connect

people

ANNUAL

REPORT

2016

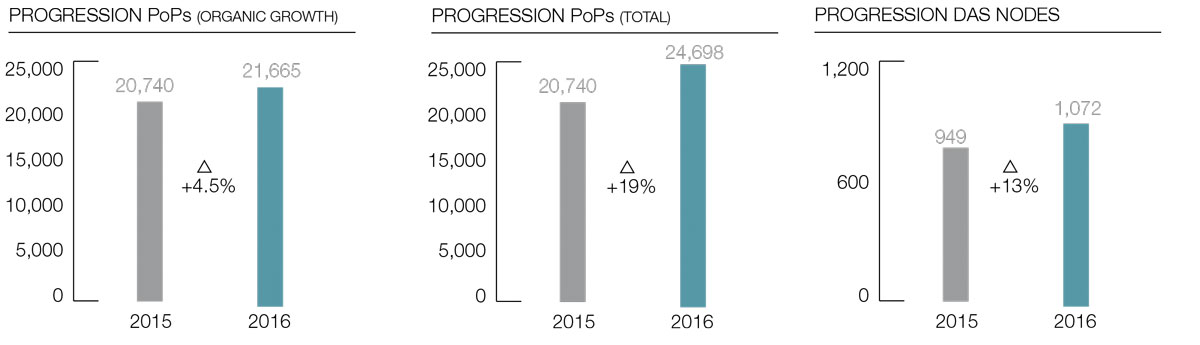

After a successful 2015 marked by its IPO, the integration of Italy and the consolidation of organisational changes, in 2016 Cellnex continued to deliver on its commitment to generate sustained value in the short, medium and long term. In this regard, the organisation has successfully consolidated its business model by capturing organic growth opportunities and developing its internationalisation drive.

In 2016 Cellnex exceeded expectations in terms of business development, experiencing significant growth - both organically and through acquisitions - with high growth potential.

Its solid organic quarter-after-quarter growth demonstrates the company’s ability to exceed expectations and improve the performance of the telecommunications sector in Europe. This trend is due to various factors, such as:

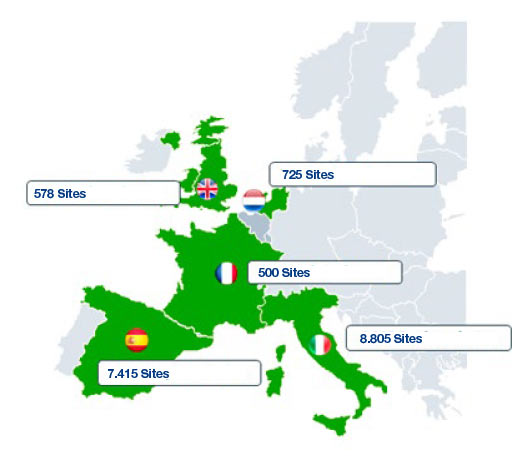

The company’s internationalisation plan began in 2015 with the agreement with the Italian mobile operator WIND to control the Italian company GALATA. This operation involved incorporating 7,377 telecommunications sites and infrastructure in Italy.

The expansion continued in 2016, increasing Cellnex’s presence in central and northern Europe, and by the end of the year 50% of adjusted EBITDA was already generated outside Spain. The timeframe of acquisitions this financial year was as follows:

1) In the second quarter of 2016 Cellnex agreed to buy 100% of Protelindo Netherlands, B.V. from the Indonesian group PT Sarana Menara Nusanta. Cellnex opened its doors to the central and northern European markets, investing € 109 million in this acquisition that was to bring long-term stable flows, since 75% of revenues are linked to contracts lasting until 2028. In addition, the Netherlands is a market with an established presence of independent telecommunications network operators, with the potential to capture synergies among the networks rolled out.

