Consolidated Management Report

Consolidated Financial Statements

Extract form the interview with the Chairman, Franco Bernabè, and the CEO, Tobias Martinez

2019, a quantum leap into a new dimension

In your opinion, what attributes would best define 2019? What would be the headlines of the financial year?

Franco Bernabè (FB): This last year has been a transformational one that marked a quantum leap in terms of size as well as a qualitative leap in consolidating the group’s position in key markets.

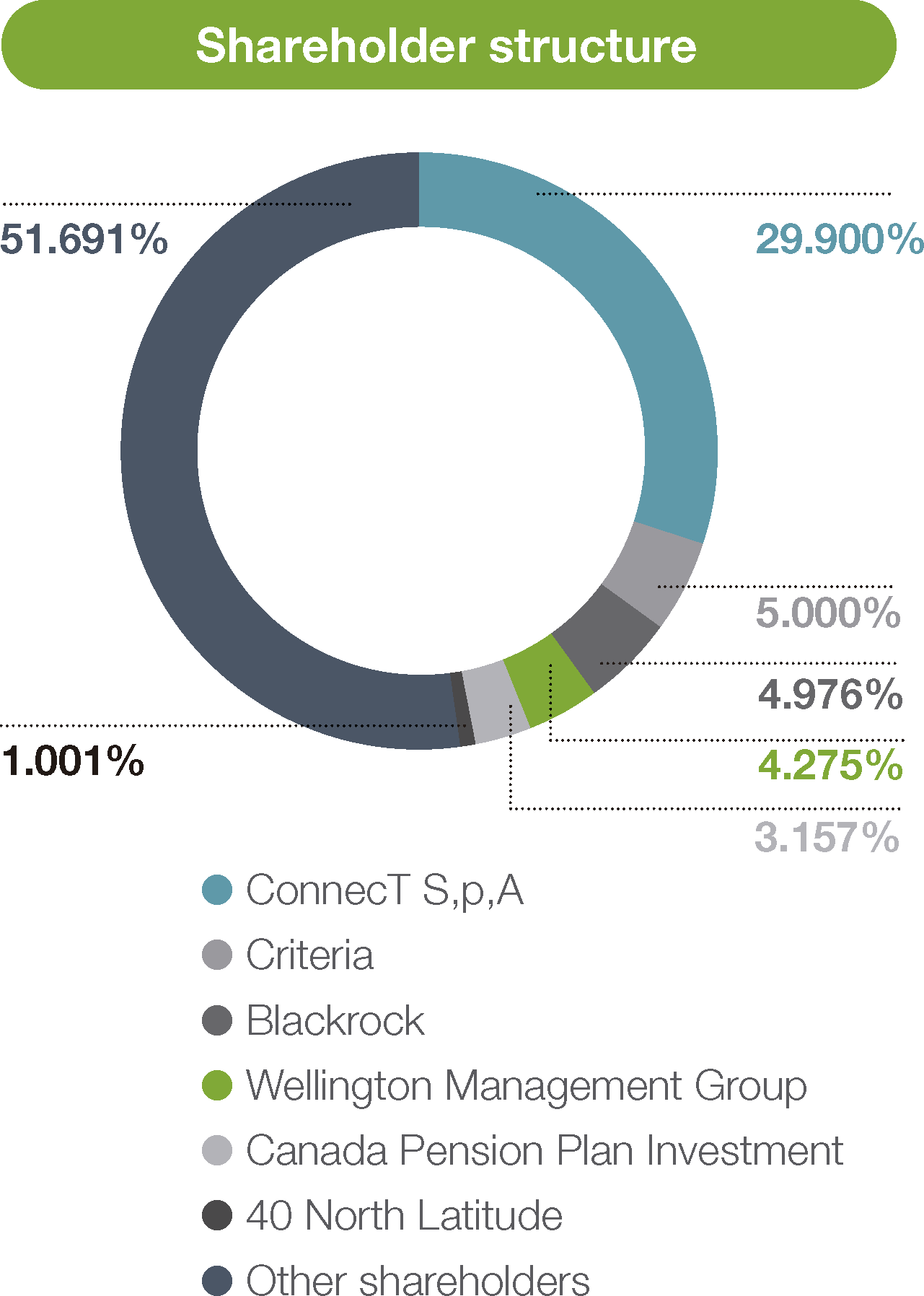

Another prominent headline would be the trust that Cellnex’s shareholders continue to place in our project, evidenced by their high degree of participation in and support for the two capital increases.

Thirdly, I would point to the way that the management team has pushed forward with an ambitious growth strategy without losing focus of the organic growth that underlies the sustainability of the project in the medium and the long term.

