

The Total Capex (€14,185Mn) also corresponds to “Total net cash flow from investing activities” (€13,904Mn, see the relevant section in the accompanying Consolidated Statement of Cash Flows for the period ended on 31 December 2021), + Cash advances to landlords (€71Mn, see Note 16 of the accompanying Consolidated Financial Statements) + (€210Mn, including the Substitutive tax paid (see footnote 6), financial investments and timing effects related to assets purchases).

10. Consists of "non-recurring expenses and advances to customers" that have involved cash movements, mainly corresponding to "COVID donations", extra compensation and benefits costs and "Costs and taxes related to acquisitions".

11. Corresponds to “Total net cash flow from financing activities” (€12,076Mn, see the relevant section in the accompanying Consolidated Statement of Cash Flows for the period ended on 31 December 2021), excluding payments of lease installments (€377Mn) in the ordinary course of business (see footnote 2) and Cash advances to landlords (€71Mn) (see footnote 10), and including non-recurring financing costs related to M&A projects.

12. Mainly corresponds to some timing effects, “Foreign exchange differences” and other impacts (see the relevant section in the accompanying Consolidated Statement of Cash Flows for the period ended on 31 December 2021).

13. “Net (decrease)/increase in cash and cash equivalents from continuing operations” (see the relevant section in the accompanying Consolidated Statement of Cash Flow for the period ended on 31 December 2021).

Revenues and results correspond to the Operating Income20 from the consolidated profit and loss account without considering advances paid to customers.

Income from operations for the year ended on 31 December 2021 was EUR 2,533 million, which represents a 58% increase over 2020 year-end. This increase was due mainly to the consolidation of the business combinations carried out i) in the second half of 2020 in the UK (the Arqiva Acquisition), Portugal (the NOS Towering Acquisition), Austria, Ireland and Denmark (the CK Hutchison Holdings Transactions completed in 2020), as well as the acquisitions completed ii) during 2021 in Sweden (the CK Hutchison Holdings Transactions), Poland (the Iliad Poland Acquisition and the Polkomtel Acquisition), the Netherlands (the T-Mobile Infra Acquisition), France (the Hivory Acquisition) and Portugal (the Infratower Acquisition). See Note 6 of the accompanying consolidated financial statements.

Telecom Infrastructure Services income increased by 74% to EUR 2,212 million due to both the organic growth achieved and the acquisitions performed during 2021, as mentioned above. This business segment is characterised by solid growth driven by increasing demand for wireless data communication services, and by the growing interest of mobile network operators (MNO) in developing high-quality networks that fulfil their consumers' needs for uninterrupted coverage and availability of wireless bandwidth (based on new Long-Term Evolution “LTE” technologies), in the most efficient way. Telecom Infrastructure Services are generated from a number of sources: i) annual base fee from telecommunications customers (both anchor and secondary tenants), ii) escalators or inflation as the annual update of the base fee and, iii) New colocations and Associated revenues (which include new third party colocations as well as further initiatives carried out in the period such as special connectivity projects, indoor connectivity solutions based on DAS, mobile edge computing, fiber backhauling, site configuration changes as a result of 5G rollout and other Engineering Services). The perimeter, therefore the number of tenants, may also be increased as a result of both acquisitions and BTS programs executions. In recent years the Group has consolidated its infrastructure network and long-term strategic relationships with its main customers, the mobile network operators. In addition to its current portfolio, the Group’s Management has identified several potential acquisitions which are currently being analysed using its demanding capital deployment criteria. The foreseeable new technological requirements linked to 5G along with other ordinary maintenance services such as investment in infrastructure, equipment and information technology systems, generally upon request of its customers, will translate into asset investment commitments in the future years. In this context, the Group carries out certain Engineering Services, that corresponds to works and studies such as adaptation, engineering and design services on request of its customers, which represent a separate income stream and performance obligation. The costs incurred in relation to these services, that will be classified as capital expenditures, can be an internal expense or otherwise outsourced and the revenue in relation to these services is generally recognized as the capital expense is incurred. The margin21 is significantly lower than the Adjusted EBITDA margin of the Group (c.20%), and this revenue is similar in amount to the operating income from Broadcasting Infrastructure segment. On the other hand, the Group owns a high-quality asset portfolio made up of selective assets and performs the subsequent streamlining and optimisation of the tower infrastructure for Telecom Infrastructure Services. Its main added value proposals in this business segment consist of providing services to additional mobile network operators in its towers and therefore streamlining the customer’s network. By increasing the ratio of customers to infrastructures, the Group will generate additional income with little additional costs. This network streamlining may generate significant efficiencies for the Group and for the MNOs. In this context, the Group’s organic growth strategy is based on different business models: (i) multiple allocation, (ii) build-to-suit, (iii) rationalisation, (iv) tower-adjacent assets, and (v) engineering services.

Income from the Broadcasting Infrastructure business amounted to EUR 218 million, which represents a 4% decrease compared with 2020 year-end. It should be noted that Cellnex completed a general cycle of renewal of contracts with customers in the broadcasting area, although in recent years the relative weight of this segment has decreased significantly. The strategy in this business segment is to maintain its strong market position while capturing potential organic growth. Cellnex plans to maintain its leading position in the Spanish national digital TV sector (in which it is the sole operator of national TV MUXs) by leveraging its technical knowledge of infrastructure and network infrastructure, its market understanding and the technical expertise of its staff. A significant portion of the contracts of the Group with operators are inflation-linked and some do not have a minimum limit or floor. The Group experienced, in the past, a high rate of renewal for the contracts in this business segment, although price pressure from customers can be possible when renegotiating contracts. The Group plans to continue working closely with regulatory authorities in relation to technological developments in both the TV and radio broadcasting markets and to leverage its existing infrastructure and customer relationships to obtain business in adjacent areas where it benefits from competitive advantages.

Other Network Services decreased its income by 2%, to EUR 103 million. This constitutes a specialised business that generates stable cash flows with attractive potential for growth. Considering the critical nature of the services in which the Group collaborates, its customers require in-depth technical know-how that is reflected in the demanding service level agreements. The Group considers that it has a privileged market presence and geographical distribution, established relationships with government agencies and excellent infrastructure for emergencies and public services. The Group aims to expand and increase its data transmission connectivity services, for both MNOs backhaul and corporate data access, by focusing on services and solutions where its valuable network can be leveraged to differentiate its proposition from its competitors, and by taking advantage of its favourable position to provide mutualised high speed data transmission to MNOs in its infrastructures. The Company plans to leverage its infrastructure and frequency planning know-how to design, roll out and operate advanced telecom services for public administrations in the field of PPDR networks, including TETRA and LTE services networks. The Company aims to be a frontrunner in new types of infrastructure services including urban telecom infrastructure solutions. In addition, Cellnex provides fibre connectivity in Spain following the acquisition of XOC. Its main customer is the public administration.

