Corporate governance

In 2017, Cellnex tasked an independent external consultant with evaluating the performance of the Board of Directors. The consultant concluded that within a short time period Cellnex had created a full set of internal regulations that guarantees compliance with legal obligations and the principles and recommendations of corporate governance, although a series of further measures were also proposed. Notwithstanding, the external consultant proposed a series of measures to put into practice. In 2018, Cellnex continued incorporating its corporate governance best practices by implementing all of the recommendations set out in the performance evaluation, in addition to those made in the Code of Good Corporate Governance for Listed Companies approved by the Spanish National Securities Market Commission (CNMV).

Towards the end of 2018, the Board performed a self-assessment of the functioning of the Board and committees using a questionnaire composed of different groups of questions: (i) Board composition; (ii) functioning of the Board; (iii) presidency of the Board; (iv) Board Secretariat; (v) Board committees; (vi) performance of the first executive and relationship with senior management; (vii) alignment and commitment of the Board with the strategic objectives; and (viii) overall assessment of the Board. The questionnaire was answered by all the members.

As a global assessment, the board members identify their strengths, their independence, their professionalism and their climate of confidence. Their dedication, collegial culture and commitment to the success of Cellnex are also appreciated. Notwithstanding the above, some areas for improvement were identified for the coming years, which are specified in an Action Plan to be implemented soon.

The selection policy for directors that the Appointments and Remuneration Committee of the Board of Directors approved in 2016 seeks to ensure an appropriate composition of the Board. According to the policy, Board member selection must take into account factors such as the company’s shareholder structure, members’ diversity of knowledge, professional experience, background, nationality and gender, as well as their availability to perform the role, specific expertise in particularly relevant areas (financial, legal, telecommunications, etc.), conflicts of interest (actual or potential), and their personal commitment to defending company interests. With regard to gender diversity under this policy, the company must ensure in the shortest possible time and at the latest by the end of 2020 that the least represented gender makes up at least 30% of the total number of members of the Board of Directors.

During FY 2018, it was agreed that the number of directors be extended once again, from 10 to 12 members. This will strengthen the composition of the Board, ensuring a compact, experienced and strategy-oriented Board of Directors comprising four Proprietary directors and seven Independent directors, in addition to the Chief Executive Officer.

BOARD OF DIRECTORS

Changes in 2018

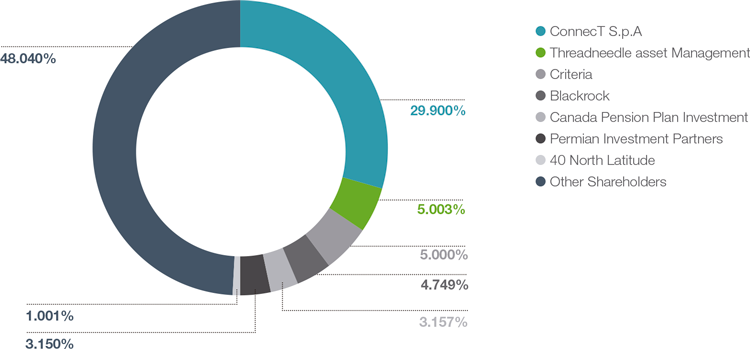

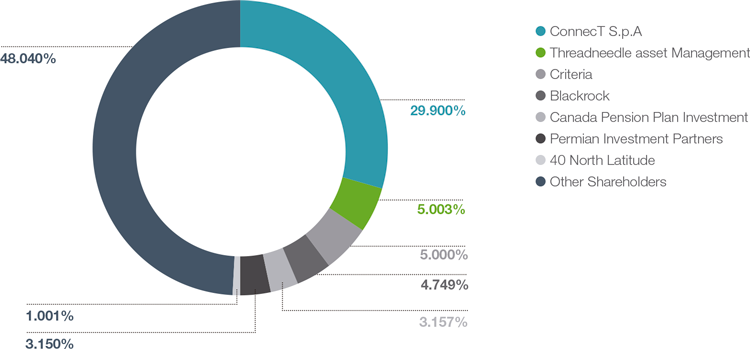

Changes in the Shareholder structure

In the context of the tender offer over Abertis (“the tender offer”), during 2018, the relevant facts detailed below have taken place, in relation to the shareholding structure of Cellnex:

On 23 March 2018, Atlantia announced that it had made a request to Hochtief, subject to the positive outcome of the tender offer, to adopt the appropriate actions for the sale by Abertis of all or part of its 34% stake in Cellnex Telecom, by virtue of the Call Option granted to Atlantia by Hochtief.