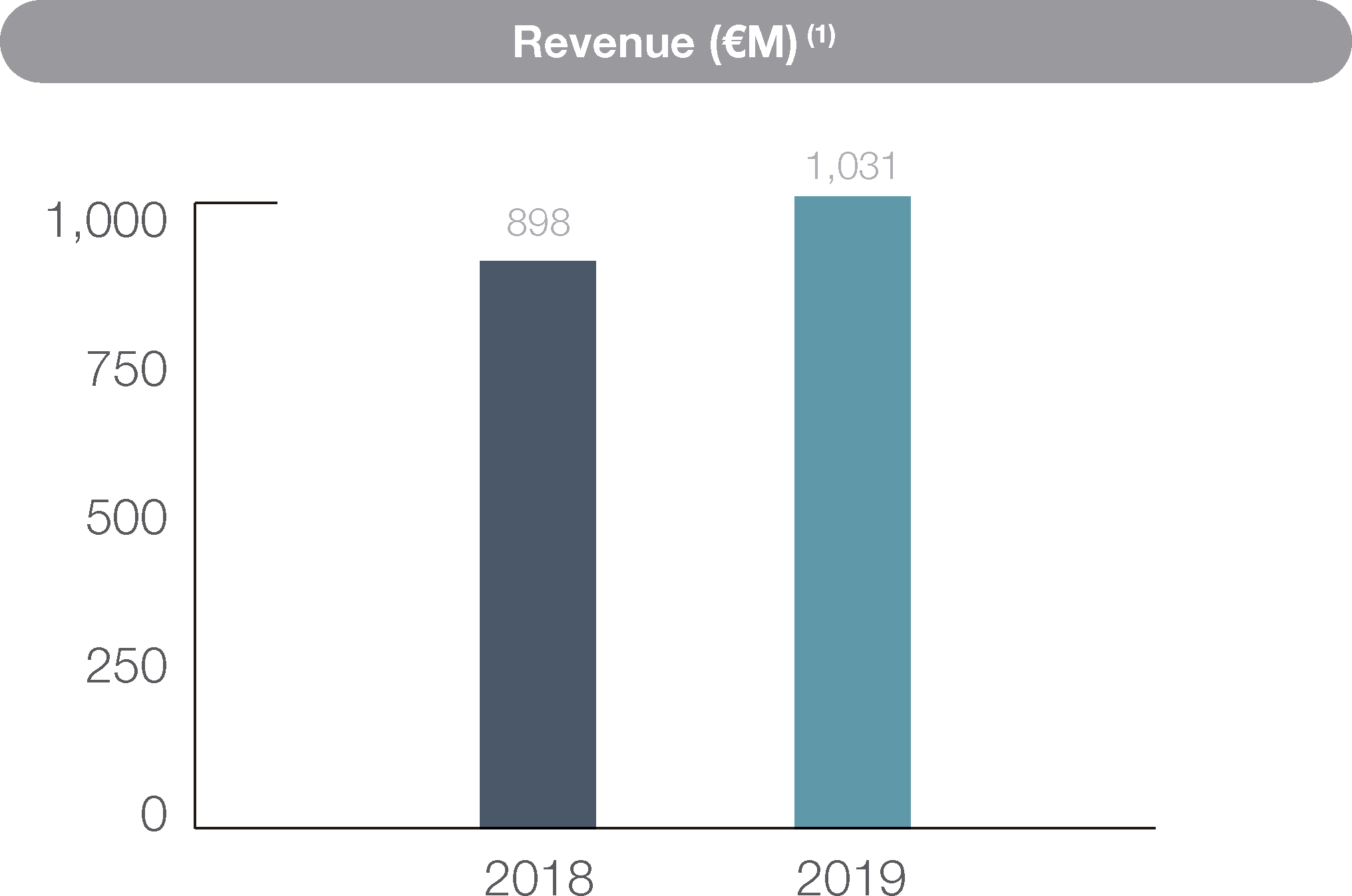

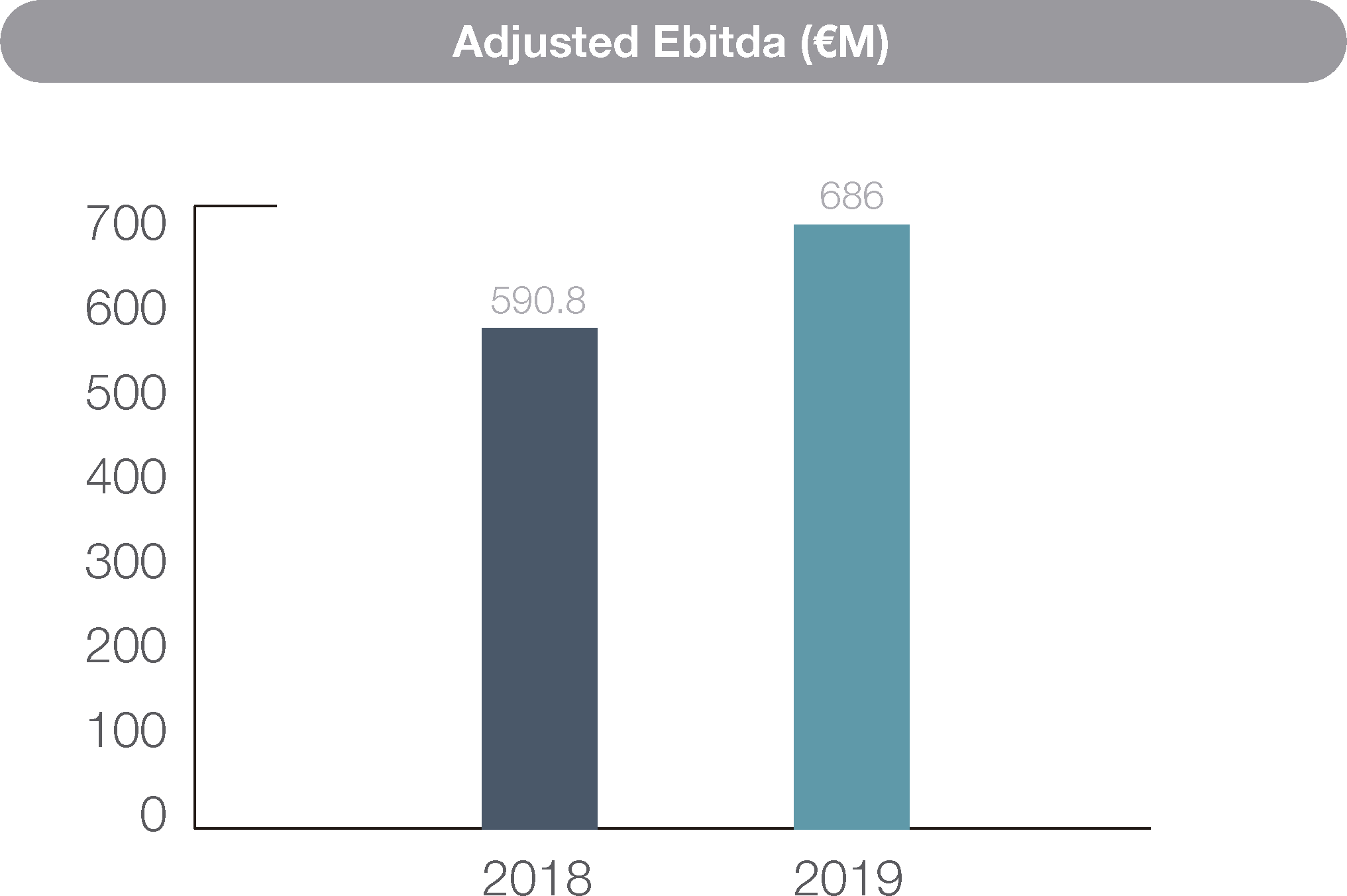

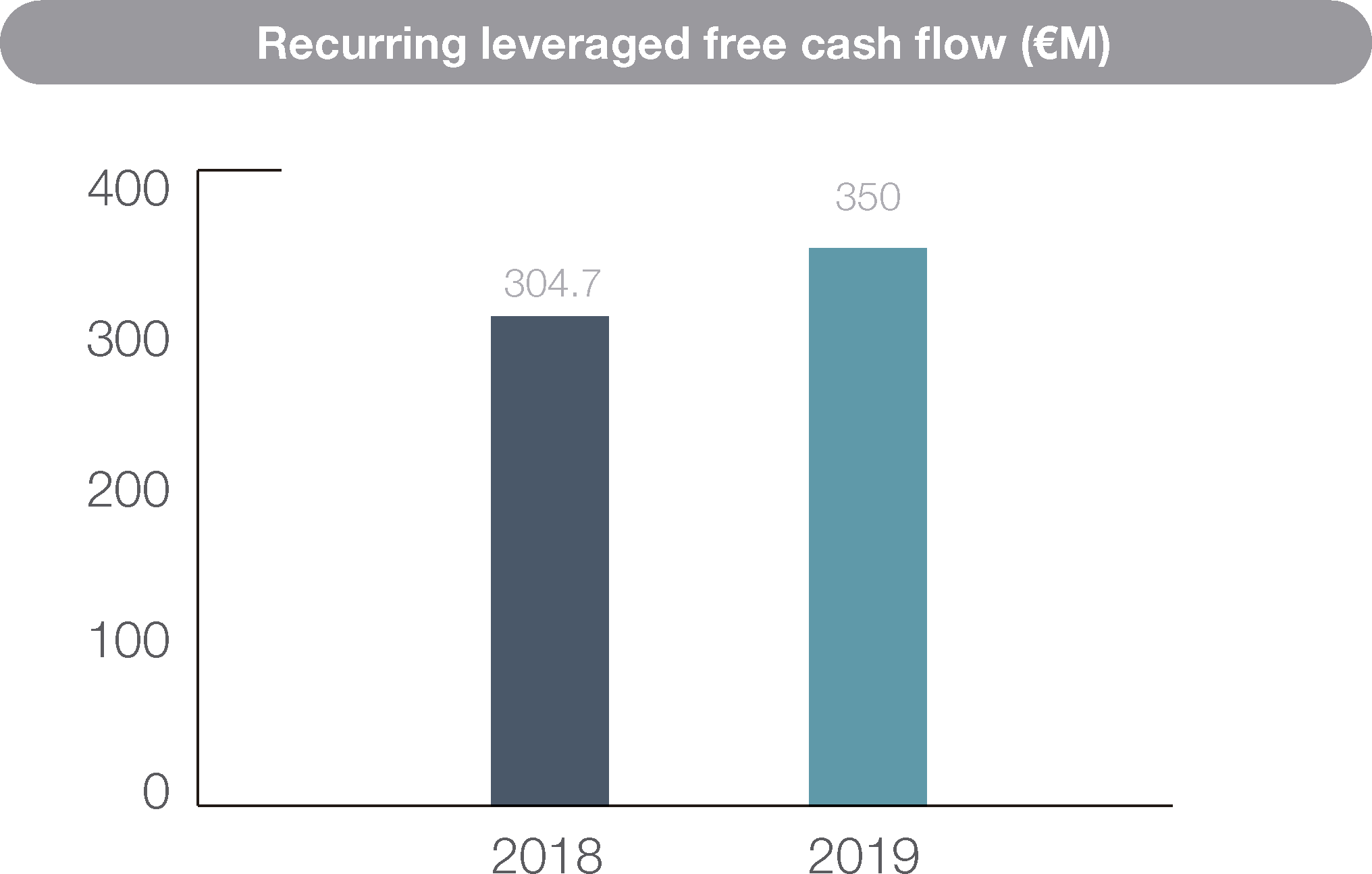

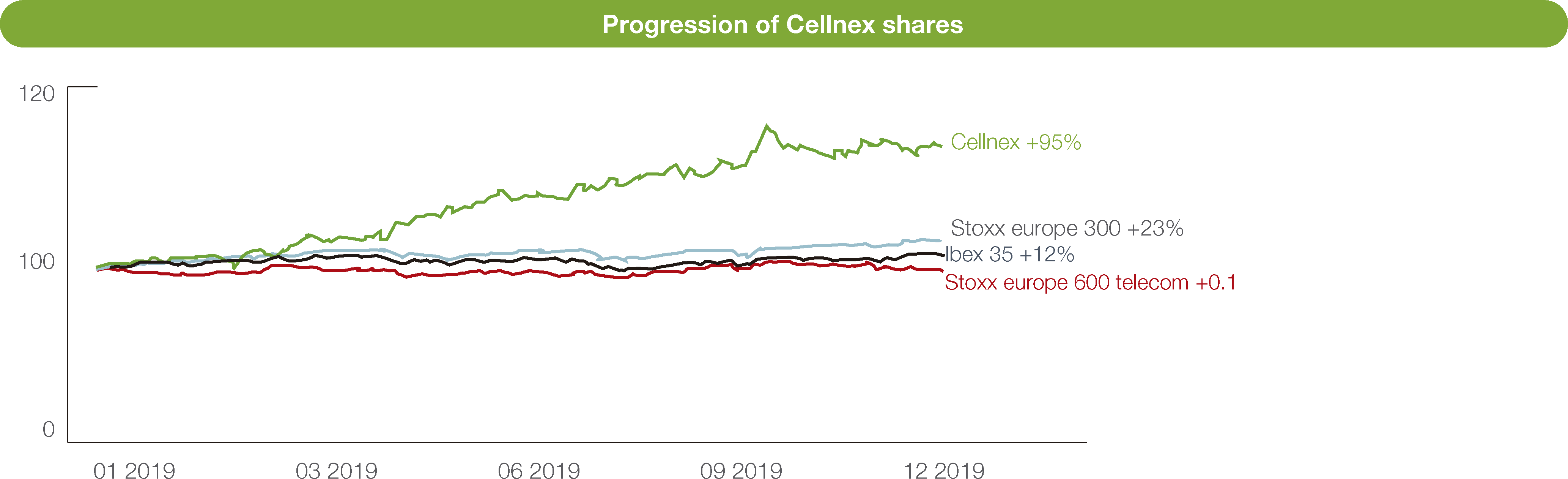

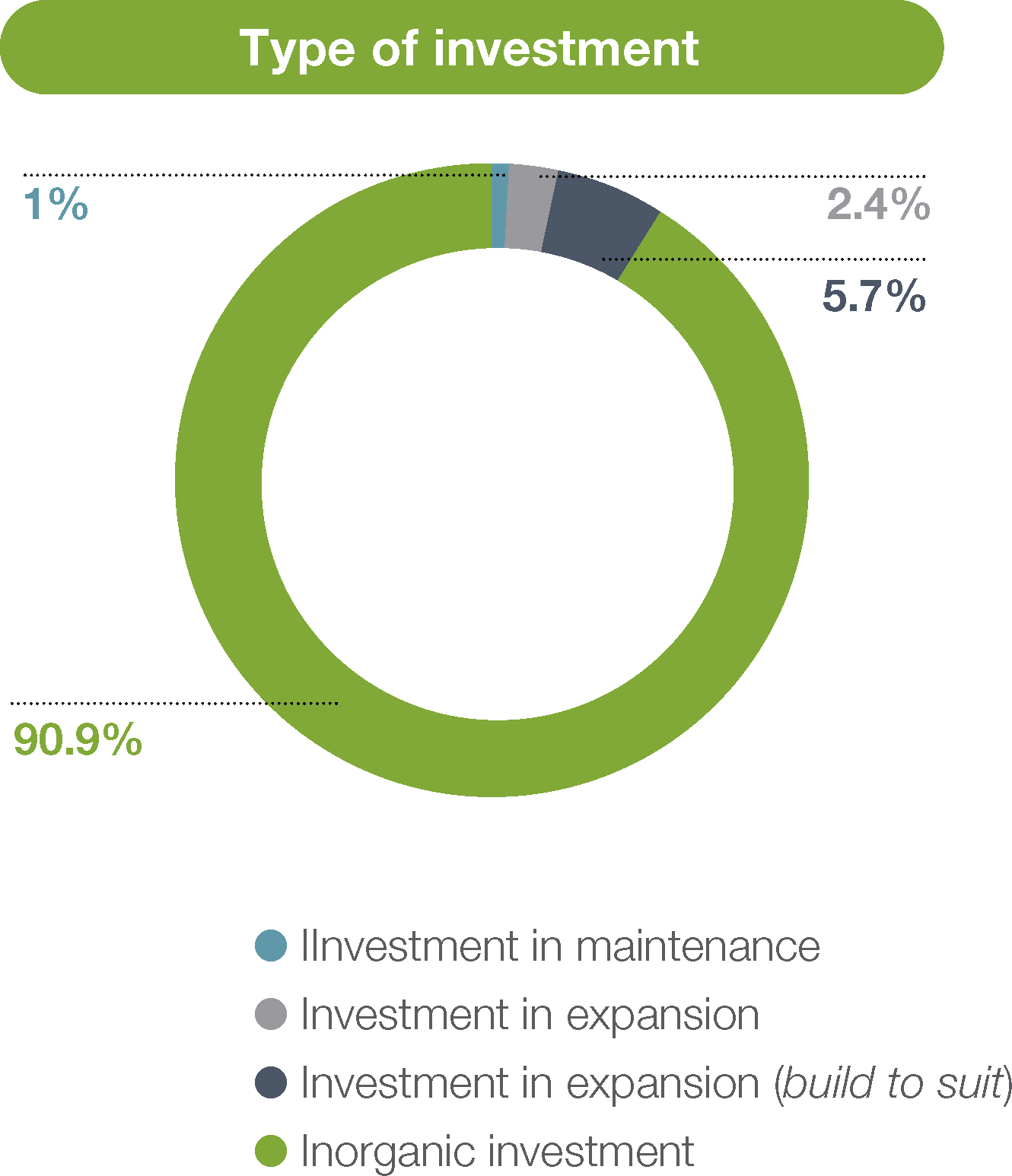

Tobias Martinez (TM): I would rate 2019 as an exceptional year. Two capital increases totalling € 3.7 billion; investment of more than € 7 billion for a company with revenues of € 1 billion; a 90% increase in the share price; all without losing focus of the day-to-day management of the company. Taken separately, each of these factors is extraordinary within the activity of any company.

