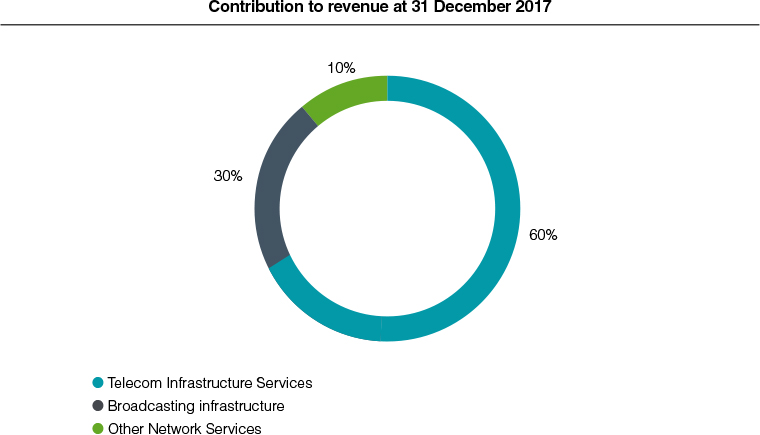

Business model

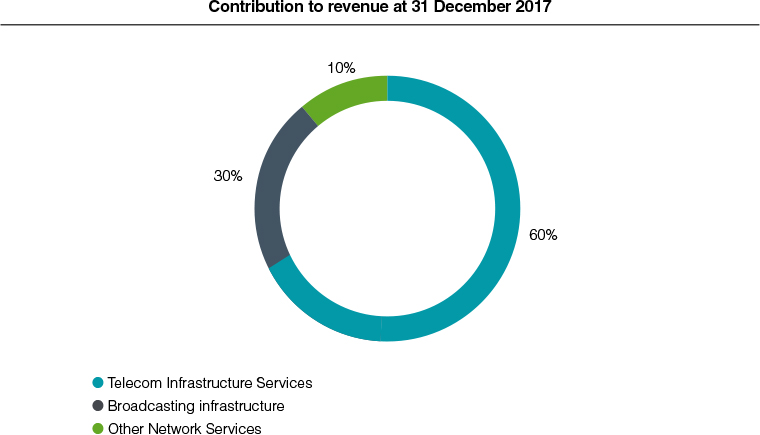

The Cellnex Group provides services related to infrastructure management for terrestrial telecommunications to the following markets:

- Telecom Infrastructure Services

- Broadcasting infrastructure

- Other Network Services

Generally speaking, this balanced set of investments, in terms of both maturity and profitability, and geographic diversification, should foster a growing positive contribution from all business sectors. In addition, Cellnex plans to continue identifying new investment opportunities and operational efficiencies that will strengthen its balance sheet and financial position.

Telecom Infrastructure Services

This is the company’s main business by turnover. It provides a wide range of integrated network infrastructure services to enable access to the Group's wireless infrastructure by mobile network operators and other wireless telecommunications and broadband network operators, allowing such operators to offer their own telecommunications services to their customers.

Cellnex acts as a neutral carrier for mobile network operators and other telecommunication operators that usually require full access to the network infrastructure to deliver services to end users.

In this context, Cellnex offers co-location services, space in its own infrastructures for installing telecommunications equipment in rural and urban sites that are suitable for providing a range of different telecommunication services. The sites are designed and equipped with the resources to provide a high-quality service that offers both availability and network stability. The co-location service includes the provision of access to the energy point, secure conditions and conditioning of the infrastructure for the installation of customer equipment, as well as operation and maintenance services.

The value creation model involves increasing the sharing ratio of its infrastructure, by incorporating new customers who view an independent infrastructure operator as the ideal partner for deploying their services, reducing barriers to entry; or by agreements for rationalising existing networks run by a number of mobile telephone operators. Network rationalisation generates efficiencies both for itself and for mobile network operators (MNOs).