Likewise, Atlantia accepted the proposal from Edizione, S.r.L. (“Edizione”) dated March 20, 2018, by virtue of which Edizione granted to Atlantia a Put Option on 29.9% of Cellnex share capital, subject to the positive outcome of the tender offer.

On 5 June, 2018, Abertis concluded the process of accelerated placement of shares of Cellnex Telecom, S.A. among qualified investors. The placement consisted of a block of 9,499,013 ordinary shares of the Company, representing 4.1% of its issued share capital, at a purchase price of EUR 22.45 per share. As a result of that placement, at that date Abertis held ordinary shares of Cellnex Telecom, representing 29.9% of its issued share capital.

On July 12, 2018, Abertis sold to Connect S.p.A. 69,273,289 ordinary shares in Cellnex, which represented 29.9% of the total share capital of the latter, at a price of EUR 21.50 per share. Connect is a subsidiary fully controlled by Sintonia S.p.A., a subholding company wholly owned by Edizione S.r.l. (“Edizione”).

Thus, as of 31 December 2018, Connect is positioned as a reference shareholder in Cellnex Telecom, S.A., holding a 29.9% stake in its share capital.

Shareholders’ agreement entered into between Sintonia, ConnecT, Infinity and Raffles

On 9 October 2018, Edizione announced through a regulatory information notice that Sintonia and ConnecT, both entities under its control, had executed a shareholders agreement with Infinity, an entity ultimately wholly-owned by the Abu Dhabi Investment Authority (“ADIA”), and Raffles, an entity ultimately wholly-owned by GIC Pte. Ltd. (“GIC”), governing the terms of the minority investment by Infinity and Raffles in the share capital of ConnecT and their commitment to inject up to EUR 1,500 million of further new equity in ConnecT to support the Company’s growth in the next four years.

On 12 October 2018, Edizione announced through a regulatory information notice the successful closing of such investment and the entry into force of the Shareholders Agreement. Following completion Sintonia holds approximately 60% of ConnecT’s share capital and each of Infinity and Raffles hold approximately 20% of ConnecT’s share capital.

The aforementioned Agreement contains certain shareholders agreements consisting in regulating the appointment of proprietary directors in Cellnex and in establishing strengthened quorums for the adoption of certain agreements in ConnecT and / or Cellnex. The specific terms of the agreement are available on the CNMV website as well as the Cellnex website.

In accordance to the aforementioned above, the most significant adaptations and changes made to the Group’s Corporate Governance in 2018 are as follows:

- Appointment of Anne Bouverot and María Luisa Guijarro as new Independent directors of the company, as a commitment to the qualitative and decisive weight of the Independent directors. A prestigious head hunter searched for and validated candidates for these appointments.

- Increase in the proportion of independent directors on the Board of Directors to almost 60% (from 5 to 7), surpassing the threshold set out in the recommendations for Good Governance of Listed Companies CNMV (at least half of all directors).

- Increase in female representation on the Board of Directors, resulting in greater gender diversity on the highest corporate governing body with 30% female representation (4 women) and complying with the CNMV recommendation on Good Corporate Governance for 2020.

- Appointment of four new Proprietary directors at the proposal of Connect, to replace the representatives of Abertis following the sale of 29.9% of Cellnex from Abertis to Connect. The new Directors from Connect are: Marco Patuano, Carlo Bertazzo, Elisabetta De Bernardi Di Valserra and John Benedict McCarthy.

- Appointment of Marco Patuano as non-executive chairman and continuation of Tobías Martínez as CEO, thereby separating non-executive and executive roles in the company and fulfilling another CNMV recommendation. In addition, despite separating the positions, with a view to incorporating corporate governance best practices, the Board decided to uphold the position of coordinating director, currently held by the Independent director Giampaolo Zambeletti.

