2018: Growth, consolidation and transformation

Growth

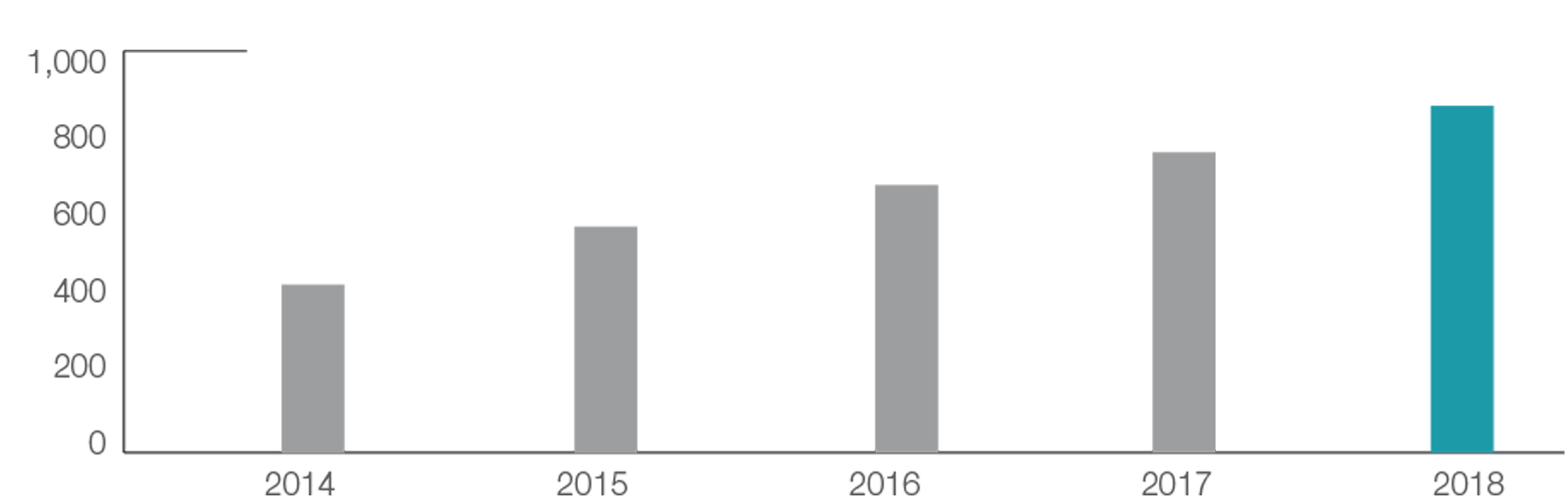

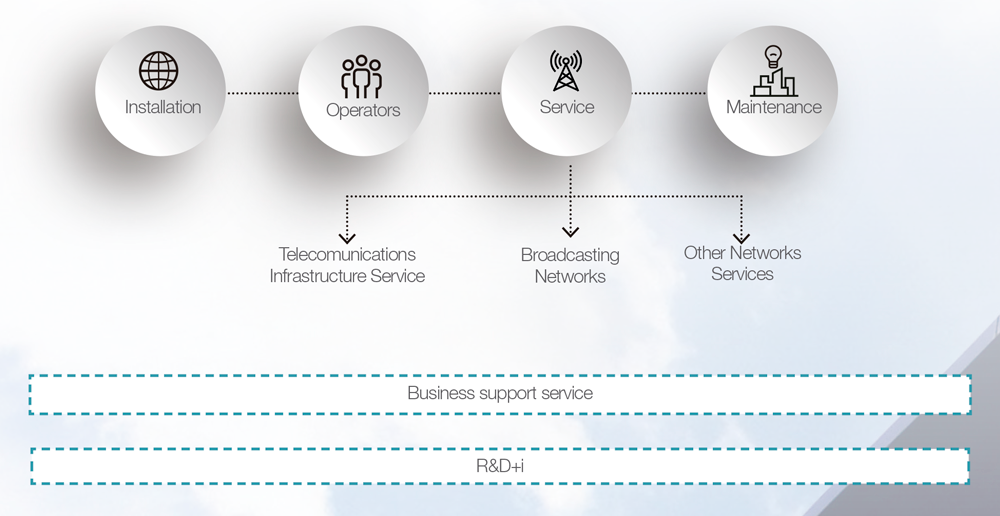

Income from operations for the period ended on 31 December 2018 reached EUR 898 million, which represents a 14% increase over the same period in 2017. This increase was mainly due to the expansion of the above-mentioned telecom infrastructure services for mobile network operators.

