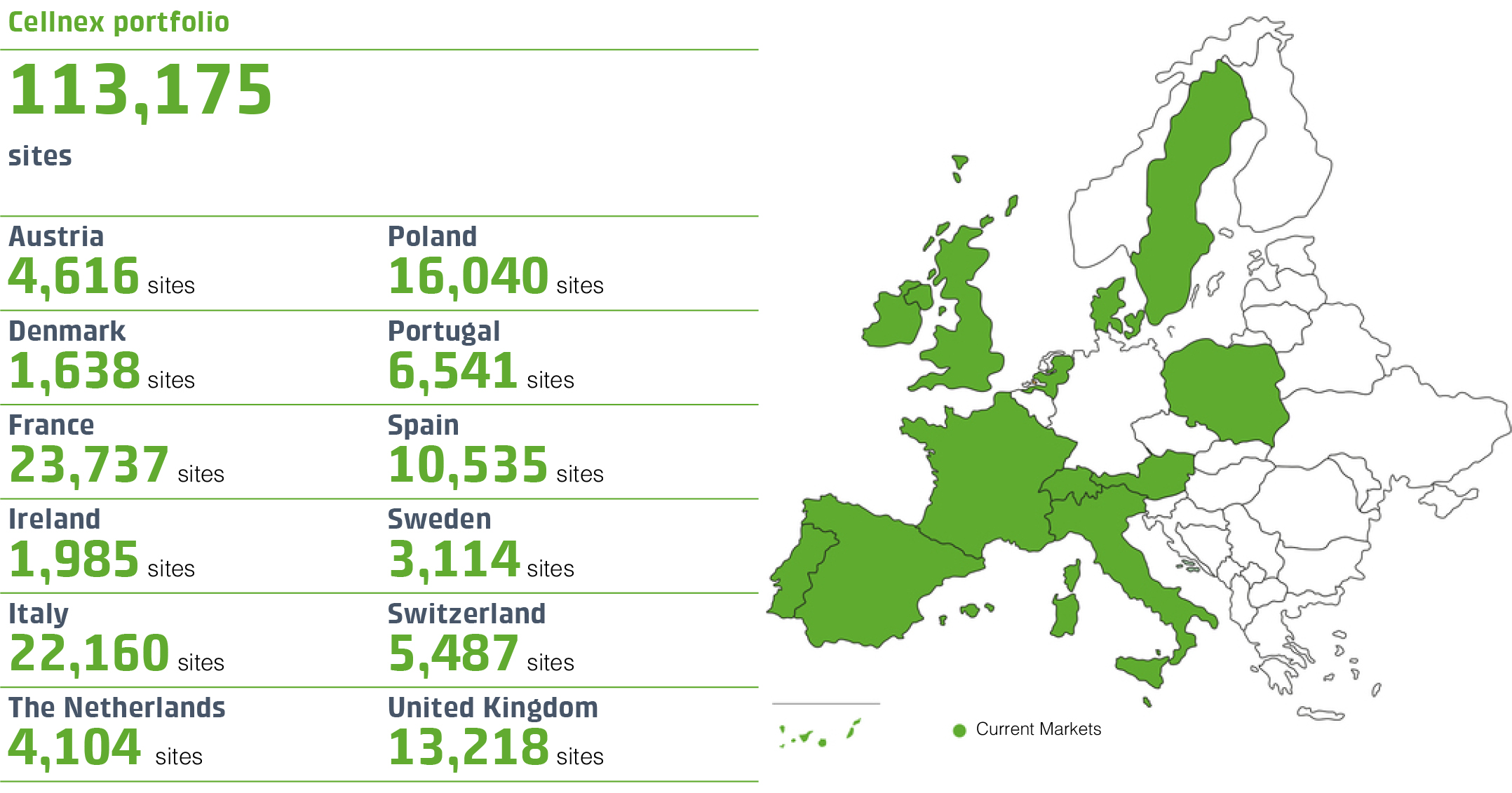

Portfolio of

113,175

sites located in 12 European countries

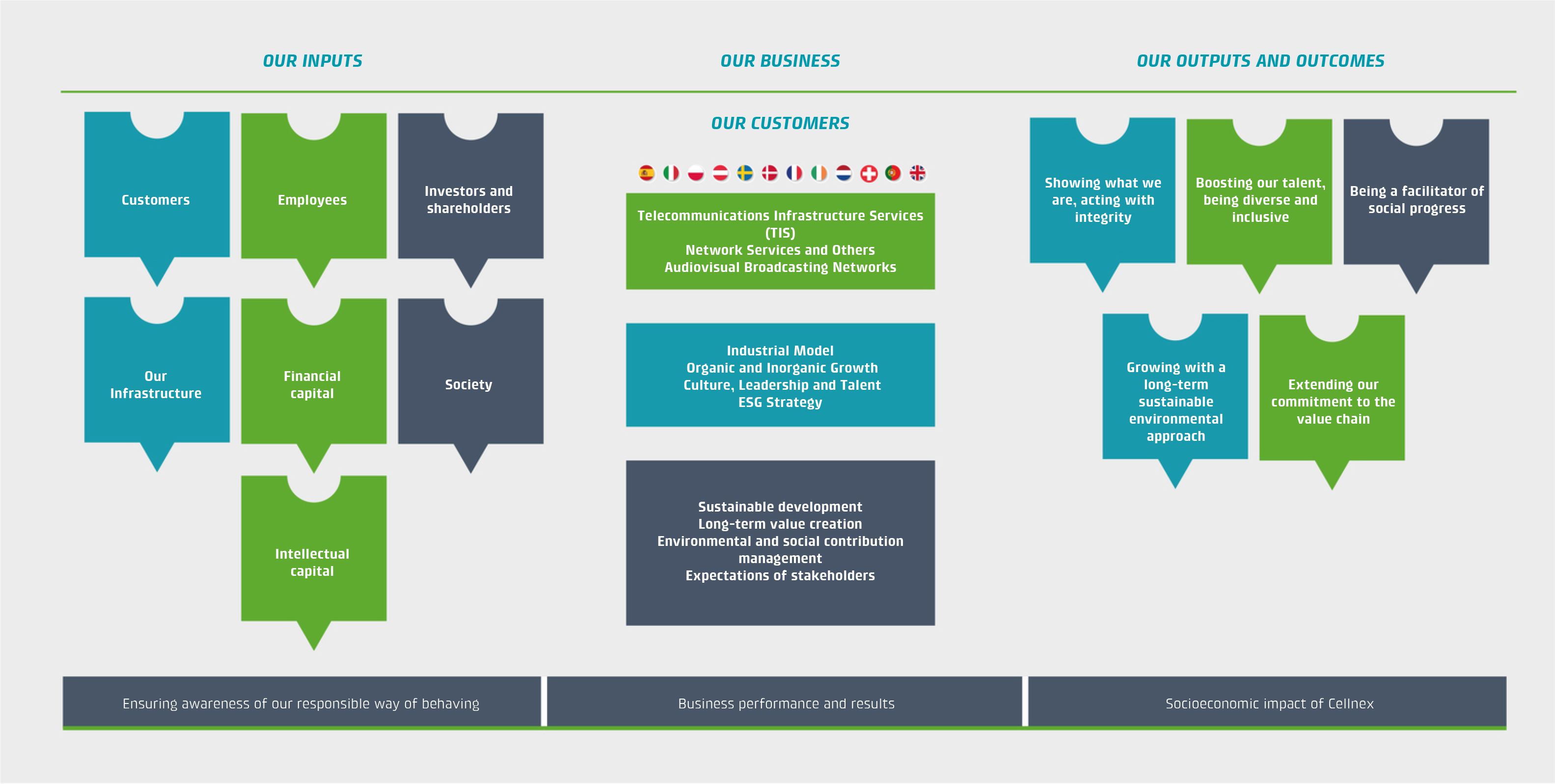

Cellnex is the main neutral[2] and independent infrastructure operator for wireless telecommunication in Europe, focused on neutral and shared management. Cellnex was established in 2015 as the result of a spin-off from the telecommunications division of Abertis Group, and from there Cellnex went public as an independent company under the name Cellnex Telecom.

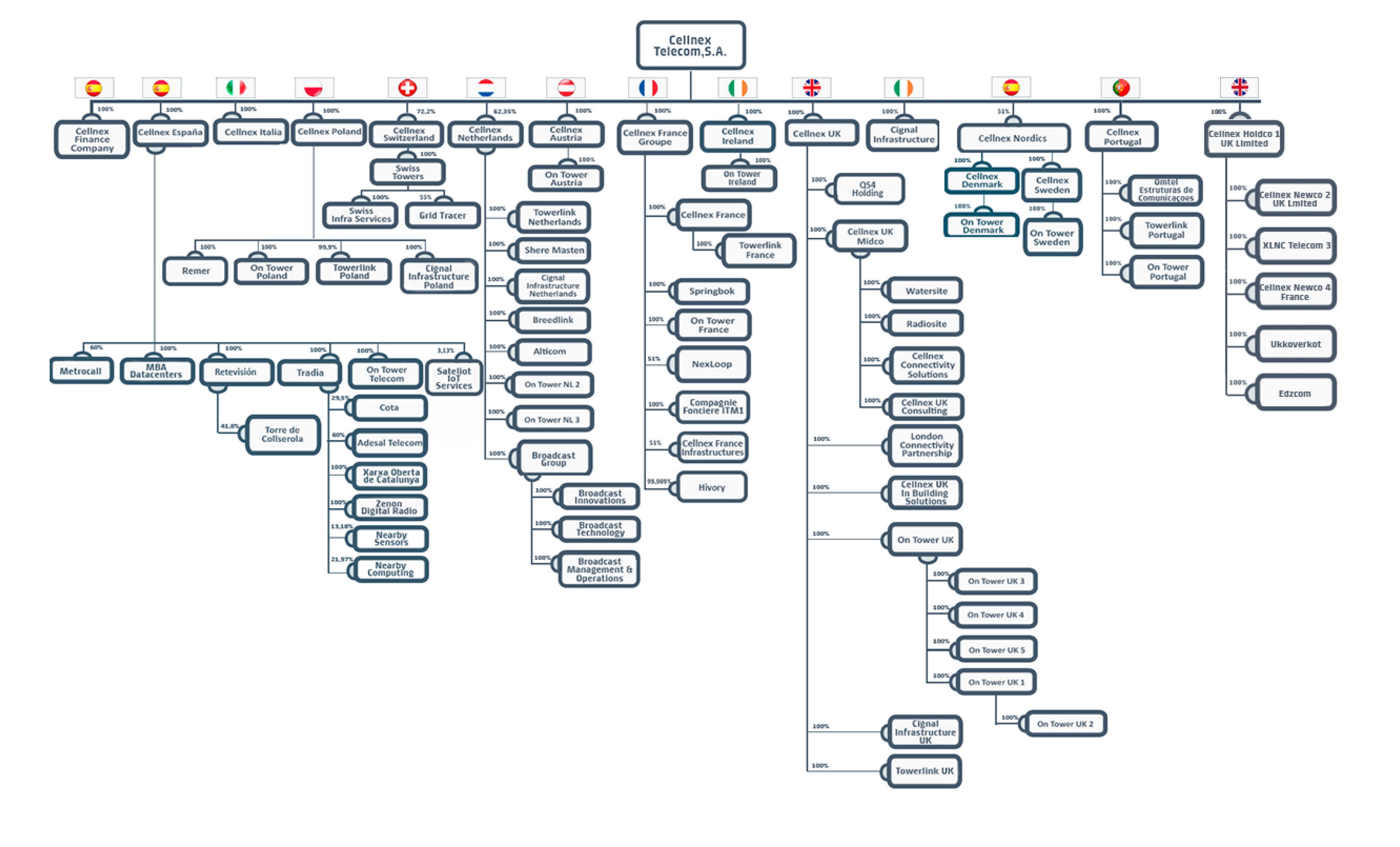

Cellnex Telecom, S.A. (a company listed on the Barcelona, Bilbao, Madrid and Valencia stock exchanges) is the parent company of a group in which it is the sole shareholder and the majority shareholder of the companies operating in the various business lines and geographical markets. Cellnex offers its customers a suite of solutions and technologies designed to ensure the conditions for reliable, top-quality transmission for the wireless dissemination of voice, data and audiovisual content. The company also delivers innovative connectivity solutions and

develops the necessary infrastructure ecosystem for the roll-out of new technologies.