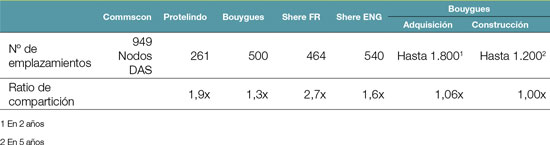

Towerlink Netherlands has 261 towers spread over the entire territory of the Netherlands. 80% of these infrastructures are located in areas close to the main national road corridors, accentuating their appeal as a location for mobile telephony operators’ equipment. The remaining 20% are located in urban and rural areas. It is worth pointing out that the consumer ratio of the Towerlink sites is 1.88.

Towerlink Netherlands has 261 towers spread over the entire territory of the Netherlands. 80% of these infrastructures are located in areas close to the main national road corridors, accentuating their appeal as a location for mobile telephony operators’ equipment. The remaining 20% are located in urban and rural areas. It is worth pointing out that the consumer ratio of the Towerlink sites is 1.88.2) In the second quarter of 2016, Cellnex Italia, S.r.l. closed the acquisition of the Italian company CommsCon. This purchase, which represented an investment of € 18.65 million, confirms Cellnex’s strategic commitment to the Italian market and also to the small cells technology or coverage solutions for large open spaces with a high concentration of users.

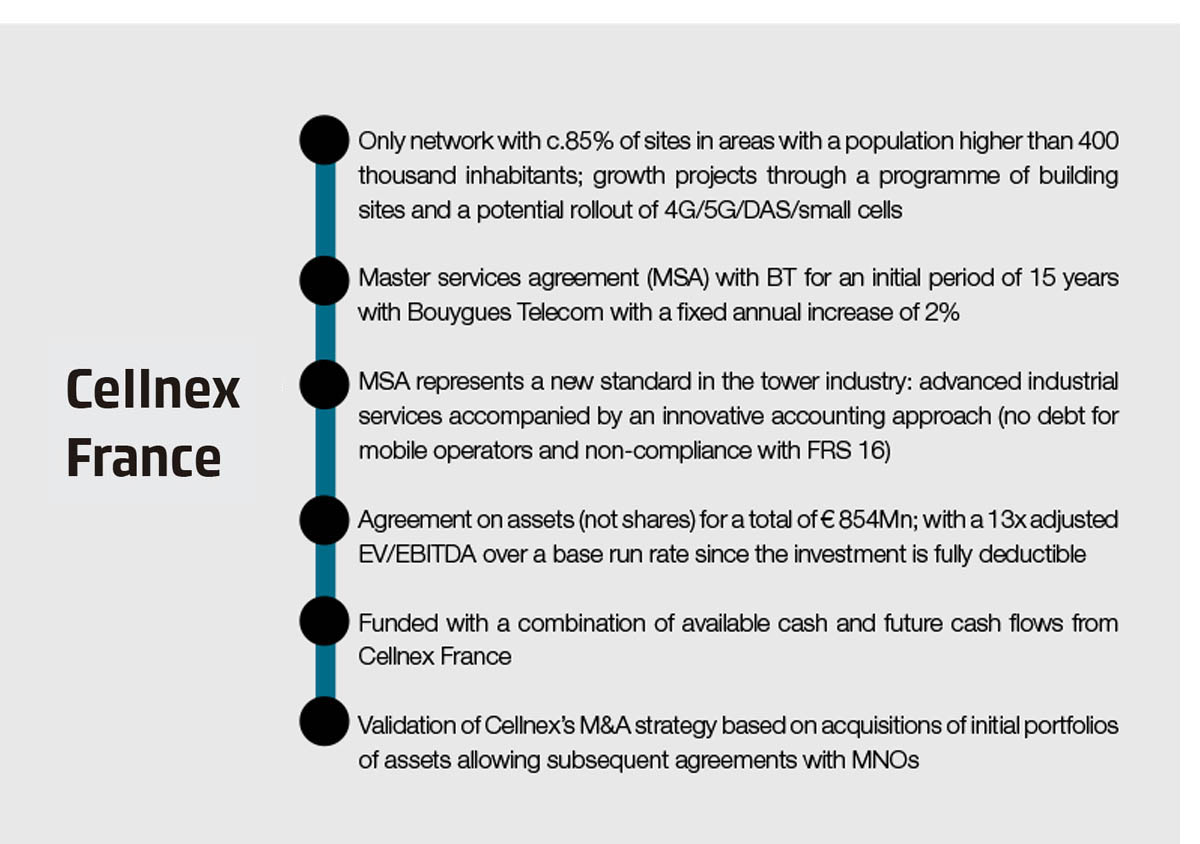

3) In the third quarter of 2016, Cellnex announced its entry into France with the acquisition, in a first phase, of 230 telecommunication towers from Bouygues Telecom for € 80 million. This operation opens a long-term industrial collaboration with Bouygues Telecom to assist in the implementation of mobile broadband based on 4G and 5G standards. In December, Cellnex closed the second phase of the agreement, which led it to incorporate 270 new towers for € 67 million, reaching a total of 500 towers in France. Also, in February 2017, it reached a new agreement with Bouygues covering two projects; the first involves incorporating 1,800 already operational sites over the next two years, for € 500 million, and the second is for building up to 1,200 new towers to be rolled out over the next five years, with an estimated € 354 million investment.

3) In the third quarter of 2016, Cellnex announced its entry into France with the acquisition, in a first phase, of 230 telecommunication towers from Bouygues Telecom for € 80 million. This operation opens a long-term industrial collaboration with Bouygues Telecom to assist in the implementation of mobile broadband based on 4G and 5G standards. In December, Cellnex closed the second phase of the agreement, which led it to incorporate 270 new towers for € 67 million, reaching a total of 500 towers in France. Also, in February 2017, it reached a new agreement with Bouygues covering two projects; the first involves incorporating 1,800 already operational sites over the next two years, for € 500 million, and the second is for building up to 1,200 new towers to be rolled out over the next five years, with an estimated € 354 million investment.

