Consolidated Management Report

Consolidated Financial Statements

Business model

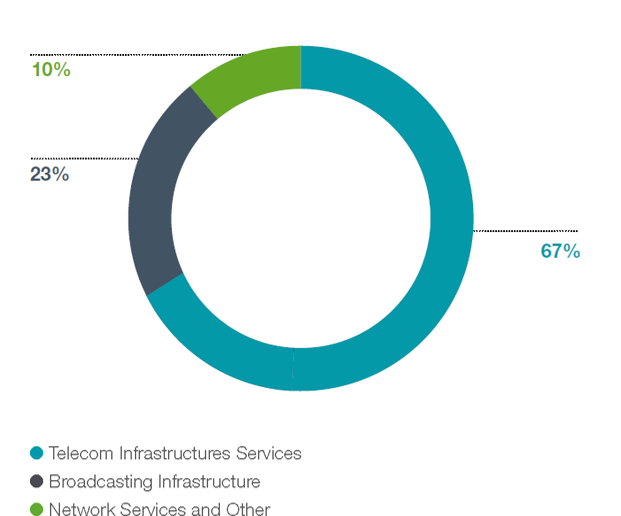

The Cellnex Group provides infrastructure management services for wireless telecommunications to the following markets:

- Telecom Infrastructure Services (TIS)

- Broadcasting Infrastructure.

- Network Services and Other.

In terms of their relative weight in the group’s 2019 P&L, the TIS business continues to strengthen its profile as a direct consequence of the significative growth experienced in the European core markets, which is mainly driven by the acquisition and integration of new telecom sites. This relative weight in favour of the TIS business will further increase in 2020 and beyond following the consolidation in the balance and P&L of the assets and companies acquired throughout 2019.

CONTRIBUTION IN INCOME AS OF 31 DECEMBER 2019

Infrastructure services for mobile telecommunications operators

Providing infrastructure services to mobile operators continues to be one of Cellnex’s main activities. During 2019 we worked on the various aspects required to allow us to evolve infrastructure to meet new upcoming challenges, with special focus on understanding how 5G technology will change the role of infrastructure providers.

5G will mean a paradigm shift in terms of connectivity, enabling an exponential increase in data consumption and transmission, as well as the minimum latency necessary for the development of applications. 5G will require a new network architecture, therefore the company is working on a neutral operator model where sharing a single infrastructure between operators will be key factor and relies upon technologies such as Optical fibre, Edge Computing and Distributed Antenna Systems (DAS) and Small Cells.

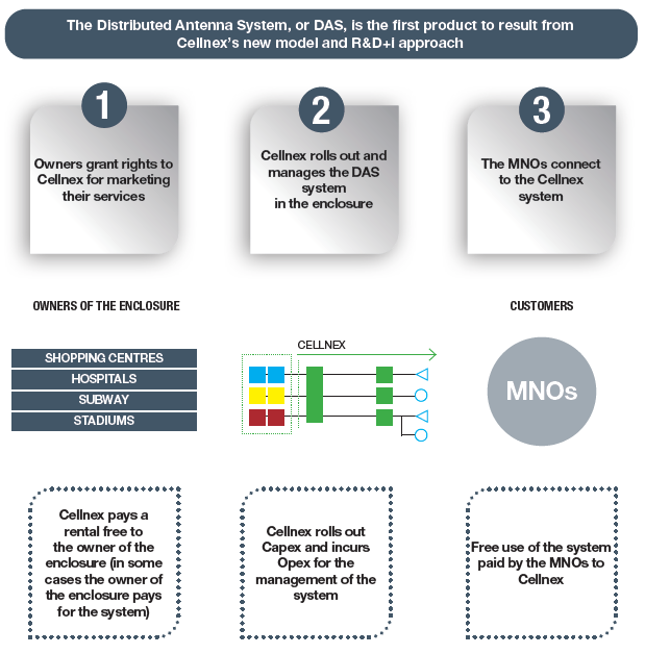

- Distributed Antenna Systems (DAS): This new network architecture will require adaptation of the equipment installed in existing infrastructures (macro sites) while increasing the densification of the network through Distributed Antenna Systems (DAS) and Small Cells in indoor areas (stadiums and sports venues, shopping centres, theatres, skyscrapers, carparks, underground networks, etc.) and outdoor areas (city centres, public transport networks, ports, airports, etc); especially high-footfall spaces .

