On 20 June 2016, the IBEX 35 Technical Advisory Committee approved the inclusion of Cellnex Telecom (CLNX: SM) in the benchmark index of Spain’s stock exchange, the IBEX 35, which brings together the principal companies on the Spanish stock exchange in terms of capitalisation and turnover. This milestone brought with it a broadening of the shareholder base, giving Cellnex higher liquidity and making it more attractive to investors. At present Cellnex has a solid shareholder base and the majority consensus of analysts who follow our company c.+70% is a recommendation to buy.

As at 31 December 2023, the share capital of Cellnex Group stood at EUR 176,619 thousand, a similar figure compared with 31 December 2022, represented by 706,475,375 cumulative and indivisible ordinary registered shares of EUR 0.25 par value each, fully subscribed and paid (see Note 14.a to the accompanying consolidated financial statements).

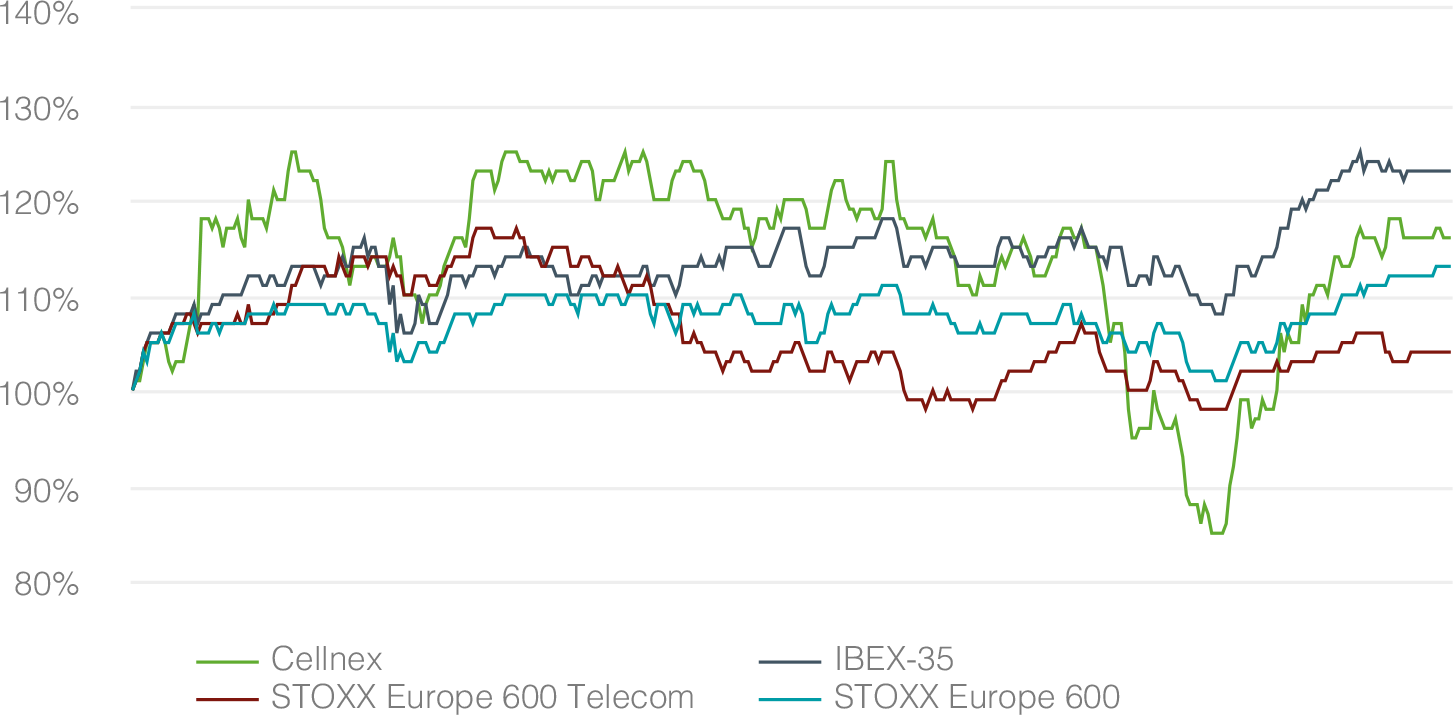

Cellnex’s share price increased +16% during 2023, closing at EUR 35.66 per share. The average volume traded has been approximately 1,722 thousand shares a day. The IBEX 35, STOXX Europe 600 and the STOXX Europe 600 Telecom were down by +23%, +11% and +2% over the same period.