The transactions performed during 2020 and 2021, especially in the Telecom Infrastructure Services business segment, has helped boost operating income and operating profit, with the latter also impacted by the measures to improve efficiency and optimise operating costs. In this sense, the Group makes cash advances to landlords basically with the purpose to obtain efficiencies. The cash advances to landlords executed during the year ended on 31 December 2021 amounts to EUR 70,640 thousand (EUR 264,118 thousand in 2020), and approximately 8% of this cash advances are covering a lease period of 10 years or less (approximately 3% in 2020).

In line with the increase in revenue, Adjusted EBITDA was 63% higher than 2020 year-end, reflecting the Group’s capacity to generate cash flows on a continuous basis.

In this context of intense growth, the “Depreciation and amortisation” expense has increased substantially, by 73% compared to the 2020 year-end, as a result of the higher fixed assets (property, plant and equipment, and intangible assets) in the accompanying consolidated balance sheet, after the business combinations undertaken during the second half of 2020 and during 2021.

Moreover, the net financial loss increased by 63%, derived largely from the new bond issuances carried out during 2021. Likewise, income tax for 2021 included the effect of the Reverse Big Merger (see Note 18 of the accompanying consolidated financial statements), which resulted in a positive impact of EUR 60 million in the consolidated income statement.

Therefore, the net loss attributable to the Parent Company on 31 December 2021 amounted to EUR 351 million due to the substantial effect of higher amortisations and financial costs associated with the intense acquisition process and the consequent geographic footprint expansion, as mentioned above. In addition, the net loss of the year has been considerably impacted by some non recurring impacts such as the 2022 redundancy provision (c. EUR -80 million) and the update of the deferred taxes due to the change of tax rate in the UK (c. EUR -100 million). This scenario remains consistent with the current strong growth that the Group continues to experience and, as mentioned in the 2020 Annual Results Presentation, the group expects to continue experimenting a net loss attributable to the parent company in the coming quarters.

Total assets on 31 December 2021 stood at EUR 41,797 million, a 73% increase compared with the 2020 year-end, mainly as a result of the consolidation of the business combinations in Sweden (the CK Hutchison Holdings Transactions), Poland (the Iliad Poland Acquisition and the Polkomtel Acquisition), the Netherlands (the T-Mobile Infra Acquisition), France (the Hivory Acquisition) and Portugal (the Infratower Acquisition). Around 78% of total assets concern property, plant and equipment and other intangible assets, in line with the nature of the Group’s business related to the management of terrestrial telecommunications infrastructure. The increase in property, plant and equipment and intangible assets is due mainly to the aforementioned acquisitions.

Total investments executed in 2021 amounted to EUR 14,397 million, in part for investments linked to generating new revenue streams, for the incorporation of new assets in Sweden, Poland, The Netherlands, France and Portugal for the continued integration and roll-out of new sites in France, as well as improvements in efficiency, and maintenance of installed capacity.

Consolidated net equity on 31 December 2021 stood at EUR 15,842 million, a 77% increase compared with the 2020 year-end, due largely to the capital increase of EUR 7,000 million carried out in March 2021.

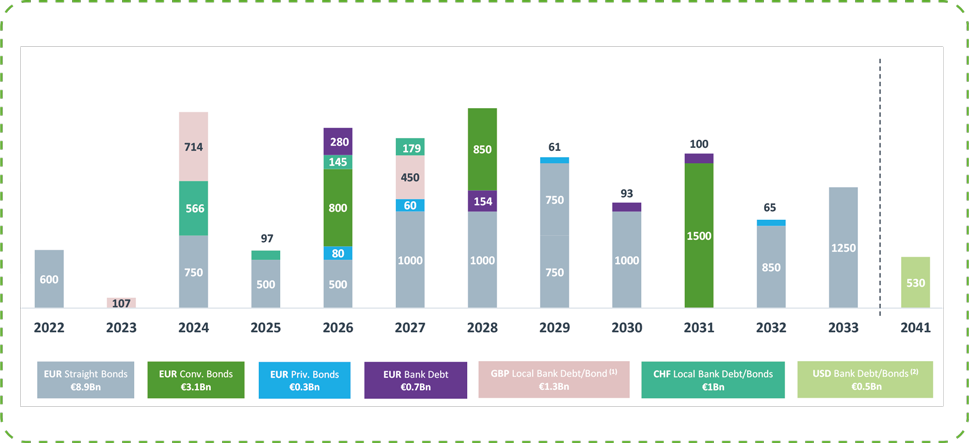

The Group's net financial debt as of 31 December 2021 stood at EUR 14,540 million compared to EUR 6,493 million at the end of 2020 (restated). Likewise, on 31 December 2021, Cellnex had access to immediate liquidity (cash & undrawn debt) to the tune of approximately EUR 8.7 billion (EUR 17.6 billion at the end of 2020).

At 31 December 2021, Cellnex holds a long-term “BBB-” (Investment Grade) with stable outlook according to the international credit rating agency Fitch Ratings Ltd as confirmed by a report issued on 19 January 2022 and a long-term “BB+” with stable outlook according to the international credit rating agency Standard & Poor’s Financial Services LLC as confirmed by a report issued on 28 June 2021.

The reconciliation of the caption “Net payment of interest” from the Consolidated Statement of Cash Flows corresponding to the year ended on 31 December 2021 and 2020, with the “Net financial loss” in the Consolidated Income Statement is as follows:

|

|

Thousands of Euros |

|

|

|

31 December 2021 |

31 December 2020 restated |

|

Interest Income (22) |

4,416 |

4,969 |

|

Interest Expense (22) |

(592,235) |

(365,183) |

|

Bond & loan interest accrued not paid |

134,998 |

89,260 |

|

Amortised costs – non-cash |

104,281 |

64,075 |

|

Interest accrued in prior year paid in current year |

(89,260) |

(54,462) |

|

Net payment of interest as per the Consolidated Statement of Cashflows (1) |

(437,800) |

(261,341) |

1. Net payment of interest as per the Consolidated Statement of Cash Flows, which corresponds to i) “interest payments on lease liabilities” for an amount of €216,644 thousand (see Note 16 of the accompanying consolidated financial statements) plus ii) “Net payment of interest (not including interest payments on lease liabilities)” for an amount of €182,532 thousand (see section “Recurring leveraged free cash flow” of the accompanying Consolidated Management Report) and plus iii) non-recurring financing costs related to M&A projects (see section “Recurring leveraged free cash flow” of the accompanying Consolidated Management Report).

