connect

people

ANNUAL

REPORT

2016

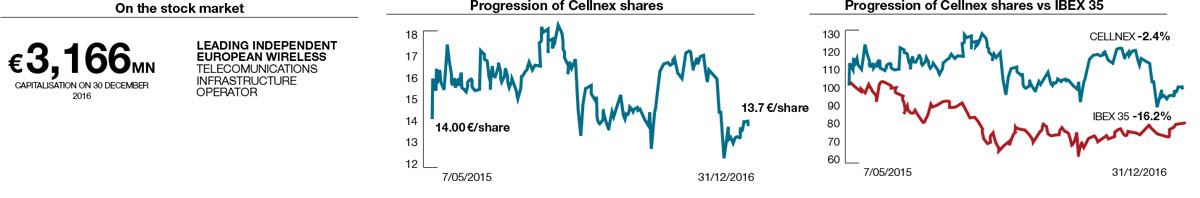

This milestone brought with it an expansion of the shareholder base, providing Cellnex greater liquidity and making it more attractive to investors. At present Cellnex has a solid shareholder base and the consensus of analysts who follow our company maintain a majority recommendation to buy.

Cellnex’s share capital amounts to € 57,920,810 and is divided into 231,683,240 ordinary shares with a nominal value of € 0.25 each, of a single class and series, fully subscribed and paid up. Each share carries one vote.

Cellnex’s capitalisation at 31 December 2016 was € 3.166 billion. The financial year was marked by significant stock market volatility caused by political and market uncertainty, in spite of which Cellnex shares performed 14% better than the selective IBEX 35 index from its launch onto the market in May 2015.

