2017: Growth, expansion and consolidation

Growth

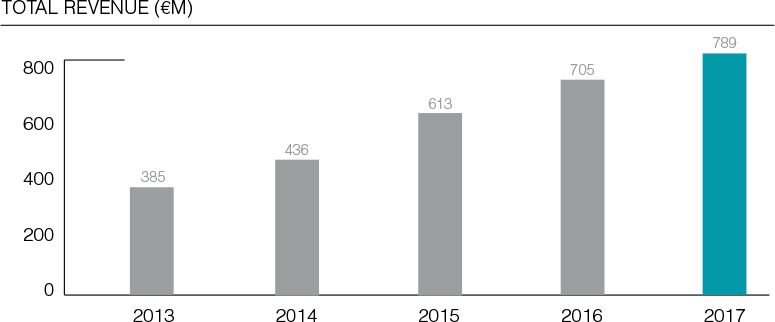

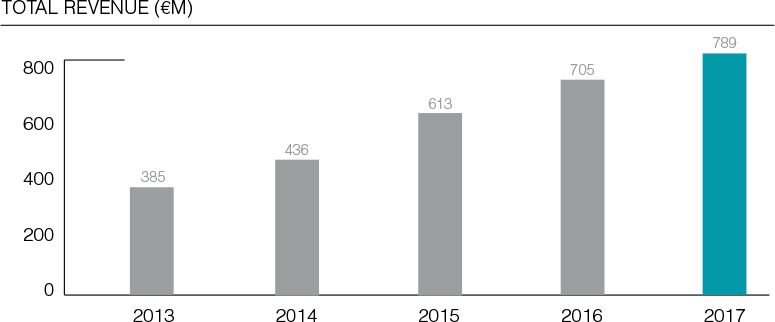

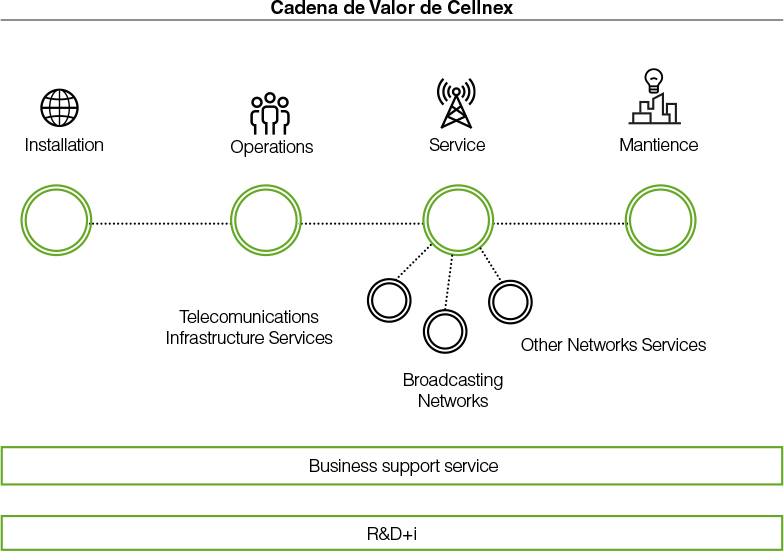

Income from operations for the period ended on 31 December 2017 reached EUR 789 million, which represents a 12% increase over the same period in 2016. This increase was mainly due to the expansion of the above-mentioned telecom infrastructure services for mobile network operators.

Telecom Infrastructure Services’ income increased by 23% to EUR 471 million due to both the organic growth achieved and the acquisitions performed in 2016 and 2017. This business segment is characterised by solid growth driven by increasing demand for wireless data communication services, and by the growing interest of mobile network operators (MNO) in developing high quality networks that fulfil their consumers' needs in terms of uninterrupted coverage and availability of wireless bandwidth (based on new Long-Term Evolution “LTE” technologies), in the most efficient way. In recent years the Group consolidated its infrastructure network and long-term strategic relationships with its main customers, the mobile network operators. In addition to its current portfolio Group’s Management has identified several potential acquisitions which are currently being analysed following its demanding capital deployment criteria. The Group owns a high-quality asset portfolio, which is made up of selective assets in Spain, Italy, the Netherlands, France, the United Kingdom and Switzerland and performs the subsequent streamlining and optimisation of the tower infrastructure for Telecom Infrastructure Services. Its main added value proposals in this line of business consist of providing services to additional mobile network operators in its towers and therefore streamlining the customer’s network. By increasing the ratio of customers to infrastructures, the Group will generate additional income with very little additional costs. This network streamlining may generate significant efficiencies for the Group and for the MNOs.