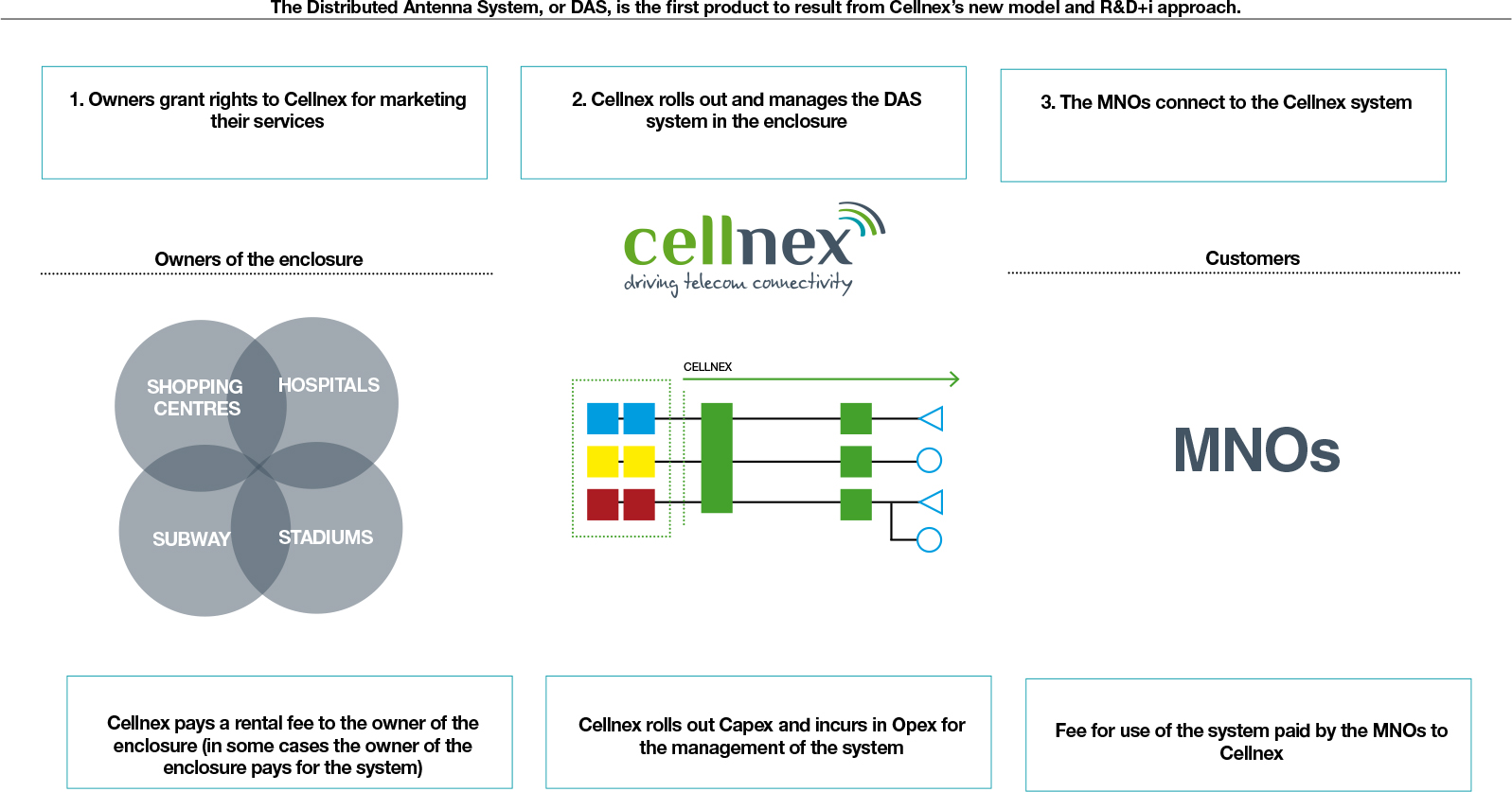

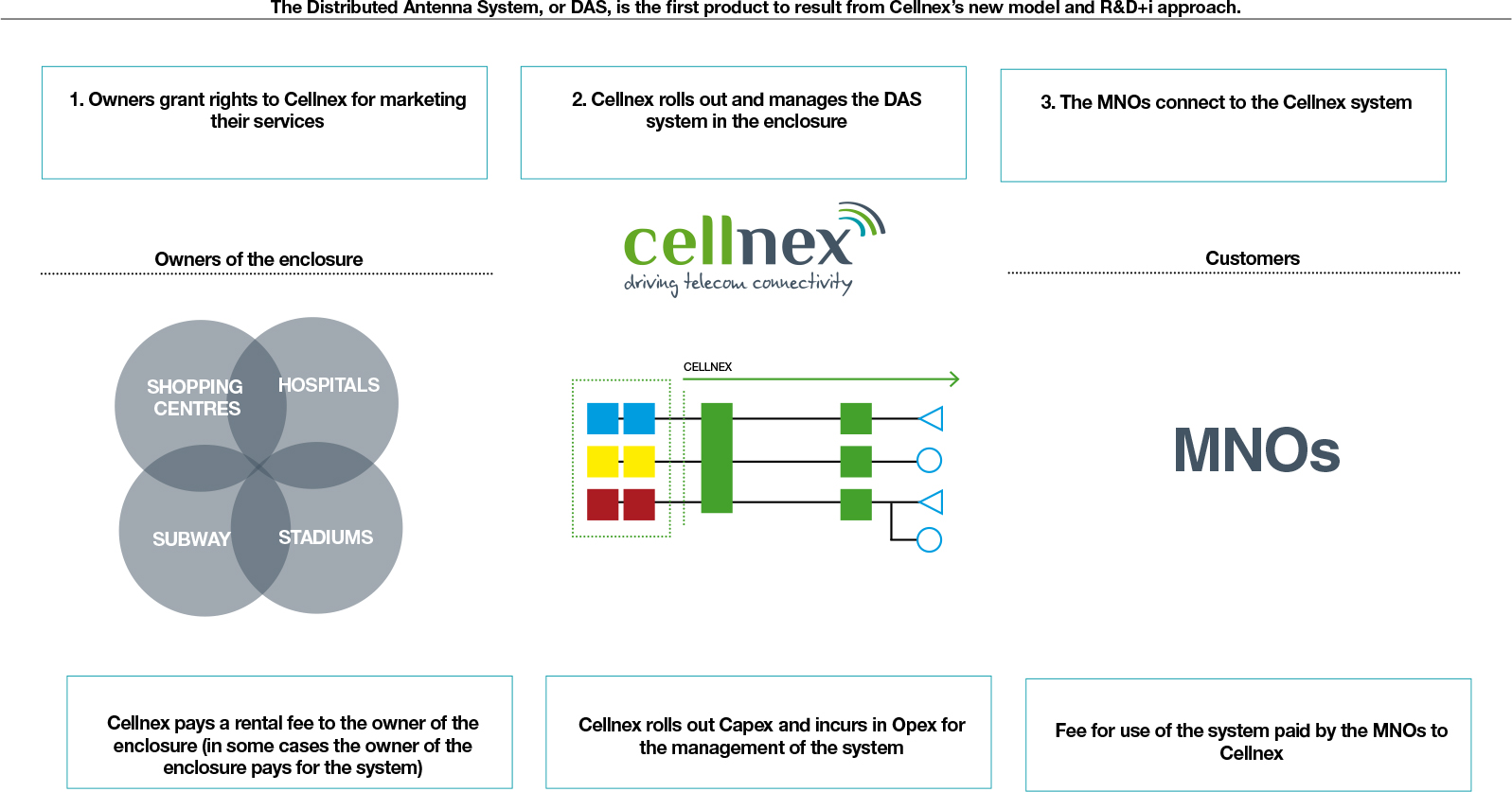

In the coming years, the market for small cells and Distributed Antenna Systems (DAS) will be the main driver of the telecommunications infrastructure sector. Users are looking for anywhere and anytime high-quality connectivity. One of the key challenges for current 4G and future 5G technologies is the exponential increase in mobile data traffic caused by the wealth of content and services offered by network access operators and the capacity developed by the new-generation terminals. In that connection, it is estimated that 5G will result in a 600% growth in mobile data traffic over the next five years. The densification of networks in open and closed spaces such as sports stadiums, skyscrapers, shopping centres, dense exteriors, airports, subway lines or railway stations, is one of the main vectors for the future deployment of 5G.

“Small cells” and DAS networks significantly increase the actual data transmission capacity that operators offer their customers thanks to densification and to greater equipment capillarity. This means that the cells (areas) covered by each antenna are smaller, helping to better distribute data traffic among connected users and transmission elements.

The acquisition of Commscon in 2016 and Alticom in 2017 consolidates Cellnex's position as a key player in the development and deployment of telephony and data coverage solutions in high-demand areas, through the implementation of advanced technologies based on "small cells" and DAS that serve various operators based on a single infrastructure and deployed equipment.

Main services offered

Telecos co-location

The telecos co-location service is focused on the operators market, and consists of offering space in towers, cabins (if any) or on the ground for the installation of telecommunications equipment. The service includes two different concepts:

- Co-location service.

- Technology services: access to the energy point.

- Other complementary services (air conditioning, uninterrupted power supply, etc.)

Passthrough Telecos

The Passthrough Telecos product consists of charging back power and/or rent payable under contract by some customers.

Marketing of external sites

This service is offered to telecommunications operators and consists of marketing co-location services on their sites. Our customer is the telecommunications operator that owns the tower.

Repair of acquired sitt

Cellnex offers a repair service for faults identified on the site during the purchase process; the repairs are billed to the telecommunications operator that has sold the site.

Small Cells & DAS

The Small Cells & DAS service consists of expanding the coverage/capacity of mobile telephony operators in areas with poor coverage, using radio frequencies owned by the mobile operator.

A network is used to expand the coverage/capacity of mobile telephony operators in areas with poor coverage using a system of passive elements and active equipment.

- Distributed Antenna System (DAS): coverage/capacity can be extended using two types of solutions: repeaters or active DAS.

Milestones 2017

Specifically in DAS:

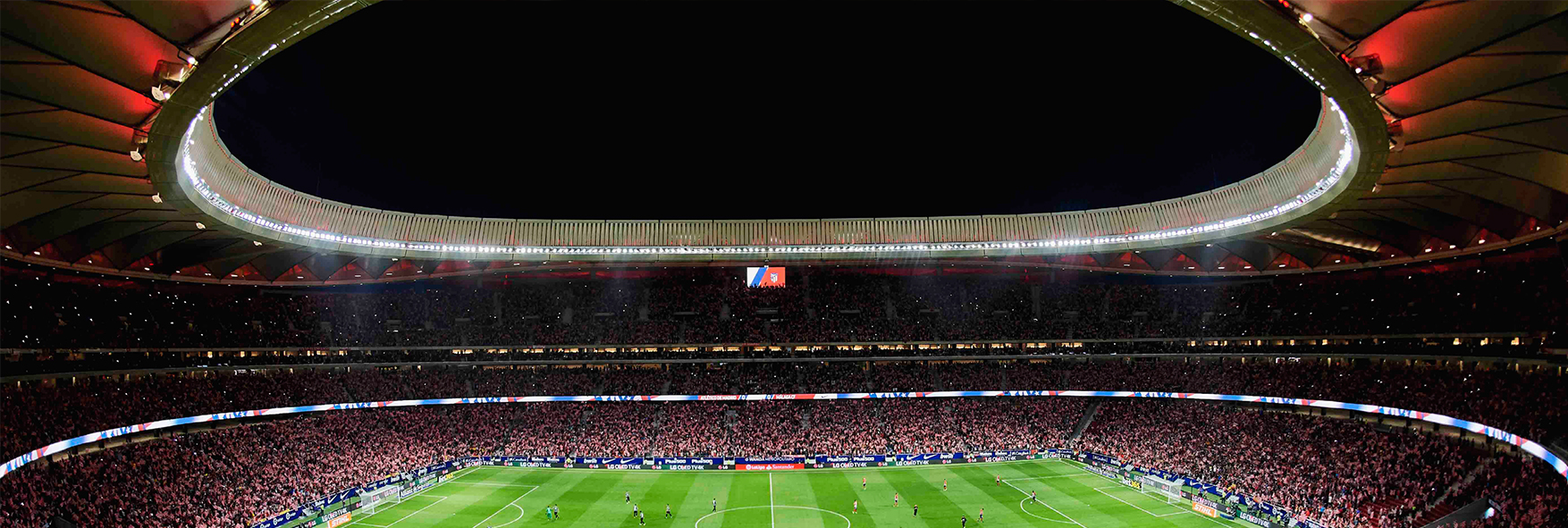

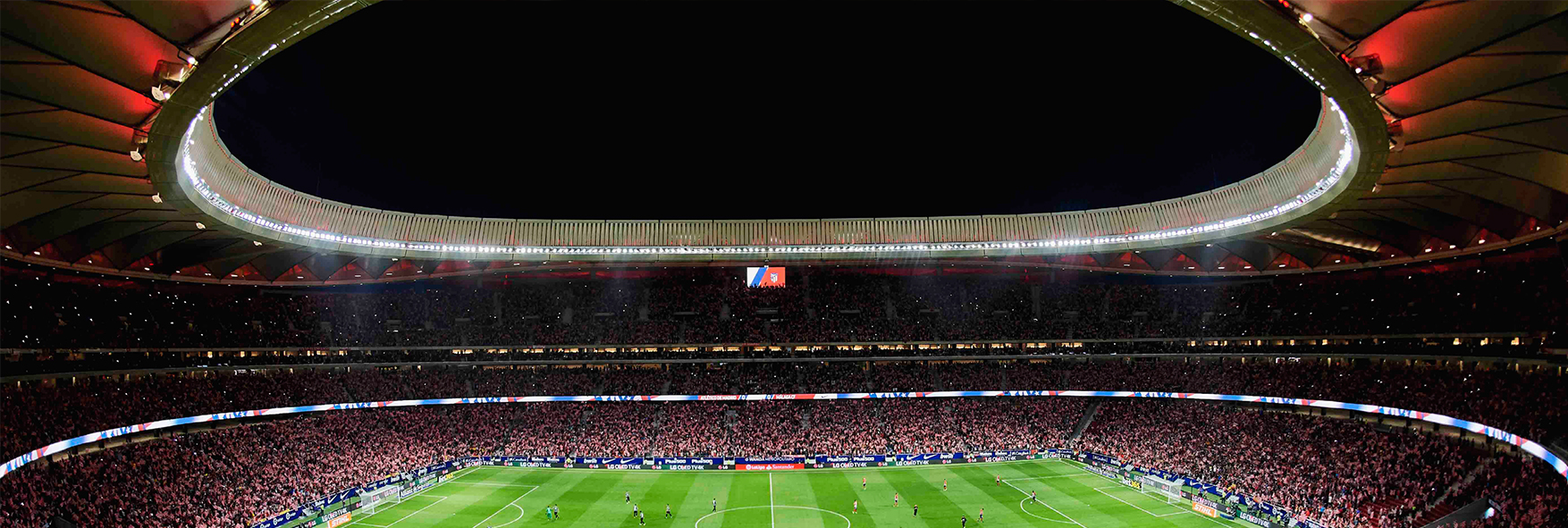

- Agreement with Atlético de Madrid to equip the new stadium with mobile broadband coverage (2G, 3G, 4G and 5G in the future). Cellnex will install a unique and exclusive network of small cells in Wanda Metropolitano Stadium (Madrid), based on DAS (distributed antenna systems) technology able to provide service to the various mobile voice and data network access operators. The contract signed with will last for ten years. This is a pioneering solution in Spain and will serve the up to 68,000 spectators that can fit into Atlético’s new stadium. This will be achieved through a unique and exclusive network of up to 250 antennas, remote units, fibre network and equipment located in the technical room. Cellnex Telecom brings to the project its experience in similar solutions rolled out in large stadiums in Italy, such as San Siro in Milan (80,000 spectators, 107 remote units and 165 antennas) or the Juventus Stadium in Turin (41,000 Spectators, 38 remote units and 91 antennas).

- Cellnex and JCDecaux have reached a commercial agreement to offer a comprehensive solution to network access operators as well as Public Administrations to roll out “small cells” and DAS technologies that will speed up densification and the development of mobile broadband telecom services offered by MNOs. In order to achieve this objective, JCDecaux and Cellnex Telecom will offer joint end to end solutions to their customers in Italy and Spain to facilitate network densification from design to maintenance while streamlining site acquisition.