- Edge Computing: This is another key element in the 5G ecosystem which shifts computing capabilities closer to the transmitting antennas and therefore closer to the data receivers (vehicles, people, machines). Bringing infrastructure closer to the end-user is fundamental to achieving minimum latency (1 millisecond), which is one of the elementary parameters of 5G technology and is directly related to the development of sectors such as autonomous vehicles, industry 4.0 or telemedicine. Cellnex is therefore committed to extending “Edge computing” - data processing at the edge of the network - bringing computing capabilities closer to antennas and therefore closer to the users (people, vehicles, and machines).

- Optical fibre: One of Cellnex's proposals is the roll-out, operation and maintenance of fibre optic networks connected to towers and antennas (macro and “small cells”) since optical fibre will be a necessary element of 5G for transmitting the huge amount of data that will be gathered by the new access networks to the operator network. Furthermore, “backhauling” with optical fibre telecommunications towers is essential to developing 5G networks, associated to the remote or “caching” servers that physically bring the data processing and storage capacity closer to the end users of 5G-based applications.

Increased fibre availability is essential to meet exponential data demand from 5G-based applications. As such, greater optic fibre capillarity is to expected in the coming years throughout the entire mobile network in its various forms (FTTT -fibre to the tower, FTTO - fibre to the offices, FTTS -fibre to the small cell-, FTTA -fibre to the antenna-, etc.), and European MNOs are shifting from copper- or microwave-based technologies towards fibre technologies to meet such increased bandwidth requirements.

In this context, the Group is assessing how to increase its commercial offer to meet the needs of its customers, increasingly investing in optical fibre, and always without retail exposure.

These assets are expected to provide co-location services offered by a neutral provider, similarly to the Group’s current Telecom Infrastructure Services segment and potentially with comparable economic principles in terms of long-term contract duration, price escalators and potential for upselling to third parties.

In addition, 5G technology provides a wide variety of capabilities that enable many different usage cases that can vary from autonomous vehicles to advanced emergency services.

Each new generation of mobile technology has fostered an increase in connection speeds and has enabled more reliable communications, but in the case of this fifth generation there are three main benefits:

- Improved mobile broadband: Not only thanks to increased capacity, but also because of improved reliability (broadband access always available) and by allowing higher speed use cases (enabling new services in cars, trains or aircraft)

- Increased connectivity: more devices can communicate simultaneously in a specific area (up to one million devices per square kilometre), providing the possibility to create new services related mainly to the Internet of Things (IoT)

- Enhanced response time: 5G improves the time response from the network, enabling a set of new use cases such as remotely controlling machinery or autonomous vehicles.

To this end, at the end of 2018 Cellnex entered the capital of Nearby Sensors, a technology start-up dedicated to rolling out the Internet of Things (IoT), distributed or Edge computing, and automation of hybrid IT-OT (Information Technology/Operational Technology) processes. Nearby Sensors is therefore a part of our open and collaborative innovation strategy, identifying entrepreneurial initiatives that start out from a close collaboration with universities and knowledge centres and end up translating into innovative value and service proposals within the scope of connectivity and telecommunications.

Infrastructure Master Plan 2018-2022

The Infrastructure Master Plan designed in 2018 with the ultimate goal of providing autonomous management at the main centres of the network and ensuring continuity of service (DTT, radio, data transmission, etc.). Therefore, it not only increases the guarantee of continued service, but also reduces operating and maintenance costs.

The Plan affects some 120 sites covering a broad swathe of the population or housing equipment for security and emergency networks, which are critical in operational terms. Therefore, the actions to be carried out will consist of renewing obsolete infrastructure and equipment and designing and implementing contingency plans.