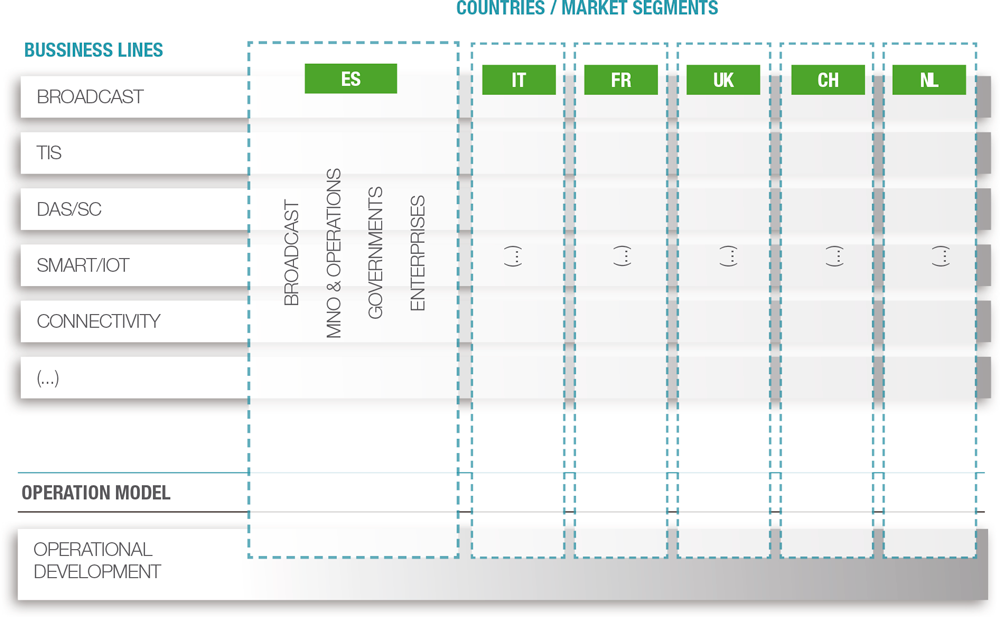

Telecom Infrastructure Services’ income increased by 24% to EUR 583 million due to both the organic growth achieved and the acquisitions performed in 2017 and 2018. This business segment is characterised by solid growth driven by increasing demand for wireless data communication services, and by the growing interest of mobile network operators (MNOs) in developing high quality networks that fulfil their consumers’ needs in terms of uninterrupted coverage and availability of wireless bandwidth (based on new Long-Term Evolution “LTE” technologies), in the most efficient way. In recent years the Group consolidated its infrastructure network and long-term strategic relationships with its main customers, the mobile network operators. In addition to its current portfolio the Group’s Management has identified several potential acquisitions which are currently being analysed following its demanding capital deployment criteria. The Group owns a high-quality asset portfolio, which is made up of selective assets in Spain, Italy, the Netherlands, France, the United Kingdom and Switzerland and performs the subsequent streamlining and optimisation of the tower infrastructure for Telecom Infrastructure Services. Its main added value proposals in this line of business consist of providing services to additional mobile network operators in its towers and therefore streamlining the customer’s network. By increasing the ratio of customers to infrastructures, the Group will generate additional income with very little additional costs. This network streamlining may generate significant efficiencies for the Group and for the MNOs.

With regard to the Broadcasting Infrastructure business, income amounted to EUR 233 million, which represents a 2% decrease compared with the same period in 2017.

Broadcasting Infrastructure activities are characterised by predictable, recurring and stable cash flows. Although this is a mature business in Spain, broadcasting activities have shown considerable resilience to adverse economic conditions, such as those experienced in Spain in recent years, this is due to the fact that the Group’s income does not depend directly on macroeconomic factors, but rather on the demand for radio and television broadcasting services by broadcasting companies.

TOTAL INCOME (MILLIONS OF EUROS)

Other Network Services increased its income by 2%, to EUR 82 million. This constitutes a specialised business that generates stable cash flows with attractive potential for growth. Taking into account the critical nature of the services in which the Group collaborates, its customers require in-depth technical know-how that is reflected in the demanding service level agreements. The Group considers that it has a privileged market presence and geographical distribution, established relationships with government agencies and excellent infrastructure for emergencies and public services. The Group’s aim is to maintain long-term relationships with its customers maximise the renewal rate of its contracts and expand its business through new contracts. The Group classifies Other Network Services into five groups: (i) connectivity services; (ii) PPDR services; (iii) operation and maintenance; (iv) Smart Cities/IoT (“Internet of Things”); and (v) other services.

