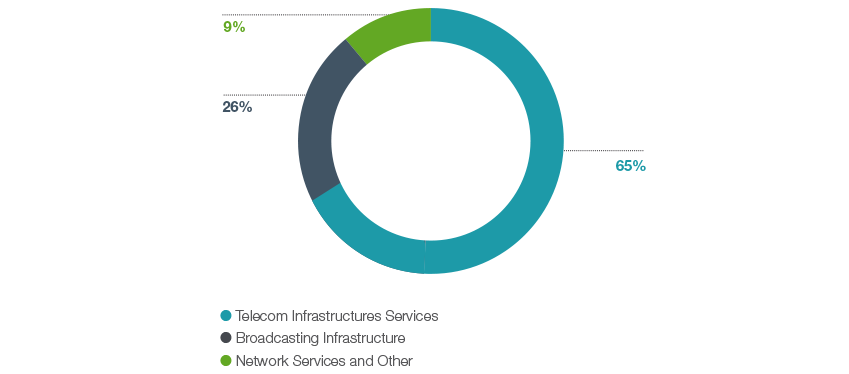

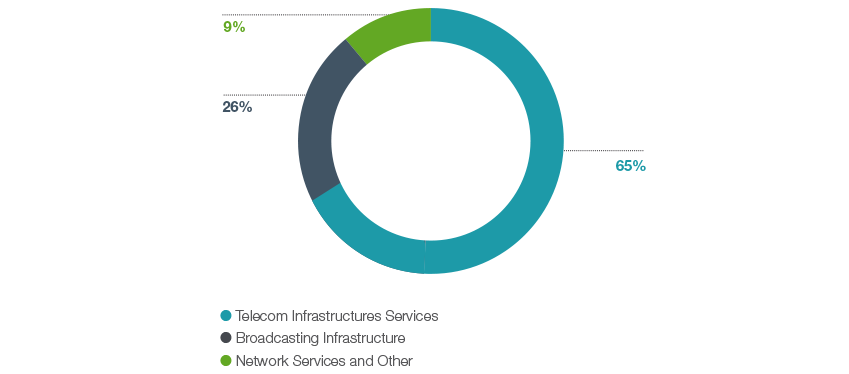

Business model

The Cellnex Group provides infrastructure management services for terrestrial telecommunications to the following markets:

- Telecom Infrastructure Services.

- Broadcasting Infrastructure.

- Network Services and Other.

Generally speaking, this balanced set of investments, in terms of both maturity and profitability, and geographic diversification, should contribute to a growing positive contribution from all business sectors. In additional, Cellnex plans to continue identifying new investment opportunities and operational efficiencies that will strengthen its balance sheet and financial position.

CONTRIBUTION IN INCOME AS OF 31 DECEMBER 2018

Infrastructure services for mobile telecommunications operators

5G will impact not only the access network but also the heart of the mobile operator’s network and the links between its various components. In this connection, Cellnex is developing initiatives to adapt current towers and small cells, as well as the fibre connection of the entire infrastructure. GRI

Providing infrastructure services to mobile operators continues to be one of Cellnex’s main activities. During 2018 we have been working on the various aspects to enable us to evolve infrastructure to meet the new challenges of the future, with special focus on understanding how 5G technology will change the role of an infrastructure provider.

In addition, 5G technology provides a wide variety of capabilities that enable a wide variety of usage cases that can vary from autonomous vehicles to advanced emergency services.

Each new generation of mobile technology has fostered an increase in connection speeds and has enabled more reliable communications, but in the case of this fifth generation there are three main benefits:

- Improved mobile broadband: Not only thanks to increased capacity, but also because of improved connectivity (broadband access always available) and by allowing greater user mobility (enabling new services in cars, trains or aircraft).

- Increased connectivity: more devices can communicate at a time in a specific area (up to one million devices per square kilometre), providing the possibility to create new services related mainly to the Internet of Things (IoT).

- Decreased response time: the time that elapses from when data is sent until it is received is not always appreciable. This time lag, or latency, is reduced so much that it opens the way to a whole new range of services that was unthinkable in previous generations, such as remotely controlling machinery or autonomous vehicles.

One of the many pieces that will enable 5G is Multi-Access Edge Computing (MEC). This architectural model places the technological resources (computing, storage, etc.) closer to the end user to increase the performance of applications or services and expand technical capabilities, such as decreasing latency.