Milestones 2019

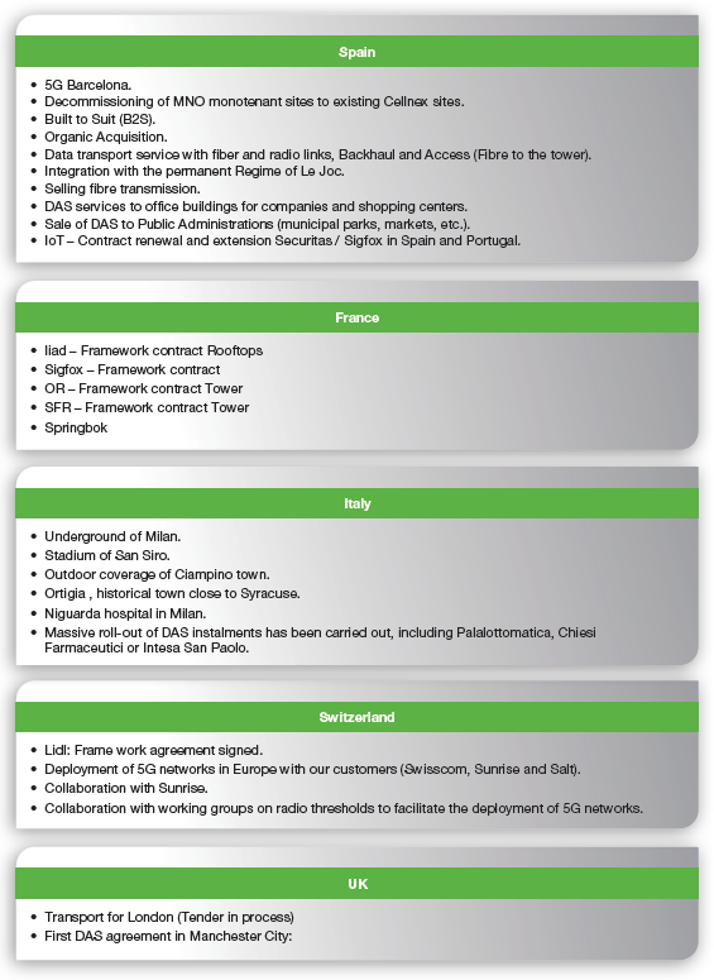

During 2019 Cellnex has carried out different projects in several countries, including:

5G Barcelona

Cellnex Telecom and 5G Barcelona have signed a collaboration agreement to develop and implement pilot projects that will make it possible to test the use of 5G technology in different sectors. This agreement has enabled Cellnex to test in Barcelona different potential new products and technologies. 5G drones to detect fires and 5G 360 video experience in music festivals are two examples of the cooperation with this institution.

Transport For London (Tender in process)

Cellnex UK is in competition with other consortia to provide coverage of the entire London Underground, laying a complementary fibre optic network and possible surface Small Cell needs. This is a pioneering tender in a new market model with partners for the implementation of integrated management of telecommunications networks (end-to-end), with various technologies (neutral network (4 and 5G), critical mission network, Wi-Fi networks, fibre optic connectivity, urban fixtures management for telecommunication services, etc.).

During 2019, Cellnex organised workshops with mobile telecommunications operators to reduce the Time-to-Market of operations. These workshops made it possible to reduce the number of inefficiencies of the various commercial phases, speeding up the process and improving the success rate of operations and coordination with operators.

In addition to this, throughout 2017, 2018 and 2019 the Group incorporated an innovative relationship practice called Land Aggregation with the site owners to provide efficiency in renting buildings and properties where the sites are located using a "cash advance" of the capitalisation of rents.

The Group, on request by its customers performs certain works and studies such as adaptation, engineering and design services on the Cellnex network (hereinafter “Engineering Services”), providing a separate income stream and performance obligation under IFRS 15. The costs incurred in relation to these services can be internal personnel costs or outsourced. The revenue in relation to these services is generally booked as the costs are incurred.

A massive rollout of landlord negotiations and land acquisitions took place during 2019. These operations involve 367 negotiations (average saving 30%), 175 Land Purchases (100% saving) and 263 DDS-Surface Rights (accounting view: 70% saving, adjusted view 100% saving).

Specifically in DAS (Distribution Antenna Systems):

Notable among the DAS projects carried out during 2019, was the first DAS agreement at Manchester City. This project came into trial service for operators in December 2019, and will be fully operational in February 2020. Due to the need for this project, work is under way to create a Network Operation Centre (NOC), which will be extended to other infrastructures, with the collaboration of external suppliers.