Cellnex’s business model focuses on the neutral and shared management of telecommunications infrastructures while strengthening its commitment to sustainability, as Cellnex aims to keep improving in this area and extend its commitment throughout its value chain and stakeholder groups. The Company integrates Environmental, Social, and Governance (ESG) factors into its strategy, measuring and managing its impact on society and the environment in an efficient and responsible way.

Cellnex's own value creation model, focusing on the shared management of telecommunications infrastructures, fosters sustainability, efficiency and responsibility in the use of the resources with which it works. By building partnerships with its customers, Cellnex enjoys a long-term relationship with them and manages the Company with the long cycle in mind, aware of the principles of ethics, good governance, respect for human rights and dialogue with its stakeholders.

[2] Neutral and independent: without the mobile network operator holding as a shareholder (i) more than 50% of the voting rights or (ii) the right to appoint or remove a majority of the members of the Board of Directors. The loss of the Group's neutral position (i.e. by having one or more mobile network operators as a major shareholder) may make sellers of infrastructure assets reluctant to enter into new joint ventures, mergers, divestitures or other arrangements with the Group (which also affects the organic growth of the business). As the Group grows, management expects that large network operators may become open to collaborating with the Group in various ways, such as by selling their sites or other infrastructure assets to Cellnex, including in exchange for shares, which could adversely affect the Group's business and future prospects, as this type of transaction could affect the perceived neutrality of the Group.

The company is listed on the Spanish stock exchange's continuous market and is part of the selective IBEX 35 and EuroStoxx 100 indices. It is also present on the main sustainability indexes, such as CDP (Carbon Disclosure Project), Sustainalytics, FTSE4Good, and MSCI.

Cellnex’s reference shareholders include GIC, Edizione, TCI, Blackrock, CPP Investments, CriteriaCaixa and Norges Bank.

The Group's company structure is as follows:

2000

Acesa Telecom (later Abertis Telecom and now Cellnex Telecom) acquire 52% of the shares in Tradia.

2005

Abertis Telecom (now Cellnex Telecom) has the only Digital Terrestrial Television network in the whole of Spain providing coverage for 80% of the population.

2006

Abertis Telecom (now Cellnex Telecom) becomes the DTT signal operator to provide national coverage to Spanish radio stations.

2012

The company acquires 1,000 telecommunication towers from Telefónica and lays the foundations for its future position as a neutral operator.

2014

Abertis Telecom (now Cellnex Telecom) buys TowerCo, the telecommunications operator that manages the mobile telephony towers located on the Italian motorway network.

2015

Cellnex Italy reaches an agreement with WIND to acquire 90% of the capital of Galata Towers (7,377 towers).

“Ringing the bell” for Cellnex Telecom at the Madrid Stock Exchange.

Inaugural bond issuance of €600 million under the EMTN programme.

2016

Cellnex Telecom acquires Protelindo Netherlands BV and Shere Masten BV in the Netherlands and reaches an agreement with Bouygues Telecom in France and the Shere group in the United Kingdom.

CSR Master Plan 2016-2020 is approved.

Adquisition of Commscon.

2017

Cellnex Italy acquires the 10% of the Galata Towers capital that it did not yet control from WIND.

Cellnex enters the Switzerland market through the acquisition of Swiss Towers AG.

FTSE Russell adds Cellnex Telecom to the FTSE4Good Index Series.

Acquisition of Alticom and 551 towers from Masmóvil.

2018

Deutsche Telekom certified Cellnex as a “Zero Outage Supplier”.

Cellnex joined the ESG sustainability index from Sustainalytics.

First issuance of a €600 million convertible bond.

2019

Capital increase of €1.2 billion and € 2.5 billion.

An Equity, Diversity and Inclusion Policy was adopted by The Board of Directors.

Cellnex announced an agreement to acquire the telecommunications division of the English company Arqiva.

Cellnex was admitted to the MSCI Europe index.

Cellnex announced the acquisition of the Irish operator Cignal. It operates 546 sites in Ireland.

Agreement with Iliad and Salt: Cellnex acquired 10,700 sites in France, Italy and Switzerland and rolled out a “built to suit” programme for up to 4,000 new sites.

2020

Cellnex acquired OMTEL and NOS Towering in Portugal.

Cellnex joined the “A List” of companies leading the fight against climate change and was recognised as a “Supplier Engagement Leader” by CDP.

Cellnex set up a €10 million euro fund during 2020-2021 for “Cellnex’s Covid-19 Relief Initiative”.

Cellnex completed the acquisition of Arqiva’s telecommunications division in the UK.

€4 billion capital increase.

Cellnex reached an agreement with Iliad to acquire the network of c.7,000 Play sites in Poland.

Cellnex reached an agreement to add about 25,000 CK Hutchison sites to its portfolio (Italy, UK, Ireland, Austria, Sweden and Denmark).

Saint Malo/Nexloop agreement with Bouygues to deploy fibre-to-the-tower in France.

6 bond issuances and a tap of an existing bond amounting to €4 billion, including a €1.5 billion convertible bond.

2021

Appointment of Bertrand Kan as the new non-executive Chairman of Cellnex.

Closing of the acquisition of several of the CK Hutchison’s assets.

Acquisition of Hivory with a portfolio of 10,500 sites in France.

Agreement with Deutsche Telekom to integrate the 3,150 T-Mobile Infra BV sites in the Netherlands.

Renewal for the fourth consecutive year of Cellnex’s certification by Deutsche Telekom as a “Zero Outage Supplier” in Spain.

€7 billion capital increase to finance Cellnex’s growth.

8 bond issuances amounting to €6 billion, including an inaugural issuance in the US dollar market.

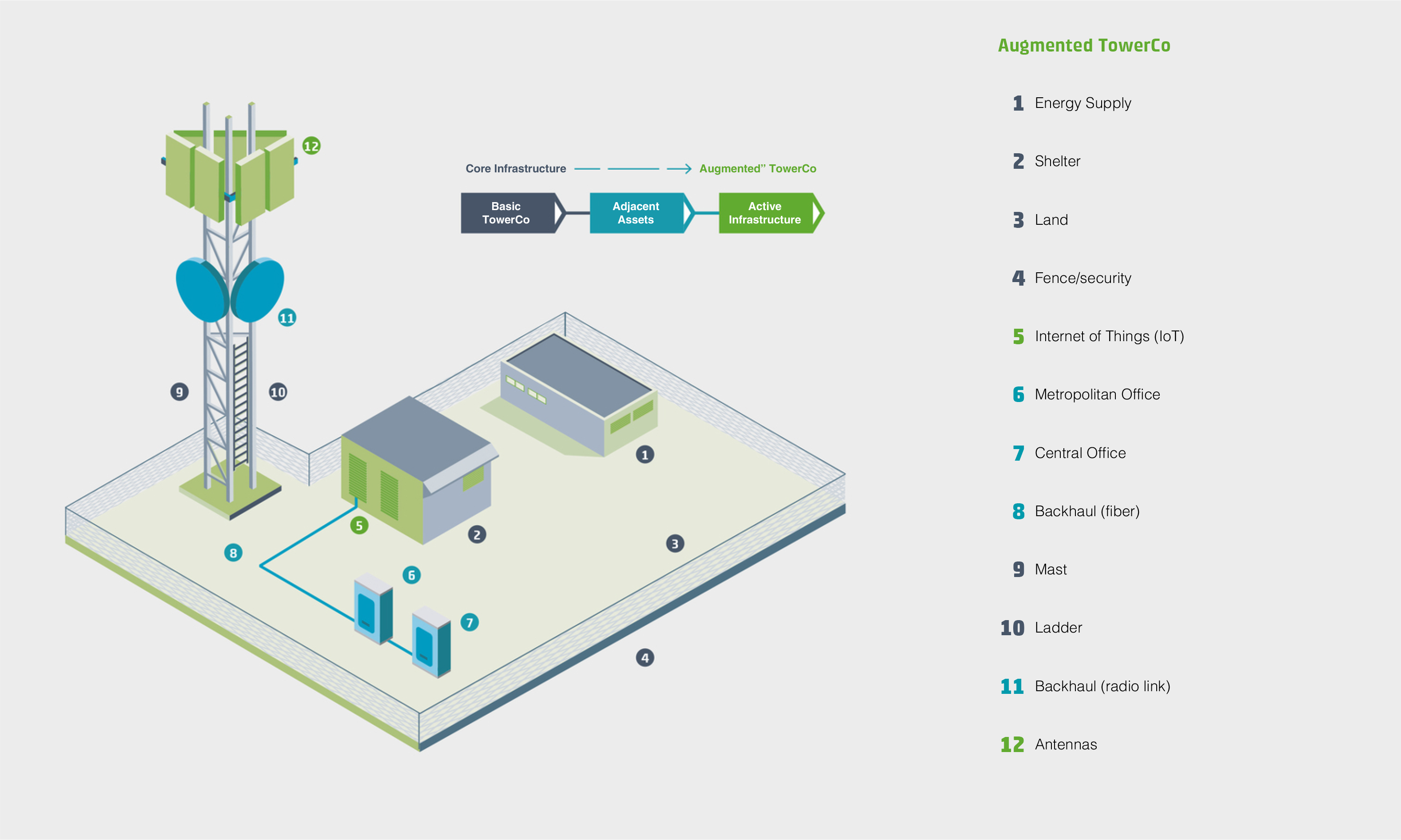

Acquisition of Polkomtel lnfrastruktura in Poland. Presentation of the Augmented TowerCo model..

Approval of Cellnex’s emission reduction targets by the Science Based Targets (SBTi) initiative.

Launch of the first acceleration programme for social impact start-ups by the Cellnex Foundation.

2022

Cellnex is included in the Bloomberg Gender-Equality Index for its commitment to equity, diversity and inclusion.

Cellnex is recognized by CDP as “Supplier Engagement Leader 2021”.

Cellnex successfully completes the pricing of a bond issue for a total amount of €1 billion.

Cellnex among the five leading global telecommunications companies in sustainability.

Cellnex acquires the British connectivity provider Herbert In-Building Wireless.

Cellnex partners with Paris La Défense to develop a 5G mmWave pilot in the financial district of the French capital.

Cellnex reaches an agreement with WIG for the sale of nearly 1,100 sites to the British infrastructure operator, as part of the closing of the transaction with CK Hutchison in the United Kingdom.

Cellnex completes its acquisition of CK Hutchison's telecommunications tower assets in the United Kingdom.

Cellnex successfully completes the pilot programme to test and validate the use of aluminium-air batteries as backup power at its sites.

Cellnex receives an award from the Catalan Association of Accounting and Management (ACCID) for best practices in financial reporting.

CDP recognises Cellnex for its commitment to tackling climate change, securing a place on the prestigious CDP ‘A List’.

Cellnex France Groupe, Bouygues Telecom and Phoenix France Infrastructures reach agreements to dispose of approximately 3,200 sites in France in very dense areas, subject to FCA approval, to meet closing requirements for Hivory.

2023

Appointment of Marco Patuano as CEO, Raimon Trias as CFO, Vincent Cuvillier as CSO, Simone Battiferri, as COO, and Anne Bouverot as Non-Executive Chairperson.

RTVE awards Cellnex broadcasting rights for its radio and television signals for the next five years.