The MEC therefore opens the possibility to create new business opportunities for Cellnex not just as one more element to be considered in terms of space, power, etc., but also for the possible value creation by a partner like Cellnex in the new telecommunications infrastructures.

To this end, at the end of 2018 Cellnex entered the capital of Nearby Sensors, a technology start-up dedicated to rolling-out the Internet of Things (IoT), distributed or Edge computing, and automation of hybrid IT-OT (Information Technology/Operational Technology) processes. Nearby Sensors is therefore a part of our open and collaborative innovation strategy, identifying entrepreneurial initiatives that start out from a close collaboration with universities and knowledge centres and end up translating into innovative value and service proposals within the scope of connectivity and telecommunications.

DTHE DISTRIBUTED ANTENNA SYSTEM, OR DAS, IS THE FIRST PRODUCT TO RESULT FROM CELLNEX’S NEW MODEL AND R&D+i APPROACH

Improving supervision and telemonitoring systems

A project was performed between 2017 and 2018 to extend the overall supervision of the centres in Spain that incorporate TIS services, both in remote stations with mobile telephony customers and in centres where operators’ services are colocated. Almost all the network of sites with TIS services has been supervised with this initiative, enabling a high level of surveillance and improved response times to incidents in Cellnex infrastructures.

Likewise, in addition to extending the supervision of the TIS centres, work has taken place to simplify the systems for remotely controlling new infrastructures and equipment deployed in the Cellnex network centres, improving accessibility for staff and increasing their interactivity with the new equipment and infrastructures.

These projects make it possible to more efficiently resolve incidents, in terms of time and cost, which has a direct impact on the improvement of supervision and remote-control systems and, in turn, on compliance with the agreements struck with customers.

Infrastructure Master Plan 2018-2022

The Infrastructure Master Plan was designed in 2018 with the ultimate goal of providing autonomous management at the main centres of the network and ensuring continuity of service (DTT, radio, data transmission, etc.). Thus, not only does it increase the guarantee of continued service, but also reduces operating and maintenance costs.

The Plan affects some 120 sites covering a broad swathe of the population or housing equipment for security and emergency networks, which are critical in operational terms. Therefore, the actions to be carried out will consist of renewing obsolete infrastructure and equipment and designing and implementing contingency plans.

Milestones 2018

- The Vocel project: In 2017, Cellnex signed a framework contract with a major mobile telecommunications operator that regulates the provision of the Cellnex co-location service, with a distinction made between four types of infrastructure: optimisation infrastructures, acquisition infrastructures, growth infrastructures and PostBarter infrastructures. This framework contract has a validity of 10 to 25 years, depending on the type of infrastructure. So far, Cellnex has carried out 170 dismantling operations and purchased 70 sites.

- Framework agreement for co-location in Cellnex sites with a major mobile telecommunications operator regulating service provision and distinguishing three types of infrastructure: Legacy infrastructures, growth infrastructures and PostBarter infrastructures. This framework contract is valid for 5 years, extendable for a further 5 years.

Pokemon project: an infrastructure outsourcing contract by a major mobile telecommunications operator, valid for 21 years. Three lines of action are marked out in the perimeter of this project: the acquisition of the entire portfolio of operator sites by Cellnex, roll-out of 160 new connected infrastructure nodes and the renewal with Cellnex of all the contracts that the operator had with its previous mobile infrastructure provider.

Pokemon project: an infrastructure outsourcing contract by a major mobile telecommunications operator, valid for 21 years. Three lines of action are marked out in the perimeter of this project: the acquisition of the entire portfolio of operator sites by Cellnex, roll-out of 160 new connected infrastructure nodes and the renewal with Cellnex of all the contracts that the operator had with its previous mobile infrastructure provider.- Provision of the operation, maintenance, installation and engineering services associated with the corporate telecommunications network of a large Spanish corporation. This contract is valid for 3 years, extendable by up to 2 years.

During 2018, Cellnex organised workshops with mobile telecommunications operators to bring down Time-toMarket of operations. These workshops made it possible to reduce the number of inefficiencies of the various commercial phases, speeding up the process and improving the success rate of operations and coordination with operators.

In addition to this, throughout 2017 and 2018 the Group incorporated an innovative relationship practice called Land Aggregation with the site owners to provide efficiency in renting buildings and properties where the sites are located using a “cash advance” of the capitalisation of rents.

