Risk management

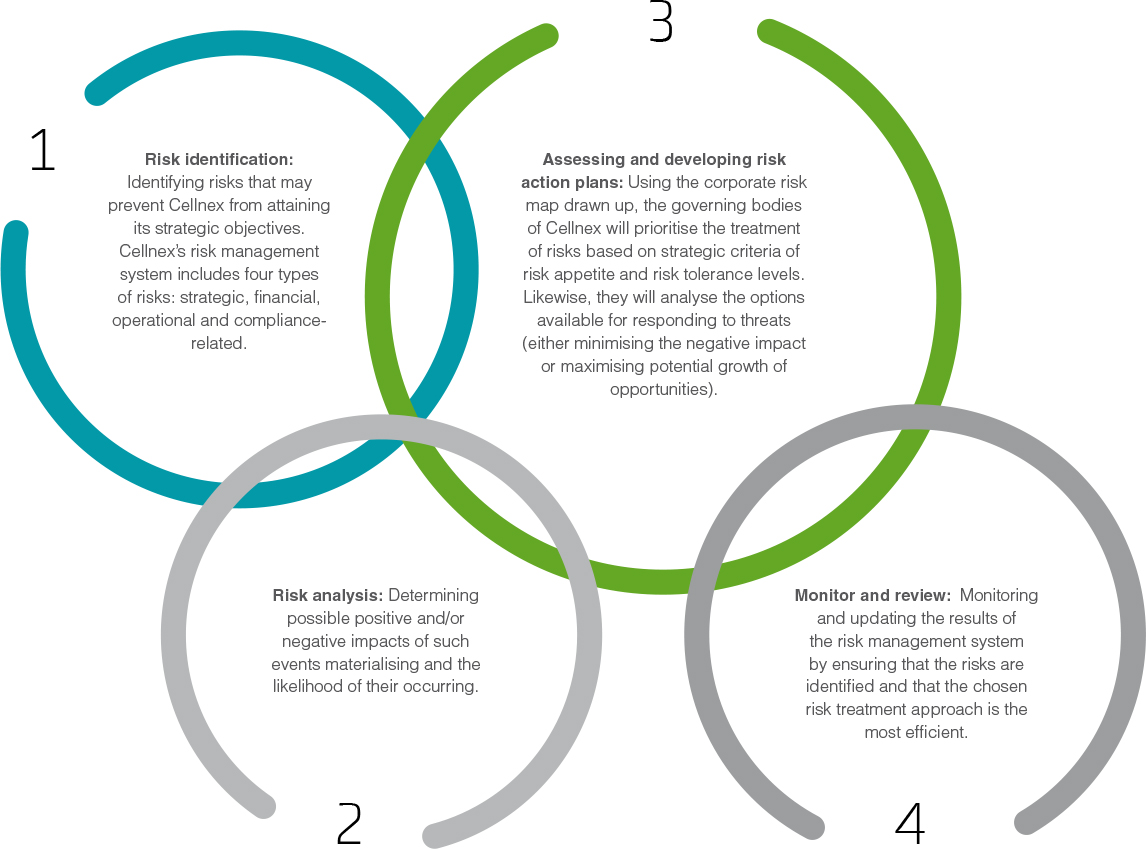

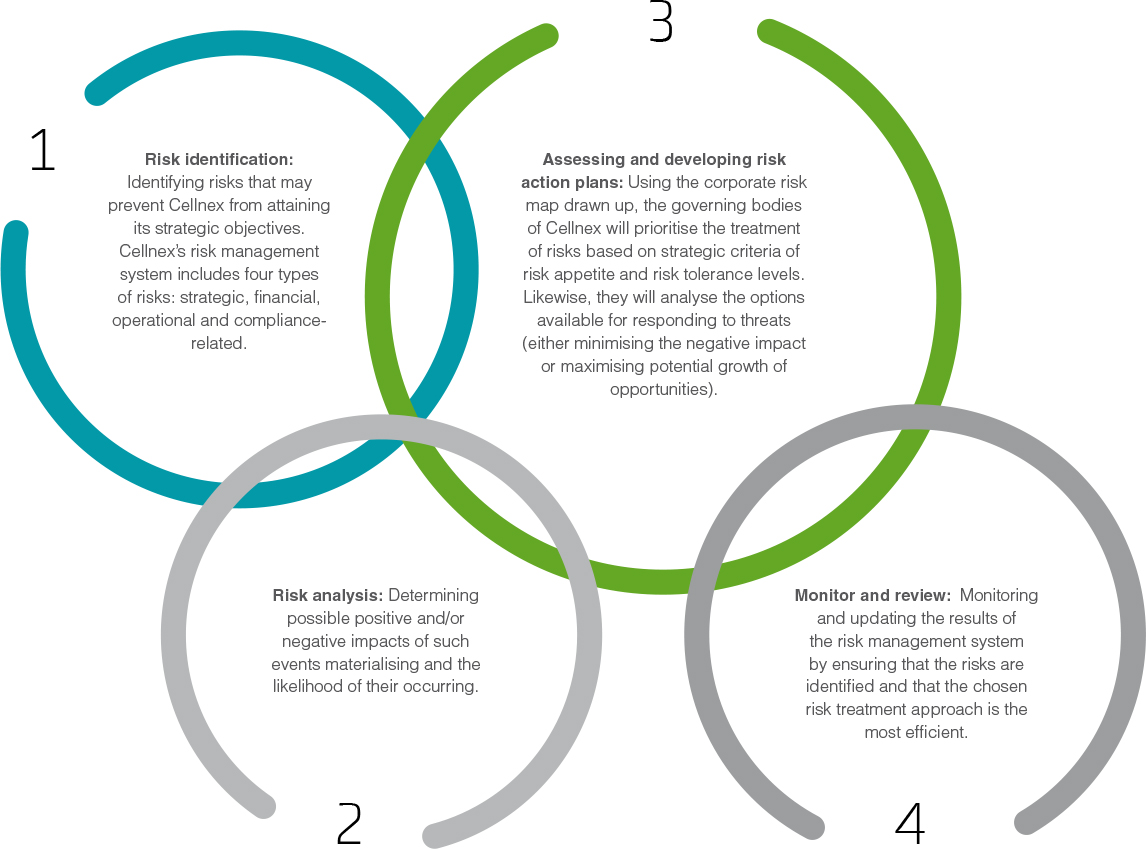

The Cellnex risk management model is formalised in a risk management policy approved and overseen by the Audit and Control Committee. This model is embodied in a comprehensive risk management system that allows risks to be managed in a logical and structured way while facilitating effective and efficient decision-making.

We should highlight that Cellnex's risk management policy states that the various areas of the Group are responsible for each of those stages. More specifically, the departments within the organisation are responsible for identifying, assessing and tracking risks and for supervising and implementing control measures to mitigate the possible negative impacts of such risks.

Cellnex's integrated risk management model involves the Steering Committee developing and monitoring a risk map while the Audit and Control Committee oversees its development. In addition, the progression of the main risks identified is communicated to the Board of Directors for consideration. When a new company joins the group, there is a prudential period of consolidation from which time the risks are analysed and the Code of Ethics disseminated.

The main stages in risk management include

GRI: 102-15

In this regard, we should underline that the management team and the governing bodies of Cellnex are aware that creating value for the organisation is directly linked to managing risks that may jeopardise the sustainability of its strategy.

Additionally, during 2017 a Model for the Prevention of Criminal Offences (MPD) was approved that includes the appropriate surveillance and control measures to prevent crimes or significantly minimise their risk. The model has a general and specific protocol.