Cellnex becomes a member of the Bloomberg Gender Equality Index for the second consecutive year.

S&P Global includes Cellnex in its "Sustainability Yearbook" for the first time.

Cellnex unveils its “Augmented Towerco” industrial model at the Mobile World Congress.

Cellnex’s 5G Catalunya project receives the "GSMA Foundry Excellence Award”.

Cellnex is recognised by CDP as a "Supplier Engagement Leader" for the second consecutive year.

Cellnex participates in the CRETA project to promote sustainable mobility and reduce traffic emissions.

AENA and Cellnex bring 5G technology to San Sebastian airport.

IBETEC awards Cellnex broadcasting rights for its radio and television signals for the next four years.

The EIB and Cellnex sign a 315 million loan to support the roll-out of 5G infrastructure and the digital transition in Europe.

Boldyn acquires the private networks business unit from Cellnex.

Stonepeak finalises the acquisition of 49% of Cellnex Nordics.

Cellnex joins the Dow Jones European Sustainability Index (DJSI Europe).

The Cellnex Group achieved many Milestones during 2023:

January 10: Three UK joins the connectivity project that Cellnex UK is rolling out on the Brighton Mainline railway line linking London and Brighton in the UK.

January 11: Tobias Martinez tenders his resignation as CEO of the company. He will step down as CEO after the Group Shareholders' Meeting scheduled for June 2023.

January 12: Vapor IO expands its Edge Computing network into Europe via Cellnex.

January 16: Cellnex provides internal mobile connectivity at The Social Hub facilities in the Netherlands and Austria.

January 18: RTVE awards Cellnex broadcasting rights for its radio and television signals for the next five years.

January 19: Cellnex and Nokia to roll out the 5G network at ADIF logistics centres.

January 24: Cellnex approved for the sixth consecutive year as DT's “Zero Outage Supplier".

January 31: Cellnex becomes a member of the Bloomberg Gender Equality Index for the second consecutive year.

February 3: Cellnex tests 5G Broadcast emissions at ISE and MWC.

February 7: S&P Global includes Cellnex in its "Sustainability Yearbook" for the first time.

February 8: Cellnex and Dublin City University (DCU) partner to create Ireland's first 5G “Smart Campus".

February 14: Cellnex installs a DAS at El Sadar stadium (CA Osasuna, Spain) for the roll-out of 5G technology.

February 27: Cellnex unveils its “Augmented Towerco” industrial model at the Mobile World Congress in Barcelona. The 5G Catalunya project, led by Cellnex, receives the "GSMA Foundry Excellence Award”. Cellnex concludes an agreement with the Principality of Asturias to implement IoT pilot projects in rural Asturias.

March 15: Cellnex is recognised by CDP as a "Supplier Engagement Leader"; for the second consecutive year.

March 27: The Board appoints Anne Bouverot as Non-Executive Chairperson of Cellnex.

April 4: Bertrand Kan and Peter Shore leave the Cellnex Board after eight years.

April 26: The Board appoints Jonathan Amouyal as a new proprietary director – on behalf of TCI – and Maite Ballester as the new independent director of the company.

April 28: Cellnex announces the appointment of Marco Patuano as the new CEO.

May 16: Cellnex participates in the CRETA project to promote sustainable mobility and reduce traffic emissions.

May 23: Airbus and Cellnex strengthen their collaboration on mission-critical communications

June 1: Cellnex's Shareholders' Meeting ratifies Marco Patuano as CEO.

June 8: Cellnex improves its rating in the Sustainalytics ESG Risk Rating.

June 14: AENA and Cellnex bring 5G technology to San Sebastian airport.

June 30: Cellnex now controls 100% of OnTower Poland.

July 5: IBETEC awards Cellnex broadcasting rights for its radio and television signals for the next four years.

July 19: The Cellnex Foundation incorporates five new social impact startups into its acceleration programme.

July 24: The EIB and Cellnex sign a 315 million loan to support the roll-out of 5G infrastructure and the digital transition in Europe.

July 28: Cellnex concludes the placement of €1 billion in new convertible bonds maturing in 2030 and announces the concurrent repurchase of approximately €787.6 million in convertible bonds currently in circulation and maturing in 2026.

August 8: FTSE Russell confirms Cellnex's ESG rating.

September 6: Cellnex sells 2,353 sites in France.

September 29: Cellnex unveils its new organisational structure. Stonepeak acquires a 49% stake in Cellnex subsidiaries in Sweden and Denmark for approximately €730 million.

October 10: Cellnex obtains the highest ESG score in the GRESB ranking.

October 23: Cellnex appoints Raimon Trias as new CFO.

November 10: Boldyn acquires the private networks business unit from Cellnex

November 30: Stonepeak finalises the acquisition of 49% of Cellnex Nordics.

December 11: Cellnex joins the Dow Jones European Sustainability Index (DJSI Europe).

December 12: USP and Cellnex sign an agreement to deploy 5G antennas in news kiosks.

The focus of operations revolves around developing infrastructures and networks to provide services to clients. This entails ensuring not only the rolling out of new infrastructures and networks, but also the maintenance and assurance of existing ones.

Cellnex currently has the following infrastructures and networks in operation:

To achieve this objective, operations are organised around the management of landlords in locations, the infrastructures, and networks.

The Site Management area oversees the entire life cycle of landlords and locations, including:

The Technical Operations department manages the entire life cycle of infrastructures and networks:

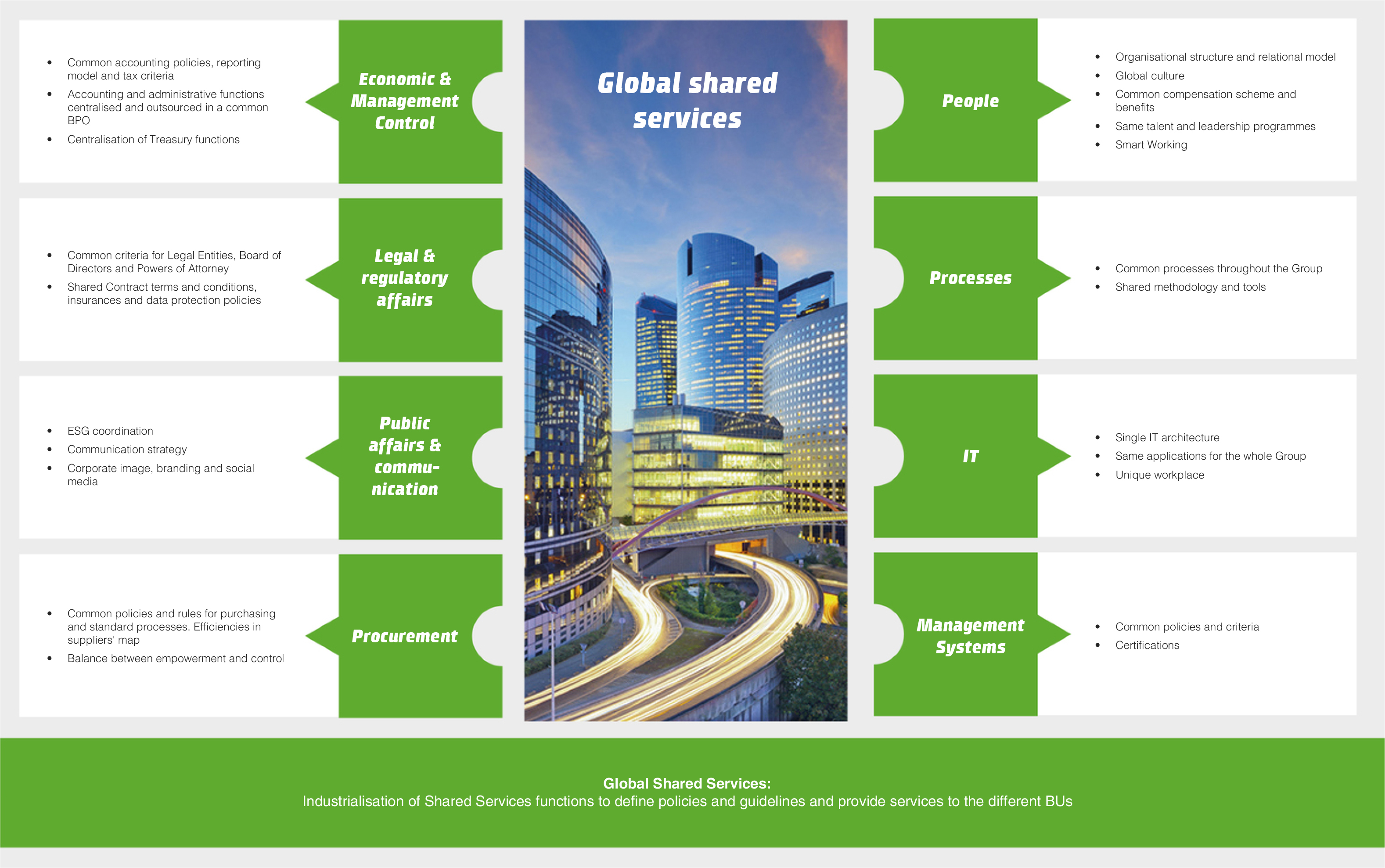

A common operational model has been developed at Cellnex to leverage synergies and scale economies, facilitating the acceleration of continuous improvement, sharing of best practices, etc. Throughout 2023, efforts have been focused on the implementation and development of the operational model alongside regular business activities.

In 2023, progress was made in integrating operations across countries with the integration of operations in France and Poland. This integration will enable continued improvement in operational performance in the construction and assurance of infrastructures and networks in 2024.

Additionally, in 2023 the implementation of TIS (Telecom Infrastructure Sharing) operations IT tools was completed in the UK, Italy, Switzerland, Portugal, Sweden, Denmark and partially in France. The goal is to undertake this implementation in the remaining countries over the course of 2024.

A project has been initiated to enhance effectiveness and efficiency in managing relationships with landlords through the digitalisation of processes related to customer service, contracting and billing. The aim of this project is to make interactions with them more agile.

Progress continues in deploying physical access systems to sites with electronic locks, mostly battery-free. Currently, more than 43,000 sites have implemented Smart Access.

Furthermore, Cellnex’s Digital Twin pilot project has been advancing, with over 3,000 sites characterised in the digital twin platform (BIM) through modelling based on documentation, blueprints, drone captures, laser sensors, etc.

Activity

During 2023, operations experienced a very high level of activity.

Cellnex has the necessary levers to guarantee the expected response to the business strategy and provide the necessary capacities to support growth and business transformation. To this end, Cellnex has developed a series of projects associated with the definition of the industrial model of a company function and/or a specific pillar of the function, such as Agora, Billing Industrial Model, Process Design, People IT Map and Active Network.

During this phase of the company, the Industrial Model prioritises process efficiency, meaning that the primary focus of current projects revolves around this objective.

Agora is the technological support (IT tool) for the Industrial Model of Operations for the TIS Business Line. Agora supports the following Operations features:

Agora's objective is to facilitate the use of the Cellnex Industrial Model in these areas with a system that is:

Based on the analysis of the billing model for customers performed in 2022, the work was carried out throughout 2023 with the goal of defining the Objective Billing Model for it to be scalable to the whole group.

This phase of the project was also led by the Global Commercial team, with the support of the Operations, Finance and IT Services, and Organisation and Processes teams to obtain an end-to-end vision of the model.

The new model will implement transformative initiatives:

Definition and implementation of a strategy prioritising initiatives to achieve three main benefits:

In 2023, an analysis was made of how Cellnex designs and shares the definition of the processes. As a result of this study, Software AG's Aris was selected as the tool to support this and help the company improve this activity. During the last quarter of 2023, the entire Cellnex Process Map was migrated, and a communication campaign will be launched to all Cellnex employees, encouraging them to share the news. A plan will be determined in 2024, with the participation of all Cellnex countries, with the aim of also deploying this tool for country specific procedures.