With regard to the Broadcasting Infrastructure business, income amounted to EUR 237 million, which represents a 1% increase compared with the same period in 2016. This increase is due to the switch on of the 6 DTT new licensed channels in the second quarter of 2016.

Broadcasting Infrastructure activities are characterised by predictable, recurring and stable cash flows. Although this is a mature business in Spain, broadcasting activities have shown considerable resilience to adverse economic conditions, such as those experienced in Spain in recent years, this is due to the fact that the Group's income does not depend directly on macroeconomic factors, but rather on the demand for radio and television broadcasting services by broadcasting companies.

Other Network Services decreased its income by 7%, to EUR 81 million. This constitutes a specialised business that generates stable cash flows with attractive potential for growth. Taking into account the critical nature of the services in which the Group collaborates, its customers require in-depth technical know-how that is reflected in the demanding service level agreements. The Group considers that it has a privileged market presence and geographical distribution, established relationships with government agencies and excellent infrastructure for emergencies and public services. The Group's aim is to maintain long-term relationships with its customers maximise the renewal rate of its contracts and expand its business through new contracts.

The main customers and projects to which the Group renders services include the Generalitat Valenciana with the implementation and maintenance of the COMDES network in Valencia, Barcelona Town Council with the deployment and maintenance of the Wi-Fi network for the city of Barcelona, the Spanish Merchant Navy with the Global Maritime Distress and Safety System service, Securitas Direct with the SIGFOX project, the Telecommunications Center of the Catalan Government (CTTI) with the management of the RESCAT network of private communications for the emergency fleets, the deployment of the TETRA network for Line 9 of the Barcelona underground system, among others.

All of the above has helped boost operating income and operating profit, with the latter also being impacted by the measures to improve efficiency and optimise operating costs.

In line with the increase in revenue, Adjusted EBITDA was 22% higher than the same period in 2016, as a result of the assets acquired during 2017, which reflects the Group’s capacity to generate cash flows on a continuous basis.

Taking into account these considerations, the consolidated net profit attributable to shareholders for the year ended on 31 December 2017 stood at EUR 33 million.

European leader in telecommunications infrastructure

Internationalising via mergers and acquisitions is a basic pillar of the Cellnex strategy.

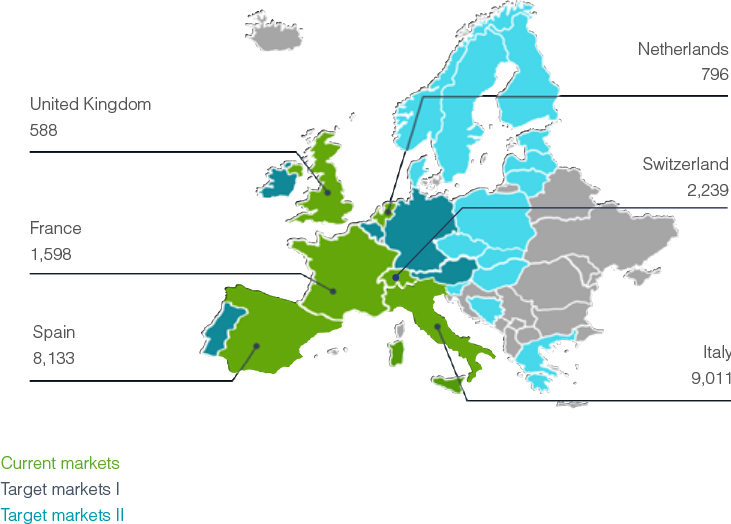

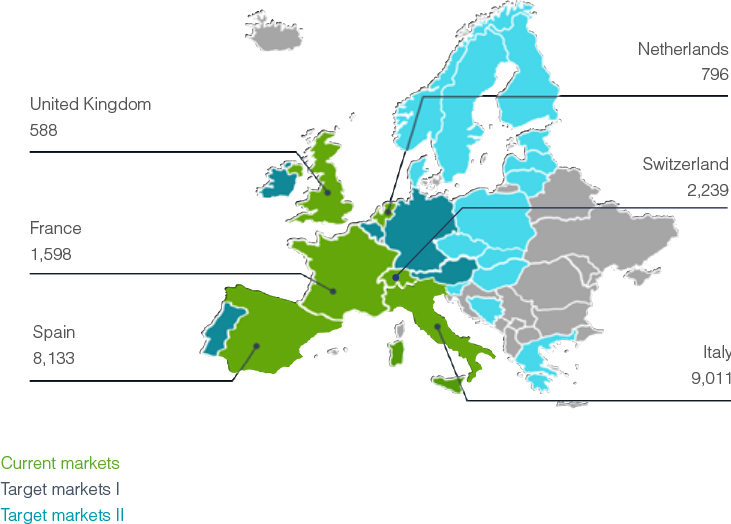

In 2017, Cellnex continued expanding its presence in Europe, and by the end of the year 43% of Adjusted EBITDA was generated outside Spain.