Cellnex's market capitalisation stood at EUR 25,193 million at the year ended on 31 December 2023, 777% higher than at start of trading on 7 May 2015, compared with a 10% drop in the IBEX 35 over the same period.

The performance of Cellnex shares during 2023, compared with the evolution of IBEX 35, STOXX Europe 600 and STOXX Europe 600 Telecom, was as follows:

|

BREAKDOWN OF THE MAIN CELLNEX STOCK RATIOS AT DECEMBER 31, 2022 AND 2021: |

31 December 2023 |

31 December 2022 |

|

Number of shares |

706,475,375 |

706,475,375 |

|

Stock market capitalisation at period/year end (millions of euros) |

25,193 |

21,844 |

|

Share price at close (EUR/share) |

35.66 |

30.92 |

|

Maximum share price for the period (EUR/share) |

38.97 |

51.70 |

|

Date |

16/02/2023 |

03/01/2022 |

|

Minimum share price for the period (EUR/share) |

26.02 |

28.02 |

|

Date |

23/10/2023 |

13/10/2022 |

|

Average share price for the period (EUR/share) |

34.77 |

38.75 |

|

Average daily volume (shares) |

1,274,360 |

1,721,999 |

TREASURY SHARES

950,688

0.135% of its share capital

On 31 May 2018 the Ordinary General Shareholder’s Meeting of Cellnex Telecom, S.A. resolved to delegate in favour of the Board of Directors the faculty to purchase treasury shares up to a limit of 10% of the share capital.

In 2021, Cellnex Board of Directors approved the Cellnex’s Treasury Shares Policy, which is available on the Corporate Website. Thus, during 2023, Cellnex did not carry out discretional purchases of treasury shares (302,207 thousand in 2022). These purchases were carried out under the delegation from the Ordinary General Shareholder’s Meeting to the Board of Directors of May 2018 and fulfilling the principles established in the treasury shares policy. The use of the treasury shares acquired under discretional purchases will depend on the agreements reached by the Corporate Governance bodies. On 1 June 2023, the Ordinary General Shareholder’s Meeting resolved to approve the aforementioned delegation in the same terms. At 31 December 2023 and 2022, 52,399 and 291,258 treasury shares have been transferred to employees in relation to employee remuneration payable in shares, respectively. In addition, during 2023, 108,578 shares have been transferred to bondholders in relation to the repurchase of senior unsecured convertible bonds. Finally, 7,342 treasury shares have been transferred as payment in kind for professional services.

The number of treasury shares as at 31 December 2023 and 2022 amounts to 950,688 and 1,119,007 shares, respectively and represents 0.135% and 0.158%, respectively, of the share capital of Cellnex Telecom, S.A.

The approved shareholders’ remuneration policy aims to maintain an appropriate balance between shareholder remuneration, the parent company’s profit generation and the parent company’s growth strategy, while pursuing an adequate capital structure. When implementing the Shareholders’ Remuneration Policy, the Group is focused on distributing an annual dividend of 10% above the dividend distributed for the prior year. As a result, each year the parent company distributes dividends against either net profit or distributable reserves attributable to the Group for the respective financial year.

On 21 July 2020, the General Shareholders’ Meeting approved the distribution of a dividend charged to the share premium reserve with a maximum of €109 million, to be paid upfront or in instalments over the years 2020, 2021, 2022 and 2023. It was also agreed to delegate to the Board of Directors the authority to establish, if appropriate, the amount and the exact date of each payment during that period, while always remaining within the maximum overall amount stipulated.

In accordance with the Shareholders’ Remuneration Policy, shareholder remuneration for fiscal year 2021 will be equivalent to that for 2020 (EUR 29.3 million)

plus 10% (EUR 32.2 million); the shareholder remuneration corresponding to fiscal year 2022 will be equivalent to that of 2021, plus 10% (EUR 35.4 million).

On 15 December 2022, the Board of Directors approved the following Shareholders' Remuneration Policy corresponding to fiscal years 2023 and 2024: (i) the shareholder remuneration corresponding to fiscal year 2023 will be equivalent to that of 2022 (EUR 36.6 million) plus 10% (EUR 40.3 million); (ii) the shareholder remuneration corresponding to fiscal year 2024 will be equivalent to that of 2023 plus 10% (EUR 44.3 million).