- Extension of the Appointments and Remuneration Committee from 4 to 5 members, with 4 Independent directors (including the Chair) and 1 Proprietary.

- Extension of the Audit and Control Committee from 3 to 4 members, with 3 Independent directors (including the Chair) and 1 Proprietary.

- Setting of a maximum number of company boards on which the Company directors may sit (4 boards).

- Review of the long-term variable remuneration plan of the Chief Executive Officer and Senior Management, under which company shares will comprise a minimum part of that remuneration. It is also important to note that it is incumbent on the Appointments and Remuneration Committee to propose the remuneration of the Chief Executive Officer and Senior Management, following a market analysis by a specialist company from which it must take the lower than average remuneration band.

- Independent third-party validation of the profiles contained in the Succession Plan proposed by the Appointments and Remuneration Committee.

- Greater company transparency by publishing all corporate policies on a common repository in a corporate SharePoint that can be accessed from all regions.

In 2018 the Board and Committees met as often as necessary to properly perform their administrative and supervisory functions, with the attendance of all or a large majority of their members. To be precise, there were 13 Board meetings, 9 CAC meetings and 9 CNR meetings.

Once again, the annual meeting of the Board of Directors and Steering Committee with certain key directors of the Group was held in November 2018 to discuss matters relating to the company’s strategy and development.

The 2018 Shareholders Meeting held on 31 May in Madrid was a resounding success with the approval of the Annual Accounts and Management Report for 2017 and a quorum of over 83%.

SHAREHOLDER STRUCTURE

The Cellnex Board of Directors

Independent directors:

- Bertrand-Boudewijn Kan, former General Manager and Chairman of the European Telecommunications Group of the Morgan Stanley investment bank. He is currently Chairman of the Board of Directors of Síminn hf., of the Advisory Board of Wadhwani Asset Management and of the Supervisory Board of UWC in the Netherlands.

- Pierre Blayau, Chairman of Caisse Central Réassurance and independent director on the Boards of Directors of Fimalac and the Canal + group +). He has previously been CEO of Pont à Mousson, PPR, Moulinex, Geodis, and Executive Director of SNCF. He has also been Executive Director of La Redoute, member of the Board of Directors of FNAC, Independent director of Crédit Lyonnais, and Chairman of the Board of Directors of Areva. Pierre Blayau is a tax inspector at the French Ministry of Finance and studied at the École National d’Administration in Paris and the École Normale Supérieure de Saint-Cloud.

- Giampaolo Zambeletti, Chairman of RCS Investimenti and Vice-Chairman of Unidad Editorial. He has been a member of the Boards of Directors of Telecom Italia International (The Netherlands), Auna, S.A. (Spain), Avea (Turkey), Oger Telecom (Dubai), Ojer Telekomunikasyon (Turkey) and Telekom Austria. He is currently a member of the Board of Directors of the Banca Farmafactoring Group in Milan.

- Peter Shore, former Chairman of the telecommunications infrastructure operator Arqiva in the United Kingdom, Uecomm, Lonely Planet Publications, HostWorks Group and Airwave. He has also been Managing Director of the Telstra Group in Australia, CEO of Priceline in Australia and New Zealand, and Managing Director of Media/Communications/Partners. He has also been Director of Objectif Telecommunications Limited, Foxtel, SMS Management and Technology, and OnAustralia. He was also a member of the Advisory Board of Siemens Australia.

- Marieta del Rivero, has held executive positions in Telefónica, Nokia (Iberia and Corporation), Xfera Móviles, Amena and Nefitel. She is currently Senior Advisor at Ericsson and is a member of the advisory boards of the Made in Mobile technology incubator and the Roca Salvatella digital transformation consultancy. She is the Chair in Spain of the International Women’s Forum and the Women Corporate Directors Foundation.