The reconciliation of the caption “Payment of income tax” from the Consolidated Statement of Cash Flows corresponding to the year ended on 31 December 2021 and 2020, with the “Income tax” in the Consolidated Income Statement is as follows:

|

|

Thousands of Euros |

|

|

|

31 December 2021 |

31 December 2020 |

|

Current tax expense (23) |

(120,725) |

(31,828) |

|

Payment of income tax prior year |

(29,542) |

(5,689) |

|

Receivable of income tax prior year |

9,009 |

— |

|

Income tax (receivable)/payable |

47,858 |

3,176 |

|

Non-recurring Income tax paid (24) |

(78,400) |

— |

|

Others |

6,230 |

(4,236) |

|

Payment of income tax as per the Consolidated Statement of Cashflows |

(165,570) |

(38,577) |

See Note 17 of the accompanying consolidated financial statements.

See Note 4 of the accompanying consolidated financial statements.

Cellnex’s borrowing is represented by a combination of loans, credit facilities and bond issues. At 31 December 2021, the total limit of loans and credit facilities available was EUR 6,814,615 thousand (EUR 14,783,431 thousand as of 31 December 2020), of which EUR 2,740,058 thousand in credit facilities and EUR 4,074,556 thousand in loans (EUR 3,324,205 thousand in credit facilities and EUR 11,459,225 thousand in loans as of 31 December 2020).

|

|

Thousands of Euros |

|||||

|

|

Notional as of 31 December 2021 (*) |

Notional as of 31 December 2020 (*) |

||||

|

|

Limit |

Drawn |

Undrawn |

Limit |

Drawn |

Undrawn |

|

Bond issues and other loans |

13,766,317 |

13,766,317 |

— |

7,729,340 |

7,729,340 |

— |

|

Loans and credit facilities |

6,814,615 |

2,079,919 |

4,734,696 |

14,783,431 |

1,864,215 |

12,919,216 |

|

Total |

20,580,932 |

15,846,236 |

4,734,696 |

22,512,771 |

9,593,555 |

12,919,216 |

(1) Without including “Lease liabilities” caption of the accompanying consolidated financial statements.

(*) These concepts include the notional value of each caption, and are not the gross or net value of the caption. See “Borrowings by maturity” of the Note 15 of the accompanying consolidated financial statements.

The following graph sets out Cellnex’s notional contractual obligations in relation to borrowings as of 31 December 2021 (EUR million):

(1) Includes EUR bonds swapped to GBP.

(2) Includes USD bonds swapped to EUR.

(3) Corresponds to Notional Debt.

In accordance with the financial policy approved by the Board of Directors, the Group prioritises securing sources of financing at Parent Company level. The aim of this policy is to secure financing at a lower cost and longer maturities while diversifying its funding sources. In addition, this encourages access to capital markets and allows greater flexibility in financing contracts to promote the Group’s growth strategy.

“Net financial debt” on 31 December 2021 and 2020 is as follows:

|

|

Net financial debt |

|

|

|

31 December 2021 |

31 December 2020 restated |

|

Gross financial debt (1) |

18,466,125 |

11,145,490 |

|

Cash and short term deposits (25) |

(3,926,578) |

(4,652,027) |

|

Net financial debt |

14,539,547 |

6,493,463 |

1. As defined in section "Context and business development".(25)

On 31 December 2021, net financial debt amounted to EUR 14,540 million (EUR 6,493 million in 2020 restated), including a consolidated cash and cash equivalents position of EUR 3,927 million (EUR 4,652 million in 2020).

|

|

Net financial debt |

|

|

|

31 December 2021 |

31 December 2020 restated |

|

Beginning of Period |

6,493,463 |

3,926,207 |

|

Recurring leveraged free cash flow |

(980,543) |

(610,265) |

|

Expansion (or organic growth) capital expenditures |

233,107 |

145,618 |

|

Expansion Capex (Build to Suit programs) |

1,346,136 |

559,417 |

|

M&A Capex (cash only) |

12,529,294 |

5,508,144 |

|

Non-Recurrent Items (cash only) |

81,346 |

36,941 |

|

Other Net Cash Out Flows |

1,349 |

(30,881) |

|

Issue of equity instruments, Treasury Shares and Payment of Dividends (1) |

(6,765,675) |

(3,982,646) |

|

Change in Lease Liabilities (2) |

1,080,039 |

615,857 |

|

Accrued Interest Not Paid and Others (3) |

521,031 |

325,071 |

|

End of Period |

14,539,547 |

6,493,463 |

(1) Corresponds to "Issue of equity instruments, Acquisition of Treasury Shares and Dividends paid" in the accompanying Consolidated Statement of Cash Flows for the period ended 31 December 2021.

(2) Changes in “Lease liabilities” long and short term of the accompanying Consolidated Balance Sheet as of 31 December 2021. See Note 16 of the accompanying consolidated financial statements

(3) “Accrued interest not paid and others” include the debt assumed on the T-Mobile Infra Acquisition (See Note 6 of the accompanying Consolidated Financial Statements).

The breakdown of the available liquidity on 31 December 2021 and 2020 is as follows:

|

|

Thousands of Euros |

|

|

|

31 December 2021 |

31 December 2020 |

|

Available in credit facilities (26) |

4,734,696 |

12,919,216 |

|

Cash and cash equivalents (27) |

3,926,578 |

4,652,027 |

|

Available liquidity |

8,661,274 |

17,571,243 |

Regarding the Corporate Rating, on 31 December 2021, Cellnex holds a long-term “BBB-” (Investment Grade) with stable outlook according to the international credit rating agency Fitch Ratings Ltd as confirmed by a report issued on 19 January 2022 and a long-term “BB+” with stable outlook according to the international credit rating agency Standard & Poor’s Financial Services LLC as confirmed by a report issued on 28 June 2021. (26) (27)

In July 2021, the Board of Directors of Cellnex Group, SA approved a new Tax Policy that reinforces and updates the Group's guiding principles in tax matters. The Policy is applicable to all Group entities and, consequently, is intended for all employees. The new Cellnex Group’s Tax Policy establishes the fundamental guidelines governing the decisions and actions of the Cellnex Group in tax matters in line with the basic principle of regulatory compliance, i.e. due compliance with the tax obligations which the Group is required to meet in each of the countries and territories where it does business, fostering cooperative relationships with tax administrations based on the duties of transparency, good faith and loyalty, and mutual trust.