On 1st June 2023, the Annual Shareholders’ Meeting approved the distribution of a dividend charged to the share premium reserve to a maximum of EUR 85 million, to be paid upfront or through instalments during the years 2023, 2024 and 2025. It was also agreed to delegate to the Board of Directors the authority to establish, if this is the case, the amount and the exact date of each payment during said period, always attending to the maximum overall amount stipulated.

During 2023, and in compliance with the Group´s Shareholders’ Remuneration Policy, the Board of Directors, pursuant to the authority granted by the decision of the General Shareholders’ Meeting of 21 July 2020, approved the distribution of a dividend charged to the share premium reserve in the amount of EUR 11,822 thousand, which represents EUR 0.01676 for each existing and outstanding share giving entitlement to receive such a cash pay-out. In addition, the Board of Directors, pursuant to the authority granted by the resolution of the Annual Shareholders’ Meeting of 21 July 2020, approved the distribution of a dividend charged to the share premium reserve in the amount of EUR 28,468 thousand, which represents EUR 0.04035 for each existing and outstanding share giving entitlement to receive such a cash pay-out.

Dividends will be paid on the specific dates to be determined in each case and will be duly announced.

Notwithstanding the above, the Group’s ability to distribute dividends depends on several circumstances and factors including, but not limited to, the net profit attributable to the Group, any limitations included in financing agreements and the Group’s growth strategy. As a result of such (or other) circumstances and factors, the Group may amend the Shareholders’ Remuneration Policy or may not pay dividends in accordance with the Shareholders’ Remuneration Policy at any given time. In any case, the Group will duly announce any future amendment to the Shareholders’ Remuneration Policy.

Cellnex provides various communication channels to its shareholders

Cellnex works continuously to maintain a good two-way relationship with its shareholders. To that end, there is a policy for communication and contact, which states that the Board of Directors will be responsible for providing suitable channels for shareholders to find any information on the management of the Group, and for establishing mechanisms for the regular exchange of information with institutional investors that hold shares in the Group.

The Group has several communication channels to ensure effective compliance with the principles of the above-mentioned Policy, some of which are general channels, designed to disseminate information to the public, while others are private and primarily intended for shareholders, institutional investors and proxy advisors.

The general channels are the website of the Spanish Stock Exchange Commission (CNMV) and other bodies, and the Cellnex corporate website. The private channels for use by shareholders and investors are the various social networks on which Cellnex has an account (such as LinkedIn, Twitter and YouTube), as well as the “Shareholders and Investors” section on the Group website and the Investor Relations Area. Concerns may also be expressed at the General Shareholders' Meeting.

Further information on stakeholder engagement can be found in section 1.3 Our commitment - Stakeholders.