In relation to this business segment, during 2018, Cellnex incorporated the XOC, a concessionary company dedicated to the management, maintenance and construction of the fiber optic network of the Generalitat de Catalunya (see Note 2.h of the accompanying consolidated financial statements).

All of the above has helped boost operating income and operating profit, with the latter also being impacted by the measures to improve efficiency and optimise operating costs.

In line with the increase in revenue, Adjusted EBITDA was 18% higher than the same period in 2017, as a result of the assets acquired during 2018 as well as organic growth, which reflects the Group’s capacity to generate cash flows on a continuous basis.

The aforementioned figures reflect the positive evolution of the main Group’s financial and business indicators. As a result of the Reorganisation Plan agreed during the first quarter of 2018, in order to adjust the workforce in its Spanish subsidiaries Tradia and Retevisión, which manage the terrestrial television infrastructure network (as detailed in Note 18.b) of the accompanying consolidated financial statements), the financial reporting period ended on 31 December 2018, closed with a EUR 15 million consolidated net loss attributable to shareholders.

Consolidation in Europe

Internationalising via mergers and acquisitions is a basic pillar of the Cellnex strategy.

In 2018, Cellnex continued expanding its presence in Europe, and by the end of the year 56% of Adjusted EBITDA was generated outside Spain.

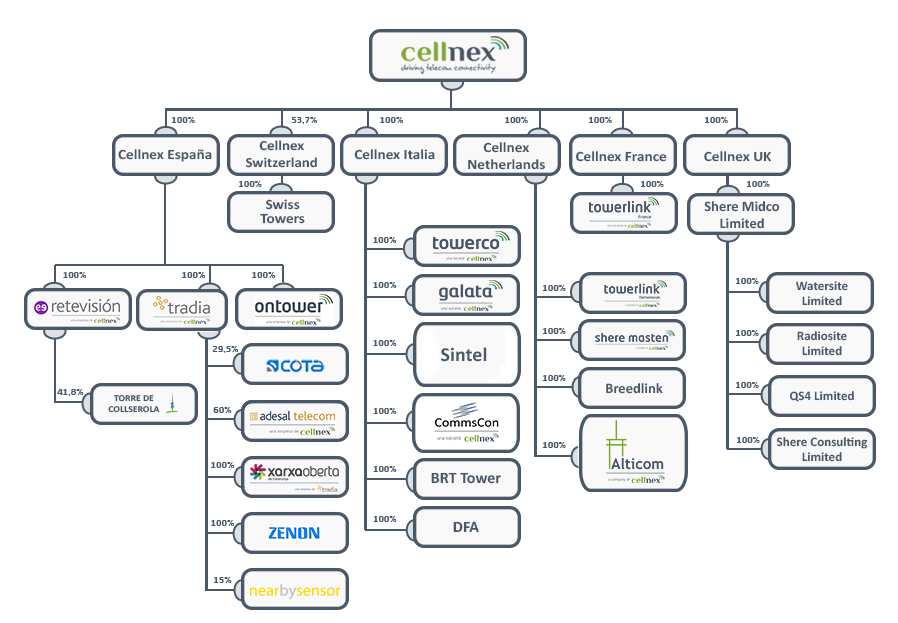

The six countries (Spain, Italy, France, the Netherlands, United Kingdom and Switzerland) in which the company operates share certain of the Group’s main customers and therefore Cellnex can capitalise on commercial synergies.

The Group’s business presents significant barriers to entry into its main markets, mainly due to its difficult-to-replicate total asset base of 23,440 sites and 1,592 nodes, which make a total of 25,032 infrastructures.

The main changes in the consolidation perimeter, together with assets purchased during financial year 2018 are as follows:

France

Agreements reached during 2016 and 2017

At 31 December 2018, in accordance with the agreements reached with Bouygues during 2016 and 2017, Cellnex, through its subsidiary Cellnex France, has committed to acquire and build up to 5,100 sites that will be gradually transferred to Cellnex until 2022 (see Note 6 of the 2017 consolidated financial statements). Of the proceeding 5,100 sites, a total of 2,803 sites have been transferred to Cellnex as at 31 December 2018.

During 2018, 1,205 sites were acquired in relation to the aforementioned agreements, for an amount of approximately EUR 350 million. In addition, the fixed assets in progress corresponding to those sites which are under construction at the end of 2018, amounted to EUR 44 million. Thus, the total investment in France in 2018, amounted to EUR 400 million, approximately.