Mass roll-out of DAS installations has been carried out in Italy, including Palalottomatica, (DAS solution with “5G ready” fibre cabling), Chiesi Farmaceutici (Headquarter premises DAS coverage) or Intesa San Paolo. Likewise, Cellnex Spain has performed DAS services to office buildings for companies and shopping centres as well as Public Administrations (municipal car parks, markets, etc.).

Cellnex Netherlands acquired On Tower Netherlands subgroup, which is present in the Netherlands and Belgium. This acquisition allows Cellnex Netherlands to incorporate know-how to enhance other Product Lines as well as entering the Flemish market in Belgium and position Cellnex ideally with a view to further deals. Moreover, in Switzerland Cellnex has signed a collaboration with Sunrise for the deployment of indoor solutions and first roll-outs s of 4G and 5G nodes.

The Telecom Infrastructure Services site portfolio at 31 December 2019 is summarised below:

|

Framework Agreement |

Project |

Nº of Sites acquired |

Beginning of the contract |

Initial Terms + Renewals (2) |

|

Telefónica |

Babel |

1,000 |

2012 |

10+10+5 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta I |

1,211 |

2013 |

10+10+5 (Telefónica) |

|

|

|

|

|

Until 2030+8 (Yoigo) |

|

Telefónica |

Volta II |

530 |

2014 |

10+10+5 |

|

Business combination |

TowerCo purchase |

321 |

2014 |

Until 2038 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta III |

113 |

2014 |

10+10+5 (Telefonica) |

|

|

|

|

|

Until 2030+8 (Yoigo) |

|

Telefónica |

Volta Extended I |

1,090 |

2014 |

10+10+5 |

|

Neosky |

Neosky |

10 |

2014 |

10+10+5 |

|

Telefónica |

Volta Extended II |

300 |

2015 |

10+10+5 |

|

Business combination |

Galata purchase |

7,377 |

2015 |

15+15 (Wind) |

|

Business combination |

Protelindo purchase |

261 |

2012 |

+15 (KPN) |

|

|

|

|

2016 |

+12 (T-Mobile) |

|

Bouygues |

Asset purchase (3) |

371 |

2016 |

20+5+5 |

|

129 |

2017 |

20+5+5 |

||

|

1,098 |

2017 |

15+5+5+5 |

||

|

1,205 |

2018 |

15+5+5+5 |

||

|

|

|

701 |

2019 |

15+5+5+5 |

|

Business combination |

Shere Group purchase |

1,042 |

2011 |

+15 (KPN) |

|

2015 |

+10 (T-Mobile) |

|||

|

|

|

|

2015 |

+15 (Tele2) |

|

Business combination |

On Tower Italia purchase |

11 |

2014 |

9+9 (Wind) |

|

|

|

|

2015 |

9+9 (Vodafone) |

|

K2W |

Asset purchase |

32 |

2017 |

Various |

|

Business combination |

Swiss Towers purchase |

2,239 |

2017 |

20+10+10 (Sunrise Telecommunications) |

|

Business combination |

Infracapital Alticom subgroup purchase |

30 |

2017 |

Various |

|

Others Spain |

Asset purchase |

45 |

2017 |

15+10 |

|

36 |

2018 |

15+10 |

||

|

|

|

375 |

2018 |

20+10 |

|

Masmovil Spain |

Asset purchase |

551 |

2017 |

18+3 |

|

|

|

85 |

2018 |

6+7 |

|

Linkem |

Asset purchase |

426 |

2018 |

10+10 |

|

Business combination |

TMI purchase |

3 |

2018 |

Various |

|

Business combination |

Sintel purchase |

15 |

2018 |

Various |

|

Business combination |

BRT Tower purchase |

30 |

2018 |

Various |

|

Business combination |

DFA purchase |

9 |

2018 |

Various |

|

Sunrise |

Asset purchase |

173 |

2019 |

20+10+10 |

|

Business combination |

Video Press purchase |

8 |

2019 |

Various |

|

Business combination |

On Tower Netherlands purchase |

114 |

2019 |

7 (7) |

|

Business combination |

Swiss Infra purchase purchase |

2,771 |

2019 |

20+10 (4) |

|

Business combination |

Cignal purchase |

546 |

2019 |

20 (5) |

|

Business combination |

Business unit from Iliad Italia, S.p.A. |

1,776 |

2019 |

20+10 (4) |

|

Business combination |

Iliad7 purchase |

5,686 |

2019 |

20+10 (4) |

|

Orange Spain |

Asset purchase |

1,067 |

2019 |

10+10+1 (6) |

|

Shared with broadcasting business |

|

1,844 |

|

|

|

“Built to Suit” and others (1) |

|

61 |

|

(1) “Built to Suit” and others: towers that are built to meet the needs of the customer. This does not include the “BTS” programs with Bouygues and Sunrise at the closing of the M&A projects.