Specifically in DAS:

- Saba and Bamsa awarded Cellnex Telecom a contract through tender to provide mobile (voice and data) coverage to 43 car parks in Spain during 2018 using DAS technology. Cellnex will deploy more than 500 small antennas on the floors of these car parks, improving user experience and preventing the loss of coverage that usually occurs in underground areas.

- The advantages associated with this greater connectivity will allow the development and deployment of new “Smart Parking” applications, enabling the use of mobile devices and multi-purpose apps. These include carsharing and map apps for route planning or provide the possibility to exchange products and discounts using the Saba app, and others, as well as facilitating the collection of e-commerce operated by Pudo. It is also scalable and is therefore prepared to respond to future demand for increased data traffic with the future 5G.

- Cellnex has equipped the Gran Teatre del Liceu of Barcelona with a Smart Wi-Fi system, consisting of fifty Wi-Fi access antennas, located in the main spaces of the Theatre. The wireless signal coverage, which extends to all of the public spaces and facilities of the Liceu, improves the connectivity experience of the spectators, who can use the web portal to access value-added services such as exclusive offers and promotions.

- Among the actions for improving connectivity, Cellnex has also equipped the Liceu with DAS technology to boost mobile coverage and provide for the future roll-out of 5G. Users can therefore use the Wi-Fi network or mobile broadband to enjoy full connectivity through their mobile device while at the theatre.

As of December 31, 2018, the Group also has 1,592 DAS antenna nodes

- Cellnex Italy designed a specific DAS system and installed it in Centro di Arese in Milan, Europe’s largest shopping centre. The system comprises many active devices (remote units) connected to antennas, constituting radiant equipment. To ensure maximum efficiency of the system, Cellnex Italy provided service and support in all phases of the project to ensure that no user at the centre should ever lose their connection.

The Telecom Infrastructure Services site portfolio at 31 December 2018 is summarised below:

| Framework Agreement | Project | Nº of Sites acquired | Beginning of the contract | Initial Terms + Renewals (2) |

| Telefónica | Babel | 1,000 | 2012 | 10+10+5 |

| Telefónica and Yoigo (Xfera Móviles) | Volta I | 1,211 | 2013 | 10+10+5 (Telefónica) |

| | | | Until 2030+8 (Yoigo) |

| Telefónica | Volta II | 530 | 2014 | 10+10+5 |

| Business combination | TowerCo purchase | 321 | 2014 | Until 2038 |

| Telefónica and Yoigo (Xfera Móviles) | Volta III | 113 | 2014 | 10+10+5 (Telefonica) |

| | | | Until 2030+8 (Yoigo) |

| Telefónica | Volta Extended I | 1,090 | 2014 | 10+10+5 |

| Neosky | Neosky | 10 | 2014 | 10+10+5 |

| Telefónica | Volta Extended II | 300 | 2015 | 10+10+5 |

| Business combination | Galata purchase | 7,377 | 2015 | 15+15 (Wind) |

| Business combination | Protelindo purchase | 261 | 2012 | +15 (KPN) |

| | | 2016 | +12 (T-Mobile) |

| Bouygues | Asset purchase (3) | 371 | 2016 | 20+5+5 |

| 129 | 2017 | 20+5+5 |

| 1,098 | 2017 | 15+5+5+5 |

| 1,205 | 2018 | 15+5+5+5 |

| Business combination | Shere Group purchase | 1,042 | 2011 | +15 (KPN) |

| 2015 | +10 (T-Mobile) |

| 2015 | +15 (Tele2) |

| Business combination | On Tower Italia purchase | 11 | 2014 | 9+9 (Wind) |

| 2015 | 9+9 (Vodafone) |

| K2W | Asset purchase | 32 | 2017 | Various |

| Business combination | Swiss Towers purchase | 2,239 | 2017 | 20+10+10 (Sunrise Telecommunications) |

| Business combination | Infracapital Alticom subgroup purchase | 30 | 2017 | Various |

| Others Spain | Asset purchase | 45 | 2017 | 15+10 |

| 36 | 2018 | 15+10 |

| 375 | 2018 | 20+10 |

| Masmovil Spain | Asset purchase | 551 | 2017 | 18+3 |

| | | 85 | 2018 | 6+7 |

| Linkem | Asset purchase | 426 | 2018 | 10+10 |

| Business combination | TMI purchase | 3 | 2018 | Various |

| Business combination | Sintel purchase | 15 | 2018 | Various |

| Business combination | BRT Tower purchase | 30 | 2018 | Various |

| Business combination | DFA purchase | 9 | 2018 | Various |

| Shared with broadcasting business | | 1,830 | | |

| "Build to Suit" and others (1) | | 270 | | |

(1) “Build to Suit” and others: towers that are built to meet the needs of the customer. It does not include the “BTS” programs committed with Bouygues and Sunrise at the closing of the M&A projects.