Extension of the partnership during 2018

On 10 December 2018, Cellnex Telecom announced that it has reached an additional agreement with Bouygues that will reinforce and extend the cooperation and partnership started in 2016, as detailed in Note 6 of the 2017 Consolidated Financial Statements. Under the terms of this new agreement, Cellnex Telecom will commit up to EUR 250 million over five years for the construction of up to 88 strategic telecom centers, also called ‘Central Offices’ and ‘Metropolitan Offices’, with capacity to house data processing capabilities. Such deployment is expected to be carried out until 2024, with the execution expected to be primarily backloaded. In addition, under this agreement, Cellnex may also acquire up to 62 additional ‘Mobile Switching Centers’ and ‘Metropolitan Offices’, which would be gradually transferred to Cellnex from 2020 to 2021. Therefore, will play a key role in the future deployment of 5G networks, as they will also provide processing capabilities in order to reduce data latency.

These new assets, once all have been built, will contribute an estimated up to EUR 39 million of additional Adjusted EBITDA (1)

Bouygues Telecom will be the main customer of these assets and thus, both companies, Cellnex and Bouygues Telecom, have also signed an agreement for the provision of services (Master Service Agreement) in line with the existing contracts between the companies.

In relation to the aforementioned contract, no sites have been transferred to Cellnex as at 31 December 2018.

As a result to the above, at 31 December 2018, in accordance with the agreements reached with Bouygues during 2016, 2017 and 2018, Cellnex, through its subsidiaries Cellnex France and Towerlink France, has committed to acquire and build up to 5,250 sites that will be gradually transferred to Cellnex until 2024.

(1) Note that Bouygues transactions have a common characteristic “up to” as Bouygues has not the obligation to reach the highest number of sites.

Spain

Acquisition of Xarxa Oberta de Catalunya

During the second half of 2018, Cellnex reached an agreement for the acquisition of 100% of the share capital of Xarxa Oberta de Comunicació i Tecnologia de Catalunya, S.A. (the “XOC”) from Imagina, a subsidiary of the Mediapro Group. The acquisition price of the shares has amounted to approximately EUR 33 million. Additionally, through this agreement, Cellnex acquires a set of assets for an amount of EUR 3 million, which, until the aforementioned date of acquisition, were owned by companies of the group to which Imagina belongs, and on the terms agreed by both parties.

As a result of the above, the total acquisition price of the transaction, amounted to EUR 36 million. The actual cash outflow in relation to this transaction (Enterprise Value) has been EUR 34 million following the incorporation of EUR 2 million of cash balances on the balance sheet of the acquired company (see Note 6 of the accompanying consolidated financial statements).

The XOC is a concessionary company dedicated to the management, maintenance and construction of the fiber optic network of the Generalitat de Catalunya, and the expiration date of the concession is 2031.

Other new agreements

On 18 December 2018, Cellnex Telecom have acquired to MNOs, 375 sites in 2018 for an amount of EUR 45 million, which have been totally transferred to Cellnex as of 31 December 2018.

In addition, on 31 January 2018, Cellnex reached a new agreement with MASMOVIL by which the Group acquired 85 sites in Spain for an amount of EUR 3.4 million, approximately.

Switzerland

On 19 December 2018, the agreement with Sunrise dated 24 May 2017 was extended, as detailed below:

- An additional acquisition of 133 sites in Switzerland for an amount of CHF 39 million (EUR 34 million), which are to be transferred to Swiss Towers on 1 January 2019.

- An extension to the build-to-suit project with Sunrise agreed in the following terms: i) up to 75 additional sites to be build (increasing the agreement to build sites from up to 400 to up to 475 sites).

These new assets will contribute an estimated up to EUR 3 million of additional Adjusted EBITDA.

At 31 December 2018, the total number of Cellnex infrastructures acquired and build (sites and nodes) in Europe was as follows:

Leadership, culture and transformation. Towards a new industrial model

Significant milestones in 2018 and main challenges for 2019

| Significant milestones in 2018 | Main challenges for 2019 |

| Defining the new 2018 Transformation Programmes based on the company's new Industrial Model | Continuing the 2018 Transformation initiatives, and defining and developing the transformational contents for 2019 |

| Amending the Objectives Model to encourage sales in the new Commercial Model | Spreading the Objectives Model to commercial staff in all the countries, with overall reporting provided by them |

| Updating the methodology for the acquisition and integration of companies, and integration of the businesses in Switzerland and France | Applying the roll-out standard developed in the incorporation and integration of new companies and countries |

| Incorporating countries into The HUB digital platform | Designing and implementing a Digital Workplace project (with a far greater scope than that of a new corporate intranet) for employees in all countries, combining all the digital resources available to the employee within the same platform, with the principal objective of improving knowledge-sharing and collaboration |

| Designing the Look & Feel of the new corporate intranet |

| Starting to define a corporate culture study | Developing and launching the Culture study, and identifying measures to achieve the desired culture |

From the outset, Cellnex has been characterised by promoting activities of a transformational nature, in search of excellence. Thus, each year the company re-evaluates the status of its ongoing initiatives, draws conclusions and lessons learned, and uses them to implement improvements in the various areas.

