connect

people

ANNUAL

REPORT

2016

2016 has been a year of progress in realising these challenges.

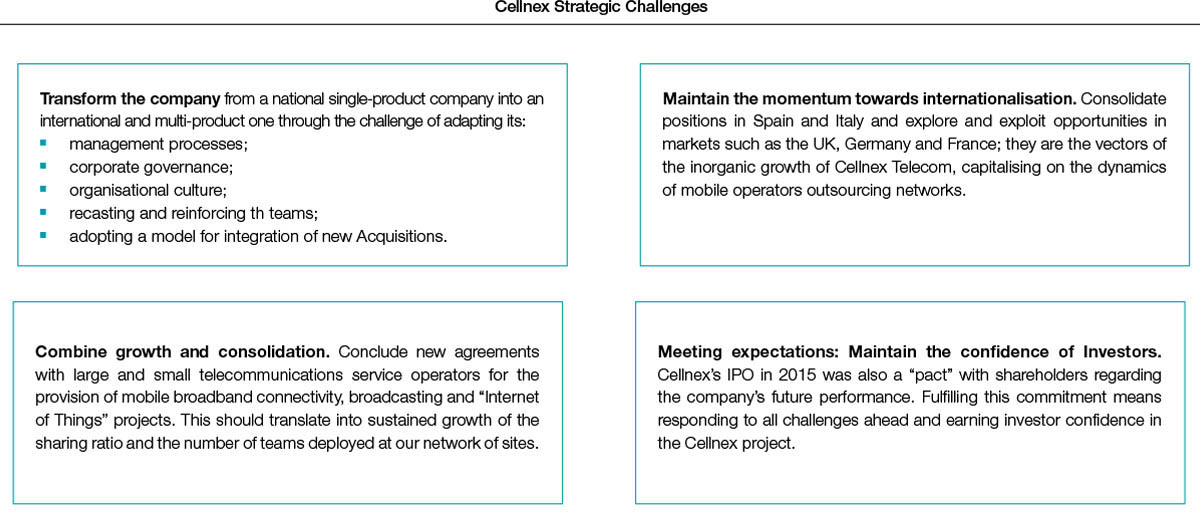

When it was floated in 2015, Cellnex identified four key strategic challenges on which the company aimed to focus, in an attempt to respond to the aim of sustained growth (diversification and internationalisation) and sustainable growth (capability to manage and integrate this growth) to ensure the competitiveness and attractiveness of the project in both the medium and the long term.

2016 has been a year of progress in realising these challenges. The key milestones include:

a. management processes

Cellnex has added almost 1,800 new sites to its portfolio in the wake of the growth operations materialised during the year in Italy

b. corporate governance

c. Cellnex culture

The acquisition of Italian company CommsCom not only strengthens Cellnex’s competitive position with regard to the networks densification projects by Rolling out 4G and 5G.

The higher rate of co-location achieved by independent operators reduces the need to build more towers, speeds up rollout, reduces implementation costs and cuts life-cycle costs for the network operator.

Telecommunications are and will be an essential asset for the economy, employment and innovation in Europe. That is why the European Commission is working on a “Strategy for a European Digital Single Market”(http://europa.eu/rapid/press-release_IP-15-4919_en.htm) based on the following main objectives.

In the Commission’s view, a fast and reliable fixed and mobile internet connection is increasingly important for education, health care, industry and transport, as well as for Europe’s economy and competitiveness.

Framed within this strategy and in order to offer more and better internet connectivity for all citizens and businesses by 2025, the Commission proposes three strategic connectivity objectives for 2025:

These objectives were presented by President Juncker during his State of the Union speech in September 2016: “We need to be connected. Our economy needs it. People need it. And we have to invest in this connectivity now”.

The speech was also accompanied by an ambitious review of EU telecoms rules, with new initiatives to respond to Europeans’ growing connectivity needs and to boost European competitiveness. These aim to encourage investment in high-capacity networks and accelerate access to public wifi for Europeans.