Cellnex has implemented a risk management model that has been approved and supervised by the Audit and Control Committee. The risk management model aims to ensure that the Group's objectives are effectively met.

The main risks that may affect the achievement of the Group's objectives are:

Cellnex risk typology (1)

Risks related to the industry and the business in which the Group operates

- Risks related to the environment in which the Group operates and those derived from the specific nature of the Group's businesses

- Risks of increased competition

- Risk of infrastructure sharing

- he expansion or development of the Group's businesses, through acquisitions or other growth opportunities, involve a series of risks and uncertainties that could adversely affect operating results or interrupt operations.

- Operational risks

- Risks about the conservation of land entitlements where the Group's infrastructures are located

- Risks inherent to the businesses acquired and international expansion of the Group

- Risk associated to significant agreements signed by the Group that can be modified by change of control clauses

- Risk related to the "non-control" of certain subsidiaries

- Risks related to the execution of Cellnex's acquisition strategy

- Regulatory risks and other similar ones

- Disputes

Risks related to financial information

- Risks of financial information, fraud and compliance

- Expected contracted income (backlog)

Financial risks

- Exchange rate risks

- Interest rate risk

- Credit risk

- Liquidity risks

- Inflation risk

- Risk related to the Group's indebtedness

GRI: 102-11, 102-15