- 3G and 4G voice and data coverage service agreements in the Cercle de Economia and the Liceo de Barcelona in Barcelona based on a single multi-operator system implemented with a DAS system that avoids the various operators deploying redundant networks.

The Group now has a unique portfolio of assets, which have enabled new business opportunities to be developed through the sharing of the infrastructure necessary in the roll out of 4th generation mobile telephones, involving the decommissioning of duplicated infrastructure.

The Telecom Infrastructure Services site portfolio at 31 December 2017 is summarised below:

| Framework Agreement | Project | Nº of Sites acquired | Beginning of the contract | Contract term in years (2) |

|---|

| Telefónica | Babel | 1,000 | 2012 | 10+10+5 |

| Telefónica and Yoigo (Xfera Móviles) | Volta I | 1,211 | 2013 | 10+10+5 (Telefónica) Until 2030+8 (Yoigo) |

| Telefónica | Volta II | 530 | 2014 | 10+10+5 |

| Business combination | TowerCo purchase | 321 | 2014 | Until 2038 |

| Telefónica and Yoigo (Xfera Móviles) | Volta III | 113 | 2014 | 10+10+5 (Telefonica) Until 2030+8 (Yoigo) |

| Telefónica | Volta Extended I | 1,090 | 2014 | 10+10+5 |

| Neosky | Neosky | 10 | 2014 | 10+10+5 |

| Telefónica | Volta Extended II | 300 | 2015 | 10+10+5 |

| Business combination | Galata purchase | 7,377 | 2015 | 15+15 (Wind) |

| Business combination | Protelindo purchase | 261 | 2012 | +15 (KPN) |

| | | | 2016 | +12 (T-Mobile) |

| Bouygues | Asset purchase (3) | 371 | 2016 | 20+5+5 |

| | | 129 | 2017 | 20+5+5 |

| | | 1,098 | 2017 | 15+5+5+5 |

| Business combination | Shere Group purchase | 1,042 | 2011 | +15 (KPN) |

| | | | 2015 | +10 (T-Mobile) |

| | | | 2015 | +15 (Tele2) |

| Business combination | On Tower Italia purchase | 11 | 2014 | 9+9 (Wind) |

| | | | 2015 | 9+9 (Vodafone) |

| K2W | Asset purchase | 32 | 2017 | Various |

| Business combination | Swiss Towers purchase | 2,239 | 2017 | 20+10+10 (Sunrise Telecommunications) |

| Business combination | Infracapital Alticom subgroup purchase | 30 | 2017 | Various |

| Others Spain | Asset purchase | 45 | 2017 | 15+10 |

| Masmovil Spain | Asset purchase | 551 | 2017 | 18+3 |

| Shared with broadcasting business | | 1,826 | | |

| "Build to Suit" (1) | | 78 | | |

(1) “Build to Suit”: towers that are built to meet the needs of the customer. It does not include the “BTS” programs committed with Bouygues and Sunrise at the closing of the M&A projects.

(2) Some of these contracts have clauses which prohibit partial cancellation and can therefore only be cancelled for the entire portfolio of sites (typically termed “all or nothing” clauses).

(3) In accordance with the agreements reached with Bouygues during 2016 and 2017, at the 2017 year-end Cellnex has committed to acquire up to 5.100 sites that will be gradually transferred to Cellnex up until 2022 (see Note 6 of the accompanying consolidated financial statements). Of the proceeding 5.100 sites, a total of 1.598 sites have been transferred to Cellnex as at 31 December 2017 (as detailed in previous table). |

Following the acquisition of Commscon Italia and Infracapital Alticom subgroup, as at 31 December 2017 the Group also maintains 1,348 antennae nodes with the DAS.

Broadcasting infrastructure

The broadcasting infrastructure business is the company’s second area of activity by turnover, and the largest in Spain. The company is the only operator offering nationwide coverage of the DTT service.

The value-creation model, in the broadcasting infrastructure business, is based on sharing the transmission network between broadcasters who do not have their own networks, such as mobile telephony operators.

Its services consist of distribution and transmission of television and radio signals, and the operation and maintenance of broadcasting networks, provision of connectivity for media content, over-the-top (OTT) broadcasting and other services. Through the provision of broadcasting services, Cellnex has developed unique know-how that has helped to develop the other services in its portfolio.

In addition, Cellnex has established the strategic objective of positioning itself as a leader in 4K Ultra High-Definition Video technology. This technology provides an image with a resolution that is significantly better than High Definition (1280 x 720), up to sixteen times higher.

At the end of March 2017, the UHF Decision of the European Parliament and the Council of the European Union regulating the use of the Spectrum band 470 - 790 MHZ for the next decade was published, being mandatory for all the Member States of the European Union. European Union. It is a balanced decision as it ensures that terrestrial TV will maintain the priority use of the Sub700 MHz band (470 - 694MHz) at least until 2030 and, at the same time, allocates the 700 MHz band (694 - 790 MHz) to the MNOs. The UHF Decision provides a realistic calendar for both the Broadcast industry, offering long-term security in the use of spectrum and for the investments to be made, and for the mobile industry that will have the 700MHz band within a reasonable time horizon (2020 with possibility to delay it 2 years with justified reasons). The Decision also points out that Member States will have to compensate for the costs arising from the forced migration of services related to spectrum reallocation.