In this strategic framework, the concept of sharing networks operated by infrastructure operators appears as a “catalyst” or an “accelerator” of this rollout and the associated investments since it lowers entry barriers in retail supply and fosters competition for end-user level services. It is also an efficiency tool that reduces the overall costs of operators in a context in which competition itself involves ever-smaller commercial margins.

Within this framework, it is worth noting that mobile operators in Europe are driving a process of outsourcing their infrastructure, as a result of by three main factors:

The higher rate of co-location achieved by independent operators reduces the need to build more towers, speeds up rollout, reduces implementation costs and cuts life-cycle costs for the network operator.

In terms of Smart/IoT network services, we are expecting a sea change that will lead to new networks for security and emergency services, operation and maintenance, and the Internet of Things.

The infrastructure operator model has also shown that independent operators can cut operating costs because they achieve better management of passive infrastructures.

The role that an infrastructure operator such as Cellnex can play in a scenario designed to facilitate the emergence of the Digital Single Market amounts to its capability - on account of its independence and neutrality in relation to the operators offering services to end-users - to offer solutions to streamline and simplify the telecommunications infrastructure map by increasing connectivity for citizens. This can help to make these operators more efficient, make better use of the networks and speed up time to market in rolling out new generation infrastructures and networks that facilitate public access to new services and solutions that are worthy of an advanced digital society and economy.

Cellnex will act as a facilitator within the DSM (Digital Single Market) on three main fronts- mobile broadband infrastructures, broadcasting, and Smart networks services / IoT.

As concerns Telecom Infrastructure Services, the short-term goal is to be facilitators for the rollout of Heterogeneous networks, or HetNets. This new paradigm is based on interoperability between technologies and infrastructures to provide ubiquitous coverage able to meet the connectivity needs of any service. The result is the creation of a heterogeneous network comprising large “traditional antennas” but also involving new, smaller ones with greater density, for example integrated into urban fixtures. In this connection, Cellnex’s fundamental long-term objective involves positioning in 5G and the opportunities for managing new networks posed by this technology.

In the audiovisual sector, both radio services and DTT, the strategic challenge is to find the right fit between traditional and experiential broadcasting. The possibilities offered by new networks can have a significant impact on this front and open up a wide range of possibilities for development. In the long term, these possibilities will enable user interaction, synchronisation of various devices, among many other applications.

In the audiovisual sector, both radio services and DTT, the strategic challenge is to find the right fit between traditional and experiential broadcasting. The possibilities offered by new networks can have a significant impact on this front and open up a wide range of possibilities for development. In the long term, these possibilities will enable user interaction, synchronisation of various devices, among many other applications.

In addition, in Brussels there is talk of the need to define an industrial strategy for the European audiovisual, cultural and creative sector that would ensure the sustainability of the model in Europe, a model that generates 6.8% of GDP and 6.5% of employment in the Union and is the guarantor of pluralism, freedom of expression and social cohesion. In this regard, the forthcoming publication of the final text of the Decision by Parliament and the Council on the UHF band, which includes the explicit guarantee of access to the DTT spectrum at least until 2030, represents a clear signal to the sector, providing it with long-term security to enable the players to continue to invest and to innovate.

In terms of Smart/IoT network services, we are expecting a sea change that will lead to new networks for security and emergency services, operation and maintenance, and the Internet of Things.

In fact, the third pillar of the DSM aims to maximise the growth of the digital economy - which requires rolling out smart infrastructures: Small Cells, wifi access points, security and emergency services, infrastructure for connected cars, etc. Within that environment, an infrastructure operator can facilitate, streamline and accelerate roll-out by efficiently connecting objects and people.

Given the significant growth of data services and the importance of improving the European public’s access to high-speed broadband, Cellnex can play a vital role in cutting the costs of network deployment and improving access to high-speed broadband across Europe.

This model has the following benefits for the economy:

GRI: G4-DMA, G4-2, G4-14, G4-45, G4-46, G4-47, G4-SO3

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analysing your browsing habits. If you continue to browse, we understand that you accept the use of these cookies. You can change your configuration or obtain further information Cookies Policy. Accept