Consolidated Management Report

Consolidated Financial Statements

Risk management

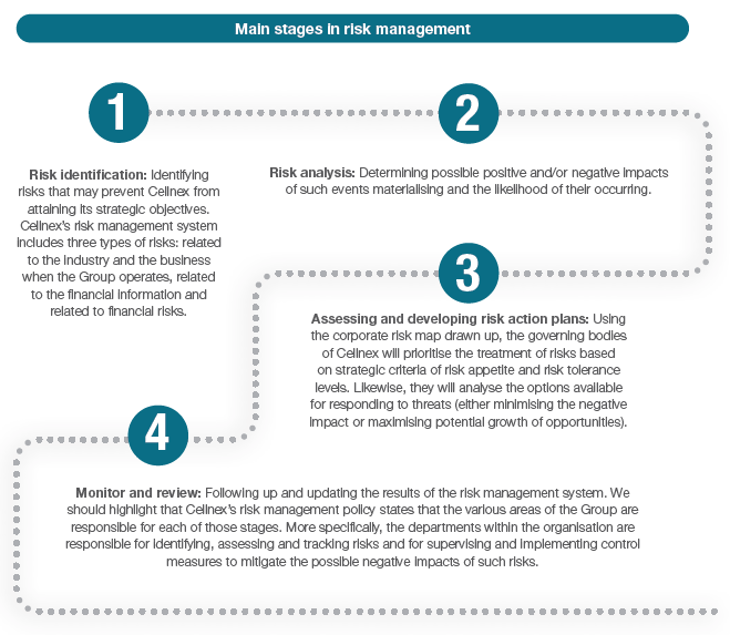

The Cellnex risk management model is formalised in a risk management policy approved and overseen by the Audit and Control Committee. This model is embodied in a comprehensive risk management system that allows risks to be managed in a logical and structured way while facilitating effective and efficient decision-making. The main stages in risk management include: risk identification, risk analysis, assessing and developing risk action plans and monitor and review.

Cellnex's integrated risk management model involves the Steering Committee developing and monitoring a risk map while the Audit and Control Committee oversees its development. In 2019, the Board of Directors examined all the Risk Maps. When a new company joins the group, there is a prudential period of consolidation from which time the risks are analysed, and the Code of Ethics disseminated.

It is important to note here that in 2019 a risk map in Corporate adopting the Cellnex Group risk management model was defined and a Risk Map and Action Plan set out using the same typology and methodology as the rest of the Group. At the end of 2019, Cellnex's Board of Directors approved the implementation of the "three lines of defense" risk model and the consequent creation of a Risk Committee. Both the Model and the functioning of the Committee will be fully operational by 2020".Likewise, maintaining the objective of homogenising risk management, there is a single risk map by geographical area. In Ireland, which recently joined the Group, the risk map is expected to be deployed in 2020.

In this regard, we should underline that the management team and the governing bodies of Cellnex are aware that creating value for the organisation is directly linked to managing risks that may jeopardise the sustainability of its strategy.

The main risks that may affect the achievement of the Group's objectives are:

Strategic risks |

I) Risks related to the environment in which the Group operates and risks stemming from the specific nature of its businesses. II) Risks of increasing competition. III) The Group’s status as a “significant market power” (“SMP”) operator in the digital terrestrial television (“DTT”) market in Spain imposes certain detrimental obligations on it compared to its competitors. IV) Industry trends and technological developments may require the Group to continue investing in asset class-businesses adjacent to telecommunication towers, such as fiber, edge computing and small cells. V) Spectrum may not be secured in the future, which would prevent or impair the plans of the Group or limit the need for the Group’s services and products. VI) Risk related to a substantial portion of the revenue of the Group is derived from a small number of customers. VII) Risk of infrastructure sharing. VIII) Risk of non-execution the entire committed perimeter. IX) The expansion or development of the Group's businesses, including through acquisitions or other growth opportunities, involve a number of risks and uncertainties that could adversely affect operating results or disrupt operations. X) Risks inherent to the businesses acquired and the Group’s international expansion. XI) Risk related to the non-control of certain subsidiaries. XII) Risks related to execution of Cellnex's acquisition strategy. XIII) Risks related to the Arqiva Acquisition: the Arqiva Acquisition may fail to close if certain conditions precedent are not met. XIV) Regulatory and other similar risks. XV) Litigation.

XVI) Risk related to the Company’s significant shareholder’s interests may differ from those of the Company. |

Operational risks |

XVII) Risks related to the industry and the business in which the Group operates. XVIII) Risk of not developing the strategic sustainability plan. XIX) Risks related to maintaining the rights over land where the Group’s infrastructures are located. XIX) Failure to attract and retain high quality personnel could negatively affect the Group’s ability to operate its business.

XXI) The Group relies on third parties for key equipment and services, and their failure to properly maintain these assets could adversely affect the quality of its services. |

Financial risks |

XXII) Financial information. XXIII) Expected contracted revenue (backlog). XXIV) Foreign currency risks. XXV) Interest rate risk. XXVI) Credit risk. XXVII) Liquidity risks. XXVIII) Inflation risk. XXIX) Risk related to the Group's indebtedness.

XXX) The Company cannot assure that it will be able to implement its Dividend Policy or to pay dividends (and even if able, that the Company would do so). |

Compliance risks |

XXXI) Fraud and compliance risks.

XXXII) Risk associated with significant agreements signed by the Group that could be modified due to change of control clauses. |

See Annex 2 for detail of risks.