(2) Renewals: some of these contracts have clauses which prohibit partial cancellation and can therefore only be cancelled for the entire portfolio of sites (typically termed “all or nothing” clauses), and some of them have pre agreed pricing.

(3) In accordance with the agreements reached with Bouygues during 2016, 2017 and 2018, at the 2018 year-end Cellnex has committed to acquire and build up to 5,250 sites that will be gradually transferred to Cellnex up until 2024 (see Note 7 of the accompanying consolidated financial statements). Of the proceeding 5,250 sites, a total of 2,803 sites have been transferred to Cellnex as at 31 December 2018 (as detailed in previous table). Note that all Bouygues transactions have a common characteristic “up to” as Bouygues does not have the obligation to reach the highest number of sites.

Broadcasting infrastructure

The broadcasting infrastructure business is the Group’s second area of activity by turnover, and the largest in Spain. The company is the only operator offering nationwide coverage of the DTT service.

The value-creation model, in the broadcasting infrastructure business, is based on sharing the transmission network between broadcasters who do not have their own networks.

Its services consist of distribution and transmission of television and radio signals, and the operation and maintenance of broadcasting networks, provision of connectivity for media content, hybrid broadcast-broadband services, over-the-top (OTT) broadcasting and other services. Through the provision of broadcasting services, Cellnex has developed unique know-how & expertise that has helped to develop the other services in its portfolio.

In addition, Cellnex has established the strategic objective of positioning itself as a leader in Ultra High-Definition Video (UHD) technology, providing images with significantly better quality for the user than other options.

At the end of the first quarter of 2017, the UHF Decision of the European Parliament and the Council of the European Union regulating the use of the Spectrum band 470 - 790 MHZ for the next decade was published, being mandatory for all the Member States of the European Union. It is a balanced decision as it ensures that terrestrial TV will maintain the priority use of the Sub700 MHz band (470 - 694MHz) at least until 2030 and, at the same time, allocates the 700 MHz band (694 - 790 MHz) to the services mobile. The UHF Decision provides a realistic timetable for both the Broadcast industry, offering long-term security in the use of spectrum and for the investments to be made, and for the mobile industry that will have the 700MHz band within a reasonable time horizon (2020 with possibility to delay it 2 years with justified reasons). The Decision also suggests that Member States should compensate for the costs arising from the forced migration of services related to spectrum reallocation.

On 29 June, 2018, the “Roadmap for the authorization process of the 700 MHz frequency band for the provision of wireless broadband electronic communications services” was published by the Spanish Administration. This was mainly possible as a result of the growing consensus in the sector, which was reflected in the results of the public consultation held a few months before. Regarding the 700MHz band (694 - 790MHz), the Roadmap foresees finalizing the 700 MHz release process before 30 June, 2020, in accordance with the schedule established in the EU regulations. For the bandwidth below 700 MHz (470-694 MHz), the Roadmap will include guarantee, at least until 2030, for terrestrial TV.

The Roadmap also proposes the approval of a series of legal pieces in the next months that will drive the migration process of the current DTT emissions from the 700MHz bandwidth. These include the approval of a new National Technical Plan for Digital Terrestrial Television that will maintain the current supply of the service and the current number of national and regional multiples, as well as the compensation scheme compatible with the EU regime for the necessary adaptations both in buildings and broadcasters’ transmission equipment.

In this sense, during 2018, the Group has continued with its work of collaboration with the Administration in relation to the Roadmap, as well as in the research and implementation of technical improvements, both in the provision of DTT, as in the on-line distribution of audiovisual content. Among such technological advances, the interactivity of the Hybrid DTT, or the quality improvement provided by the UHD.