This Tax Policy replaces the first Group's Tax Strategy approved in 2016.

It should be noted that Cellnex’s tax policy establishes, among others, its commitment to pay any applicable taxes in all countries in which it operates and the alignment of its taxation with the effective performance of economic activities and value generation. As a consequence of this principle, the presence in the territories where the Cellnex Group runs its activity responds to business reasons. Additionally, the Cellnex’s tax policy prohibits operating in territories considered as tax havens under Spanish law or included in the "European Union's black list of non-cooperative tax jurisdictions" in order to evade tax obligations which would otherwise be applicable. In this regard, the Cellnex Group companies are entities incorporated in European countries that do not figure on the list of countries or territories classified as such.

Also, in the same Board of Directors meeting in July 2021, it was approved the new Tax Risk Control and Management Standard, setting out the principles and structure of the tax risk control and management framework, in accordance with the new Tax Policy. In particular, this document collects and provides for the principles and standards of action, internal processes and internal bodies aimed at mitigating and/or eliminating the different types of tax risks that can be revealed at the Group’s level.

In addition, the deployment of the Tax Risk Control and Management System started at an international level in 2021 and will still continue in 2022 by the roll-out of tax processes and controls to guarantee an implementation of the Tax Control Framework following the best practices in this matter, gaining public interest and generating value for its shareholders by respecting and complying with tax regulations when making business decisions to avoid tax risks and inefficiencies.

In this context, and to guarantee the proper functioning, supervision and effectiveness of the Tax Control Framework, the Board of Directors also approved in July 2021 the incorporation of the Tax Compliance Committee. This new body is dependent on the Audit and Risk Management Committee and is structured in a collegiate body made up of a Chairperson, three Members and a Technical Secretary (without right to vote). While the three Members belong to the Cellnex Group, the Chairperson is an independent tax expert with extensive and recognized prestige in the tax field.

Cellnex is fully committed to transparency in tax matters and foster a relationship with Tax Administrations based on the principles of mutual trust, good faith, transparency, collaboration, and loyalty, having been recognised as one of the top IBEX-35 companies in terms of fiscal transparency by Fundación Compromiso y Transparencia (the Commitment and Transparency Foundation) in its annual report "Contribución y Transaprencia 2020".

In particular, and with regard to Spain, in September 2020, the Board of Directors of Cellnex Telecom, SA approved the adhesion to the Code of Good Tax Practice of the Spanish Tax Authorities. In line with the principles of cooperative relationship with the Tax Authorities and transparency provided for in the Group’s Tax Policy, in 2021 the Cellnex Group has proceeded to submit the Tax Transparency Report for the year 2020 (see the list of entities that have submitted the Tax Transparency Report in the following link: https://sede.agenciatributaria.gob.es/Sede/colaborar-agencia-tributaria/relacion-cooperativa/foro-grandes-empresas/codigo-buenas-practicas-tributarias/entidades-presentadoras-it.html). Although its submission is not compulsory for the entities or Groups adhered to the Code, the Cellnex Group has considered that the submission of this report is essential to bond a strong and bidirectional relationship with the Spanish Tax Authorities.

On the other hand, and looking at other territories where the Cellnex Group has presence, in September 2021 it was appointed the Senior Accounting Officer for certain UK entities of the Group, being its main duties the adoption of the reasonable steps to ensure that the company establishes and maintains appropriate tax accounting arrangements. Additionally, the Senior Accounting Officer must monitor the arrangements and identify any aspects in which these fall short of the requirement.

Cellnex is also sensitive to and aware of its responsibility in the economic development of the territories in which it operates, helping to create economic value by paying taxes, both on its own account and those collected from third parties. Accordingly, it makes a substantial effort and pays great attention to fulfilling its tax obligations, in accordance with the applicable rules in each territory.

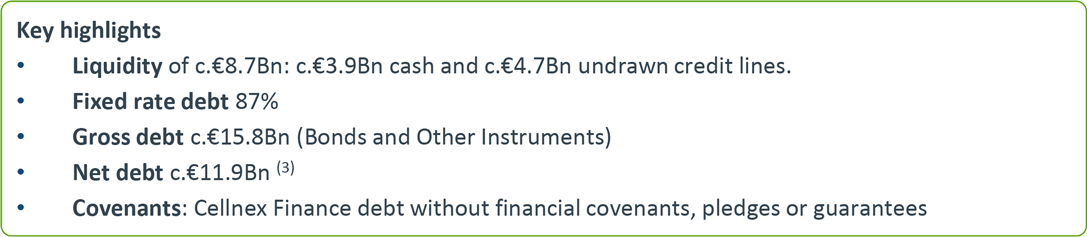

Following the OECD's cash basis methodology, Cellnex's total tax contribution in 2021 was EUR 510.4 million (EUR 244.8 million in 2020). Own taxes are those borne by the company and those of third parties are those that are collected and paid to the various tax authorities on behalf of said third parties, and therefore do not represent a cost for the company.

|

CELLNEX TAX CONTRIBUTION (€Mn) |

||||||

|

|

31 December 2021 |

31 December 2020 |

||||

|

|

Own taxes (1) |

Tax collected from third parties (2) |

Total |

Own taxes (1) |

Tax collected from third parties (2) |

Total |

|

Spain |

26 |

77 |

103 |

33 |

36 |

70 |

|

Italy |

102 |

52 |

153 |

19 |

38 |

57 |

|

France |

51 |

4 |

55 |

8 |

20 |

28 |

|

Netherlands |

4 |

15 |

20 |

8 |

10 |

18 |

|

United Kingdom |

30 |

6 |

36 |

22 |

5 |

27 |

|

Switzerland |

4 |

7 |

11 |

4 |

8 |

12 |

|

Ireland |

10 |

9 |

19 |

1 |

2 |

3 |

|

Portugal |

12 |

17 |

29 |

2 |

29 |

31 |

|

Austria |

— |

5 |

5 |

— |

— |

— |

|

Sweden |

2 |

6 |

8 |

— |

— |

— |

|

Denmark |

— |

4 |

4 |

— |

— |

— |

|

Poland |

51 |

16 |

67 |

— |

— |

— |

|

Total |

292 |

218 |

510 |

97 |

148 |

245 |

(1). Includes taxes that represent an effective cost for the company (basically includes payments for income tax, local taxes, various rates and social security business fee).