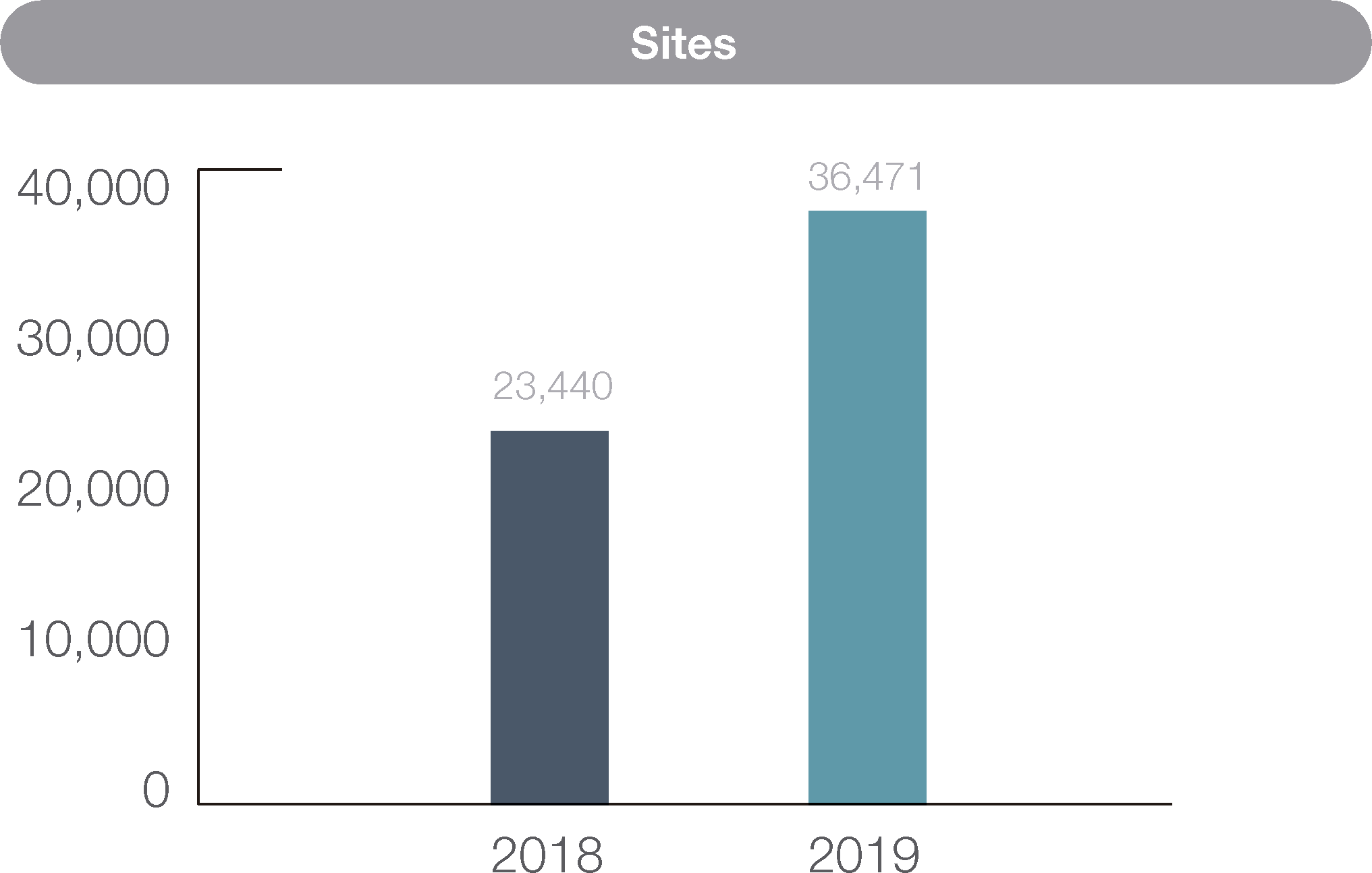

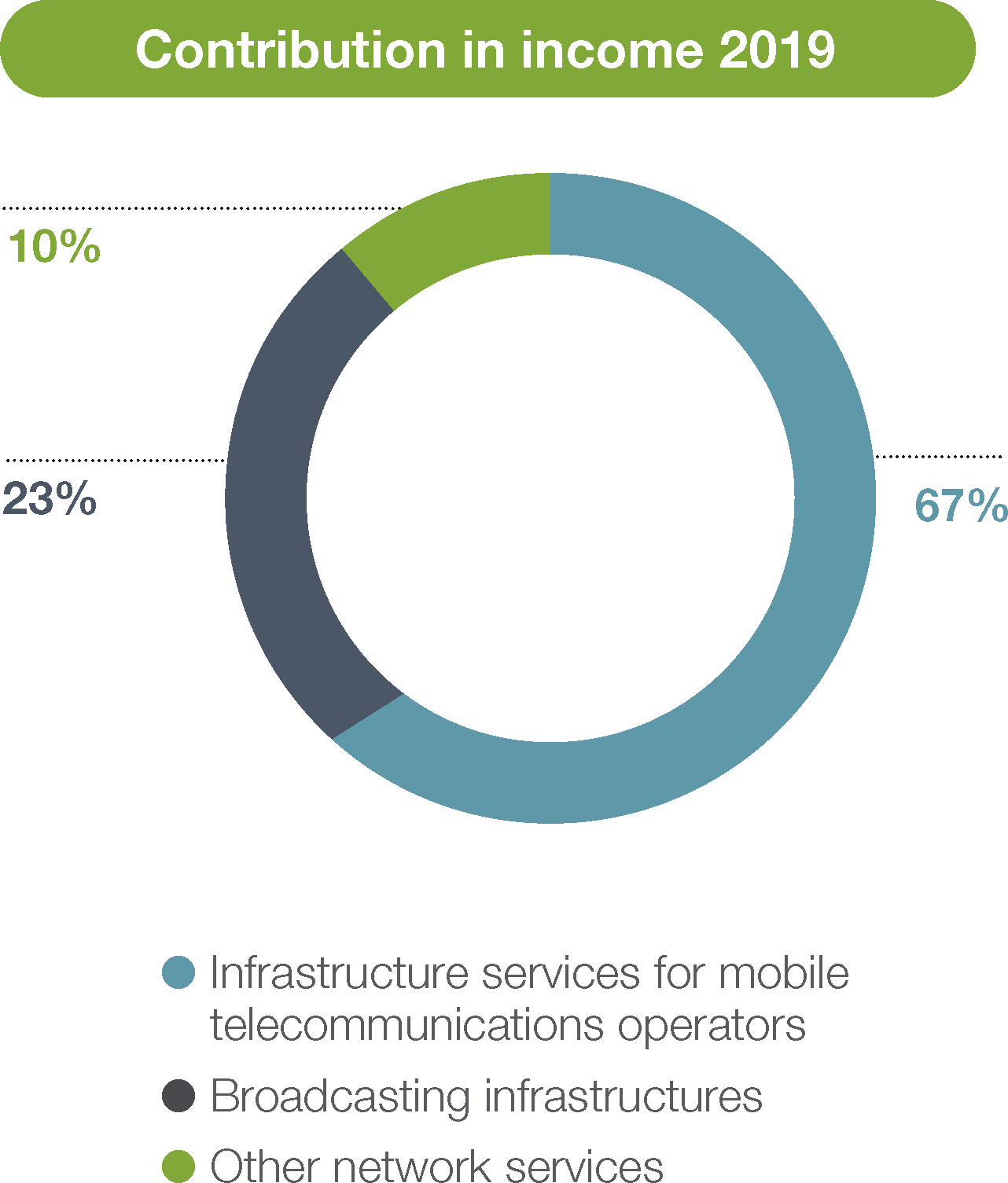

This growth will allow us to consolidate the group’s position in the markets in which we operate while further expanding our geographical footprint in Europe with the incorporation of Ireland and Portugal into the project. All of this was achieved with consolidated data that once again show double-digit growth in revenue and EBITDA.

What happened in 2019 to cause this intense dynamic of growth and transformation? What factors lay behind it?