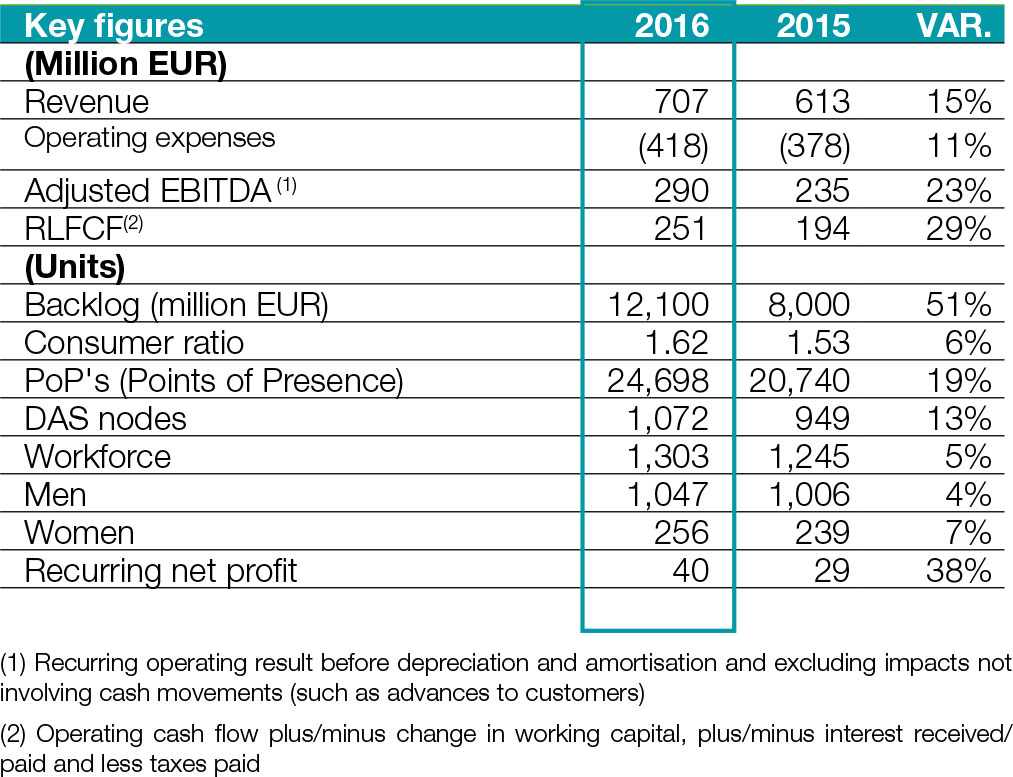

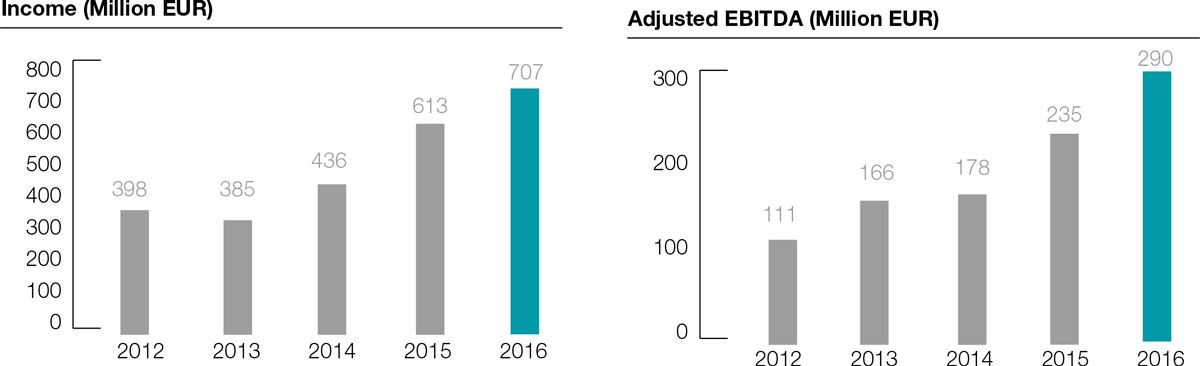

The breakdown of the main financial and operating figures show the degree to which the targets set for 2016 were achieved. From among the main financial figures we would highlight the trends in the following:

The breakdown of the main financial and operating figures show the degree to which the targets set for 2016 were achieved. From among the main financial figures we would highlight the trends in the following:

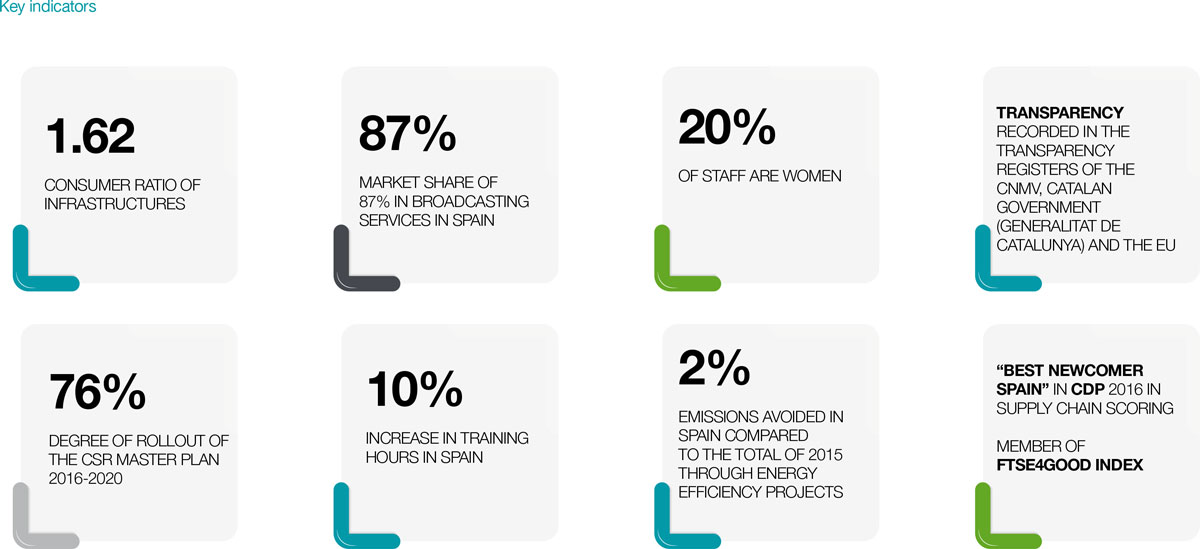

The main highlights of the year in the operating figures were:

Successful operational integration of new companies incorporated into the perimeter of the Cellnex group in 2015 and 2016;

Successful operational integration of new companies incorporated into the perimeter of the Cellnex group in 2015 and 2016; In relation to the reputational figures, 2016 was a particularly noteworthy year for the following reasons:

GRI: G4-DMA, G4-9, G4-10, G4-13

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analysing your browsing habits. If you continue to browse, we understand that you accept the use of these cookies. You can change your configuration or obtain further information Cookies Policy. Accept