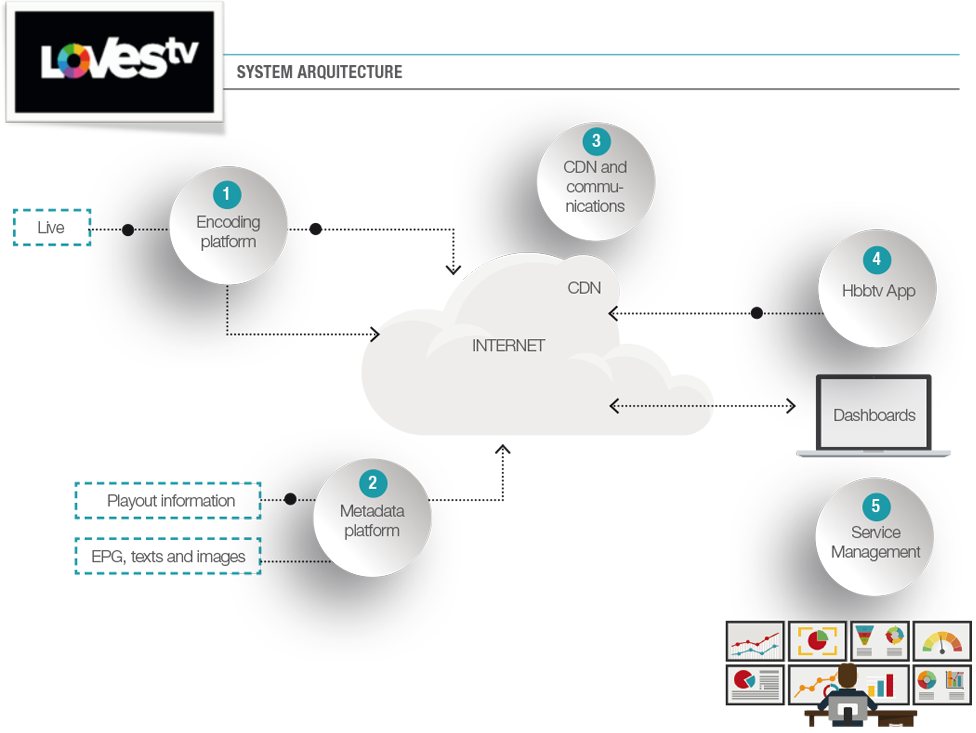

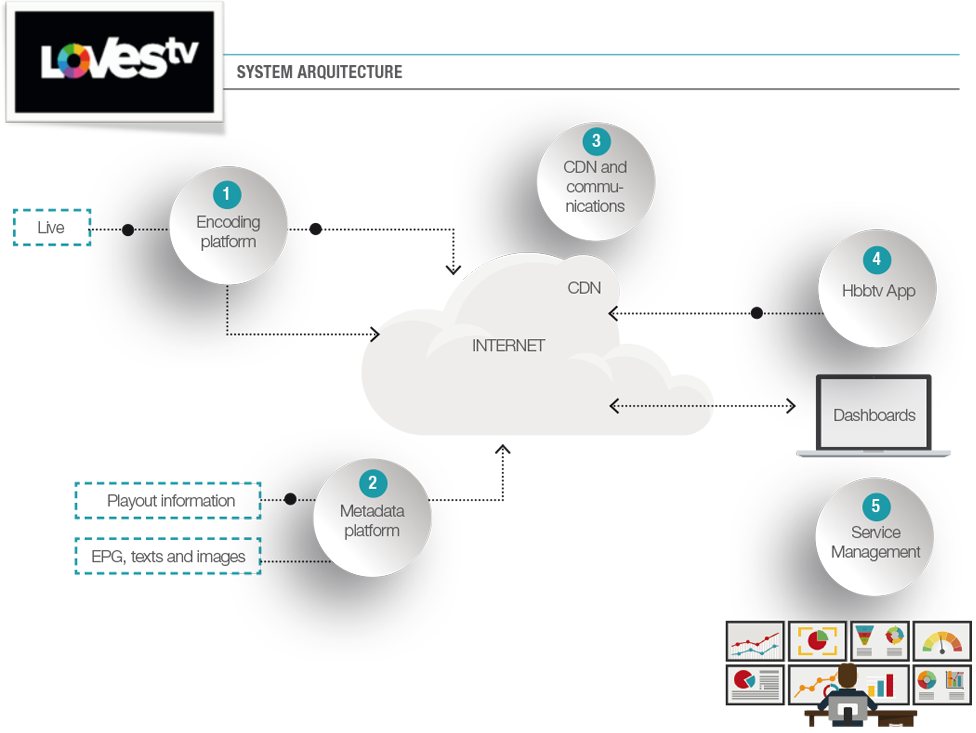

In relation to the above, the Group is the technological provider of LOVEStv, the new audiovisual platform of DTT based on HbbTV jointly developed with the public radio broadcaster RTVE and the two large Spanish commercial radio broadcasting groups, Atresmedia and Mediaset Spain. This platform allows the viewer to access the contents of the last week from the television, as well as viewing programs from the beginning even if they have already started.

Cellnex Telecom, as an independent agent, has worked together with broadcasters and developers in the implementation of the necessary solutions for these new audiovisual services, since Cellnex meets the conditions that make it the right partner, given its technological capacity and extensive know-how in OTT platform services and HbbTV.

Additionally, Cellnex continues its international work in the main forums developing the future of the audiovisual sector as HbbTV, DVB, EBU, ITU or BNE.

Milestones 2018

LOVEStv

On the 28th November of 2018, one week after World Television Day, LOVEStv streaming platform was introduced, which Cellnex Telecom, as the technology provider, has developed together with the public broadcaster RTVE and the two large Spanish private broadcasting groups, Atresmedia and Mediaset España. The project’s test launch took place in June.

This new service is based on Hybrid DTT technology and allows viewers to enjoy the advantages of linear DTT while they can access content and new non-linear services. LOVEStv makes it possible to harness the internet’s capacity in order to improve viewer experience, offering more features, such as:

- Viewing the contents of the previous week.

- Starting a programme from the beginning when it has already begun.

- An improved programming guide.

LOVEStv has been designed as an open platform that can easily integrate any broadcasters wishing to enrich its content offering. It is worth pointing out that the LOVEStv platform was awarded with the Grand Prix of the jury of the prestigious HbbTV Awards, which acknowledges innovation in content discovery applications.

Pilot test for Ultra High-Definition