TM: For our company, 2018 appeared somewhat less dynamic from the point of view of inorganic growth, however during that time our teams were already working to prepare some of the opportunities which we saw materialise in 2019.

Another factor is a more structural change that is occurring in the telecommunications sector through which large mobile network operators are decoupling infrastructure management from service provision. Some examples are the decisions taken by Iliad in France and Italy, or Salt in Switzerland, to segregate and transfer management of their infrastructure to neutral operators like Cellnex.

This further confirms the wisdom of the decision made by pure infrastructure operators like Cellnex, which in our case is also characterised by our neutrality and independence.

FB: This undercurrent in the sector is driven by the need to increase sharing, efficiency, cost optimisation and MNOs capturing value, generating resources that can be ploughed back into new investments such as 5G or improving their balance sheet structures.

We understand that this is a structural trend with great future potential that will continue to offer opportunities for infrastructure operators such as Cellnex.

Two capital increases in the same year, two corporate bond issues, improved conditions in available credit lines… Cellnex seems able to activate a diversified range of financial instruments to support this growth strategy. Will they continue in this vein? And again, as we pointed out in 2018, where is the limit?

FB: The current state of the sector is helped by the prevailing situation of debt and capital markets. These tailwinds help companies like Cellnex, with its industrial and growth project, to enjoy excellent conditions in terms of lending costs or liquidity by investors that are willing to support capital increases with a solid base project. That has facilitated this combination of instruments which has afforded us access to considerable financing to accompany and support this exceptional growth.

TM: The limit will be set by the opportunities that arise in the sector, the situation of the financial markets and how these opportunities fit into the industrial vision of Cellnex’s model.

It could be said that the past behaviour of Cellnex shares on the stock market, which have revalued by 95%, clearly reflects this transformation. Cellnex shares enjoyed the highest increase on the IBEX 35 during the year. How do you value this?

TM: It would be hard not to view this as anything but positive. This reflects the trust in a project that combines geographical expansion with stability, recurrence and predictability of the flows generated.

FB: There can be no doubt that the market has welcomed Cellnex very warmly since its IPO in May 2015. In fact, if we analyse total shareholder return, which is 217,27% since the IPO, it has evolved in parallel to the quality and quantum leap by the Group. We closed 2019 with revenues more than double those at the end of 2014. Cellnex’s market cap during this period, incorporating the increases, has increased by a factor of 4.5, reflecting the consistency between the company’s real growth and its market valuation.

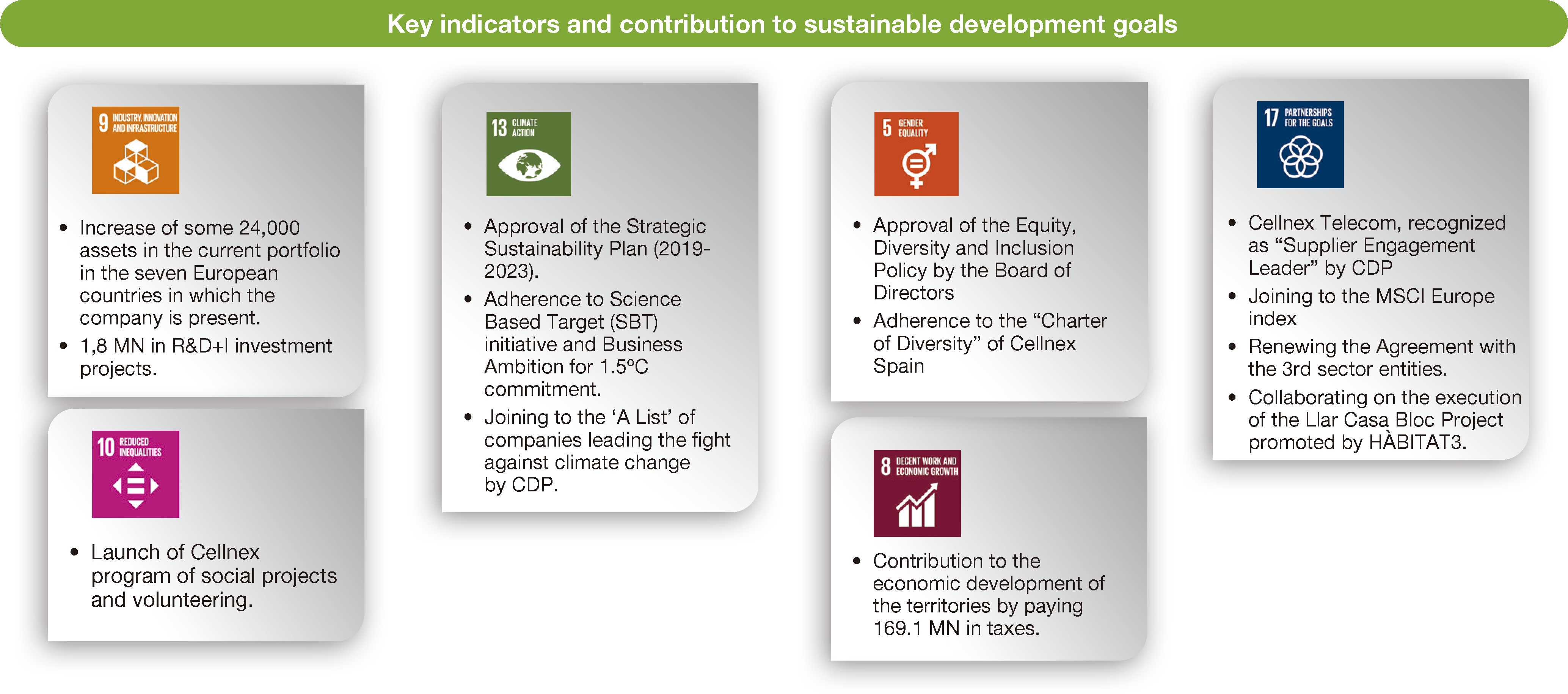

We tend to evaluate listed companies in a one-dimensional way – looking only at the share price – but investors are also increasingly valuing environment, social responsibility, corporate governance (ESG) criteria. How relevant are these criteria for Cellnex?

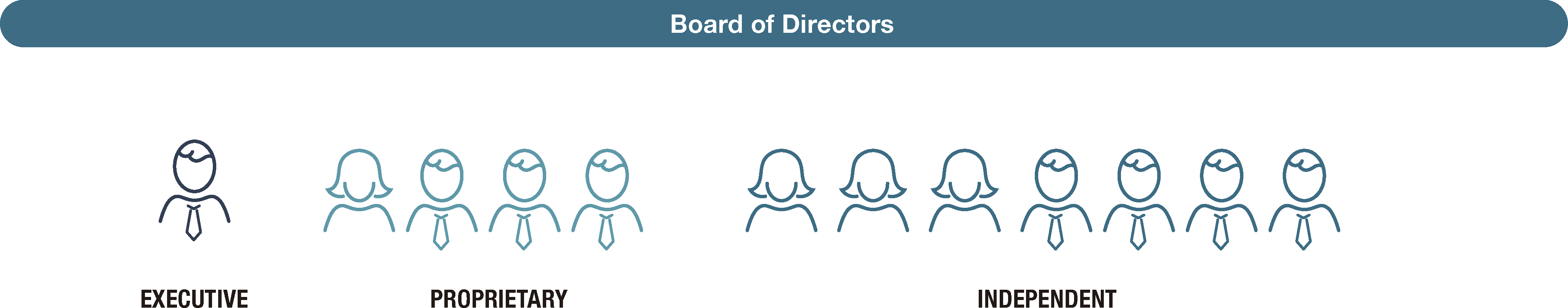

FB: The elements comprising the company’s best practices in terms of good governance, corporate responsibility (CR) and sustainability are factors that are increasingly appreciated and monitored by investors, analysts and markets.