(2) Renewals: some of these contracts have clauses which prohibit partial cancellation and can therefore only be cancelled for the entire portfolio of sites (typically termed “all or nothing” clauses), and some of them have pre agreed pricing (positive/negative).

(3) In accordance with the agreements reached with Bouygues during 2016, 2017 and 2018, at 31 December 2019 Cellnex has committed to acquire and build up to 5,250 sites that will be gradually transferred to Cellnex up to until 2024 (see Note 6 of the accompanying consolidated financial statements). Of the proceeding 5,250 sites, a total of 3,504 sites have been transferred to Cellnex as at 31 December 2019 (as detailed in previous table). Note that all Bouygues transactions have a common characteristic “up to” as Bouygues does not have the obligation to reach the highest number of sites.

(4) Master Agreements with initial terms of approximately 20 years, to be automatically extended for 10-year periods (all-or-nothing basis), with an undefined maturity.

(5) Contracts with clients are linked to CPI, have an average duration of c.20 years and a high probability of renewal due to the portfolio’s strong commercial appeal and limited overlap with third party sites.

(6) Orange Spain will beT the main customer of this portfolio of telecom sites, with whom Cellnex has signed an inflation-linked Master Lease Agreement for an initial period of 10 years that can be extended by one subsequent period of 10 years and subsequent automatic 1-year periods (undefined maturity).

(7) Contracts with clients are linked to CPI and have an average duration of approximately c.7 years to be automatically extended (undefined maturity).

As at 31 December 2019 the Group also maintains 1,995 antennas nodes with the DAS.

Broadcasting infrastructure

The broadcasting infrastructure business is the Group’s second area of activity by turnover, and the largest in Spain. The company is the only operator offering nationwide coverage of the DTT service.

The value-creation model, In the broadcasting infrastructure business, the value-creation model is based on sharing the transmission network between broadcasters who do not have their own networks.

Its services consist of distributing and transmitting television and radio signals, and operating and maintenance of broadcasting networks, providing of connectivity for media content, hybrid broadcast-broadband services, and over-the-top (OTT) streaming services. Through the provision of broadcasting services, Cellnex has developed unique know-how and expertise that has helped to develop the other services in its portfolio.

In addition, Cellnex has established the strategic objective of positioning itself as a leader in Ultra High-Definition Video (UHD) technology, providing images with significantly better quality for the user than other options.

At the end of the first quarter of 2017, the UHF Decision of the European Parliament and the Council of the European Union regulating the use of the Spectrum band 470 - 790 MHZ was published and is, mandatory for all the Member States of the European Union. It is a balanced decision as it ensures that terrestrial TV will maintain the priority use of the Sub700 MHz band (470 - 694MHz) at least until 2030 and, at the same time, allocates the 700 MHz band (694 - 790 MHz) to mobile services. The UHF Decision provides a realistic timetable for both the Broadcast industry, offering long-term security in the use of spectrum and for the investments to be made, and for the mobile industry, which will have the 700MHz band within a reasonable time horizon (2020 with the possibility to delay it by two years with justified reasons). The Decision also suggests that Member States should compensate for the costs arising from the forced migration of services related to spectrum reallocation.

Royal Decree 391/2019 was published on 21 June 2019 and, approves the National Technical Plan for Digital Terrestrial Television (“The National Plan”) and regulates certain aspects for the release of the second digital dividend. The National Plan establishes the main guidelines for making the most of the second digital dividend, including:

- The 700MHz (694-790MHz) band will be ready for mobile services on 30 June 2020.

- The sub700MHz (470 – 694MHz) band will be used by DTT at least until 2030.

