connect

people

ANNUAL

REPORT

2016

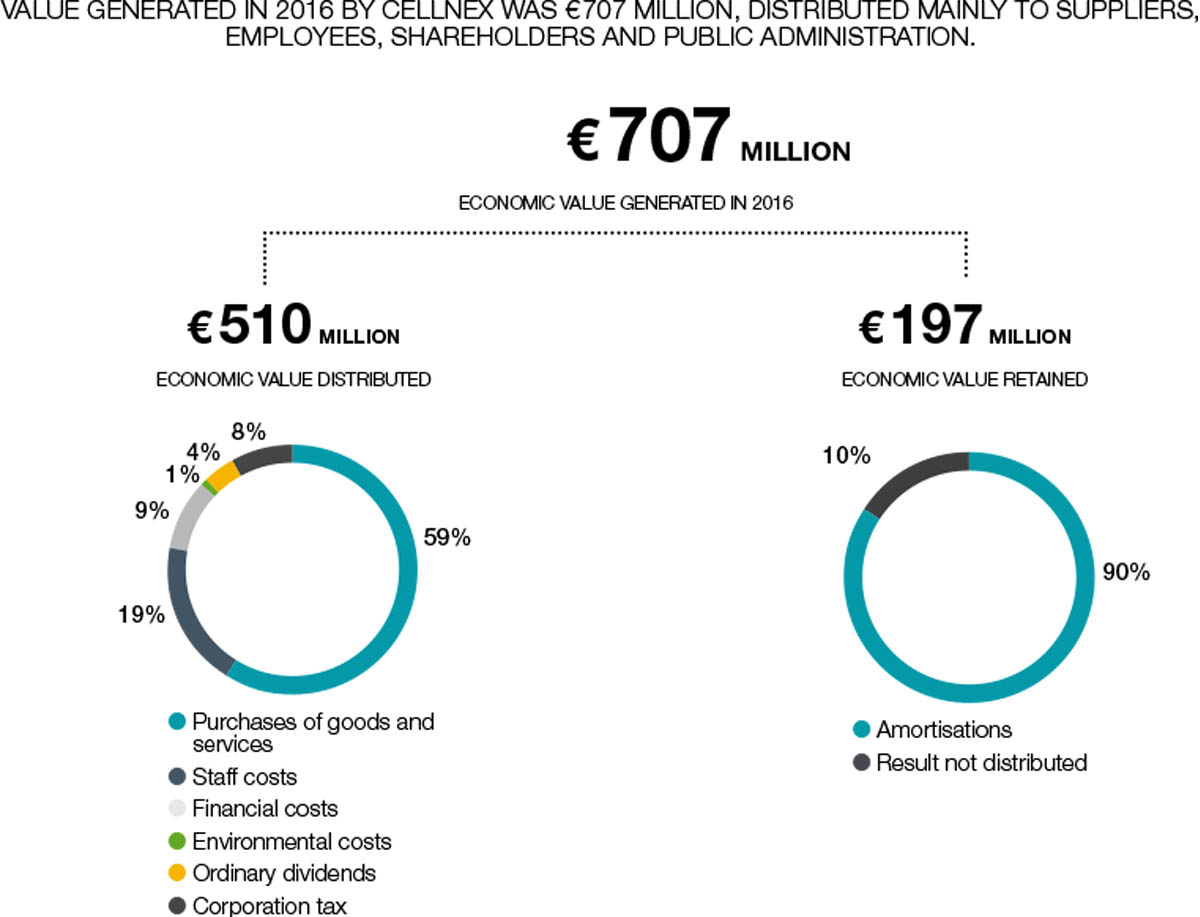

2016 was a key year for Cellnex with regard to achieving the strategic objectives that were set at the time of the IPO. In this connection, the company has performed very strongly, marked by growth, organically and through M&A. Consequently, Cellnex’s management model, based on solid growth and sustainable value generation, has led to a successful 2016.

2016 was a key year for Cellnex with regard to achieving the strategic objectives that were set at the time of the IPO. In this connection, the company has performed very strongly, marked by growth, organically and through M&A. Consequently, Cellnex’s management model, based on solid growth and sustainable value generation, has led to a successful 2016.

Company results in 2016, on a like-for-like basis, revealed organic growth of 4.5%. The company added more than 200 sites each quarter, with a consumer ratio of 1.62. Likewise, this solid organic growth, together with the successful M&A process, boosted adjusted EBITDA and FCRA per share.

Generating operating cash flow

The success of the Cellnex IPO has demonstrated the strength of its value proposition, a combination of ongoing service contracts and cash-flow visibility, key elements for creating growth. The ability to generate stable and growing cash flow also ensures that value is steadily created over time for shareholders.