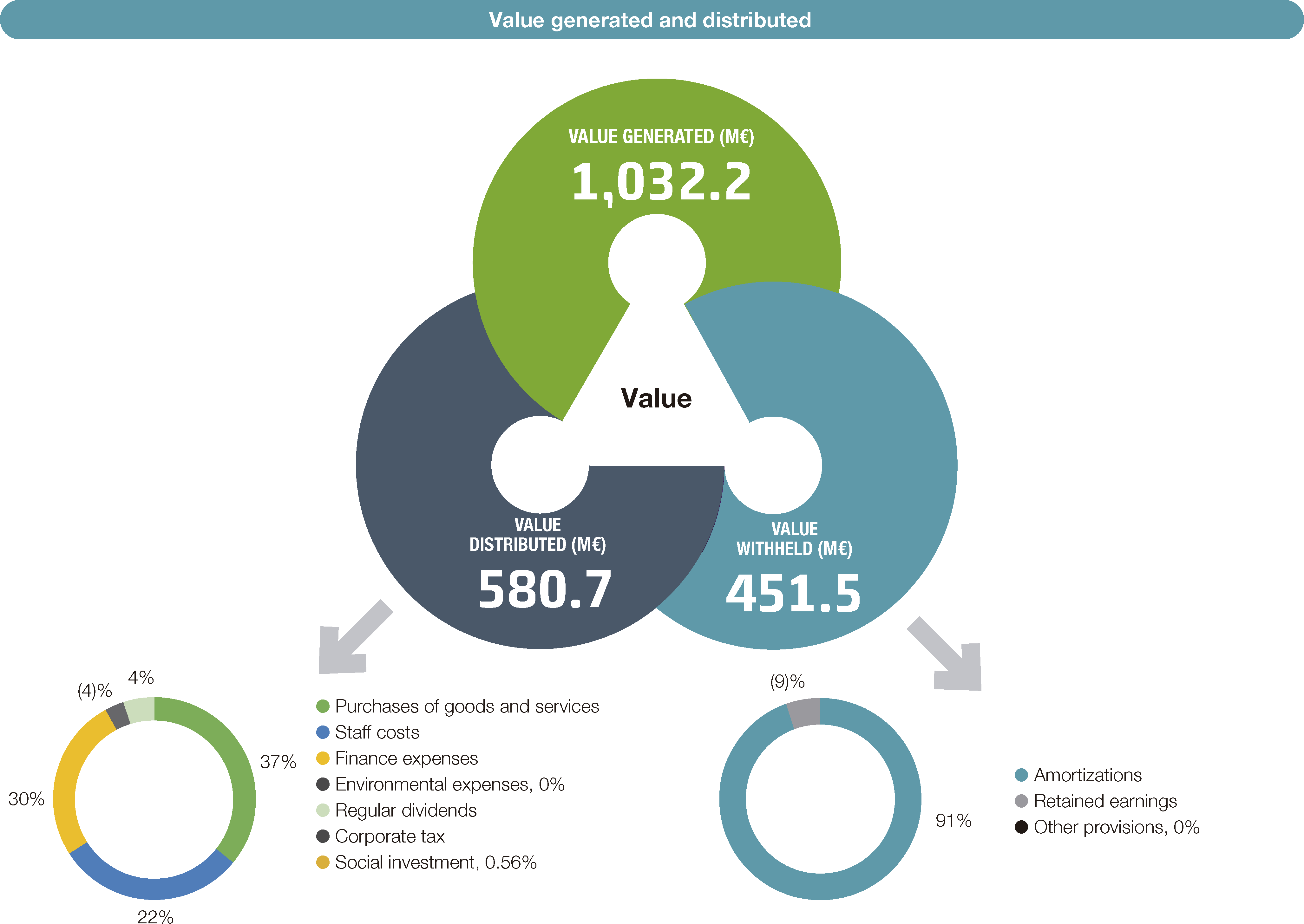

There is no doubt that the value creation that we must foster, recognise and, where appropriate, reward, is that of sustainable and distributed value. In this context, we see the transposition of the EU Directive on non-financial information into the Spanish legislative framework as very positive. Being as demanding about “non-financial” reporting as financial information is certainly a very important step forward.