(2). Includes taxes that do not affect the result, but are collected by Cellnex on behalf of the Tax Administration or are paid on behalf of third parties (they basically include the net value added tax, with holdings on employees and third parties and social security quota of the employee).

The breakdown of the income tax payment by country for the 2021 financial year is as follows:

|

BREAKDOWN OF THE INCOME TAX PAYMENT BY COUNTRY (thousands of euros) |

||||||||

|

|

31 December 2021 |

31 December 2020 |

||||||

|

|

Income from sales to third parties |

Income from intra-group operations with other tax jurisdictionss |

Tangible |

Corporate |

Income from sales to third parties |

Income from intra-group operations with other tax jurisdictionss |

Tangible |

Corporate |

|

Spain |

530,052 |

34,280 |

850,711 |

53,239 |

530,328 |

55,397 |

865,317 |

23,878 |

|

Italy |

512,454 |

721 |

1,280,899 |

97,505 |

336,296 |

521 |

507,655 |

5,369 |

|

France |

413,586 |

2 |

3,153,484 |

79,328 |

309,759 |

— |

1,815,502 |

11,817 |

|

Switzerland |

146,141 |

401 |

209,462 |

4,002 |

137,467 |

— |

193,190 |

3,813 |

|

Netherlands |

96,704 |

— |

152,665 |

5,827 |

63,793 |

— |

276,779 |

324 |

|

Ireland |

55,572 |

— |

167,806 |

1,057 |

13,504 |

— |

— |

— |

|

United Kingdom |

311,814 |

507 |

324,705 |

(93,348) |

144,339 |

377 |

198,107 |

(1,792) |

|

Portugal |

103,254 |

— |

247,382 |

2,716 |

69,286 |

— |

222,457 |

5,308 |

|

Austria |

72,899 |

— |

207,763 |

5,222 |

— |

— |

— |

— |

|

Sweden |

48,995 |

48 |

141,677 |

54 |

— |

— |

— |

— |

|

Denmark |

28,574 |

363 |

69,557 |

333 |

— |

— |

— |

— |

|

Poland |

212,754 |

— |

826,194 |

3,096 |

— |

— |

— |

— |

|

Total |

2,532,799 |

36,322 |

7,632,305 |

159,031 |

1,604,772 |

56,295 |

4,079,007 |

48,717 |

In June 2020, the Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 was published on the establishment of a framework to facilitate sustainable investments and amending Regulation (EU) 2019/ 2088, known as EU Taxonomy. The Taxonomy aims to harmonize, at the Union level, the criteria for determining whether an economic activity is considered environmentally sustainable, in order to eliminate the use of own definitions on sustainability, corporate "greenwashing", and the obstacles in raising funds for truly sustainable projects. With the harmonization of the criteria proposed by the taxonomy, the European Commission seeks to establish definitions and common sustainability criteria based on independent and science-based indicators.

To determine the environmental sustainability of an economic activity, it must contribute to the achievement of certain environmental objectives. The Taxonomy Regulation establishes six environmental objectives: (i) mitigation of climate change; (ii) adaptation to climate change; (iii) the sustainable use and protection of water and marine resources; (iv) the transition to a circular economy; (v) pollution prevention and control; and (vi) protection and restoration of biodiversity and ecosystems.

At the moment, the Taxonomy Regulation has only proposed (through the Climate Delegated Act) the economic activities and the sustainability criteria and safeguards to be met for the contribution to the climate objectives of climate change mitigation and adaptation to climate change. With this window of opportunity open, Cellnex wants to highlight the nature of the economic activities it carries out in Europe.

The following details how the calculation of the different Taxonomy indicators has been proposed based on the financial and business data of 2021.

Once the regulatory requirements planted within the framework of Regulation 2020/852/EU on Taxonomy were studied, the analysis began with an identification of the economic activities carried out by the Group:

After this initial identification of the large lines of business, external consultants identified the NACE codes of the specific economic activities linked to the four large branches described and tried to assign them to the different companies of the group. With this more specific list of activities, the Cellnex team identified the different economic activities or specific lines of business at a consolidated level. The result was a list of specific economic activities for each of the large branches described, providing definitions for each of them and the necessary details to define a specific NACE.

|

Telecom Infrastructure Services |

Broadcasting Infrastructure |

Other Network Services |

|

TIS |

Broadcast |

IoT |

|

5G |

Internet Media |

Smart Services |

|

Engineering Services |

|

MCPN |

|

Fiber |

|

Connectivity |

|

Utility fee |

|

O&M |

|

LTE |

|

Other income |

|

Pass through |

|

|

|

Others TIS |

|

|

|

DAS BL |

|

|

|

Land Aggreg. |

|

|

|

Datacenters |

|

|

This degree of detail made it possible to start proposing the fit of the different business units with the statistical definitions of the different economic activities.

Based on the identification of the different economic activities and their respective definition, the most appropriate NACE code was assigned to each of them. The allocation of NACE codes to each of Cellnex's activities is shown below:

|

TIS |

61.20 Wireless telecommunications |

|

5G |

61.20 Wireless telecommunications |

|

Engineering Services (W&S) |

42.22 Construction of electrical and telecommunications networks |

|

71.12 Construction of electrical and telecommunications networks |

|

|

Fiber |

61.10 Telecommunications by cable |

|

Utility fee |

- |

|

LTE |

61.20 Wireless telecommunications |

|

Pass through |

- |

|

DAS BL |

61.90 Other telecommunications activities |

|

Land Aggreg. |

68.20 Rental of real estate on own account |

|

Datacenters |

63.11 Data processing, hosting and related activities |

|

Broadcast |

60.10 Broadcasting activities |

|

Internet Media |

60.20 Television programming and broadcasting activities |

|

IoT |

60.20 Television programming and broadcasting activities |

|

Smart Services |

61.90 Other telecommunications activities |

|

MCPN |

61.90 Other telecommunications activities |

|

Connectivity |

61.20 Wireless telecommunications |

|

O&M |

61.30 Satellite telecommunications |

|

Other income |

- |

This allocation was validated by those responsible for internal and financial control using the NACE Rev.2 system and their knowledge of the Group's activities.