The six countries (Spain, Italy, France, the Netherlands, United Kingdom and Switzerland) in which the company operates share certain of the Group’s main customers and therefore Cellnex can capitalise on commercial synergies.

The Group’s business presents significant barriers to entry into its main markets, mainly due to its difficult-to-replicate total asset base of 21,017 sites and 1,348 nodes, which make a total of 22,365 infrastructures.

The main changes in the consolidation perimeter, together with assets purchased during financial year 2017 are as follows:

France

On 31 January, 2017 Cellnex agreed with Bouygues Telecom the acquisition and building of up to a maximum of 3,000 sites in France, structured around two projects. The first one relates to the acquisition of up to 1,800 sites for a total enterprise value of EUR 500 million and involves urban sites in the main cities of France (c.85% located in areas with a population above 400,000 inhabitants) which are to be gradually transferred to Cellnex France over a period of 2 years from 2017 year-end

Cellnex and Bouygues Telecom have also agreed on a second project for the building of up to a maximum of 1,200 sites for a total investment of EUR 354 million. This build-to-suit project relates to sites to be built over an estimated period of 5 years from 2017 year-end.

In addition, as at 31 December 2017, the total number of infrastructures to be acquired and built was increased by up to 1,600 additional sites following the extensions reached with Bouygues Telecom in July and December (see Note 6 to the accompanying consolidated financial statements).

Upon completion of these projects, Cellnex France is expected to own and operate a unique portfolio of up to 5,100 sites in France, in high demand areas and ready to capture future organic growth.

Together, these projects are expected to generate annual Adjusted EBITDA of approximately EUR 100 million on a run-rate basis (once all of the sites have been acquired and built). These projects are fully aligned with Cellnex’s corporate purpose and with its international expansion strategy based on the acquisition of an initial portfolio of assets allowing for subsequent market consolidation, and represent a clear example of consistent delivery of the Company’s equity story based on growth.

Cellnex is thus strengthening its position in France by becoming the second largest independent tower operator, reinforcing its current long-term partnership with Bouygues Telecom and setting the foundations to continue capturing organic growth in the country through future densification needs.

Switzerland

According to Note 2.h of the accompanying consolidated financial statements, during the third quarter of 2017, Cellnex incorporated 2,239 sites in Switzerland, through the acquisition of Swiss Towers AG in consortium with Deutsche Telekom Capital Partners and Swiss Life Asset Managers, for an acquisition price, free of cash, amounting to EUR 400 million (Enterprise Value).

The consortium that acquired Swiss Towers AG from Sunrise Communications comprises Cellnex (54%), Swiss Life Asset Managers (28%) and Deutsche Telekom Capital Partners (18%).

The acquisition agreement includes the signing of a Master Service Agreement from Swiss Towers to Sunrise for an initial period of 20 years, renewable for a further 20 years in two 10-year periods. In addition, Cellnex and Sunrise have also agreed the deployment (build to suit) of an additional 400 sites during the next 10 years, as well as 200 DAS (Distributed Antenna System) nodes.

Following this transaction, Cellnex Telecom has become the first independent wireless telecommunications services and infrastructure operator to enter Switzerland, consolidating the Company’s position in Europe.

GRI:102-4, 102-6, 102-7, 102-10

Swiss Towers AG, a former subsidiary of Swiss mobile operator Sunrise Communications International, has 2,239 sites throughout Swiss territory, with a greater presence in the northern and western cantons of the country. 32% of these sites are located in urban areas and 64% on rooftops offering ideal conditions for the future roll-out and densification of equipment associated with 4G and 5G.

Netherlands

During the third quarter of 2017, Cellnex Telecom acquired the Dutch telecom infrastructure operator Alticom from Infracapital, which operates 30 long-range, high-capacity telecommunications sites for transmission equipment for voice, data and audiovisual content operators, located throughout the Netherlands. The purchase price, free of cash (Enterprise Value), amounted to EUR 129 million (see Note 2.h of the consolidated financial statements).