4) In the third quarter of 2016 Cellnex also agreed to buy 100% of Shere Group from the Arcus Infrastructure Partners infrastructure fund. The transaction involved an investment of € 393 million and the incorporation of 464 mobile sites in the Netherlands plus 540 in the UK. This acquisition has special strategic significance, since it marks Cellnex’s entry into a very dynamic market with a high degree of outsourcing of telecommunications infrastructure management.

Shere Masten has one of the largest portfolios of wireless communications towers and sites in the UK and the Netherlands. In the Netherlands it holds a portfolio of 462 telecommunication sites for the distribution of mobile communication and telecommunication data. The customers to which it rents include the mobile network operators KPN, Vodafone, T-Mobile and Tele2.

Shere Masten has one of the largest portfolios of wireless communications towers and sites in the UK and the Netherlands. In the Netherlands it holds a portfolio of 462 telecommunication sites for the distribution of mobile communication and telecommunication data. The customers to which it rents include the mobile network operators KPN, Vodafone, T-Mobile and Tele2.

In addition to all of these acquisitions important agreements have been struck with telecommunications operators and significant steps taken to support growth in DAS projects. In this connection, an important partnership was signed with JC Decaux in February 2017 to provide a comprehensive end-to-end solution for network access operators and public administrations in Spain and Italy to roll out small cells and DAS technologies to accelerate the densification and development of mobile broadband services.

Since its IPO in 2015, Cellnex has stimulated a broad-based transformation to respond to organisational challenges, in the operational and the strategic management of the company. This stimulus has involved formalising policies and procedures, consolidating sound corporate governance structures and implementing a project to transform management to achieve its strategic objectives.This transformation is based on pillars such as transparency and compliance and attention to ethical principles of integrity, honesty, respect for diversity, integration and equal opportunities.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analysing your browsing habits. If you continue to browse, we understand that you accept the use of these cookies. You can change your configuration or obtain further information Cookies Policy. Accept