During 2023, the People team worked on reviewing and defining, where necessary, all relevant People policies and processes with the target of establishing clear ways of working, responsibilities and processes, and to ensure that all Cellnex countries apply similar criteria, if not otherwise required by law. In parallel and in order to support those processes, Cellnex selected SAP Success Factors as the global People tool. In 2023, Cellnex started the definition and implementation of the main module that will support the company's organisational information as well as the main employee information, necessary to launch all people processes. This tool will be rolled out in all Cellnex countries in 2024. In 2023, Cellnex also defined a roadmap for the implementation of a new tool that encompasses People's main functionalities and improves upon these processes in new phases of the project.

With the integration of Polkomtel Infrastruktura in Poland, in addition to the purchase of the passive infrastructure, Cellnex has also acquired the Radio Access and Transmission network. As this is the first purchase of this type of infrastructure, Cellnex Poland, with the collaboration of the Corporate teams, is working on the definition of the Active Network Model. In addition, the development of this model aims to be the basis of the Cellnex Industrial Model in potentially future countries where this line of activity can be developed.

Cellnex’s operations have grown exponentially in recent years. A product of this growth has been the expansion of its European presence, increasing operational complexity and widening the scope of products and services offered by the company. With the Group’s main offices in Spain, this growth has resulted in Cellnex's footprint encompassing a total of 12 European countries (Austria, Denmark, France, Ireland, Italy, the Netherlands, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom). This geographical footprint caters to Cellnex’s goal of driving digitalisation and creating a pan-European telecommunications infrastructure platform.

Cellnex has a portfolio of 113,175 sites, which rises to 127,489 if the sites are included in the process of completion or with planned roll-outs up to 2030. The resulting total number of sites built or acquired by Cellnex, as on 31 December 2023, is as follows:

Cellnex Austria joined the Group in 2020, as a result of the agreement between Cellnex Group and CK Hutchison. Since its entrance into the Austrian market, Cellnex has become the main independent operator of telecommunication towers in the country. Cellnex Austria operates more than 4,616telecommunication sites located in urban, peripheral and rural areas throughout Austria. Notably, several dozen Cellnex sites have been deployed to provide mobile coverage to isolated rural towns in areas previously considered dead spots. All of this has been achieved by Cellnex Austria's employees, a team that has years of experience in the sector and provides efficient and quality solutions to customers.

Cellnex Denmark owns 1,638 sites throughout Denmark, serving telecommunications operators and technology companies through state-of-the-art telecommunications infrastructure. Cellnex Denmark has been part of the Group since 2020. At the forefront of these efforts is a proactive team of professionals with extensive experience in telecommunications, committed to providing telecommunications infrastructure services for the benefit of all interested parties.

In the second half of 2023, Cellnex completed the divestment of a 49% interest in its subsidiaries Cellnex Sweden and Cellnex Denmark to Stonepeak in exchange for approximately €730Mn. The Group will continue to manage and consolidate these operations. For further details please see Note 2 (changes in the scope of consolidation perimeter) of the accompanying Consolidated Financial Statements.

Cellnex in France was founded in July 2016 as part of an initial agreement to purchase more than 500 telecommunication sites from Bouygues Telecom. Cellnex France Group, which in turn is part of the Cellnex Group, is made up of seven companies: Cellnex France, On Tower France, Nexloop France, Springbok Mobility, ITM 1, Hivory and Cellnex France Infrastructure. The vast majority of the sites are located in quality locations in densely populated areas, an ideal situation for the future deployment of 5G. On Tower France, founded in December 2019, currently manages more than 9,000 sites throughout France. Nexloop France was created in May 2020 under a strategic partnership between Bouygues and the Cellnex France Group. Nexloop designs, implements, owns, manages, operates and maintains fibre optic infrastructure networks and numerous regional collection sites, as well as marketing services related to these activities. Springbok Mobility, a 100% subsidiary of the Group since 2019, develops and operates dedicated indoor infrastructures for companies and real estate businesses, in existing or planned buildings, under its Mobile Inside global service contract, which is based on ensuring that buildings are 100% connected. Hivory, a recent 2021 acquisition from Altice France and Starlight Holdco, manages the 11,000 sites that principally serve the French mobile phone operator SFR. In total, Cellnex France Group manages 23,737 sites. France is the only country where Cellnex has three anchor clients (Bouygues, Iliad and SFR) with which it is deploying build-to-suit programmes.

Moreover, Cellnex executed the disposal of 2,353 sites in France to Phoenix Tower International (PTI) and to a joint venture of PTI and Bouygues Telecom. These transactions were made in compliance with the agreements that were reached in accordance with the remedies established by the French Competition Authority, following Cellnex’s acquisition of Hivory in 2021. The Group has received approximately €631 million from the sale of these assets. Following this execution, Cellnex expects to transfer an additional c.870 remaining sites, to be concluded by 2024.

Furthermore, Cellnex reinforced its partnership with Altice through an additional agreement to deploy to new 1,800 PoPs on existing and new sites for SFR. There is an associated long-term service provision contract for a 20-year period from the starting date of each new PoPs and all-or-nothing renewal, and the total investment over a 6-year period is expected to be of up to EUR 275 million.

Cellnex also reached an agreement with Bouygues Telecom to extend the fibre-to-the-tower project roll-out initiated in 2020 through Nexloop, extending the service provision contract until 2050, extendible for successive additional periods of 5 years (2050+5+5). This new agreement also includes building up to 65 new metropolitan offices designed to house data processing centres (Edge Computing). The associated investment over a 6-year period amounts to up to €275 million.

Cellnex Ireland’s portfolio of sites consists of more than 1,985 sites located throughout the country, including the CK Hutchison sites, for which an agreement was reached in 2020. Cellnex Ireland is focusing primarily on the development and management of fibre infrastructure and tower sites to meet the requirements of the wireless communications industry. Furthermore, Cellnex Ireland is committed to providing the necessary infrastructure to support the improvement and availability of high-speed wireless broadband in rural areas and to help mobile operators address coverage in said communities.

Cellnex Italy has been operating since 2014 and was the group’s first international market outside Spain. Cellnex manages a complex and far-reaching network of high strategic value for mobile telecommunications, as well as for the development of current ultra-fast mobile 4-4.5G networks and new 5G technology, which covers the whole of Italy with a total of over 22,160 sites. Cellnex Italy provides multiple services in multi-operator mode, a key concept for the development of wireless networks and services, in order to optimise investments and ensure a more rational and efficient use both in terms of operations and the environmental impact of the existing and future network.

Cellnex Netherlands' infrastructure is managed by a capable team of professionals with years of experience within the telecommunications, broadcasting and data centre sectors. Its main offices are located in Utrecht. Cellnex’s telecommunications infrastructure in the Netherlands consists of antenna masts, rooftops, broadcasting towers and networks, data centres, DAS and Private Network installations, and advertising masts strategically located in both urban and rural areas. Cellnex Netherlands joined the company in 2016 following the acquisitions of Protelindo Netherlands BV (in 2016), Shere Masten BV (in 2016), Alticom BV and Breedlink BV (in 2017), On Tower Netherlands BV (in 2019), Cignal Infrastructure Netherlands BV (originally T-Mobile Infra BV) (integrated in 2021), Media Gateway (purchased in 2021), and The Broadcast Group BV (in 2023). Cellnex Netherlands manages 4,104 sites, 35 data centres and more than 700 radio broadcasting transmitters.

In July 2023, Cellnex executed its option to buy the remaining 30 percent stake in On Tower Poland for EUR 512 million (PLN 2.27 billion) from the Iliad Group, owner of Play, and already has 100 per cent in On Tower Poland.

In the first half of 2023, Cellnex and Iliad Purple entered into an agreement under which Cellnex (through Cellnex Poland, of which Cellnex owns 100%) acquired an additional 30% interest in the share capital of On Tower Poland Sp. z o.o. ("On Tower Poland") from Iliad Purple for an amount of approximately PLN 2,273 million (with a Euro value of €512 million as of the date of completion), exclusive of taxes. Following this acquisition, Cellnex Poland held 100% of On Tower Poland as of 30 June 2023. Thus, the indirect stake that Cellnex held in On Tower Poland increased from 70% to 100% on 30 June 2023. Cellnex Poland manage 16,040 sites.

Cellnex Portugal joined the group in 2020, comprising Omtel (Omtel, Estruturas de Comunicações, S.A.), On Tower Portugal (On Tower Portugal, S.A.), Towerlink (Towerlink Portugal, S.A.), Infratower (Infratower, S.A.), Cignal Infrastructure, and Hivory Portugal. Through Omtel, On Tower and Infratower, Cellnex owns approximately 6,541 telecommunication sites across urban, suburban, and rural areas in mainland Portugal and the islands of Madeira and the Azores. The integration of Hivory and Infratower into Omtel in December 2023 aims to optimise synergies, simplify the corporate structure and adopt faster and more efficient governance mechanisms, thereby making the incorporated company more solid, competitive and responsive to the challenges of the present and the future. In December 2023, Cellnex Portugal concluded a five-year contract with SIRESP, S.A., providing operations and maintenance services for passive infrastructures supporting the SIRESP network (the Integrated System for Emergency and Safety Networks of Portugal). The awarding of this contract represents another crucial development in the growth story of Cellnex in Portugal, emphasising the company's responsibility, demand and professionalism in managing critical infrastructures. Portugal remains a strategic market for the development of the Cellnex Group.

The Group's central offices are in Spain and the activity undertaken in that country is carried out by the company Cellnex Spain. Cellnex Spain has an extensive telecommunications vast network in Spain that encompasses by 10,535 operational sites. This extensive network of sites has a broad geographical reach and enables Cellnex Spain to offer services to different types of customers, ranging from mobile operators and broadcasters to administrations, among others. Cellnex Spain, as a neutral operator, offers services to three customer segments: (i) Operators, (ii) Broadcasters and (iii) Public Administrations and Large Companies. (i) With regards to the Operators, the company mainly provides collocation of base stations and connectivity (data transmission). It boasts a high degree of efficiency in the deployment of networks, a high degree of continuity in their locations and is strategically positioned within the Development Area of 5G networks. (ii) Public and private broadcasters entrust the distribution and broadcast of their signal to Cellnex. (iii) Cellnex Spain provides services to state, regional and local public administrations, as well as large companies to provide them with network services such as Mission Critical Private Networks (PPDR, Public Protection and Catastrophe Response) and Critical Business Private Networks, among others.

Lastly, regarding projects with European NextGen funds, Cellnex has participated in the Unique 5G sectoral, Unique 5G backhaul and Unique 5G active rural networks programmes, both directly and indirectly, supporting its customers (Operators and Large Enterprises). The aim is to achieve operational excellence in delivering services to customers.

Cellnex has been operating in the Swedish market since 2021, following the acquisition of CK Hutchison’s assets and the consequent incorporation of On Tower Sweden. Cellnex Sweden has more than 3,114 sites throughout the country and includes everything from 72-metre towers to distributed antenna systems for mobile and other networks. This enables the company to offer operators extremely cost-effective and environmentally-friendly installations. Cellnex Sweden provides a full range of services, including the deployment and optimisation of sites and installation services, and site operation and maintenance. Cellnex Sweden is an infrastructure colocation partner of the main Swedish wireless operators. The company provides secure and well-maintained sites for mobile, broadcast, IoT, Wi-Fi and fibre operators.

Additionally, as stated above, Cellnex has completed the divestment of a 49% interest in the operation to Stonepeak.