Alticom’s customers include all the telecommunication and broadcast operators in the Netherlands, with whom it has contracts ranging from 5 to 10 years.

Following the acquisition of CommsCon in Italy in June 2016, the characteristics of Alticom’s sites are a key element to the future roll-out of 5G. They have the capacity – and connectivity to the fibre optic backbone – to host remote or ‘caching’ servers to bring data processing and storage capacity to the end users of 5G-based applications which is essential for meeting the exponentially increasing demand and requirements of an increasing number of people and connected objects.

Alticom has 30 sites in the Netherlands, located mainly in urban and suburban areas. Alticom’s main activity is now co-location services for telecommunications operators. However, since 2008, Alticom has radically altered its business model, moving into Data Center housing services, with growth anticipated through greater adoption of cloud services and new network architectures.

Italy

En el tercer trimestre de 2017, Cellnex Italia adquirió a Wind Tre el 10% del capital de Galata que aún no controlaba.

During the third quarter of 2017, Cellnex Italia acquired from Wind Tre the remaining 10% of the share capital of Galata. The purchase was the result of exercising the put option that Wind Tre held on this 10% after the acquisition of 90% of Galata by Cellnex Italia in March 2015.

At 31 December 2017, the total number of Cellnex infrastructures (sites and nodes) in Europe was as follows:

Consolidation

The Group continues to be the leading neutral Telecom Infrastructure Services provider for mobile network operators in Spain and Italy. During the year ended on 31 December 2017 and 2016 the Group expanded its Telecom Infrastructure Services to new countries: France, the Netherlands, the UK and Switzerland. In addition, the Group is the main Broadcasting Infrastructure provider in Spain with a majority share in the national and regional markets.

During 2016, Cellnex formalised policies and procedures, strengthened governance structures and implemented a project to transform management. 2017 was a year of formalisation and consolidation of the Group's corporate structure that has made it possible to move towards a global, integrated, customer-oriented and people-led company.

In that context, in 2017, Cellnex presented a new organisational vision of the Group that aims to meet the needs of international growth and the expansion of the company in other countries such as Italy, France, the United Kingdom, the Netherlands and Switzerland. To achieve this objective, the configuration of the new organisational structure was based on three fundamental principles.

- An integrated Group based on the model of a company that shares values and principles of action, rather than a conglomerate of subsidiaries.

- A global company with an equally global vision and maintaining a strong customer orientation.

- An organisation in which people, and the processes on which they rely, practice leadership and apply best practices.

In line with these principles, the new organisational model introduces a (corporate) matrix structure and a more operational structure oriented to each business unit (country), so that the activities of the countries and businesses are aligned with the corporate business guidelines.

The corporate structure must guide the strategy and reinforce implementation so that the business units focus on growth and profitability, while the countries focus on meeting customer expectations.

The new organisational structure was introduced in 2017 in two phases without affecting the Group’s day-to-day operation or management, thereby ensuring that an efficient, quality service was provided. In the first phase, teams were assigned and responsibilities and communication were transferred to the entire organisation, while in the second phase the programme to transform the organisational model was carried out to switch to the new Group structure.

Furthermore, within the framework of the new corporate structure, the Department of Integration and Processes was set up, responsible firstly for the whole end-to-end process of integrating new companies, and for monitoring and reporting on the status of the integrations; and, secondly, for designing and deploying a process map and model and making sure that it is consistent with the company's strategy at all times. As a result, Cellnex has the necessary internal processes for a systematic, smooth and orderly integration of the different businesses, assets and subsidiaries into the Group, fostering multi directional relationships within the company.

The main measure implemented in 2017, designed to ensure the internal integration processes, was the first phase of the deployment of the key computer systems used by the company in Italy, namely the financial system (SAP) and the corporate industrial system (Aqua).