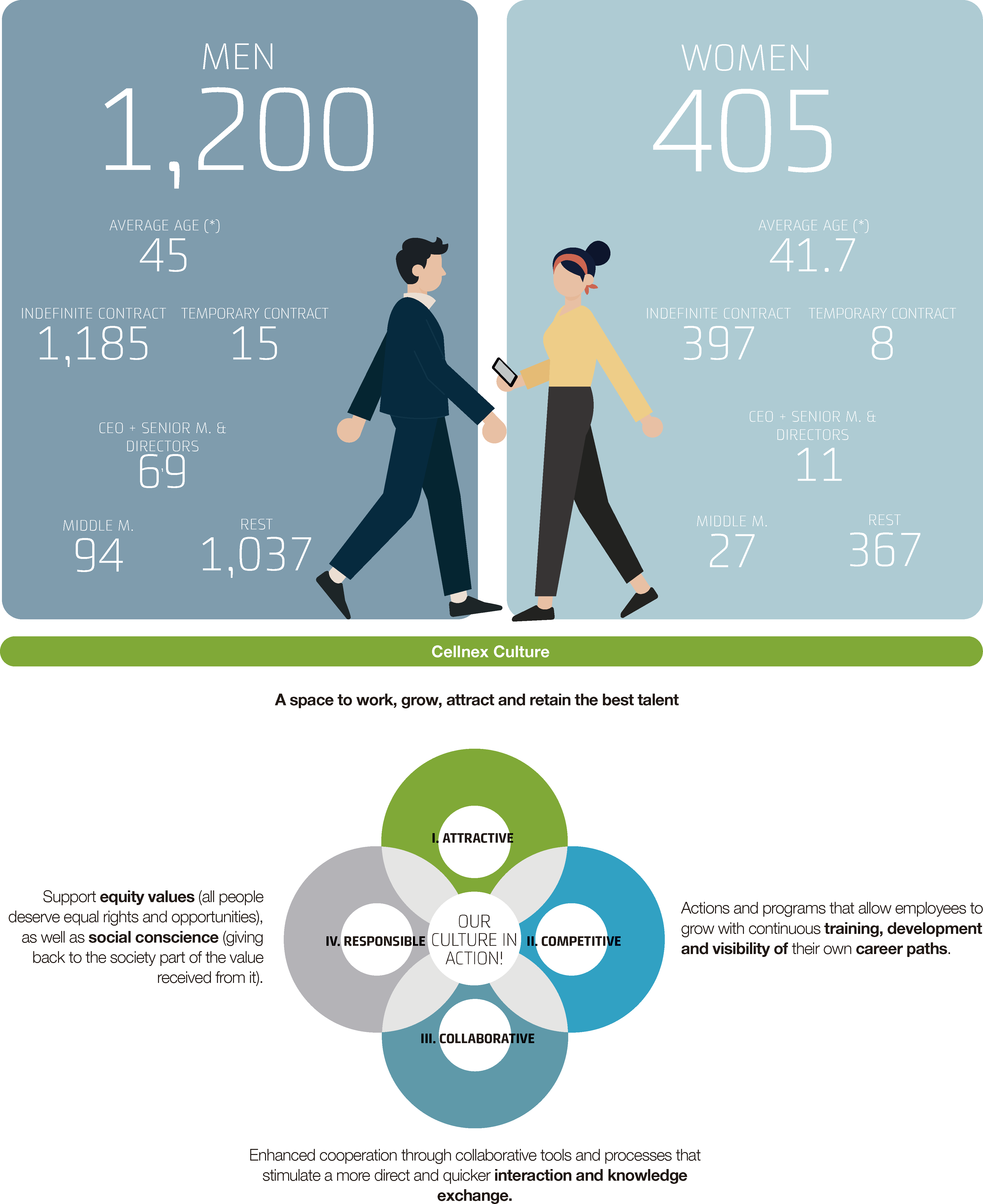

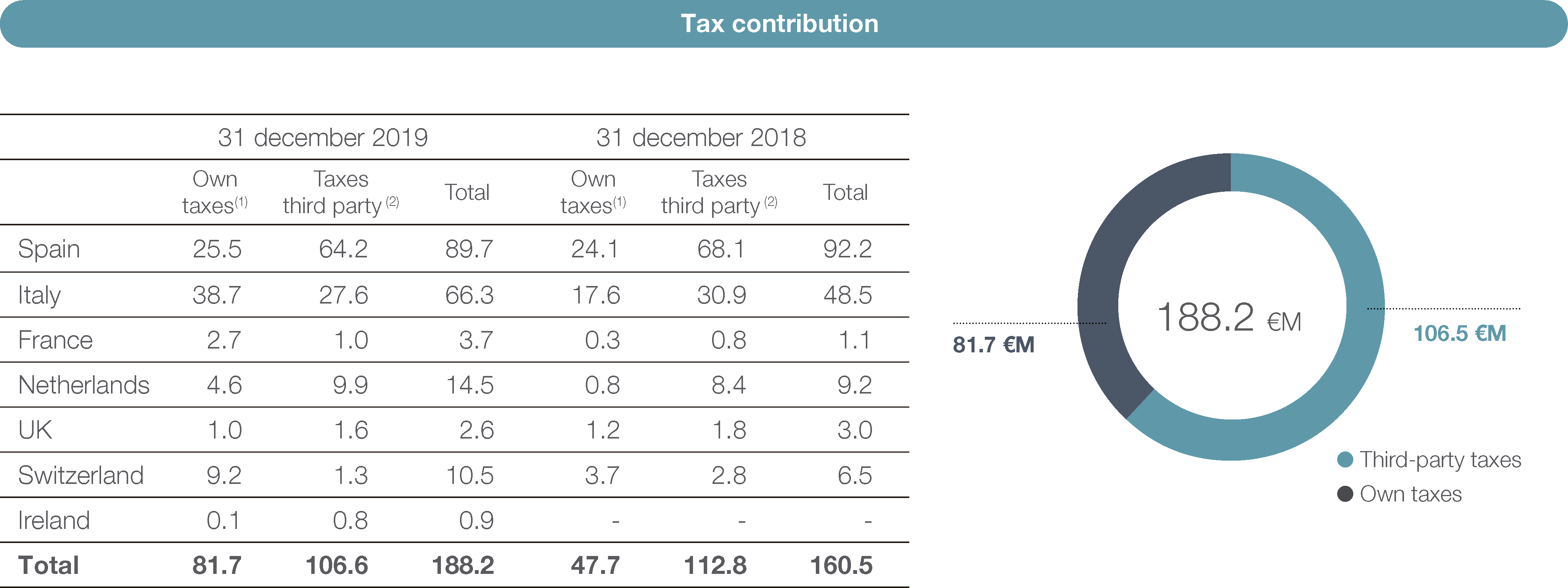

TM: We truly create value in terms of all the stakeholders with an interest in our project, beginning with our employees. In 2019 we have carried out various actions such as a Plan to distribute shares to all Group employees or the approval of the Group’s Equity, Diversity and Inclusion Policy by the Board.

We must also call for commitment from our supply chain, requiring our suppliers to take on board principles related to the sustainability of their own business activity, just as our customers and stakeholders expect it from us. In this area at Cellnex we have undertaken to meet the Science Based Target’s (SBTi) emission reduction objectives to keep the global temperature increase below 1.5°C., thus contributing to the fight against climate change.

Also, we must redirect resources towards society adopting a leading role in innovation and entrepreneurship projects. This also applies to projects and initiatives that bring home the values of training, integration and bridging the digital divide to sectors of society at risk of exclusion.

It is very important to target the fulfilment of these criteria, which is why , within the framework of our Corporate Responsibility Master Plan, we also take on public commitments, which we renew each year, such as Cellnex’s adherence to the United Nations Global Compact and its Principles, or being part of the FTSE4GOOD and CDP (Carbon Disclosure Project) and “Standard Ethics” sustainability indexes.

Looking to 2020, and the new decade that is beginning, where do you see Cellnex?

FB: The great challenge for Cellnex is to consolidate this quantum leap in terms of the size that we have achieved over these last few years, and which has sped up during 2019. Consolidating means integrating teams, aligning strategies and objectives and promoting a culture and a common language. Neither must we lose sight of the fact that the market will continue to offer growth opportunities.