Cellnex is the leading independent and neutral telecommunications infrastructure and services operator in Switzerland. Led by a team of industry experts, Cellnex Switzerland manages a broad network of 5,487 telecommunications sites across the country. Cellnex Switzerland is made up of the companies Swiss Towers AG and Swiss Infra Services SA. Swiss Towers AG was acquired in 2017 by integrating the infrastructure of Sunrise Communications AG. In 2019, Swiss Infra Services SA was created by taking over the infrastructure of Salt Mobile (90%). In the first half of 2019, the Group entered into a long-term industrial alliance with Matterhorn Telecom Holding SA by virtue of which Swiss Towers AG purchased 90% of the share capital of Swiss Infra SA. In the first quarter of 2021, Cellnex (through Cellnex Switzerland AG), entered into an agreement with Matterhorn Telecom Holding SA to acquire 10% of the share capital of Swiss Infra Services SA from Matterhorn. Pursuant to this acquisition, Swiss Towers AG held 100% of Swiss Infra SA as of 31 December 2021.

Cellnex UK has over 13,218 sites and has access to hundreds of thousands of street-level assets essential for outdoor Small Cells and 5G deployments in dense urban areas. Responsible for leading Cellnex's business in the UK, the Management Team is committed to developing collaborative partnerships with customers, portfolio partners and stakeholders across the industry, driving innovation and growth and creating value for everyone in today's connected world.

In 2023, Cellnex UK focused on its core TIS (Tower Installation Services) business as well as its Small Cells and In-Building solutions offering, following a period of heavy M&A activity from 2020 to 2022. Throughout 2023, the UK team delivered a total of 2,100 upgrade projects and 240 new PoPs (Points of Presence). Cellnex UK also achieved its highest delivery volumes ever for two of the four UK Mobile Network Operators in 2023.

The team acquired 55 sites in Scotland as part of the S4GI (Scottish 4G Infill) programme – playing an important role in improving connectivity for rural communities in Scotland. And after acquiring Herbert In-Building Wireless in Q4 2022, Cellnex UK has continued to win new customers for its in-building business.

Cellnex ensure the conditions for reliable and high-quality transmission

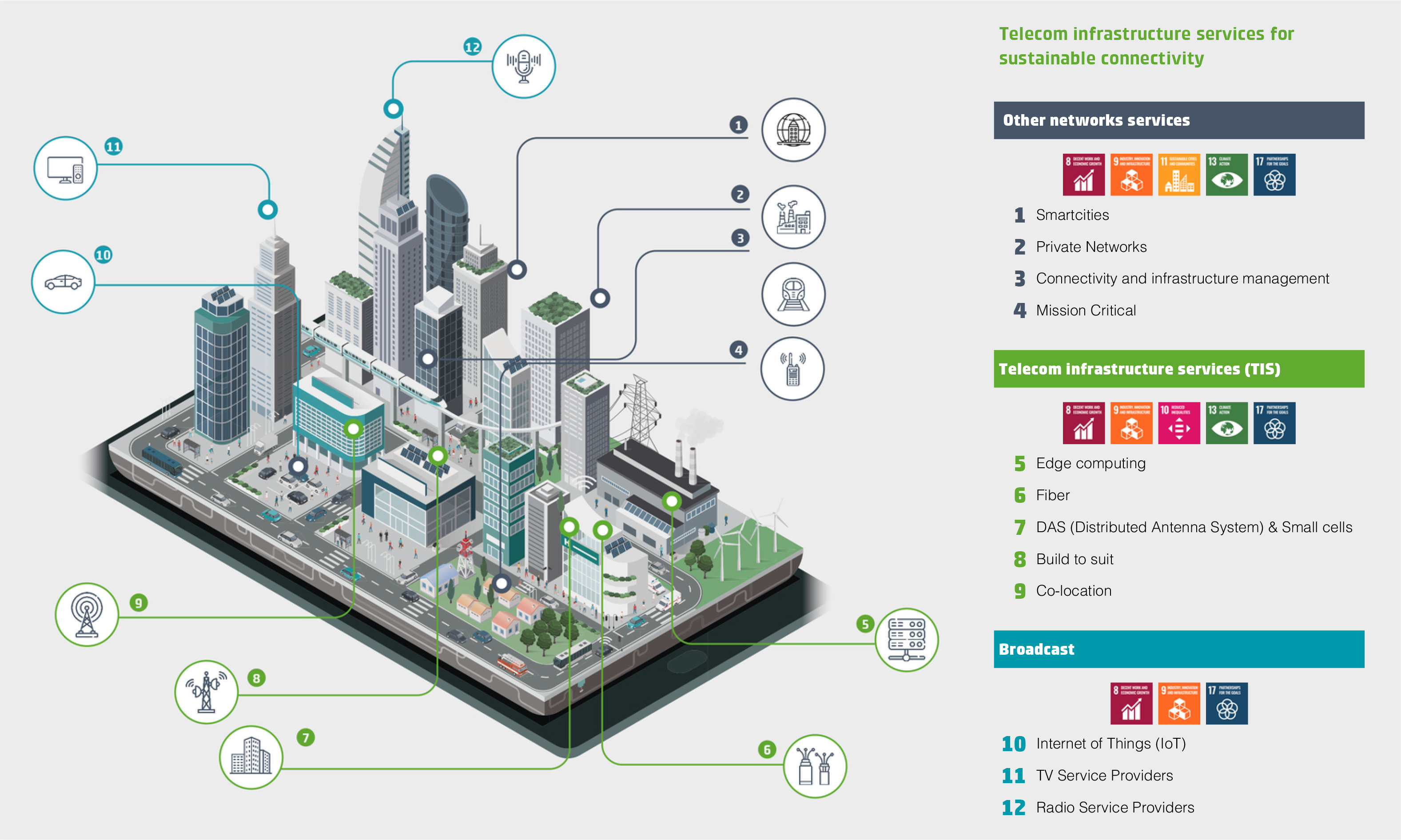

Cellnex offers its customers telecom infrastructure services for sustainable connectivity so that customers do not have to manage the infrastructures and networks over which their systems operate. Cellnex's neutral host approach enhances its efficiency, creating a model that revolves around multi-operator sites. This strategy results in reduced costs for customers, enhanced sustainability in telecom and connectivity ecosystems, and swift fulfilment of stakeholders' expectations through rapid service deployment. In this regard, Cellnex sites are the preferred choice for Mobile Network Operators (MNOs), as well as other telcos and operators seeking sustainable connectivity.

Cellnex’s range of services are aimed at ensuring the necessary conditions for reliable and high-quality transmission for both fibre and wireless telecommunications. The services provided by Cellnex are:

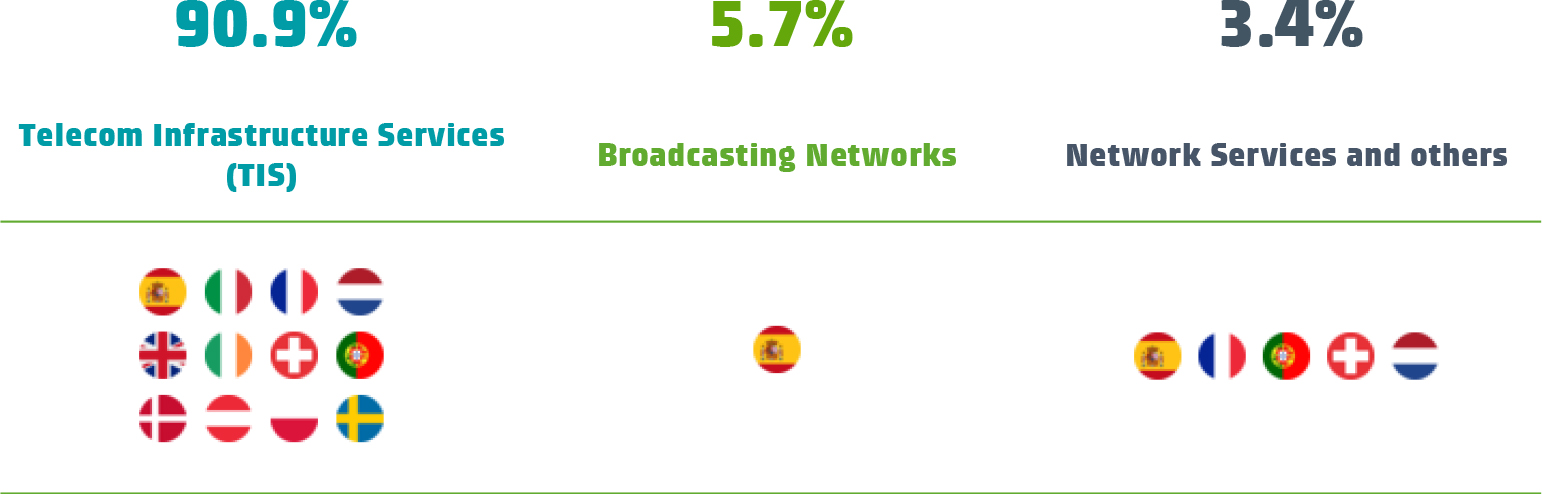

Although the main service is Telecom Infrastructure Services, Cellnex offers other types of services in the various countries where it is present, as shown below. In this regard, the portfolio of services provided by Cellnex can be marketed in all the countries where the company is present, complying at all times with local market regulations and any other additional regulations in each country.

Lastly, asset buyback options can be exercised in the event of an explicit breach by a Group company of the contractual obligations under services level agreements with its customers (“SLAs”) or if a change of control clause included in any of the Group’s material contracts is triggered. These asset buy back options will be executed at a price below fair market valuation.

Policies are developed to ensure the availability of services throughout the value chain, from the engineering and design phases and the implementation of technical solutions to Service Assurance by network operation and maintenance:

Services are provided 24 hours a day, seven days a week, with technical staff continuously present at the service control centre, as well as staff from the Technical Units area and the various levels of escalation, to ensure that there are no periods of inactivity.

Cellnex operates in 154,795 Point of Presence (PoPs), has a portfolio of 111,409 sites, including BTS committed deployments and is committed to the development of new generation networks. A summary of the portfolio of Telecommunications Infrastructure Services sites for 31 December 2023 is presented below. Cellnex data centres are set up per floor, compact and modular, so they can always be set up according to the latest technology and fine-tuned based on individual specific requirements.