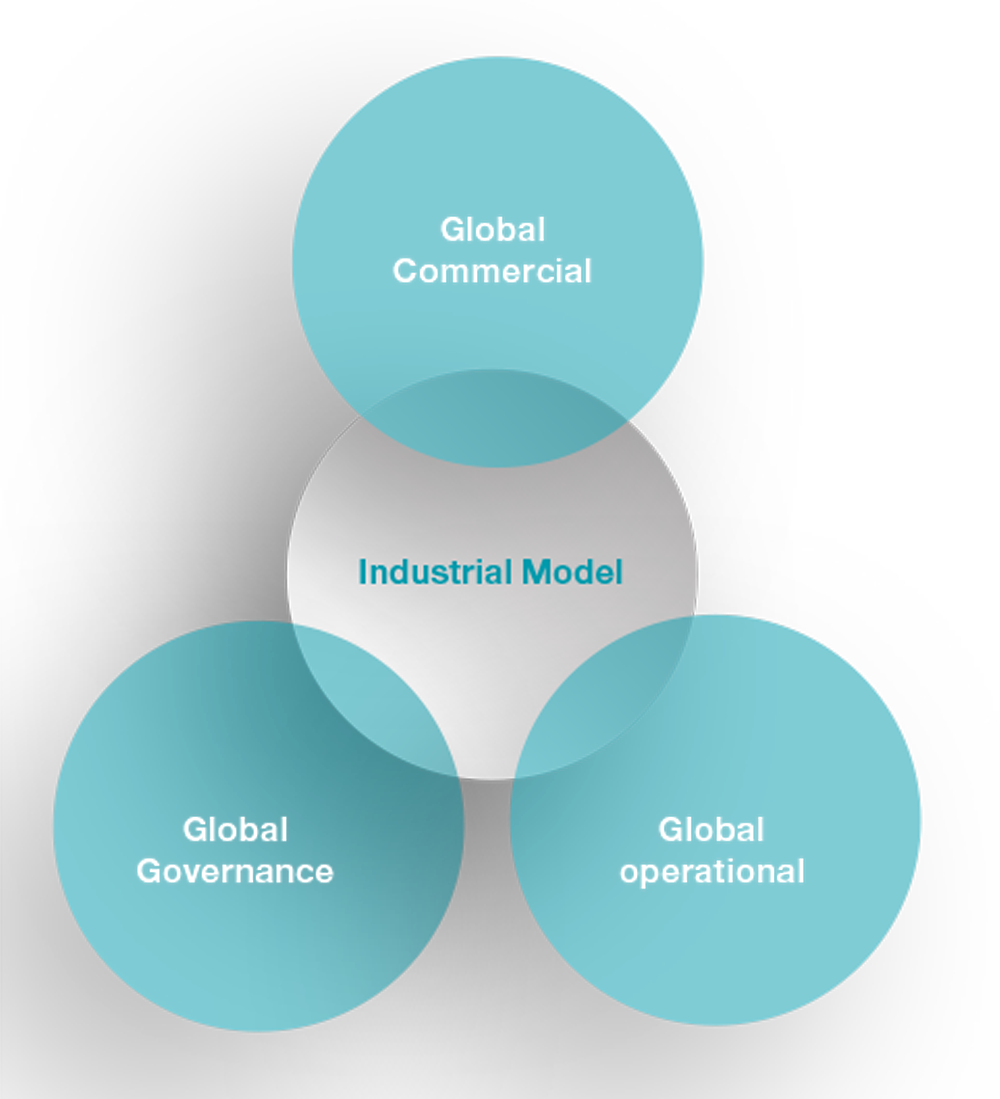

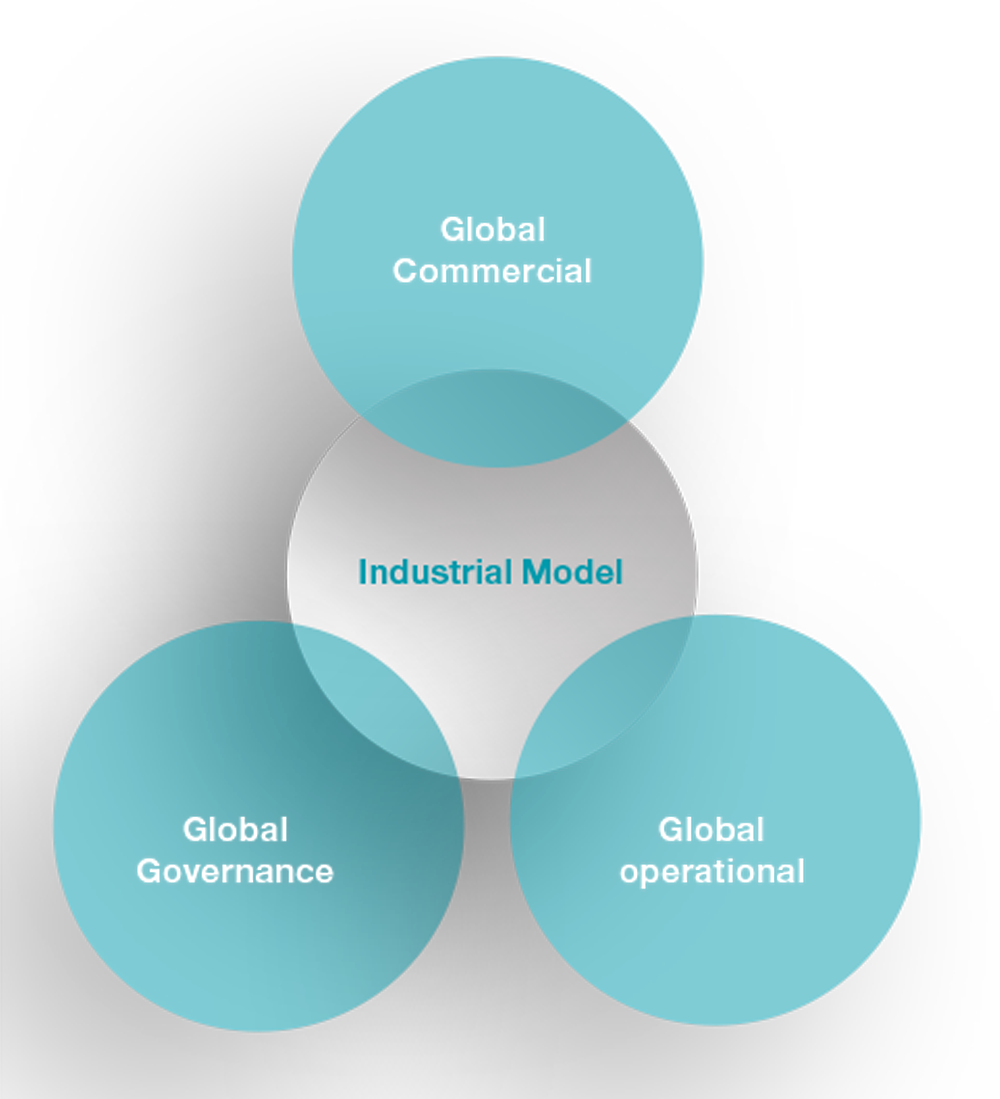

Along these lines, publishing the new Industrial Model in 2018 meant redefining the company’s Transformation Programme to adjust to the levers of the model, which was structured into 16 initiatives grouped into 3 axes: Global Commercial, Global Operational and Global Governance:

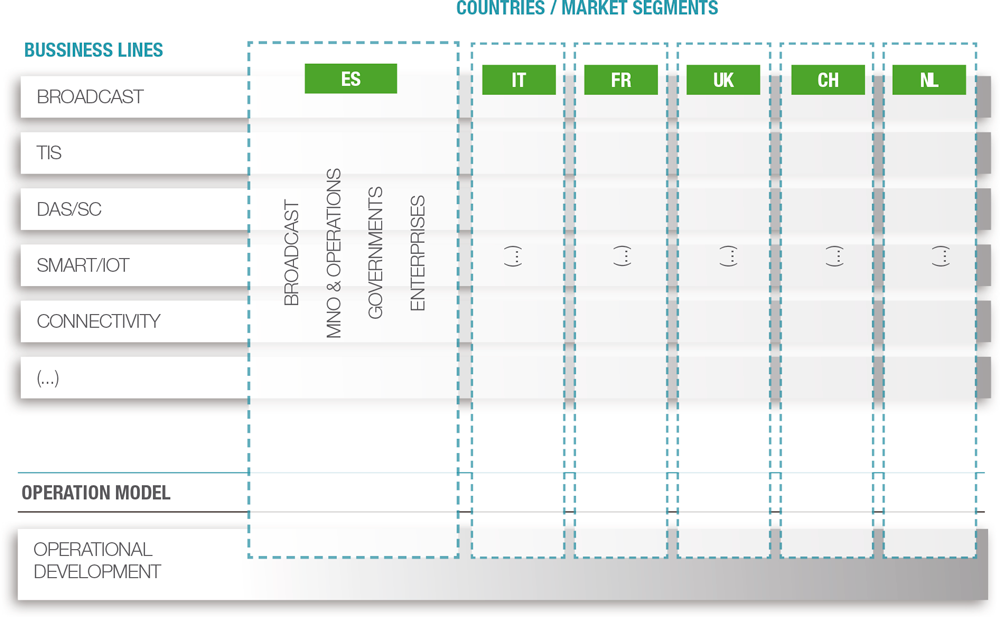

The commercial axis consists of two initiatives: the Innovation Model (explained in the section on An innovative and transformational business) and the New Commercial Model, known as the Trinity Project, which is based on the following principles: business segment orientation, support for the Business Lines, new commercial roles for sales efficiency, and effectiveness.

COMMERCIAL MODEL

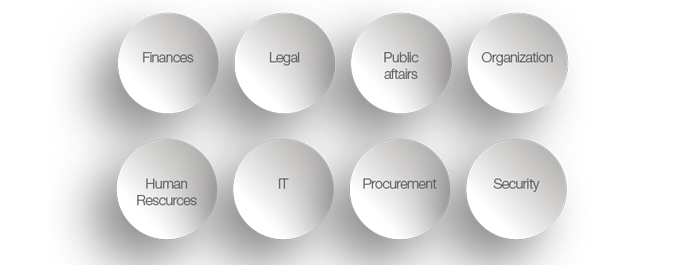

CORPORATIVE SERVICES

The Operational axis comprises the initiatives related to operational excellence, the digital agenda and improving information systems to consolidate and improve IT services.

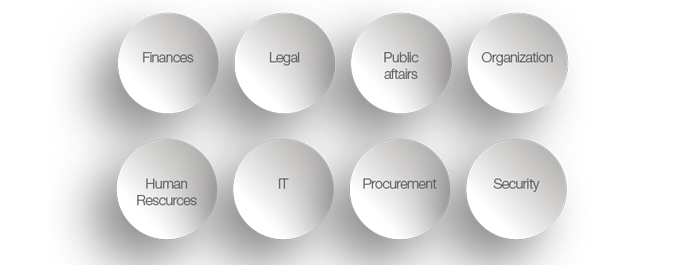

Finally, the third axis of the Transformation Plan, Governance, has three subprogrammes: Balanced Scorecard (measuring strategic indicators), Revenue Assurance (checking movements for services rendered) and Shared Services (consolidating the relationship model between corporation and countries).

At the end of 2018, the overall progress achieved by the Transformation programmes was about 80% of the original planned.

The activities that remained outstanding, as well as those planned for 2019, will be performed during this year, which will also include a series of new lines of action identified with all areas of the company, to define new transformational ideas.

The redesign of the Commercial Area during 2018 also showed up the need to review the Objectives Model of the business commercial agents to align them with the new sales goals. This process, which was rolled-out in Spain in 2018, will be spread to the remaining countries with the progressive implementation of the new business model within these countries, to make available integrated reporting on them to assess performance with respect to the commercial objectives set.

The methodology of acquisition and integration of companies was revised and redefined in 2018 to optimise the process of incorporating new companies and countries into the Cellnex universe, allowing the French and Swiss businesses to be integrated. This standard of incorporation and roll-out will help to integrate new businesses more swiftly and efficiently during 2019.

In the digital sphere, 2018 saw the progressive incorporation of countries into The Hub Platform (which brings together various talent and training elements that are available for employees), which will complete its roll-out in 2019 with the incorporation of the Netherlands. At the same time, work has been ongoing to design the new corporate intranet.

At the end of last year, the intranet development project underwent a change in scope, as it was extended to a Digital Work Place, which aims to gather all the digital elements available to employee on the Cellnex intranet. Likewise, as this project is developed, from 2019 up to launch in the countries, we will work to analyse the company’s various internal communication channels, as well as the development of a corporate internal communication policy.