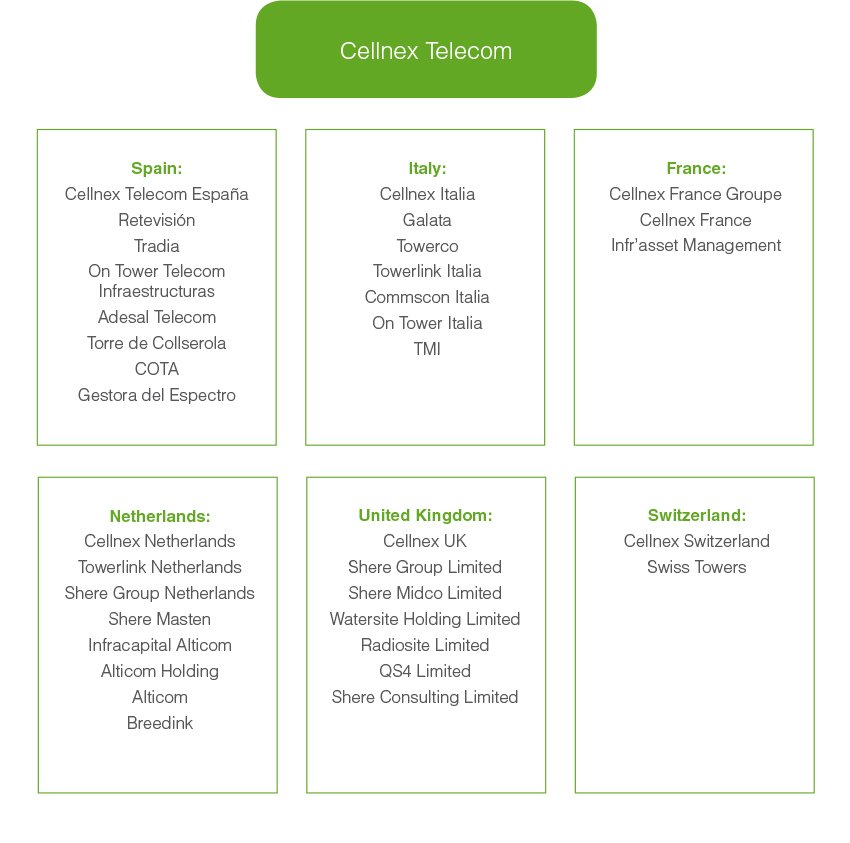

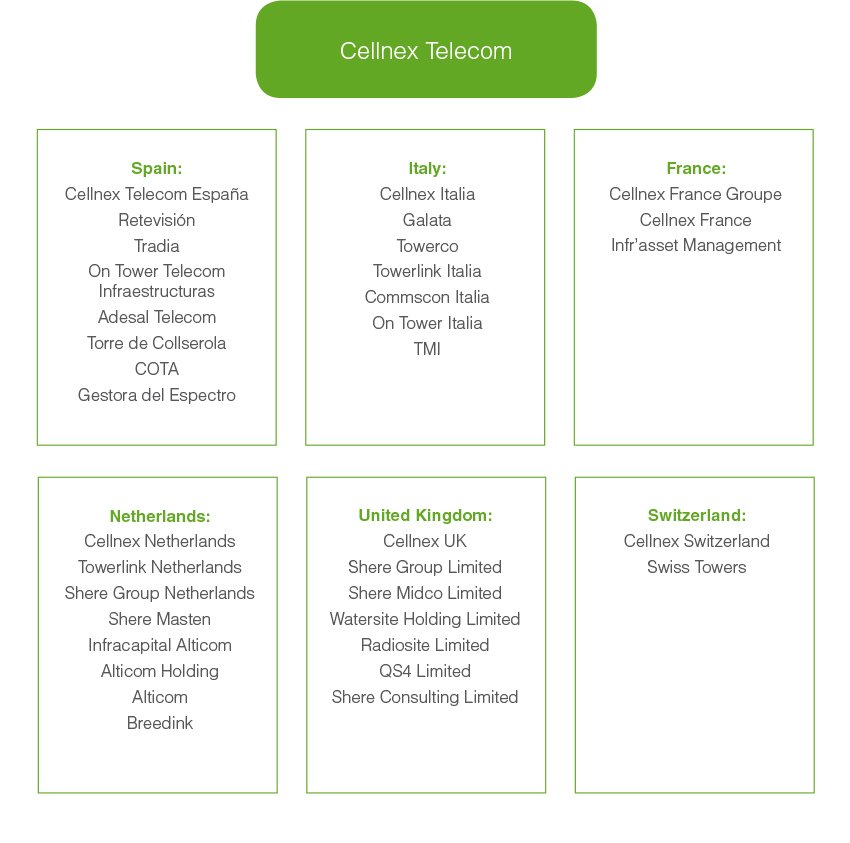

The organisational structure of the Cellnex Group at 31 December 2017 is summarised as follows:

The detail of the Group's subsidiaries and associates at 31 December 2017 and of the percentages of ownership is shown in Appendixes I and II, respectively, to the consolidated financial statements.

GRI:102-4, 102-6, 102-7, 102-10