According to the UHF Decision, European administrations will have to publish their Roadmap that pilots the process before 30 June, 2018. In the case of Spain, it is expected that this will be a non-disruptive Plan, which will maintain the number of MUX and that facilitates the technological evolution and the renovation of the television park.

In this sense, during 2018, the Group will continue with its work of collaboration with the Administration in relation to the Roadmap, as well as in the research and implementation of technical improvements, both in the provision of Digital Terrestrial Television services (DTT), as in the on-line distribution of audiovisual content. Among such technological advances, the interactivity of the Hybrid DTT, or the quality improvement provided by the Ultra High Definition (UHD - Ultra High Definition) stand out. In addition to the 4K broadcasts on DTT, the Group will announce during the next months the latest developments in Hibernate DTT (HbbTV).

Another important point is that on 20 December 2017, the EU Court of Justice annulled the European Commission Decision adopted in June 2013, which ordered the recovery of state aid granted by Spain to the operators of DTT in areas extending coverage up to 98% of the Spanish population. The immediate consequence for Cellnex Telecom, as contractor for some of the tenders for extension of coverage, is that the company no longer has to refund any amounts to the Administrations, and where the refund had already been made, the Administration must return the amounts to Cellnex.

Main services offered

Digital TV

Cellnex has led the implementation of DTT in Spain. The solutions offered by Cellnex include signal distribution, encoding in the most innovative formats and the broadcast of content in ultra-high definition (UHD).

- DTT Services: servics required for the provision of the DTT carrier service, such as the broadcast of national and regional DTT, broadcast of local DTT, extended DTT, headers and satellite reception.

- Premium DTT Signal encryption service to enable pay-TV services to be broadcast by DTT.

- Hybrid DTT: a Spanish interactive TV specification that integrates DTT and Internet into a single user experience.

- Engineering channel: a service that enables receiver manufacturers to download new software versions via DTT.

Radio

Cellnex offers configurable sound quality, data service capability, flexible composition of the multiple channel, efficient spectrum use and cost effectiveness.

- FM: Cellnex has several analogue radio broadcast offerings, depending on the transmission power required and the broadcast area (local, regional or national).

- DAB/DAB+: Cellnex offers the Digital Audio Broadcasting (DAB) system and the upgraded version DAB+, some three times more efficient than the previous one.

Operations and maintenance services

Cellnex provides broadcast operations and maintenance (O&M) services for broadcasters relying on Cellnex to operate and maintain the customer's equipment, whether or not they are located in Cellnex Telecom centres.

- MW O&M: operation and maintenance services for medium-wave stations which, despite having ever-fewer listeners, still need operation and maintenance.

- TV O&M: operation and maintenance services for our customers’ TV networks.

- FM O&M: operation and maintenance services for FM broadcasters owning their own equipment and who have the relevant permit.

Broadcast transport

This family includes all transport services necessary for providing broadcast services as well as transport services sold to broadcasters.

- Satellite broadcast transport: DVB-S2 full-mux broadcast services, SAT DTT channel broadcast, satellite TV broadcast, satellite radio broadcast and use of the teleport to provide satellite transport in the broadcast environment.

- Terrestrial transport and fibre-optic broadcast: services for the contribution and broadcast of audiovisual services or transport services for broadcasters such as terrestrial audiovisual transport, fibre-optic audiovisual transport, video contributions and audio encoding.

Internet media

Cellnex Telecom provides services that use the Internet as a communication channel to transmit audiovisual content.

- CDN: traffic and storage of Internet Content Distribution Network (CDN).

- Online Video Solutions (OVS): solutions adapted to the needs of diverse clients that require video management.

- HbbTV services: Interactive application services are provided using the HbbTV interactivity standard, such as: videos on demand, start over, metrics, audiences or advertising.

- OTT payment platform: Platform to develop multi-screen cloud services for payment operators or major broadcasters.

- CAS Cloud: conditional access service for a remote management platform, which generates the data needed for the operation of CAS without the need for the end customer to have their own complete platform.

Engineering and consulting

Thanks to its experience in the broadcast environment, Cellnex has the capability to carry out consulting work at national and international level relating to broadcast services.

Milestones for 2017

Throughout 2017 a number of Ultra High-Definition pilot trials were carried out, through collaborative projects such as:

- Broadcasting of the UHD DTT test channel from Torrespaña (Madrid), Valencina (Seville) and Collserola (Barcelona).

- Broadcast of the documentary series "Spanish World Heritage Cities": Segovia. Joint project with RTVE.

- Demonstrations during the Mobile World Congress on DTT broadcast in UHD.

- Broadcast of the final of the Champions League live in 4K. Joint project with Antena 3.

- Changing of the Royal Guard broadcast live in UHD: 4K and HDR. Joint project with RTVE.

- Demonstrations at the 4K Summit in Málaga. Broadcast of three UHD-HDR services statistically multiplexed on one DTT transmitter.

- Incorporation of the centre of Mijas in trial broadcasts in UHD over DTT to cover the city of Málaga.