As regards culture, work began to define the scope of a study on corporate culture at the end of 2018 to update the Group culture, in response to significant changes - fundamentally in terms of both the business model and the diversity of the markets and countries in which it operates-, analyse employee perception and determine lines of action to fill the gaps identified. The study will be launched in 2019 and conclusions drawn, while the measures identified will be implemented.

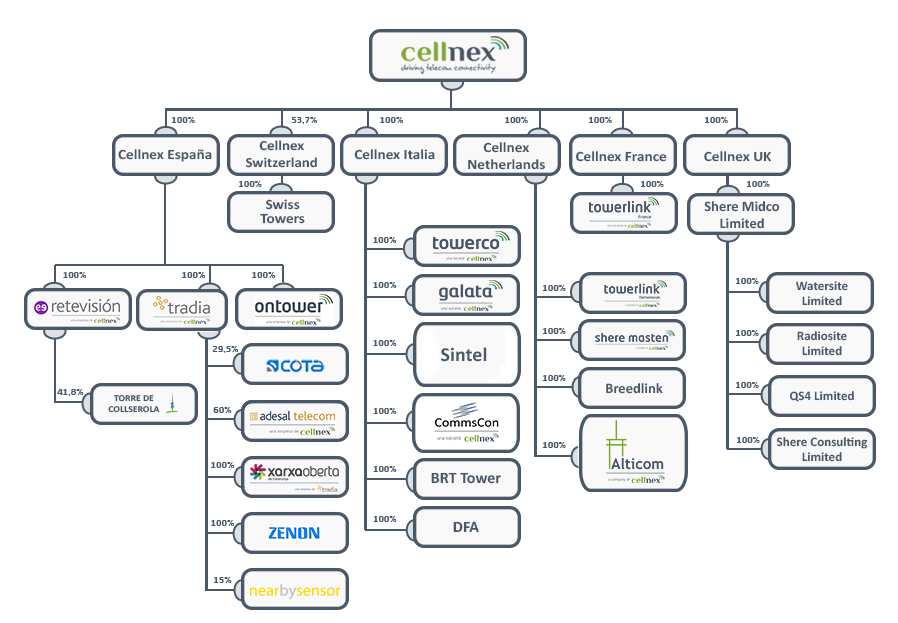

As of 31 December 2018, the organisational structure of the Cellnex Group is as follows:

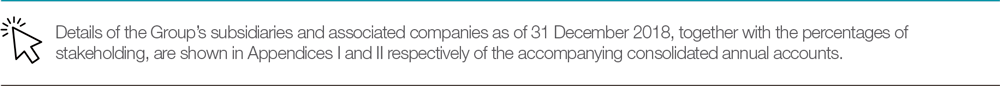

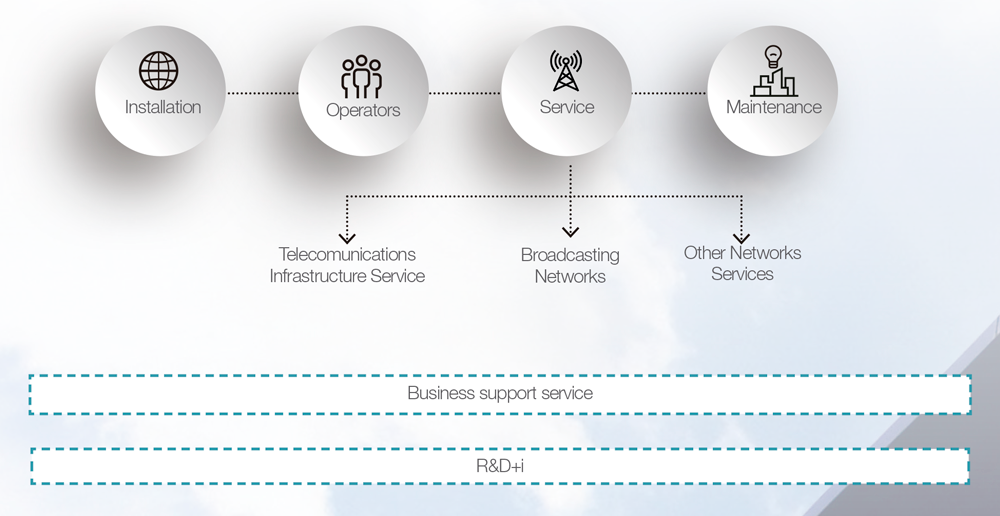

Celinex’s Value chain

GRI: 102-4, 102-6, 102-7, 102-9, 102-10