Throughout 2018 numerous actions continued to be performed in the Ultra High-Definition area, through collaborative projects such as:

- Broadcast over the UHD TDT test channel from Torrespaña (Madrid), Valencina (Seville) and Collserola (Barcelona).

- Demos of TDT broadcast in UHD during the Mobile World Congress.

- Demos of TDT broadcast in UHD during the BIT Broadcast fair.

- First TDT broadcasts of a complete UHD signal with HFR, HDR and WCG in collaboration with RTVE.

- Demo at the 4K Summit in Malaga.

Other network services

At Cellnex, the “smart” concept means sharing, efficiency, security, resilience and ubiquitous connectivity. Cellnex provides the infrastructure required for the development of a connected society by providing the following network services: transport of data, security and control, Smart communication networks including IoT, Smart services and managed services and consulting.

As an infrastructure operator, Cellnex can facilitate, streamline and speed up the deployment of these services through efficient connectivity of objects and people, in rural and urban environments, helping to build genuinely smart territories.

The network and other services activity is a specialised business that creates value through innovative solutions and stable financial flows with attractive growth potential. Given the critical nature of these services, the customers of this activity demand in-depth technical know-how and strict service level agreements.

The connectivity of objects is set to grow very significantly in the near future. The Internet of Things (IoT) network is based on a model that connects physical objects and keeps them integrated in a network. The alliance between Cellnex Telecom and IoT network provider Sigfox is evidence of the Group’s commitment to develope this technology both today and in the near future. In this regard, Cellnex’s position as a reference global operator of IoT has become consolidated with more than one million objects connected in Spain’s largest network dedicated to the Internet of Things.

This activity will continue to grow in the security market through our main customer in the home, people and vehicles sector. In addition to this, the main development is occurring in the water metering and smart city services markets.