- Anne Bouverot, former CEO of Morpho, a biometrics and cybersecurity company (2015-2017) and Managing Director of the GSMA (2011-2015). She previously held various inter national management positions in telecommunications companies such as France Telecom/Orange (Executive Vice-chair of Mobile Services, 2009-2011), Global One Communications and Equant. She is currently a non-executive director of Capgemini and Edenred in France.

- María Luisa Guijarro Piñal, has held positions including Global Director of Marketing and Sponsorship, CEO of Terra España, Director of Marketing and Business Development in Spain and, more recently, member of the Executive Committee in Spain as head of Strategy and Quality.

Proprietary directors:

- Marco Patuano, has primarily worked in the Telecom Italia Group (1990-2016). He became CEO of the Group in 2011, participated in the creation and launch of TIM (1995-2001) and spent six years abroad (2002-2008) as CFO of TIM Brazil, General Manager for Latin America and CEO of Telecom Argentina. He has been CEO of Edizione Srl., the holding company of the Benetton family, since January 2017. He is a board member of Atlantia S.p.A., Autogrill S.p.A., AC Milan S.p.A. and Benetton Group Srl.

- Carlo Bertazzo, is General Manager of Edizione Srl, the industrial holding company of the Benetton family. He joined Edizione in 1994 and played a key role in the Group’s diversification process by managing the acquisitions of Autogrill and Generali Supermercati (1995), Atlantia (2000), a stake in Telecom Italia (2001) and Gemina (2005), currently Aeroporti di Roma and integrated in Atlantia. His role has also entailed developing Edizione’s relationships with investors in Italy and worldwide.

- Elisabetta De Bernardi Di Valserra, began her career in the investment banking team at Morgan Stanley (2000) where she worked in the Communications & Media team in London, later joining the corporate finance team in Milan, where she remained as Executive Director until 2013. She has been Investment Director at Edizione Srl, the holding company of the Benetton family, since 2015 and is a Board member of Atlantia and Getlink.

- John Benedict McCarthy, has been the Global Head of Infrastructure, Real Estate and Infrastructure Department of the Abu Dhabi Investment Authority (ADIA) since May 2013. He is jointly responsible with ADIA’s top management for designing and implementing the investment strategy for the infrastructure division, and for overseeing the work of the ADIA infrastructure team. Prior to joining ADIA, John McCarthy was Managing Director and Global Director of RREEF Infrastructure at Deutsche Bank since 2005. He was previously the Global Head of Infrastructure Capital and Structured Capital Markets at ABN Amro Bank.

Executive Director:

- Tobías Martínez Gimeno, Chief Executive Officer of Cellnex. He is the executive head of the company. He joined Acesa Telecom (now Cellnex Telecom) in 2000, first as a Director and Managing Director of Tradia and later of Retevisión. Before joining the Abertis Group he led his own information and telecommunications systems business project for over 10 years.

Non-Executive Secretary:

- Javier Martí de Veses, General Secretary of Cellnex. He is in charge of the company’s legal area, covering Legal Advice, regulatory matters and insurance. He is also Secretary of the Board of Directors and Chairman of the Ethics and Compliance Committee. He has worked for the Group since 1998 when he took over Legal Advice of what was then Retevisión, and has since held various different positions in the organisation.

Deputy Non-Executive Secretary:

- Mary Annabel Gatehouse, Director for International Corporate Development Advice of Cellnex. In 2014 she took over Legal Affairs management for Europe and North America for Abertis Infraestructuras S.A. From 2007 she was Legal Director and Executive Secretary of TBI plc/Abertis Airports. She trained at international law firm Ashurst, LLP specialising in large-scale infrastructure projects in the London and Madrid offices.

Committees of the Board of Directors

The Cellnex governance bodies are supplemented by the Audit and Control Committee (CAC) and the Appointments and Remuneration Committee (CNR), both composed of non-executive directors, mostly independent. It is also important to note that independent directors chair the Board Committees.

The responsibilities and functioning of the Committee and Control Committee, and Appointments and Remuneration Committee, are set out in the Terms of Reference of the Board of Directors.

GRI: 102-18, 102-22, 102-23, 102-24, 102-27, 102-28, 405-1, diversity and equal opportunity management approach (103-1, 103-2, 103-3)