RAN sharing involves the sharing of all Radio Access Network (RAN) equipment, including the antenna, mast, and backhaul equipment. The frequencies of different MNOs are emitted from the same telecom equipment, providing services to corresponding users. In this way RAN access networks of the various MNOs are incorporated into a single physical network, which is then split into separate networks at the point of connection to the Core of each MNO (MORAN) or the same Core (MOCN).

|

Framework Agreement |

Project |

No of Sites acquired (19) |

Beginning of the contract |

Initial Terms + Renewals (1) |

|

Telefónica |

Babel (Renewed, see detail footnote 18) |

1,000 |

2012 |

10+10+5 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta I (Renewed, see detail footnote 18) |

1,211 |

2013 |

10+10+5 (Telefónica) |

|

Until 2030+8 (Yoigo) |

||||

|

Telefónica |

Volta II (Renewed, see detail footnote 18) |

530 |

2014 |

10+10+5 |

|

Business combination |

TowerCo Acquisition |

321 |

2014 |

Until 2038 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta III (Renewed, see detail footnote 18) |

113 |

2014 |

10+10+5 (Telefonica) Until 2030+8 (Yoigo) |

|

Telefónica |

Volta Extended I (Renewed, see detail footnote 18) |

1,090 |

2014 |

10+10+5 |

|

Neosky |

Neosky |

10 |

2014 |

10+10+5 |

|

Telefónica |

Volta Extended II (Renewed, see detail footnote 18) |

300 |

2015 |

10+10+5 |

|

Business combination |

Galata Acquisition |

7,974 |

2015 |

15+15 (Wind) (2) |

|

Business combination |

Protelindo Acquisition |

261 |

2012 |

+15 (KPN) |

|

2016 |

+12 (T-Mobile) |

|||

|

Bouygues |

Asset purchase |

4,444 |

2016 - 2017 |

20+5+5+5 / 25+5+5 (3) |

|

41 |

2018 |

20+5 (3) |

||

|

Business combination |

Shere Group Acquisition |

1,114 |

2011 |

+15 (KPN) |

|

2015 |

+10 (T-Mobile) |

|||

|

2015 |

+15 (Tele2) |

|||

|

Business combination |

On Tower Italia Acquisition |

11 |

2014 |

9+9 (Wind) |

|

2015 |

9+9 (Vodafone) |

|||

|

K2W |

Asset purchase |

32 |

2017 |

Various |

|

Business combination |

Swiss Towers Acquisition |

2,239 |

2017 |

20+10+10 (Sunrise Telecommunications) (4) |

|

361 |

2019 |

20+10+10 (Sunrise Telecommunications) (4) |

||

|

Business combination |

Infracapital Alticom subgroup Acquisition |

30 |

2017 |

Various |

|

Others Spain |

Asset purchase |

45 |

2017 |

15+10 |

|

36 |

2018 |

15+10 |

||

|

375 |

2018 |

20+10 |

||

|

Masmovil Spain |

Asset purchase |

551 |

2017 |

18+3 |

|

85 |

2018 |

6+7 |

||

|

Linkem |

Asset purchase |

426 |

2018 |

10+10 |

|

Business combination |

TMI Acquisition |

3 |

2018 |

Various |

|

Business combination |

Sintel Acquisition |

15 |

2018 |

Various |

|

Business combination |

BRT Tower Acquisition |

30 |

2018 |

Various |

|

Business combination |

DFA Acquisition |

9 |

2018 |

Various |

|

Business combination |

Video Press Acquisition |

8 |

2019 |

Various |

|

Business combination |

On Tower Netherlands Acquisition |

114 |

2019 |

7 (5) |

|

Business combination |

Swiss Infra Acquisition |

2,887 |

2019 |

20+10 (6) |

|

Business combination |

Cignal Acquisition |

814 |

2019 |

20 (7) |

|

Business combination |

Business unit from Iliad Italia, S.p.A. |

4,037 |

2019 |

20+10 (6) |

|

Business combination |

On Tower France Acquisition |

8,926 |

2019 |

20+10 (6) |

|

Orange Spain |

Asset purchase |

1,500 |

2019 |

10+10+1 (8) |

|

Business combination |

Omtel Acquisition |

3,509 |

2018 |

20+5 (9) |

|

687 |

2021 |

20+5+5+5 (17) |

||

|

102 |

2022 |

20+5+5+5 (17) |

||

|

Business combination |

Arqiva Acquisition |

6,289 |

2020 |

10+1+1+4 (MBNL/EE) (10) |

|

2014 |

2024 (CTIL) (10) |

|||

|

Business combination |

NOS Towering Acquisition |

2,243 |

2020 |

15+15 (11) |

|

Business combination |

Hutchison Austria Acquisition |

4,616 |

2020 |

15+15+5 (12) |

|

Business combination |

Hutchison Ireland Acquisition |

1,171 |

2020 |

15+15+5 (12) |

|

Business combination |

Hutchison Denmark Acquisition |

1,638 |

2020 |

15+15+5 (12) |

|

Business combination |

Small M&A |

9 |

2020 |

Various |

|

Business combination |

Hutchison Sweden Acquisition |

3,114 |

2021 |

15+15+5 (12) |

|

Business combination |

T-Mobile Infra Acquisition |

3,147 |

2021 |

15+10 (13) |

|

Business combination |

On Tower Poland Acquisition |

8,891 |

2021 |

20+10 (14) |

|

Business combination |

Hutchison Italy Acquisition |

9,289 |

2021 |

15+15+5 (12) |

|

Business combination |

Polkomtel Acquisition |

7,149 |

2021 |

25+15 (15) |

|

Business combination |

Hivory Acquisiton |

10,326 |

2021 |

18+5+5+5 (16) |

|

Business combination |

Iaso Acquisition |

5 |

2021 |

Various |

|

Business combination |

Hutchison UK Acquisition |

6,367 |

2022 |

15+15+5 (12) |

|

Shared with broadcasting business |

1,682 |

|||

|

Others |

232 |

|||

|

Telefónica (Renewal) |

Tranche I |

1,543 |

2022 |

13+10+7 (18) |

|

Telefónica (Renewal) |

Tranche II |

1,450 |

2022 |

10+10+10 (18) |

|

Telefónica (Renewal) |

Tranche III |

1,400 |

2022 |

7+10+10+3 (18) |

(1) Renewals: most of these contracts have clauses prohibiting partial cancellation and can therefore be cancelled only for the entire portfolio of sites (typically termed “all or nothing” clauses), and some of them have pre agreed pricing (positive/negative).

(2) The initial term of the MSA with Wind is 15 years, to be extended for an additional 15-year period (previously confirmed), on an “all-or-nothing” basis. The fees under the MSA with Wind are 80% CPI-linked, taking into consideration that the increase shall not exceed 3% per year, without a minimum in case it is 0%. After the initial term, the fee could have +5%/-15% adjustment.

(3) In accordance with the agreements reached with Bouygues during 2016 – 2020, at 31 December 2022 Cellnex had committed to acquire and build up to 5,300 sites that will be gradually transferred to Cellnex until 2030 (see Note 8 of the accompanying consolidated financial statements). Of the proceeding 5,300 sites, a total of 1,877 sites have been transferred to Cellnex as of 31 December 2022 (as detailed in the previous table). Note that all Bouygues transactions, like most of the BTS programmes Cellnex has in place with other MNOs, have a common characteristic “up to” as Bouygues does not have the obligation to reach the highest number of sites. During 2016 – 2017 various MSAs have been signed with Bouygues in accordance with the different transactions completed (Glénan, Belle-Ille, Noirmoutier). All MSAs have an initial term of 20/25 years with subsequent renewable three/two 5-year periods, on an “all-or-nothing” basis. In relation to the MSA signed with Bouygues in 2018 (Quiberon transaction) the initial term is 20 years with subsequent renewable 5-year periods (undefined maturity). The contracts with customers are linked to a fixed escalator of 2%, except for Nexloop which is 1%.

(4) The MSA with Sunrise has an initial term of 20 years, to be automatically extended for 10-year periods, on an all-or-nothing basis, with undefined maturity. The contracts with customers are index-linked to the CPI, taking into consideration that the increase has no maximum per year and the decrease cannot be less than 0%.

(5) Contracts with customers are index-linked to the CPI and have an average duration of approximately seven years, to be automatically extended (undefined maturity).

(6) The MSAs with Iliad and Salt have an initial term of 20 years, to be automatically extended for 10-year periods, on an all-or-nothing basis, with undefined maturity. The contracts with customers are linked to a fixed escalator of 1%.

(7) Contracts with customers are index-linked to the CPI and have an average duration of c.20 years and a significant probability of renewal due to the portfolio’s strong commercial appeal and limited overlap with third party sites.

(8) The main customer of this portfolio of telecom sites is Orange Spain, with which Cellnex has signed an inflation-linked Master Lease Agreement for an initial period of 10 years that can be extended by one subsequent period of 10 years and subsequent automatic one-year periods, on an “all-or-nothing” basis.

(9) The initial term of the Omtel MSA is 20 years, subject to automatic extensions for additional five-year periods, unless cancelled, on an “all-or-nothing” basis, with undefined maturity. The fees under the Omtel MSA are CPI-linked, taking into consideration that the increase shall not exceed 2% per year and the decrease cannot be less than 0%.

(10) The initial term of the MSA with MBNL and EE is 10 years with three extension rights. The duration of the MSA with CTIL is until 2024 at least two years before, extension to be discussed. This MSA is index-linked to the CPI.

(11) The NOS Towering MLA has an initial duration of 15 years, to be automatically extended for additional 15-year periods, on an “all-or-nothing” basis, with undefined maturity. The fees under the NOS Towering MLA will be CPI-linked, taking into consideration that the increase shall not exceed 2% per year and the decrease cannot be less than 0%.

(12) The initial term of each CK Hutchison Continental Europe MSA is 15 years, with possible extensions for a further 15-year period and subsequent 5-year periods, on an “all-or-nothing” basis (same duration for all countries). The fees under the CK Hutchison Continental Europe MSA are CPI-linked, taking into consideration that the increase shall not exceed 2.25% per year and the decrease cannot be less than 0%.

(13) Initial term of 15 years + subsequent automatic renewals of 10 year periods (all or nothing, undefined maturity basis). The fees under the T-Mobile Infra MLA are CPI-linked, taking into consideration that the increase shall not exceed 3.5% per year and the decrease cannot be less than 0%.

(14) Initial term of 20 years to be automatically extended for subsequent 10 year periods (on an all or nothing basis). The fees agreed in the Iliad Poland MSA are annually adjusted in accordance with the Polish CPI provided that the increase shall not exceed 4% per year, without a minimum in case it is 0%.

(15) 25 years with automatic 15 year renewals.

(16) 18 years with automatic 5 year renewals. All-or-nothing renewal clause, undefined maturity. The contracts with customers are linked to a fixed escalator of 2%.

(17) MSA with 20 years + automatic 5 year renewals. All-or-nothing renewal clause, undefined maturity. The fees under the Omtel MSA are CPI-linked, taking into consideration that the increase shall not exceed 2% per year and the decrease cannot be less than 0%

(18) All Telefónica contracts as an anchor tenant have been renewed and unified under one single MLA. The new MLA is CPI-linked without cap and with floor at 0%. Likewise, in each tranche and once the initial period and first two extensions have elapsed, the price may be revised by +5%/-5%.

(19) The number of sites acquired by project includes BTS deployed post closing, synergies and others.

"The deployment of 5G at Cellnex Spain not only demonstrates our technical excellence, but also our ability to work as a team, anticipate market needs and prioritise customer satisfaction, aspects that distinguish us as leaders in the sector."

Gonzalo García de Frutos

Country Head of Engineering - Cellnex Spain

Cellnex Site Share solution enables Mobile Network Operators (MNOs) to develop and grow their networks, cost-effectively and efficiently, as Site Share allows MNOs to place their radio base stations on Cellnex-managed structures and sites in return for an annual licence fee. This service involves adapting sites for new co-locations or multiple network modifications required by the operators (installation of new technologies, equipment changes, upgrades, etc.). The objective is to meet and improve the SLAs (service level agreements) offered by Cellnex, which fall under two main categories: The delivery time SLA, when an Operator requests a new shelter or a network modification to carry it out with the highest quality and in the agreed time or better; and the Operation and Maintenance (O&M) SLA to provide the services with the agreed continuity and service level and to work proactively on improving them.

Moreover, Cellnex offers a diversity of topographies ranging from dense-urban and suburban to rural locations, including an unrivalled selection of high and privileged position sites, enabling its customers to extend coverage to fill gaps and increase density of PoPs and enabling them to expand to new spectrum bands.

In Telecommunications Infrastructure Services (TIS), the most notable milestone for Cellnex Spain has been the adaptation of sites to accommodate the 5G technology of operators (Telefónica, Orange, and Vodafone) in the 700 MHz and 3.5 GHz bands. These modifications and enhancements began en masse in 2022 and continued on a large scale throughout 2023, reaching a cumulative total of 5,000 adaptations. They will continue in 2024.

Additionally, in 2023 Cellnex Spain has carried out additional actions, apart from those related to 5G, including the roll-out of the Jumping project (Orange, Vodafone) and reinforcements for transmission, 4G enhancements, etc.

Moreover, wherever a new telecommunications site is required, Cellnex’s built-to-suit service will build on demand. In this regard, Cellnex will develop brand new, high-quality, shareable infrastructures, taking care of everything: from the site location search, permits and management of the landlord agreements to the site and tower construction and connection to the power grid. The sites are available in a range of heights from 15m to over 50m and the site will be tailored to customer requirements and to environmental regulations.

