Creating value in the company

Cellnex´s Financial Structure

Cellnex’ borrowings are represented by a combination of loans, credit facilities and bonds issues. As at 31 December 2018, the total limit of loans and credit facilities available was EUR 1,606,398 thousand (EUR 1,695,922 thousand as of 31 December 2017), of which EUR 1,287,415 thousand in credit facilities and EUR 318,984 thousand in loans (EUR 1,152,351 thousand in credit facilities and EUR 543,571 thousand in loans as of 31 December 2017).

As at 31 December 2018, Cellnex weighted average cost of debt (considering both the drawn and undrawn borrowings) was 1.9%(3) (2.0% as at 31 December 2017) and the weighted average cost of debt (considering only the drawn down borrowings) was 2.2% (2.4% as at 31 December 2017).

Cellnex´s Financial Structure (Thousands of Euros)

| | Notional as of 31 December 2018 (*) | Notional as of 31 December 2017 (*) |

| | Limit | Drawn | Undrawn | Limit | Drawn | Undrawn |

| Bond issues and other loans | 2,552,835 | 2,552,835 | - | 1,890,000 | 1,890,000 | - |

| Loans and credit facilities | 1,606,398 | 586,471 | 1,019,927 | 1,695,922 | 635,852 | 1,060,070 |

| Total | 4,159,233 | 3,139,306 | 1,019,927 | 3,585,922 | 2,525,852 | 1,060,070 |

(*) These concepts include the notional value of each caption, and are not the gross or net value of the caption. See “Borrowings by maturity”.

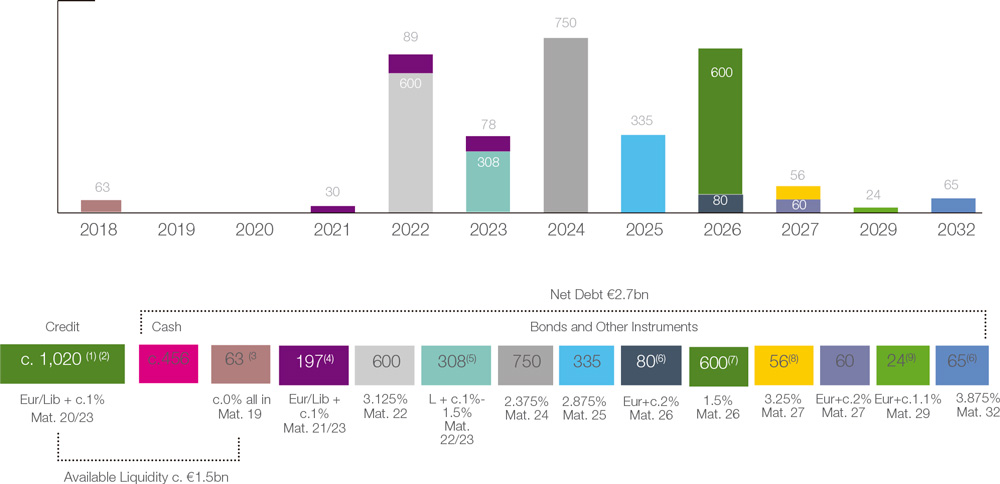

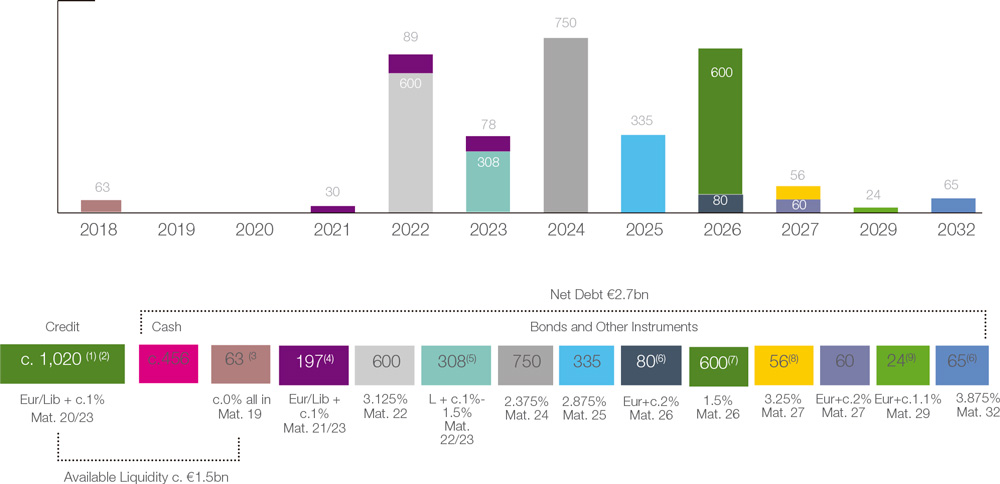

The following graph sets forth Cellnex’s notional contractual obligations in relation to borrowings as of 31 December 2018 (EUR million):

Contractual obligations as of 31 December 2018 (EUR million)

(1) RCF Euribor 1M; Credit facilities Euribor 1M and 3M; floor of 0% applies

(2) Maturity 5 years

(3) Euro Commercial Paper

(4) Includes c.£150Mn debt in GBP; natural hedge investment in Cellnex UK Ltd

(5) EUR169Mn debt in Swiss Francs at corporate level (natural hedge) + EUR139Mn debt in Swiss Francs at local level in Switzerland. No financial covenants or share pledge (Swiss Tower and/or Cellnex Switzerland) in line with all the debt placed at the Parent Company Corporate level

(6) Private placement

(7) Convertible bond into Cellnex shares (conversion price at €38 per share)

(8) Bilateral loan

(9) EIB

The Group’s borrowings were arranged under market conditions, therefore their fair value does not differ significantly from their carrying amount.

In accordance with the foregoing and with regard to the financial policy approved by the Board of Directors, the Group prioritizes securing sources of financing at Parent Company level. The aim of this policy is to secure financing at a lower cost and longer maturities while diversifying its funding sources. In addition, this encourages access to capital markets and allows greater flexibility in financing contracts to promote the Group’s growth strategy.