- The Spanish DTT bouquet remains unchanged, keeping the current multiplex number.

- All DTT contents will be in HD before 1 January 2023.

- DTT receivers shall be compatible with HD, UHD and HbbTV services under certain conditions.

The current challenge of the Group is how to work to comply with timetables, investments and technical issues while ensuring the impact for citizens and society is kept to a minimum.

Furthermore, during 2019, the Group has continued to work together with the Administration in relation to the second digital dividend, as well as on research and implementation of technical improvements, in the provision of DTT, and in the on-line distribution of audiovisual content. Such technological advances include the interactivity of Hybrid DTT, or the quality improvement provided by UHD.

In relation to the above, the Group is the technological provider of LOVEStv, the new HbbTV-based DTT audiovisual platform developed joinly with the public radio broadcaster RTVE and the two large Spanish commercial radio broadcasting groups, Atresmedia and Mediaset Spain. This platform allows the viewer to access the contents of the last week from the television (catch-up), as well

as viewing programmes from the beginning even if they have already started (start-over).

Cellnex Telecom, as an independent agent, has worked together with broadcasters and developers in implementing the necessary solutions for these new audiovisual services, since Cellnex satisfies the conditions making it the right partner, given its technological capacity and extensive know-how in OTT platform services and HbbTV.

Additionally, Cellnex continues its international work in the main forums developing the future of the audiovisual sector such as HbbTV, DVB, EBU, ITU or BNE.

Milestones 2019

LOVEStv

LOVEStv streaming platform was launched on 28 November 2018, one week after World Television Day. Cellnex Telecom, as the technology provider, developing together with the public broadcaster RTVE and the two large Spanish private broadcasting groups, Atresmedia and Mediaset España. The project's test launch took place in June.

This new service is based on Hybrid DTT technology and allows viewers to enjoy the advantages of linear DTT while they can access content and new non-linear services. LOVEStv makes it possible to harness the capacity of the Internet to improve viewer experience, offering more features, such as:

- Viewing the contents of the previous week.

- Starting a programme from the beginning when it has already begun.

- An improved programming guide.

LOVEStv was designed as an open platform that can easily integrate any broadcasters wishing to enrich its content offering. It is worth pointing out that the LOVEStv platform was awarded with the Grand Prix of the jury of the prestigious HbbTV Awards, 2018, which acknowledges innovation in content discovery applications.

The second phase of LovesTv is expected to be launched soon, including a personalised area (MyLOVESTv), multiscreen and targeted advertising as key new features.

Pilot test for Ultra High-Definition

Celnex is showcasing DTT as a platform ready for UHD broadcasting, UHD DTT test transmissions are broadcasting contents provided by RTVE using seven transmitters located in five different cities in Spain (Madrid, Barcelona, Sevilla, Málaga and Santiago de Compostela). The contents broadcasted includes a complete set of technological improvements associated to UHD such as: 4k resolution, High Frame Rate (HFR) up to 100 frames per second, High Dynamic Range (HDR)10, Wider Colour Gamut (WCG) of REC ITU BT 2020, and Next Generation Audio (NGA), HEVC and AC-4 have been used for video and audio coding respectively.

Numerous actions continued to be performed in the Ultra High Definition area throughout 2019, via collaborative projects such as:

- Broadcast over the UHD TDT test channel from Torrespaña (Madrid), Valencina (Seville) and Collserola (Barcelona).

- Demos of TDT broadcast in UHD during the Mobile World Congress.

- Demos of TDT broadcast in UHD during the BIT Broadcast fair.

- First TDT broadcasts of a complete UHD signal with HFR, HDR and WCG in collaboration with RTVE.

- Demo at the 4K Summit in Malaga.

Other network services

At Cellnex, the "smart" concept means sharing, efficiency, security, resilience and ubiquitous connectivity. Cellnex provides the infrastructure required for the development of a connected society by providing the following network services: transport of data, security and control, Smart communication networks including IoT, Smart services and managed services and consulting.

As an infrastructure operator, Cellnex can facilitate, streamline and speed up the deployment of these services through efficient connectivity of objects and people, in rural and urban environments, helping to build genuinely smart territories.