Security and Control

- The Maritime Rescue Company (SASEMAR) under the Spanish Ministry of Public Works, signed the “Provision of services within the Global Maritime Distress and Safety System” in 2017, providing continuity to the service that Cellnex Telecom has been providing since 2009. The contract entered into force in August 2018 and has an initial term of four years, extendable for a further two years. Cellnex works through its network of Coastal Stations distributed along the Spanish coastline to guarantee a 24/7 “Permanent listening service” on the maritime frequency bands. The services provide include receiving automatic alerts and distress calls, to be sent immediately to Maritime Rescue coordinators, as well as transmitting information for maritime safety and meteorological information, according to the guidelines established by Maritime Rescue and the connection between the Spanish Medical Radio Centre and any ships requesting that service. Providing the service complies with the international conventions signed by Spain, in particular the Safety of Life at Sea (SOLAS) Convention and the International Search and Rescue Convention (SAR), which are the most important international treaties governing the safety of ships. In relation to the above, Cellnex has extensive experience in managing security and emergency communications networks and services.

- Extension of the contract with the Regional Government of Valencia (Generalitat Valenciana) to extend the services of the Digital Mobile Emergency and Security Communications network (COMDES), for a further four years (2018-2022). Extending the contract provides continuity to the service that Cellnex has been providing since 2007 and covers improving urban coverage, including coastal areas and underground spaces such as the Metro and tunnels, traffic capacity and access for user applications. In total, we estimate that more than 50 municipalities will benefit from an improvement in their current coverage.

Smart communications networks

- Agreement with Castellolí to equip the Parcmotor speed circuit with the necessary infrastructures and technology to allow the agents and companies working to develop the mobility of the future, advanced traffic solutions and vehicle manufacture to develop innovative products and services linked to smart mobility and the connected and autonomous vehicle. The objective is to make the Castellolí Parcmotor into a benchmark environment and an innovative testing space for the development of ITS (Intelligent Transport Systems) technological solutions, particularly in the field of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications, which can subsequently be implemented in vehicles (future mobility), in towns and cities (smart cities) and on roads and motorways (smart roads).

- Growth of 10.6%, with respect to 2017, of Corporate’s commercialization activity, which consists in providing customers with the necessary infrastructure, in order to offer it, in turn, to the end customer.

- Growth of 61.6%, compared to 2017, of the Backhaul activity dedicated to connecting MNOs base stations.

Communications infrastructures - Smart

Communications infrastructures - Smart

- Agreement with Heliot, the Sigfox operator in Switzerland, to roll-out the first global IoT (Internet of Things) network in the Alpine country. The roll-out of this IoT network will be performed via the more than 350 Cellnex sites in Switzerland, with an initial expected coverage of 50% of the population, aiming to reach 90% in 2019. This will be the second such network that Cellnex has rolled out in Europe in collaboration with Sigfox. The first Internet of Things network has been providing service throughout Spain since 2015, with national coverage of 93% of the population through more than 1,500 sites and over 1 million connected devices, providing water telemetry services, security, waste management or tracking, inter alia.

- Acquisition of Xarxa Oberta de Catalunya (XOC), a concessionary company of Catalonia Government dedicated to the roll-out, operation and maintenance of fibre optic networks, which acts as a neutral operator, making surplus network capacity available to the operators’ wholesale market. This acquisition allows Cellnex to reinforce and expand its capabilities and know-how to develop the connectivity of its sites through a high-bandwidth Fibre to the Antenna (FTTA) neutral telecommunications network. Likewise, with the integration of the XOC, Cellnex continues to increase the acquisitions performed with a view to the future roll-out of 5G, two outstanding examples of which are Commscon in Italy (2016) and Alticom in the Netherlands (2017). This is a necessary process to prepare for the 5G network with its greater demand for transmission capabilities, also associated with the need to provide fibre optic connectivity to remote caching servers that bring data processing and storage capacity physically closer to the end users of 5G-based applications.

GRI: 102-2, 102-6, 102-7

Pokemon project: an infrastructure outsourcing contract by a major mobile telecommunications operator, valid for 21 years. Three lines of action are marked out in the perimeter of this project: the acquisition of the entire portfolio of operator sites by Cellnex, roll-out of 160 new connected infrastructure nodes and the renewal with Cellnex of all the contracts that the operator had with its previous mobile infrastructure provider.

Pokemon project: an infrastructure outsourcing contract by a major mobile telecommunications operator, valid for 21 years. Three lines of action are marked out in the perimeter of this project: the acquisition of the entire portfolio of operator sites by Cellnex, roll-out of 160 new connected infrastructure nodes and the renewal with Cellnex of all the contracts that the operator had with its previous mobile infrastructure provider.

Communications infrastructures - Smart

Communications infrastructures - Smart