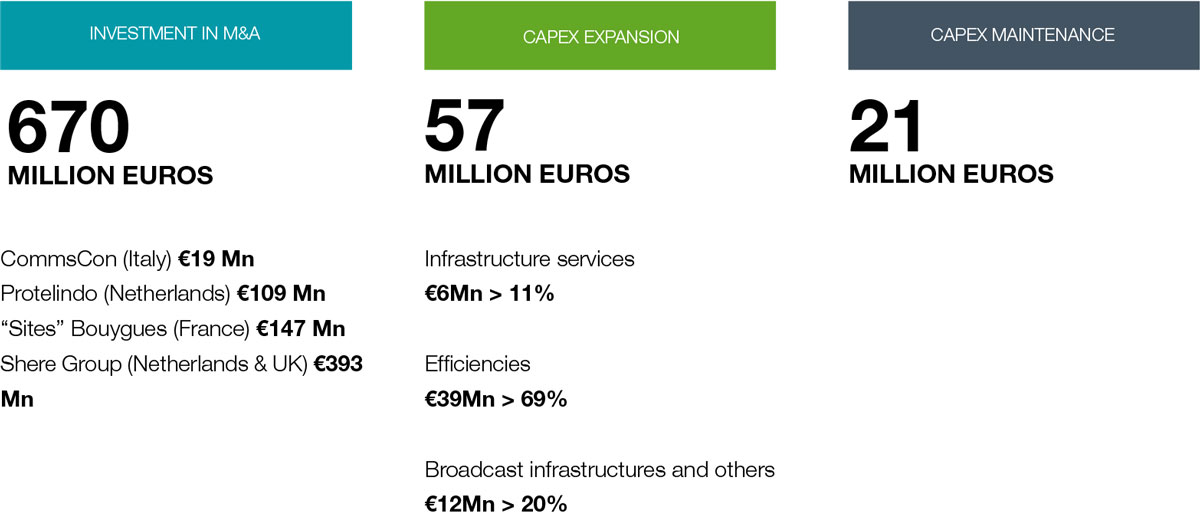

Investment and capital resources

Cellnex’s investment strategy has a long-term focus and embodies the concepts of selection, discipline and industrial approach. The company applies strict investment criteria focused on quality assets, with a minimum rate of return and a sustainable balance sheet structure. In this regard, 90% of total capital investment (€ 748 Mn) was allocated to M&A and the rest to CAPEX expansion and maintenance.

The current main objective in this regard is based on identifying new opportunities for Cellnex to grow in Europe, consolidating the position it has already established in Italy, Spain, France the UK and the Netherlands.

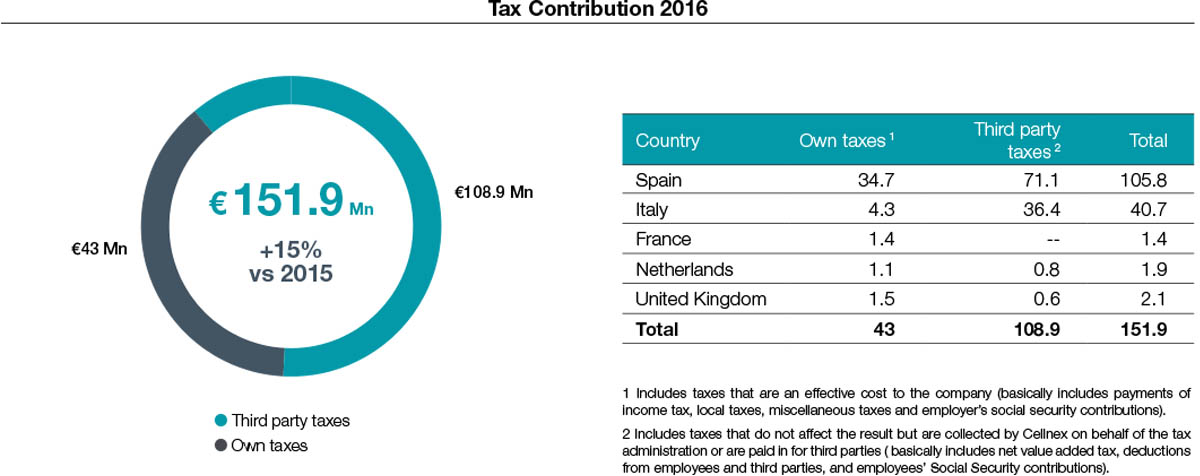

Cellnex’s tax contribution

In 2016 Cellnex established basic guidelines that are to govern the decisions and actions of the Cellnex Group on tax matters through the adoption of the Group’s taxation strategy by the Board of Directors.

In 2016 Cellnex established basic guidelines that are to govern the decisions and actions of the Cellnex Group on tax matters through the adoption of the Group’s taxation strategy by the Board of Directors.

Likewise, the Audit and Control Committee approved the standard on control and management of taxation risks, which defines the principles and structure of the framework for managing and monitoring such risks.

The Group acts responsibly in tax matters in its business management and meets its tax obligations in all the countries in which it operates, currently Spain, Italy, the Netherlands, France and the UK, applying consistent fiscal criteria in accordance with regulations, administrative doctrine and case law and maintaining appropriate relations with the corresponding tax authorities.

Cellnex is also sensitive to and aware of its responsibility in the economic development of the territories in which it operates, helping to create economic value by paying taxes, both on its own account and those collected from third parties. Accordingly, it makes a substantial effort and pays great attention to fulfilling its tax obligations, in accordance with the applicable rules in each territory.

Following OECD methodology on cash basis accounting, Cellnex’s total tax contribution in 2016 was € 151.9 million (132.2 in FY 2015).

Own taxes are those paid for the company and third party taxes are those collected and aid into the various tax offices on behalf of such third parties, therefore they are not a cost to the company.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analysing your browsing habits. If you continue to browse, we understand that you accept the use of these cookies. You can change your configuration or obtain further information Cookies Policy. Accept