Once the business activities and their classification based on the NACE system were identified, those codes included in the list of Taxonomy activities were identified, specifically those listed in the Climate Delegated Act (Mitigation and adaptation). At the same time, and to avoid using only NACE codes, the direct or indirect fit of specific business units to activities included in the Taxonomy was assessed, one by one.

Of Cellnex's economic activities, the following were identified as potentially eligible:

|

Cellnex business activity |

Activity incorporated in Regulation 2020/852 |

|

Datacenters |

(Mitigation/Adaptation) 8.1. Data processing, hosting and related activities |

|

Engineering Services (W&S) |

(Adaptation) 8.2. Programming, consulting and other computer-related activities |

|

Broadcast, Internet Media, IoT, MCPN |

(Adaptation) 8.3. Radio and television programming and broadcasting activities |

|

Engineering Services (W&S) |

(Mitigation/Adaptation) 9.1. Research, development and innovation close to the market |

|

Engineering Services (W&S) |

(Adaptation) 9.1. Technical engineering services and other activities related to technical advice on adaptation to climate change |

|

IoT, Engineering Services (W&S) |

(Mitigation/Adaptation) 7.5. Installation, maintenance and repair of instruments and devices to measure, regulate and control the energy efficiency of buildings |

|

Engineering Services (W&S) |

(Mitigation/Adaptation) 6.13 - 6.16 Low carbon infrastructure activities |

This prior identification had the objective of assessing, broadly speaking, how the Group's operations fit in with the activities described in the annexes of the Climate Delegated Act.

Once the business activities and their classification based on the NACE system were identified, those investments related to eligible activities based on the Taxonomy were identified, specifically those of the Climate Delegated Act. At the same time, and to avoid using only investments linked to business units, the eligibility of the specific investment items included in the third point, related to the purchase of output from aligned activities (currently eligible), was considered.

Of these items, only those related to expansion and maintenance have been considered for the calculation of the numerator and denominator, based on the calculation methodology described in Annex I of the Delegated Act of Article 8. Of these categories, the following items are included specific:

|

Investment items |

Activity incorporated in Regulation 2020/852 |

|

Datacenters |

(Mitigation/Adaptation) 8.1. Data processing, hosting and related activities |

|

Broadcast |

(Adaptation) 8.3. Radio and television programming and broadcasting activities |

|

Internet Media |

(Adaptation) 8.3. Radio and television programming and broadcasting activities |

|

Radiocommunications |

(Adaptation) 8.3. Radio and television programming and broadcasting activities |

|

TIS Expansion (Only specific games) |

(Mitigation/Adaptation) 7.5 Installation, maintenance and repair of instruments and devices to measure, regulate and control the energy efficiency of buildings |

|

New Offices |

(Mitigation/Adaptation) 7.2 Renovation of existing buildings |

|

Efficiency CapEx (Energy) |

(Mitigation) Activities 7.5 and 7.6 related to the installation, maintenance and repair of instruments and devices to measure, regulate and control the energy efficiency of buildings or renewable energy technologies. |

In a later phase, for each of the business activities listed in the NACE code table, it was validated if they really fit with the activities of the proposed Taxonomy. The approach of this task helped to outline the activities finally eligible in relation to those incorporated in the Climate Delegated Act.

Comparing with the table presented previously, the most substantial change is found in the consideration of non-eligibility of consulting or technical assistance activities within the Engineering Services (W&S) business. Although these activities are related to customized engineering services for different types of clients, and although some of the projects being worked on contribute to mitigating or adapting to climate change, they are not considered to fit the definition and approach of the activities proposed in the Taxonomy.

As regards Cellnex's revenue, the specific economic activities included in the Telecommunications Infrastructures, Broadcasting Infrastructures and other network services items have been considered. The following table shows the adjusted EBITDA items as published in the annual accounts.

|

Operating income (Thousands of Euros) |

||

|

|

December 31, 2021 |

December 31, 2020 |

|

Telecommunications Infrastructure Services |

2,211,789 |

1,272,583 |

|

Broadcast Infrastructures |

218,290 |

227,257 |

|

Other network services |

102,720 |

104,932 |

|

Operating income |

2,532,799 |

1,604,772 |

|

Operating Income (Thousands of Euros) |

||

|

|

December 31, 2021 |

December 31, 2020 |

|

Services |

2,441,669 |

1,565,921 |

|

Other operating income |

94,399 |

42,510 |

|

Customer loans |

(3,269) |

(3,659) |

|

Operating Income |

2,532,799 |

1,604,772 |

After this second phase of validation of eligibility for the economic activities carried out by Cellnex, the following list was obtained:

|

Cellnex business unit |

Eligibility based on Taxonomy (Activity) |

Environmental objective |

|

Datacenters |

8.1. Data processing, hosting and related activities |

CC Mitigation |

|

Datacenters |

8.1. Data processing, hosting and related activities |

CC adaptation |

|

Broadcast |

8.3. Radio and television programming and broadcasting activities |

CC adaptation |

|

Internet Media |

8.3. Radio and television programming and broadcasting activities |

CC adaptation |

|

IoT |

7.5 Installation, maintenance and repair of instruments and devices to measure, regulate and control the energy efficiency of buildings (b) (Part related to electronic water meters) |

CC adaptation |

|

IoT |

8.3 Radio and television programming and broadcast activities (5.a) (Related to emergency telecommunications services that increase resilience to climate risks) |

CC adaptation |

|

MCPN |

8.3 Radio and television programming and broadcast activities (5.a) (Related to emergency telecommunications services that increase resilience to climate risks) |

CC adaptation |

Focusing now on why each of the activities has been deemed eligible, the following points should be noted:

The most relevant revenue item for the group, Telecommunications Infrastructure Services (TIS), which represent approximately 69.4% of sales, could not be included in the eligibility calculations given that within the environmentally sustainable economic activities that it presents the regulation, there is still no activity consistent with that carried out by Cellnex. TIS activity is based on the operational efficiency of telecommunications towers, an activity with a great positive impact as described above. The incorporation of environmentally sustainable services linked to connectivity through wireless and cable networks is lacking, an important prejudice in the evaluation of the environmental sustainability of Cellnex's business. The lack of development of the Taxonomy generates public image damage to a company whose main business is linked to efficiency, nonsense.