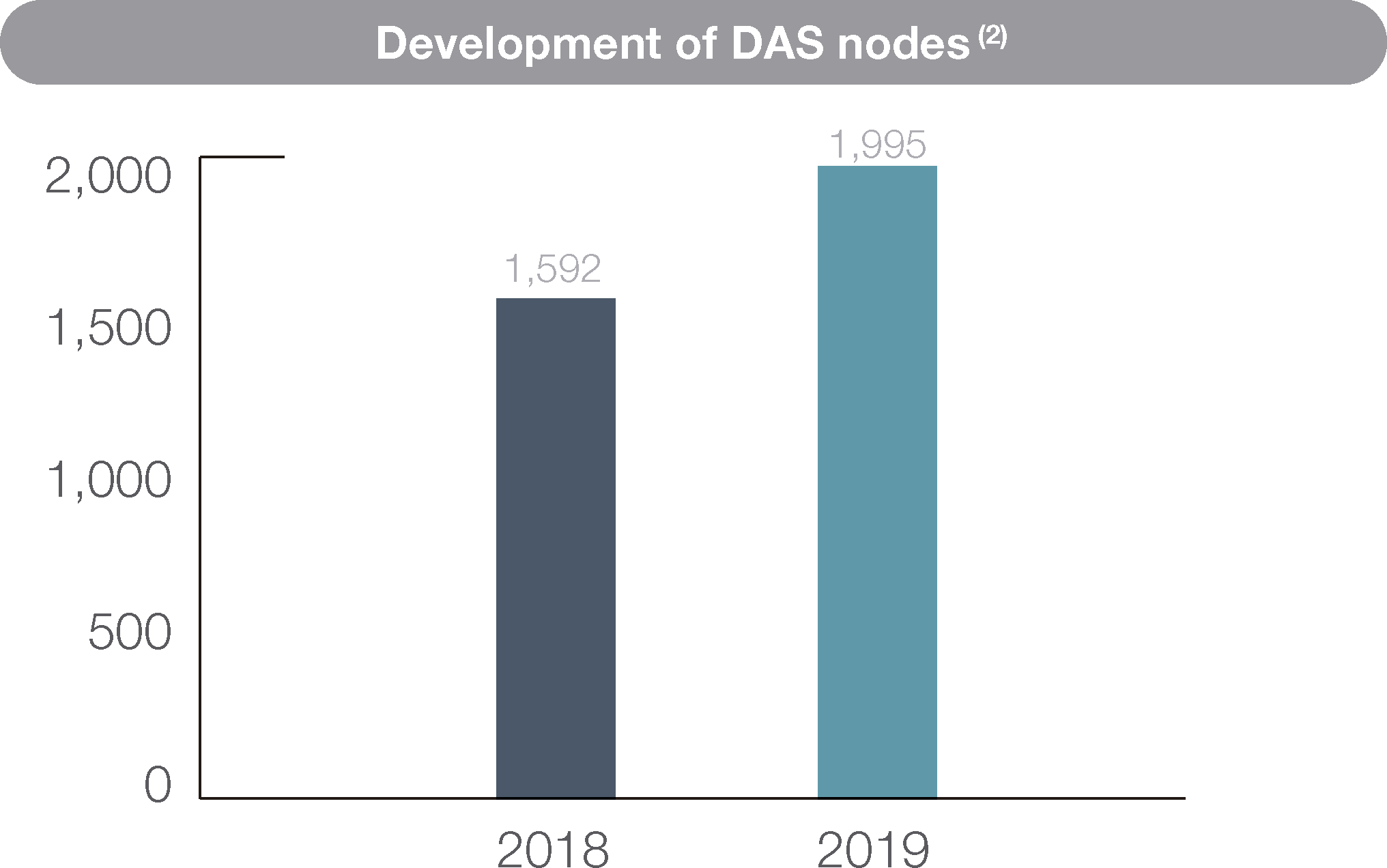

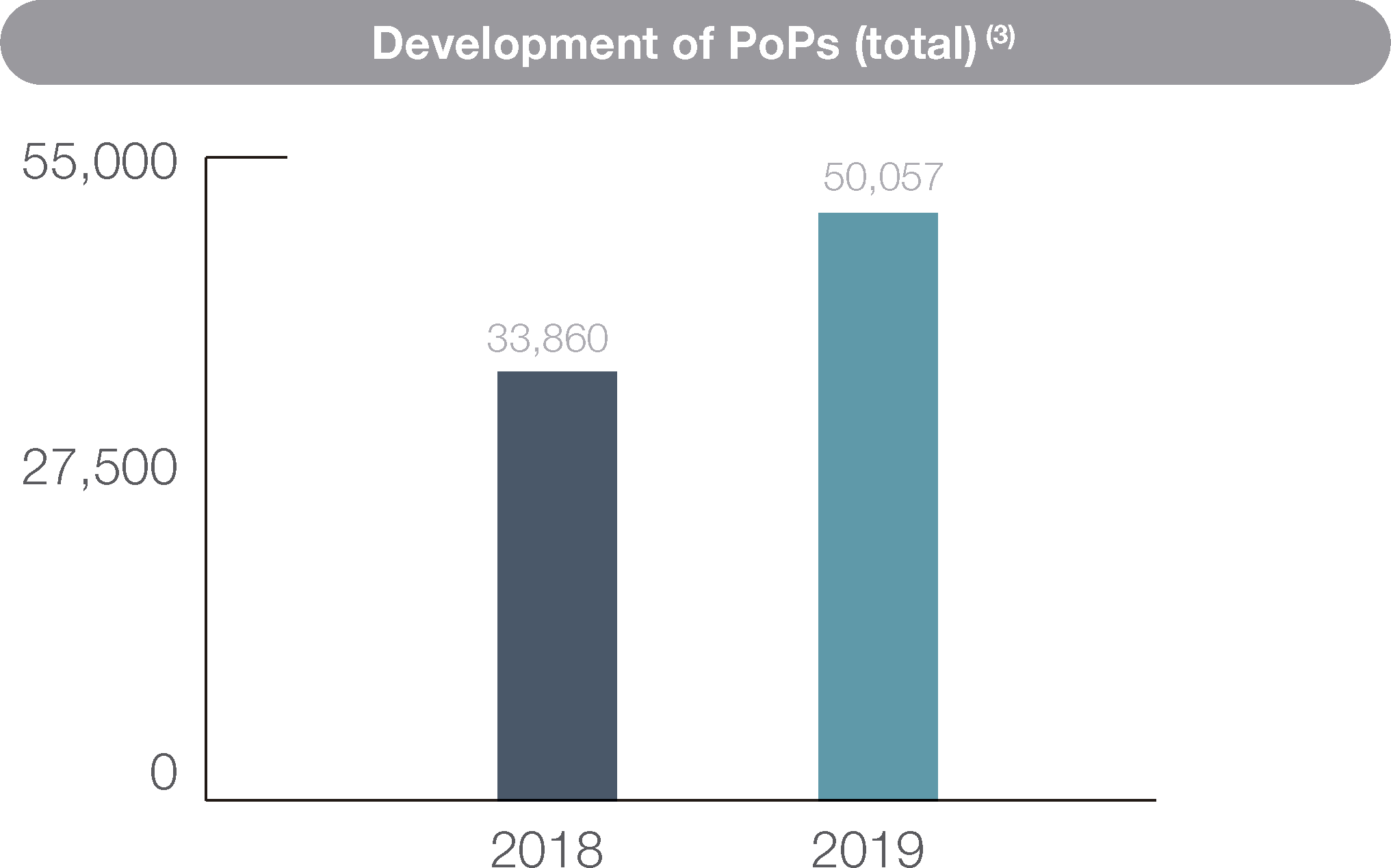

TM: I agree thoroughly. Looking beyond the inorganic growth that will remain a dominant vector for the group, we must continue to focus on the three key axes that will facilitate the effective roll-out of 5G on which Cellnex has already been working, confirming the migration of the model from tower operator to become an all-encompassing digital infrastructure service provider. I am thinking here of Small Cells and Distributed Antenna Systems (DAS), fibre optic connectivity to the various telecommunications sites, the so-called backhauling fibre, or Fibre To The Antenna (FTTA) and the network-distributed data processing capacity, also known as Edge Computing. In all these areas we are looking at new opportunities and projects.

Main indicators

Business development 2019

(1) Operating income, which discounts certain impacts that do not involve cash movements (such as advances paid to customers). See section “Financial and operational figures” of the 2019 Cellnex Integrated Annual Report.

(2) DAS: Distributed Antenna System.

(3) PoPs: Points of Presence.

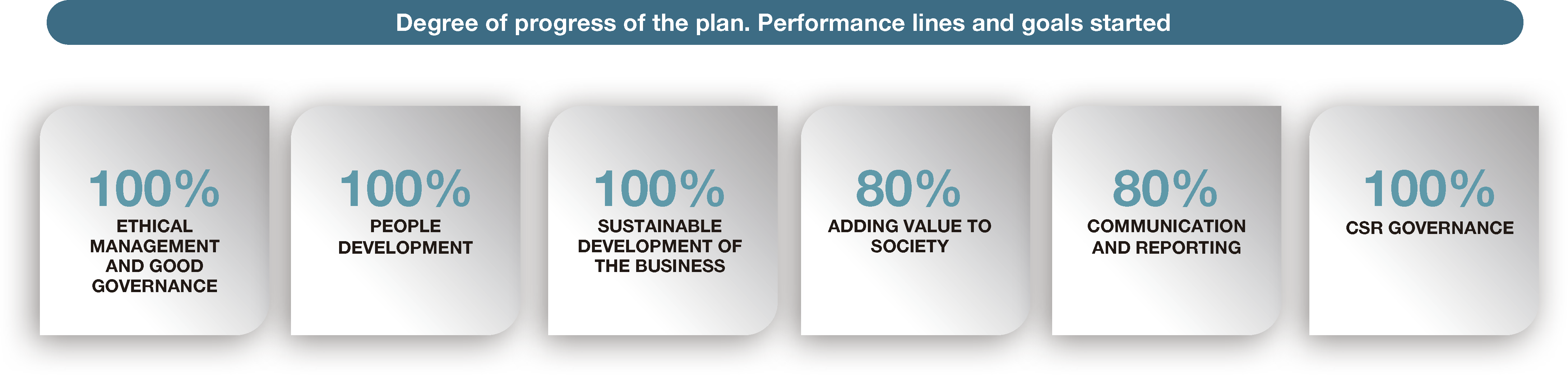

Key indicators

View of 2019

Value creation

Value generated and distributed

(1) Includes taxes that are an effective cost to the company (basically includes payments of income tax, local taxes, miscellaneous taxes and employer’s social security contributions).

(2) Includes taxes that do not affect the result but are collected by Cellnex on behalf of the tax administration or are paid in for third parties (basically includes net value added tax, deductions from employees and third parties, and employees’ Social Security contributions).

Management model

Strategy and business model

Talent