Throughout 2023, Cellnex has been working with its customers to increase network coverage and capacity - these adjacent assets include: distributed antenna systems (DAS) and Small Cells, which are key to delivering hyper connectivity in special venues that experience high densities throughout the day, such as stadiums, shopping centres, metro and rail stations; fibre-to-the-tower (FTTT), to expand data transmission capacity; and edge computing enabled sites which are key to ensuring the low latencies (response times) that are crucial for the delivery of critical applications and processes. The augmented TowerCo model is based on the company’s know-how and expertise in end-to-end services.

“The realization and commercialization of the DAS networks metro coverage in the cities of Naples and Catania confirm the key role of Cellnex Italia as enabler of mobile connections and as preferred partner not only of the mobile operators but also of the main companies owning and managing the communication lines of the Italian metros. Today thanks to the DAS solutions also cities of Naples and Catania have a full connected metro transport network with a minimal visual and electromagnetic impact.”

Alessandro Prosdocimo

Commercial Director - Cellnex Italy

Small Cells and Distributed Antenna Systems (DAS) are systems designed to increase network coverage and capacity by extending mobile operators' coverage, mainly in indoor and highly crowded outdoor areas where the signal level and capacity of existing mobile operators' base stations do not reach the required levels of service. Instead of providing coverage with high power base stations, Cellnex provides tailored coverage with a system of distributed radios and antennas. This facilitates outstanding mobile connectivity for spots where large numbers of users are concentrated, such as stadiums, skyscrapers, shopping malls, crowded outdoor areas and airports. These solutions also provide excellent coverage for underground places like tunnels, car parks or railway stations. In addition, DAS and Small Cells are one of the basic infrastructures that will underpin the roll-out of the new 5G communication standard.

Notably, Cellnex Spain has continued to deploy DAS at major football stadiums for clubs such as Osasuna, Almería and Levante to ensure optimal mobile coverage and capacity even when they reach their maximum spectator capacity, transforming these venues into Smart Stadiums. Additionally, Cellnex has implemented DAS systems to provide multi-operator coverage in office buildings and retail stores for major companies like Ikea, as well as strategic buildings of gas and electricity distribution companies such as Naturgy.

Furthermore, it is worth noting that Cellnex has reached an agreement with USP to deploy 5G antennas on news stands, which will become key locations for the Small Cells network roll-out, thereby boosting connectivity in major cities.

After being awarded the relevant concessions, Cellnex Italy has initiated the design and construction of multi-operator Distributed Antenna Systems (DAS) in the Naples and Catania metro.

In Naples, Cellnex will cover line 1, also called “Metro dell'Arte”, referring to the permanent contemporary art installations in numerous stations. The DAS system, designed by Cellnex in the 16 stations and tunnels on Line 1, will consist of a network of optical repeaters, connected to a widespread distribution of antennas with minimal visual and electromagnetic impact, designed for the diffusion of mobile operators' signals. In the case of Catania, Cellnex will roll out a similar system to provide reliable mobile coverage in the 12 stations and tunnels on the metro network.

Construction of the essential infrastructure for the repetition of the mobile radio signal will allow all passengers on the Naples and Catania metros to have stable, high-performance cellular coverage - data and voice - for their smartphones and tablets, even in particularly overcrowded situations, thus increasing the overall quality of the transport service and travel experience. Ensuring stable and high-performance mobile coverage in the public transport network is one of the key factors in transforming a city, and its transport network, into a smart city.

"The Social Hub is a hotel where travellers, locals and students get together to learn, stay, work and play. Cellnex Netherlands has implemented a DAS infrastructure at this location, which ensures coverage and capacity of all Dutch operators. This gives the community the flexibility to make optimal use of their personal connectivity preferences."

Annejan Stege

Senior Deployment Project Manager - Cellnex Netherlands

The Old War Office in Whitehall has recently opened as The OWO. Located at one of London’s most historically important and influential addresses, the building has undergone a monumental transformation and will host London’s first Raffles hotel. The OWO has been reimagined as a new destination with the 120-bedroom Raffles Hotel, a collection of nine restaurants and three bars, a Guerlain Spa and 85 Raffles-branded residences. The in-building connectivity solution provides fast, consistent mobile signal and data coverage across the building and is now live for residents and visitors, supported by the UK Mobile Network Operators.

The OWO, like many large, historic buildings, was constructed with materials that naturally block mobile signals from outside the building. Cellnex UK deployed a Distributed Antenna System (DAS) inside the building that provides fast and reliable connectivity across indoor areas and corner spaces in the building, including the hotel’s 600 capacity ballroom.

Luxury hotels, commercial real estate and hospitality are key markets for Cellnex UK’s in-building division, which expanded in October 2022 after the company acquired indoor connectivity specialists Herbert In-Building Wireless and formed Cellnex UK In-Building Solutions (CUKIS). The CUKIS team has extensive experience across these three markets, delivering solutions in line with a building’s original architecture and historical features, both as standalone retrofits and within major construction site environments, ensuring minimal disruption during deployment and constant coordination with other parties. As a neutral host, Cellnex UK is in a strong position to support the hospitality and real estate sector to deliver the connectivity that their customers need in their daily lives. Delivery of multiple projects has been undertaken this year through CUKIS, including successful installations and handovers to operations at major global retailers, mixed use office spaces and shopping centres - as well as at 'The OWO' luxury hotel in London, in Addenbrookes hospital in Cambridge, and across multiple Sky UK offices - alongside the securing of both new and repeat business in a number of different sectors including commercial real estate and hospitality arenas.

The Social Hub

Cellnex will deliver indoor mobile coverage to The Social Hub, formerly known as The Student Hotel, at two key locations for the next 10 years. Cellnex supports optimal mobile coverage by means of a DAS and in close cooperation with the national mobile network operators. Implementation has been completed at the Delft (Netherlands) and Vienna (Austria) locations. Founded in 2012 as The Student Hotel, The Social Hub pioneered the model known as hybrid hospitality. Now, having evolved from a student hotel into a global concept putting 'social' at its core, guest and community connection is a key part of its business offering. The Social Hub's current 16 locations in six countries - including Delft, Amsterdam, Berlin, Bologna, Florence, Madrid and Vienna - offer a wide range of facilities and services. These include large, shared spaces, student housing, hotel rooms, co-working spaces, meeting rooms, gyms, bars, restaurants and community event programmes.

The Social Hub is embarking on retrofitting existing and new locations with increasingly sustainable materials. However, high-quality insulation materials are characterised by low permeability for mobile signals. At the same time, good indoor coverage is important to offer guests an optimal experience.

"After a year of very intense work, Cellnex España was able to renew the contract for the Integral Management Service of critical mission communications for emergencies and security of the Generalitat de Catalunya (RESCAT). This success is due to the commitment, dedication and involvement of the entire team to provide a high quality service. We are confident that we will continue to give our best to guarantee the continuity of the service and we face the new contract with the challenge of initiating the technological evolution of the network to broadband."

Gemma Silvestre

Key Account Manager - Cellnex Spain

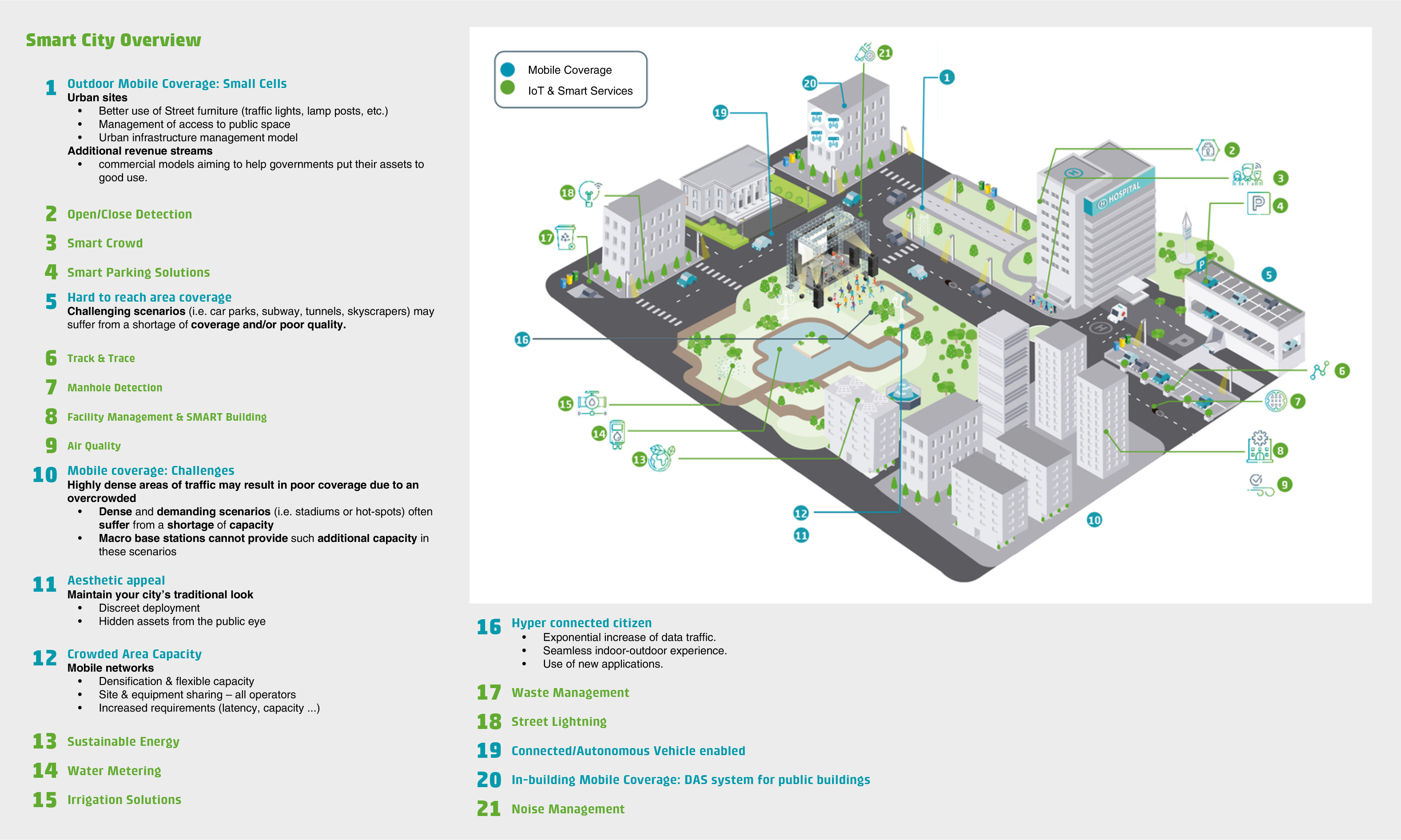

Cellnex offers integrated and adaptable solutions to develop a connected society and make the Smart concept a tangible reality in both urban and rural areas. These include: Mission Critical Private Networks (MCPN) services, Business Critical Private Networks (BCPN) services, connectivity services, Operation and Maintenance services and IoT and Smart City services.

Mission Critical Private Networks (MCPN) services

Mission Critical Private Networks (MCPN) are mobile networks specially designed and dimensioned to provide coverage for the bodies and professional groups involved in security and emergencies (police, firefighters, ambulances, etc.), in both urban and rural areas, with very high availability, robustness, and reliability to ensure their communications.

In January 2023, the renewal contract for the RESCAT network (Emergency and Security Radiocommunications of Catalonia) came into effect, signed for a period of five years. Throughout this year, Cellnex has implemented an extensive plan for the renewal and improvement of the network, expanding coverage and implementing new network functionalities. In the same year, Cellnex also rolled out the LINCE critical mission network for the Andalusian Regional Government, the largest DMR technology network in Europe. Additionally, the COMDES network in the Autonomous Community of Valencia has been extended for one more year.