The numerator of the CapEx indicator, which must be reported according to the Taxonomy regulations, establishes that the following investments can be accounted for as eligible/aligned:

In general, Cellnex distinguishes its investments in:

|

Investment (Thousands of Euros) |

||

|

|

December 31, 2021 |

December 31, 2020 |

|

Maintenance investment |

76,799 |

52,381 |

|

Expansion investment (or organic growth) |

233,107 |

145,618 |

|

Expansion investment (Build-to-suit projects) |

1,346,136 |

559,417 |

|

Inorganic investment (M&A) |

12,741,420 |

5,618,195 |

|

Total capex |

14,397,463 |

6,375,612 |

For each of these categories, the specific investment items have been identified that, after an analysis of their fit with the definitions, are considered eligible. Most of these come from investments in expansion and maintenance of eligible activities. Here is the corresponding table:

|

Investment item |

Eligibility Based on Taxonomy (Activity) |

Environmental objective |

|

Datacentres |

8.1. Data processing, hosting and related activities |

CC Mitigation |

|

Broadcast |

8.3. Radio and television programming and broadcasting activities |

CC adaptation |

|

Internet Media |

8.3. Radio and television programming and broadcasting activities |

CC adaptation |

|

New Offices |

7.2 Renovation of existing buildings |

CC Mitigation |

|

Radiocommunications |

8.3 Radio and television programming and broadcasting activities |

CC adaptation |

|

Efficiency CapEx (Energy) |

7.5 Installation, maintenance and repair of instruments and devices to measure, regulate and control the energy efficiency of buildings |

CC Mitigation |

|

Efficiency CapEx (Energy) |

7.6 Installation, maintenance and repair of renewable energy technologies. |

CC Mitigation |

|

Expansion TIS (Proyecto “Remotas”) |

7.5 Installation, maintenance and repair of instruments and devices to measure, regulate and control the energy efficiency of buildings |

CC Mitigation |

Although in the section on CapEx above those investment items to be considered as eligible have been raised, this section seeks to elaborate a reasoning for each one of them.

In this phase of implementation of the requirements of the regulation, compliance with the criteria established in Article 3 of Regulation 2020/852/EU has not been evaluated, these include the Technical Selection Criteria (CTS), the criteria of not causing no significant prejudice (DNSH) or the minimum guarantees established. Looking ahead to 2023, to ensure a correct alignment analysis, Cellnex will carry out an exhaustive analysis of said criteria.

As previously stated, the Taxonomy requires the reporting, in 2022, of the percentage of turnover, CapEx and OpEx eligible based on the economic activities published in the Climate Delegated Act, which covers both adaptation and mitigation to climate change.

The financial information used for this initial analysis was subject to external audits when the annual accounts for the year were closed. These were subject to joint analysis and control by the local and central teams to ensure consistency with the consolidated income for the year 2021. The controls focused both on the treatment of intra-group transactions and on the breakdown of turnover by segment of business activity and sub-segment.

The consolidation of financial data is governed by the accounting policies of IFRS and is audited by Cellnex's financial auditors. The financial data is extracted from the so-called "reporting package" of each country, whose data comes from the consolidation ERP system "FCCS", which is fed by "PBCS" which in turn is fed by "SAP" or local ERP depending on each country. The computerization of these processes ensures the minimization of human errors.

The income presented here is accounted for as follows by commercial activity:

Based on this, one could say that, of the eligible activities, 21.21% of revenues correspond to leases - Datacenter business - and the remaining 78.79% is based on contracts with clients for specific services.

The data provided does not consider the production of companies for others within the Cellnex Group. This case could occur for IoT and MCPN activities.

The CapEx data presented in this report is accounted for as follows:

As established in Annex I of the Delegated Disclosure Act (Art. 8) referring to regulation 2020/852/EU, in its point 1.1.3.2, those non-financial companies that consider that OpEx is not a material indicator for their model of business, are exempt from calculating the OpEx KPI numerator set out in the Taxonomy regulation.

The Group considers that the OPEX margin for the calculation of the Taxonomy is not material, mainly and in accordance with the accounting regulations of IFRS16, the most significant item (rental costs) is reflected in the financial interests and in the amortisation of the financial statements. of the company. Therefore, it makes the company have a very high operating leverage and margin.

To avoid double counting, the calculations of the different indicators have differentiated between activities incorporated in the mitigation or adaptation objective, accounting only based on the objective where the contribution is considered more substantial. In this way, duplicate posting of the same revenue item or CapEx is avoided.

Given that the economic activities of the company have been differentiated with a significant degree of detail and a conservative approach has been followed with the aim of including only those clearly eligible items in the calculations. Regarding the IoT activity, to carry out this distribution of the volume of turnover, 1% has been awarded referring to the business of electronic equipment for water consumption and 84% to the development of emergency networks for authorities. Regarding the Efficiency CapEx (Energy) activity, the investments have been differentiated according to activities 7.5 and 7.6 by 99% for the first, focused on energy efficiency, and 1% for the second, focused on the installation of renewables. These data have been obtained from the company's economic analysts.

Below are the results of the study:

For a detailed breakdown of the information, see Annex 8.7 of this Report.

The results obtained in this second year of evaluation of the degree of eligibility of Cellnex's activities under the list of economic activities of the Taxonomy regulation present levels similar to the European market average, however, lower than those expected by the company. It is considered that Regulation 2020/852/EU of the European Union is not a useful tool to assess the environmental sustainability of the group's business. This is due to the fact that most of the economic activities that are carried out have not been included in the list of mitigation and adaptation activities. Consequently, Cellnex cannot assess whether or not it meets the technical selection criteria and thus assess its substantial contribution to sustainability. For those activities where it does meet the technical selection criteria, it is expected that in large part it will not be able to report said turnover as aligned due to a methodological consideration. The Delegated Disclosure Act (Art. 8) establishes that “adapted” activities cannot be counted in the numerator of the turnover indicator.

The European Parliament and the Council have prioritized the economic activities that may have, from their point of view, the most relevant contribution to the two environmental objectives of the Union. This first Delegated Act focuses on climate objectives - climate change mitigation and climate change adaptation - and therefore includes the most relevant activities for reducing greenhouse gas emissions and increasing climate resilience. This includes the sectors with the highest contribution to CO2 emissions (energy, manufacturing, transport, buildings), as well as the activities that enable their transformation, necessary to achieve the EU climate objectives.

Through the Climate Delegated Act, the EU taxonomy criteria cover the economic activities of approximately 40% of listed companies, in sectors that are responsible for almost 80% of direct greenhouse gas emissions in Europe. This approach raises the paradox that the most polluting sectors such as energy or transport are covered by regulation, while activities in the digital sector, with less environmental impact, are not included. This is why the eligibility percentages of some companies, to be published in 2022, are going to be much higher than those of Cellnex due to the mere fact that their economic activity or sector is covered by regulation, while a large part of the Cellnex turnover (TIS), not included.