The network and other services activity is a specialised business that creates value through innovative solutions and stable financial flows with attractive growth potential. Given the critical nature of these services, the customers of this activity demand in-depth technical know-how and strict service level agreements.

The connectivity of objects is set to grow very significantly in the near future. The Internet of Things (IoT) network is based on a model that connects physical objects and keeps them integrated in a network. The alliance between Cellnex Telecom and IoT network provider Sigfox is evidence of the Group's commitment to develop this technology both today and in the near future. In this regard, Cellnex's position as a reference global operator of IoT has become consolidated with more than one million objects connected in Spain's largest network dedicated to the Internet of Things.

This activity will continue to grow in the security market through our main customer in the home, people and vehicles sector. In addition to this, the main development is occurring in the water metering and smart city services markets.

Security and Control

- Securitas Direct renewed and extended the Internet of Things (IoT) connectivity services contract with Cellnex Telecom in June 2019. This agreement allows Securitas Direct to maintain its exclusive ATN network, increasing its size, coverage and capabilities to continue to develop innovative solutions. Cellnex Telecom will increase six-fold the current capacity of the IoT network, based on Sigfox technology, to provide it with more features, such as the ability to transmit images and send audio messages. It will also extend its coverage to Portugal with Sigfox, becoming the operator of the network in both countries, providing service to more than 1.2 million customers. The contract has been signed for a total of fifteen years, starting with a six-year period followed by an extension of nine more years.

- In addition, a contract was signed in September 2019 for an emergency and security digital mobile communications service in the Autonomous Community of Navarre for the six-year period of, 2020-2025. This network provides coverage to the entire region and serves various units of the Government of Navarre, including emergencies in Navarre, the Autonomous Police, the Fire Service of Navarre, Ambulances, the Environmental Nursery Service, and the Road Maintenance Service.

- Pilot testing of combining TETRA and LTE technologies for Critical Mission.

- Coverage in AVE high-speed rail tunnels to different places in Spain to extend the safety and emergency network.

- Zenon: sales of Mission Critical Handsets (TETRA).

Smart communications networks

- Mobility Lab, a project developed by Cellnex Telecom, was presented at the Circuit Parcmotor Castellolí Barcelona. The operator has equipped the venue with the necessary infrastructure and technology to allow users and customers to develop new products and services in the field of smart mobility and vehicle connectivity, (IoT, 5G and connected/autonomous vehicle), designed especially for non-urban or semi-rural environments. The connectivity implemented means that what happens on the track and inside the car can be checked, viewed and/or monitored from anywhere in the world. The company’s experience in the telecommunications sector and Castellolí’s infrastructure offer a complete solution for testing connected and autonomous vehicles in a controlled, safe and sustainable environment. Moreover, the solutions deployed by Cellnex Telecom at Parcmotor Castellolí operate under the premise of an efficient and environmentally responsible energy management, since they are self-powered by wind and/or solar energy.

- IoT Project with the company Red Eléctrica. Fire detection system from the high-voltage towers of Red Eléctrica. It is a project called "challenge the open innovation" that emerged from Ennomotive, a crowfunding platform of engineers' ideas for challenges related to fire detection and prevention.

- Multioperator SmallCells Pilot. A multi-operator Small-Cells pilot has been deployed to validate installation models and the impact on urban environments, while validating integration into operators' networks.

- Alokabide. Extension of the Social House project (monitored houses) with the Basque Government, after the implementation already rolled out in Catalonia. Cellnex will equip the selected homes with sensors that will allow remote data collection and monitoring in order to improve the comfort conditions of the users of these homes and facilitate the protection and management of these "connected" homes.

- Pilot network tests of domestic water consumption meters (IoT)

- Development of new IoT verticals.

- Smart & Iot in Italy.

- Deployment of an IoT network in Switzerland, reaching more than 85% coverage.

Communications infrastructures - Smart

- Extension of contract with Endesa to renew the entire connectivity network of its own buildings.

- Extension of the contract for the renewal and maintenance of fibre networks to different companies.

- Co-location of SigFox networks at sites in France, Italy and Switzerland.

- A tender has been submitted in the Netherlands for the deployment of a telecommunications network for air traffic control.

- Agreement to manage TLC services for the public transportation system of Milan and other surrounding areas thanks to a joint venture with other companies (ATM, A2A, ...).