The UNED (National Distance Learning University) has granted Cellnex approval to implement phase 2 of the project to optimise the energy efficiency of the air-conditioning and lighting systems at its university campuses through Internet of Things (IoT) technology. The objective is to reduce and optimise energy consumption, especially in empty spaces, maintaining pre-defined comfort conditions which, in turn, avoid cost overruns by reducing or raising the temperatures of spaces when unoccupied and also avoiding overly drastic differences between occupied and unoccupied spaces that prevent them being kept at optimal levels. Cellnex will equip UNED university campuses with sensors to enable remote data collection and monitoring for real-time control of lighting and air-conditioning systems, thereby cutting energy consumption.

Cellnex will promote the development of 5G infrastructure in European transport corridors. Additionally, studies encompass establishing connectivity between Italy and Austria, along with implementation of the EUMOB project in collaboration with Abertis.

As regards the metro system in the country, specifically Metro M4 Milano, in addition to the initial six stations opened in 2022, two new stations on the M4 line (San Babila and Tricolore) were introduced in 2023, establishing a connection from the centre of Milan to Linate Airport. Furthermore, initiatives have been launched for the development of Metro Napoli and Metro Catania.

Other progress made by Cellnex in Italy includes the DAS System for Fiumicino Airport – ADR, Tetra Standard Mission Critical System for Rome Airports (Fiumicino and Ciampino), Tetra standard professional mobile radio system for the municipality of Livorno, Tetra standard professional mobile radio system for emergency communications for AMT Metro Genoa, remote reading service on LoraWAN infrastructure for the provinces of Brindisi and Taranto – Pugliese Aqueduct and 12,000 iliad and fastweb hospitality via WindTre.

In 2023, Cellnex collaborated with Radio Televisión Española (RTVE) in UHD-4K HDR broadcasting of various events, including the World Athletics Championships in Budapest and the FIFA Women's World Cup in Australia/New Zealand. The success of these pilot tests culminated in RTVE's announcement to start its regular UHD-4K-HDR broadcast channel on 14 February 2024.

Cellnex continues to be one of the leading broadcast infrastructure operators in Europe, primarily in Spain and the Netherlands, distributing Digital Terrestrial Television (DTT) signals and Radio signals (FM and digital DAB/DAB+) from its high towers to deliver content from broadcasters to homes and users. The public service nature of these broadcasts demands very high service availability standards, which Cellnex provides to its customers through the high reliability of its infrastructure, with redundant power and transmission systems, and stringent processes defined for the flawless operation and maintenance of all these services. In Spain specifically, Cellnex has around 3,000 sites transmitting DTT and Radio signals.

Thanks to services provided and initiatives implemented by Cellnex, the DTT platform demonstrates its innovative character year after year by incorporating improvements in the broadcast quality of its channels, such as Ultra High Definition (UHD-4K), hybridisation with the world of non-linear broadband with services like the HbbTV LOVEStv platform and future access to mobile terminals through the new 5G Broadcast standard.

LOVEStv updates: In 2023, LOVEStv, the joint content platform of the main Spanish broadcasters (RTVE, Atresmedia, and Mediaset), updated its user interface. The new interface provides access to last week’s content and the most visited content on the platform, along with the option to continue watching partially-viewed content or access the search engine, all on a single screen. Notably, users can seamlessly continue watching content from linear television on LOVEStv, thanks to integration with DTT.

Contribution and diffusion test through 5G for UHD-HDR content: a pioneering worldwide pilot test of UHD-HDR transmission, with next-generation enhanced audio (NGA), was conducted under the Spanish industrial association UHD España, the vice presidency of which is held by Cellnex. The test used multi-camera contributions through a 5G network, cloud mixing and multimedia broadcast TDT transmission, including 5G Broadcast to reach mobile terminals. This pilot test represents a key milestone that paves the way for the future of these technologies in UHD services, facilitating their contribution, production, and broadcast.

Broadcast project highlights in Spain for 2023 include renewal of the contract with RTVE for another five years for DTT and Radio carrier services, totalling over €300 million. Contracts for DTT carrier services with the regional television stations in the Autonomous Community of Madrid and DTT and FM services with the regional radio and television in the Balearic Islands have also been renewed. Additionally, the government of the Autonomous Community of Castilla y León has granted some new FM licenses to broadcasters, many of whom have contracted the Broadcasting Service to Cellnex in 2023. .

Lastly, and no less importantly, in the final months of 2023, intensive work was carried out with all national, regional and local public and private Television operators to prepare for the migration of their DTT licenses from standard definition (SD) to High Definition (HD) on 14 February 2024, as established by Royal Decree 16/2023 of 17 January 2023.

A full 5G-UHD workflow has been showcased in Madrid by UHD Spain in collaboration with Cellnex. 4 UHD-HDR cameras were transiting simultaneous streams between 25 and 30Mbps to the cloud production system thanks to the private 5G network deployed for this purpose. After the cloud production the concert was broadcast through the DTT UHD test network, covering more than half of the population of Spain, by satellite, CDN and additionally in a 5G Broadcast network locally available at the event venue.

In 2023, 26 innovation projects were carried out

Innovation at Cellnex is led by the Innovation Department and has two main functions:

Cellnex is investing €5.9 million in the development, testing, and launch of new products

The innovation department focuses on the development of two main types of projects:

In line with Cellnex’s commitment to innovation and technological improvements, the company is investing €5.9 million in developing, testing, and launching new innovative products and solutions in the countries where Cellnex operates. The main projects are described in the following sections.

“Cellnex UK is delivering the infrastructure to support the next stage of the UK’s SONIC* Labs programme which is undertaking activity to test interoperability and integration of open, disaggregated and software-centric multi-vendor network solutions. Over the past 9 months Cellnex UK has worked hard to deliver the outdoor infrastructure test bed platform, which is comprised of macro sites, small cell locations, transmission and edge data centre hosting. This will enable the SONIC partners to undertake real world testing of Open RAN products and accelerate the path to commercial deployment and adoption.”

Jonathan Freeman

SGO Director - Cellnex UK

Neutral host, connectivity in areas with high seasonal occupancy

Barcelona has become the scenario for a complete 5G network roll-out undertaken jointly by Cellnex, MásMóvil and their partners. They have deployed a neutral host model on Barcelona’s beaches that enables efficient and flexible 5G network roll-out and extends connectivity services to shadow areas and areas where the needs for network resources are highly seasonal, such as beaches.

In 5G Catalunya, Cellnex has implemented an efficient and dynamic multi-operator neutral network in a tourist area that suffers variations and a wide range of peaks in the number of users, the Barcelona Beach.

Operators need to roll out their 5G networks in an efficient manner, so Cellnex’s role as the neutral operator will avoid the deployment of four distinct networks in Spain by offering the possibility of resource-sharing. Operators will therefore be able to offer higher quality service and increase their coverage more effectively to places that were previously shadow areas, mainly due to roll-out costs.

5G Catalunya has demonstrated a new multi-operator virtualised 5G network deployment model in which Cellnex offers an efficient solution to the growing demand for network capacity in high-traffic areas. One example is the challenges that summertime traffic peaks pose to the scaling of mobile network capacity in tourist areas such as beaches, resulting in network congestion and poor user experience.

5G Catalunya has implemented an efficient virtualised multi-operator neutral network which, by sharing infrastructure, fibre and radio access network (RAN) resources, allows mobile network operators to efficiently increase network capacity and consequently densify operator networks while reducing deployment costs.

The roll-out involved installing a virtualised RAN based on Open RAN. This new network architecture makes it possible to virtualise elements of the network on general-purpose servers and uses open software and interfaces to integrate the various components of the access network, fostering innovation and reducing deployment costs. The servers were installed in an edge data centre managed by Cellnex. In addition, a Small Cell was deployed to cover part of Somorrostro beach and two mobile network identifiers (PLMN_ID) were broadcast to simulate two network operators sharing the mobile network (RAN Sharing). Másmovil Group provided both the frequency and PLMN_ID.

This pilot project represents one of the first experiences in which networks are successfully shared through virtualised RAN.

Outdoor Open RAN Testing in London

Cellnex UK will deploy a 5G Open RAN network in Hammersmith and Fulham. The collaboration partners include Digital Catapult, Capgemini, Ofcom and the Department of Science, Innovation and Technology.

The outdoor facility will serve as a critical hub for the advancement and validation of Open RAN solutions, allowing vendors to rigorously test their products in a representative network deployment scenario.

Cellnex will own the end-to-end delivery of the platform, utilising its infrastructure assets, extensive network design and delivery expertise. The network will comprise two rooftop macro sites and seven Small Cell locations to enable overlapping 5G coverage in a dense urban environment. Transmission will include a combination of Cellnex dark fibre and commercial ethernet services back to the core. In addition, two edge sites with standard server hardware will enable a virtualised RAN solution and create the flexibility to test different network architectures.

The test environment will showcase Open RAN capabilities in a real-life scenario and provide collaborative learning opportunities with mobile network operators and the wider industry for both public and private networks.

Cross-border corridor between Spain and France based on 5G

5GMed will demonstrate advanced Cooperative Connected and Automated Mobility (CCAM) and enhanced communication for railways along the “Figueres – Perpignan” cross-border corridor between Spain and France. This is enabled by a multi-stakeholder compute and network infrastructure deployed by MNOs, neutral hosts, and road and rail operators, based on 5G.

For the project, the cross-operator service orchestration is moving on to edge technologies - testing and achieving the objective will be one of the main challenges. The project is also working on several innovations in multi-connectivity supporting high-speed vehicles and trains. Different enhancements are also being studied to speed up roaming transitions across MNOs and neutral hosts.

An important point regarding the project is that this network is being tested through four different use cases:

Digital Connecting Europe Facility (CEF-2)

CEF-2: Cellnex continues to drive 5G infrastructure in European transport corridors and in rural areas where the current lack of mobile coverage serves to digitally exclude these territories.

Cellnex has been awarded five projects by the European Commission. These include one new deployment (Baltcor) and one study (5G Fréjus) of feasibility to drive 5G infrastructure in European transport corridors, thus benefiting EU citizens and industry. The new deployment project will cover one cross-border corridor connecting Poland to the Czech Republic. In addition, the study includes the connection between France and Italy.

The main objective of these projects, which are part of the European Commission's Digital Connecting Europe Facility (CEF-2) programme, is to provide high-quality, seamless 5G connectivity for road safety services, to offer connectivity services to vehicle and passenger users along these corridors, and to provide 5G connectivity in rural environments to deploy use cases related to health and education. To this end, Cellnex will deploy 10 new telecommunications sites, where it plans to work with mobile operators based on its neutral host model, complemented by a V2X communications infrastructure and edge computing nodes to provide 5G connectivity along some 400 km.

Managing public safety and emergencies using 5G

This initiative, which falls within the scope of 5G Catalunya, involves the Barcelona Urban Police Force and Fire Brigade and focuses on three basic safety pillars: prevention, rapid intervention, and drawing conclusions for better management of emergencies, traffic and public safety by analysing past situations.

The initiative took place at the junction of Avinguda Diagonal, Carrer Pere IV and Carrer Lope de Vega in Barcelona’s Poblenou neighbourhood. Cooperation from the Guardia Urbana – which provided descriptions of its usual operations so they could be improved using 5G – was a key factor in developing the project. In addition to 5G terminals, five security cameras were installed on three street lights, which were then connected to a control centre managed by the Guardia Urbana.

The use case involved testing Stand Alone (end-to-end) and Open Ran (open standard) 5G networks for a complex web of devices and applications which, thanks to the features of this new wideband and real-time technology, will make it possible to manage emergencies and traffic more efficiently and monitor the safety of officers while on duty.