A company like Cellnex, with first-rate ESG credentials, and a business model based mainly on the efficiency and sharing of telecommunications infrastructures among multiple operators, will not be able, in the short term, to present levels of eligibility and alignment with the Taxonomy elevated. This is so because economic activities that fit correctly with the company's business have not been incorporated. The regulation does not yet give Cellnex the possibility of demonstrating its credentials in the matter, which is why work will be done to include these activities in the lists of the Climate and Environmental Delegated Acts. At the moment, everything indicates that in the approval of the Environmental Delegated Act that covers the 4 missing environmental objectives, activities related to Cellnex's business will not be incorporated either. In fact, the activities that are intended to be incorporated are considered residual in the sector and do not manage to improve its coverage.

Cellnex has adopted a conservative approach when reporting eligibility based on the Taxonomy, avoiding forcing the definitions of economic activities to incorporate activities of its business. Cellnex understands that the regulation has the objective of avoiding “greenwashing” and it would not do any good to try to play with the regulation in favor of the company. An approach that responds to the principles of integrity, representativeness and truthfulness has been maintained.

However, Cellnex considers it necessary for the European Commission to make an effort to sufficiently cover the activities of the ICT sector, one of the sectors that will generate the greatest contribution to the gross domestic product of the world of the future. In this sense, it is considered that the Commission should encourage the incorporation of more activities within the limits of the regulations. Not only those activities clearly focused on environmental sustainability are a key part of the ecological transition, but facilitating activities, such as ICTs in many cases, must be incorporated transversally.

Cellnex will work in the coming months and years to promote an active dialogue at European level with the Platform on Sustainable Finance. The objective is to make it easier for all companies in the ICT sector to expand their eligibility based on the Taxonomy, establishing the foundations for the "Green ICT" sector of the future and valuing the substantial contribution to the different environmental objectives.

Internally, Cellnex will work during 2022 to carry out the relevant evaluations and validations to ensure compliance with the criteria set out in article 3 of regulation 2020/852/EU. The technical selection criteria will be validated for each of the different business units that carry out the same Taxonomy activity, trying to obtain evidence or certificates that prove compliance with the criteria established at the lowest level possible. The same approach will be used to validate the criteria of not generating any significant damage to other environmental objectives (DNSH). Finally, the minimum guarantees will be validated first at the group level and in a second phase at the economic activity level, identifying any non-compliance with them.

Cellnex will invest during 2022 in the hiring of technical experts to help in the evaluation of the criteria set out in the previous paragraph to ensure proper compliance with the regulations.

As part of the commitment to sustainability, Cellnex has designed a Sustainability-Linked Financing Framework to reinforce the role of sustainability as an integral part of the Group’s funding process.

The Framework is aligned with the best practices as described by the International Capital Market Association’s (“ICMA”) Sustainability-Linked Bond Principles (“SLBP”) 2020 and the Loan Market Association’s (“LMA”) Sustainability-Linked Loan Principles 2021 (“SLLP”) and will also provide investors with further insights into Cellenx's sustainability strategy and commitments.

Cellnex’s Sustainability-Linked Financing Framework aims at covering any upcoming Sustainability-Linked financings, whether through Sustainability-Linked Bonds, Sustainability-Linked Convertible Bonds, Sustainability-Linked Loans or other debt instruments such as credit facilities and derivatives, whose financial characteristics are linked with sustainability performance targets. Altogether, all Sustainability-Linked financing instruments will be referred to as sustainability-linked financings.

The Framework has been reviewed by Sustainalytics, providers of Second Party Opinions (SPO) and considers it to be aligned with the International Capital Markets Association's Sustainable Bond Principles 2020 and the Loan Market Association's Sustainable Lending Principles 2021.

Cellnex has selected two environmental KPIs and one social KPI, which are core, relevant and material to its business and industry and are aligned with its ESG Strategy.

At the beginning of 2022 Cellnex refinanced a EUR 2,5Bn Revolving Credit Facility linked to the Sustainability Framework for 5 years (two years extension) with two of the indicators included in the Framework.

|

Indicator |

Description |

Status 2021 |

Target 2025 |

Target 2030 |

|

KPI 1a28 |

Reduction in Scope 1, 2 and 3 from fuel and energy-related activities GHG emissions |

(17.7)% |

(45.0)% |

(70.0)% |

|

KPI 1b |

Reduction of absolute Scope 3 GHG emissions from purchased goods and services, and from capital goods |

(7.6)% |

(21.0)% |

_ |

|

KPI 2 |

Annual sourcing of renewable electricity |

40.5% |

100% |

_ |

|

KPI 328 |

Percentage of women in directors and senior management/manager roles29 |

23.8% |

30% |

_ |

In the first quarter of 2022, Cellnex Poland and Iliad Purple entered into an agreement amending the exercise conditions of Iliad Purple's right on 10% of the share capital of On Tower Poland. Pursuant to the terms of this agreement, Cellnex Poland and Iliad Purple have agreed that such 10% interest in On Tower Poland will be purchased by Cellnex Poland before the end of the first quarter of 2022, for a price of PLN 615 million (approximately EUR 140 million at the current exchange rate) (exclusive of taxes). This price implies the same valuation of On Tower Poland applied at the closing of the Iliad Poland Acquisition.

In the first quarter of 2022, Cellnex France Groupe, Iliad, On Tower France and Free Mobile entered into two agreements amending the exercise conditions of Iliad's right and the Iliad Master Agreements (defined in the consolidated financial statements ended as of 31 December 2019). Pursuant to the terms of such agreements, Cellnex France Groupe and Iliad have notably agreed that Iliad's remaining 30% non-controlling interest in On Tower France will be purchased by Cellnex France Groupe before the end of the first quarter of 2022, subject to the approval of Iliad's Board of Directors, that will take place after the formulation of these consolidated financial statements. The agreed consideration for the acquisitions of the 30% interest in On Tower France is EUR 950 million, exclusive of taxes, which have been calculated following the criteria defined in the Iliad SHA (defined in the consolidated financial statements ended as of 31 December 2019). On top of that, Cellnex has enhanced the build-to-suit programmes with 2,000 new sites (additional to the minimum 2,500 sites already commited -see Note 5 of the consolidated financial statements ended as of 31 December 2019-) until 2027, with an Enterprise Value of EUR 639 million.