Cellnex has also carried out various pilot tests in the field of Hybrid DTT using the HbbTV interactivity standard.

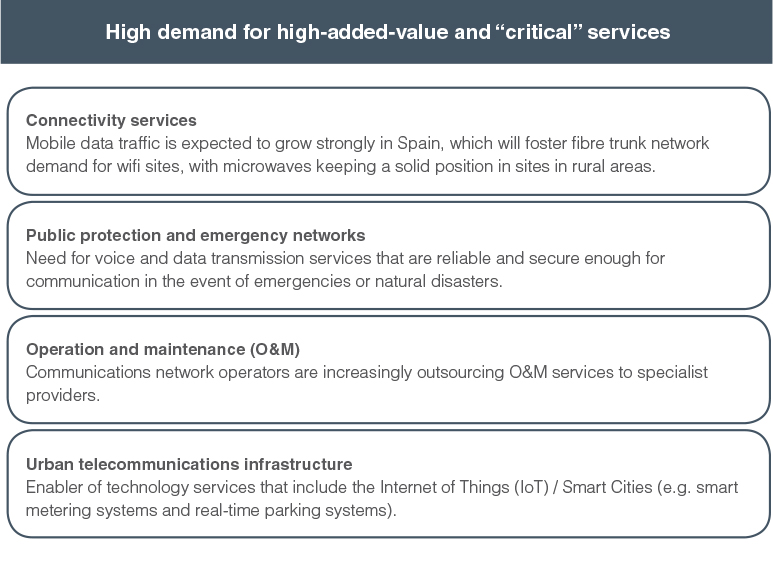

Other network services

In Cellnex, the "smart" concept means sharing, efficiency, security, resilience and ubiquitous connectivity. Cellnex provides the infrastructure required develop a connected society by providing the following network services: data transport, security and control, Smart communication networks including IoT, Smart services and managed services and consulting.

As an infrastructure operator, Cellnex can facilitate, streamline and accelerate the deployment of these services through efficient connectivity of objects and people, in both rural and urban environments, helping to build genuine Smart territories.

The network and other services activity is a specialised business that creates value through innovative solutions and stable financial flows, with attractive growth potential. Given the critical nature of these services, customers of this business require in-depth technical know-how and demanding service-level agreements.

The connectivity of objects is set to grow very significantly in the near future. The Internet of Things (IoT) network is based on a model that connects physical objects and keeps them integrated in a network. The alliance between Cellnex Telecom and IoT network provider Sigfox is evidence of the Group's commitment to developing this technology both today and in the near future. In this regard, Cellnex's position as the majority global operator of IoT has become consolidated with more than one million objects connected in Spain's largest network dedicated to the Internet of Things.

This activity will continue to grow in the security market through our main customer in the home, people and vehicles sector. In addition to this, most development is occurring in the water metering and smart city services markets.

Main services offered

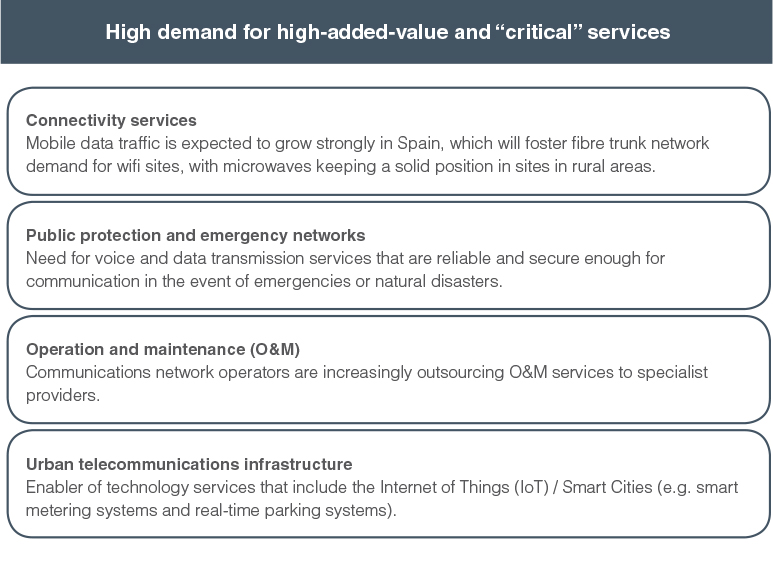

Connectivity services

Cellnex offers all the transport services needed to provide connectivity services to operators and the Public Applications and Corporations market. Cellnex provides two types of connectivity services: connecting companies or telecommunications operators and providing back-haul services to towers with fibre or radio links, where there is high redundancy.

- Satellite connectivity: a range of services to provided satellite connectivity in the Operators and APC market including VSAT and satellite point-to-point circuits.

- Terrestrial and fibre-optic connectivity: connectivity services using the terrestrial transport network, such as dark fibre, Franck circuits, digital links, urban circuits, Amazon Direct Connect and Internet flow.

Public protection and emergency networks

Cellnex Telecom specialises in the design, rollout, operation and maintenance of critical service networks serving security and emergency forces. Main services offered:

- Maritime security: in the field of maritime security, we provide safety of life at sea and rescue services, vessel identification and maritime traffic services.

- Public Protection and Disaster Relief (PPDR) networks and services: a wide range of security and emergency network products and services, comprising the following commercial offerings: TETRA networks, DOTS, terminals and accessories, local networks, OTR3S, AIRS and control centres.

Operation and maintenance and other services

Cellnex Telecom provides operation and maintenance (O&M) services that include preventive and corrective maintenance of networks and infrastructures, monitoring reports and resource management for optimising incident management.

- O&M: this product includes the provision of all operation and maintenance services for telecommunications networks to telecommunications operators and public administrations.

- Co-location of other services: a service consisting of renting space rental and supplying mains power for equipment to APC market customers who do not have a telecommunications operating licence.

- Engineering and consulting: all consulting services provided to customers in the operators and APC market.

Smart telecommunications infrastructure

Cellnex provides communications networks for Smart cities and specific solutions for efficient management of resources and services in cities. Cellnex considers that its infrastructure has unique locations to take advantage of the growth opportunities entailed by the appearance of Smart cities and IoT, and offers a variety of services associated with this concept, such as:

- Smart platform: SmartBrain technology solution, which is based on a set of components and standards for data capture, processing, and exploitation, with the highest levels of security and traceability. This technology is composed of the following blocks: raw data capture and management, event management, big data and data services.

- Smart networks and services: private networks formed by various technologies used to capture, process and exploit the data. The main offerings are networks of data sensors, wifi services and coverage for offering services such as Internet access, roaming and offloading, Smart connectivity for urban areas and rural risks involved in the design, installation and maintenance of a remote irrigation management system.

- IoT: digital interconnection of people, everyday objects and systems over the Internet, based on technology provided by the French company Sigfox, has already been deployed throughout the country and now has more than 1,300 active sites, which makes it the largest dedicated IoT network in Europe. It is a low-power wider area network that solves the current problems of deploying IoT solutions, because it allows the use of devices that run on batteries for very long periods (even years) and eliminates the need to deploy a network of gateways and repeaters throughout the city, by allowing the sensor to communicate directly with the network already deployed.

Milestones for 2017

Security and control

- The Maritime Rescue Company under the Spanish Ministry of Public Works, signed the “Provision of services within the Global Maritime Distress and Safety System” for the Safety of Human Life at Sea with Cellnex Telecom on 27 September 2017. The contract will come into force in August 2018 and has an initial term of four years, renewable for a further two years, for an annual amount over EUR 7 million. It gives continuity to the service Cellnex Telecom has been providing since 2009. The company will provide the service through its network of coastal stations which allows 24/7 listening on maritime channels, all year round. The contract allows for receiving automatic alerts and distress calls, to be sent immediately to Maritime Rescue coordinators, as well as transmitting information for maritime safety and meteorological information, according to the guidelines established by Maritime Rescue and the connection between the Spanish Medical Radio Centre and any ships requesting that service. The provision of the service complies with the international conventions signed by Spain, in particular the Safety of Life at Sea (SOLAS) Convention and the International Search and Rescue Convention (SAR), which are the most important international treaties governing the safety of ships. In relation to the above, Cellnex has extensive experience managing security and emergency communications networks and services.

- The Group has been finalising the certifications relating to the extension of the TETRA network of the Catalan Railway system. In addition, a batch of spare parts has been supplied for the TETRA network mentioned above, notably the design, supply and installation to extend the coverage of the TETRA system on the Barcelona-Vallès line of the Catalan railways (FGC), on the section extending the branch line between the stations of Sabadell Plaza Mayor and the depots at Ca N'Oriach.

- Extension of the Catalonia emergency and security radiocommunications (RESCAT) network by means of two new base stations, each with twin carriers/frequencies to enhance coverage in certain areas of the territory, and the upgrade of the network to the new available technology has begun. Similarly, rollout of the project to extend the coverage of the RESCAT network in the Girona mono-bore tunnel of the AVE (Sagrera-Figueres line) has begun; the tunnel is 7,638 m long and there are also plans to offer coverage in the 13 emergency exits.

- Contract for the maintenance of the Ascó-Vandellós nuclear power plant communications and the contract for the provision of services within the global life-saving and safety system at sea. It should also be noted that the implementation of the DMR municipal network of Marbella (Andalusia) has been initiated.

Smart communications networks

- Agreement with Castellolí Parcmotor to equip the racing circuit with the necessary infrastructures and technology to enable the agents and companies working to develop the mobility of the future, advanced traffic solutions and vehicle manufacture to develop innovative products and services linked to smart mobility and connected and autonomous vehicles. The objective is to make the Castellolí Parcmotor into a benchmark environment and an innovative testing space for the development of ITS (Intelligent Transport Systems) technological solutions, particularly in the field of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications, which can subsequently be implemented in vehicles (future mobility), in towns and cities (smart cities) and on roads and motorways (smart roads).

- The first part of the contract with T-Systems for connectivity and co-location services in 32 Cellnex infrastructures has been completed and distributed throughout Spain, for the pan-European EAN (European Aviation Network) network.

- The marketing activity relating to Back-Haul and Corporate circuits with the operators is operating according to the established forecasts

GRI: 102-2, 102-6, 102-7