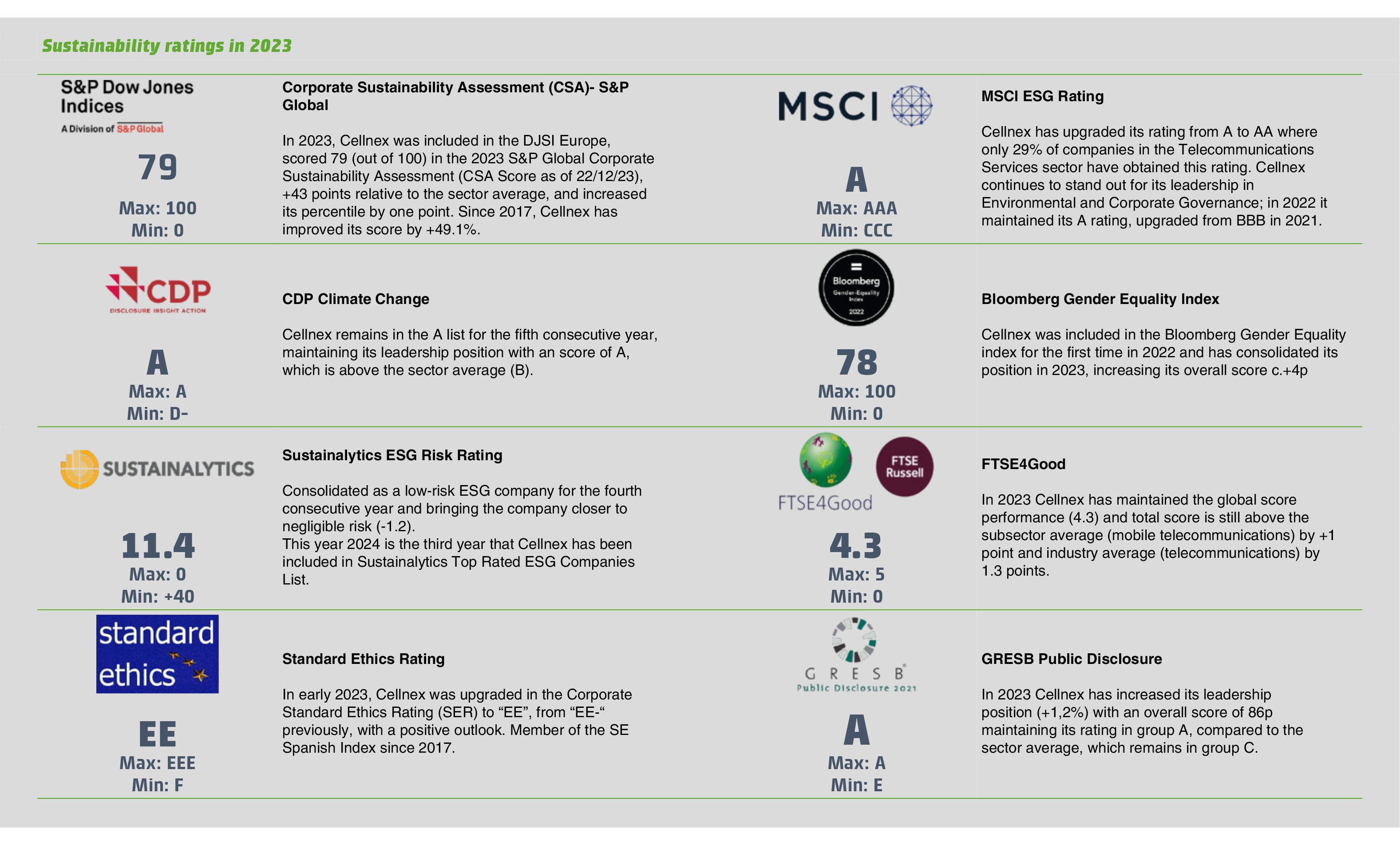

In 2023, Cellnex consistently improved its overall score in the sustainability ratings, reaching all-time highs

In recent years, there has been an increase in European legislation regarding a number of ESG topics, many of which are already being applied (Green Deal, EU Taxonomy) and others that will come into force over the coming years (Corporate Sustainability Reporting Directive, Human Rights Due Diligence Directive). This has translated into a considerable increase in interest among stakeholders in knowing, demanding, and evaluating the level of companies' commitment in relation to various ESG issues, as the implementation of actions aligned with ESG criteria carries a lot of weight with investors when choosing one investment over another.

In this regard, more and more companies are integrating ESG as a fundamental pillar of their business model, thereby increasing competition between them in relation to ESG performance. Information is therefore needed to measure and compare companies' contributions and responsibility in relation to ESG topics. To do this, analysts, agencies, and information providers in the field of sustainability evaluate the exposure of companies to ESG risk as well as their risk mitigation and management capacity, obtaining a rating for companies in terms of sustainability performance.

Cellnex is evaluated in the main international sustainability ratings, including CDP, Sustainalytics, MSCI, CSA from S&P Global, FTSE4Good, and Standard Ethics, among others. Through its ESG performance Cellnex demonstrates its commitment to meeting investors' expectations based on transparency and accountability in terms of sustainability.

Compared with the previous year, in 2023 Cellnex consistently improved its overall score in the sustainability ratings, thus reaching all- time highs. The 2023 score ratings are summarised below.

Sustainalytics measures a company's ESG risk and is usually used by investors worldwide, as it is an environmental, social, and corporate governance (ESG) research and rating company. The rating ranges from 0 to 100, where the higher the score, the higher the risk, understood as the degree to which a company's economic value is at risk due to ESG factors. Score values from 0 to 10 indicate negligible risk.

Cellnex is part of the STOXX Global ESG index, which offers a representation of the world's leading companies in terms of ESG criteria, based on the indicators provided by Sustainalytics.

In 2023, Cellnex has continued working on its risk management, improving its ESG Risk Rating by 20%, achieving a score of 11.4 points (-2.6 vs 2022 score), which consolidates Cellnex position as a low ESG risk company for the fourth consecutive year and brings the company closer to negligible risk, at a distance of 1.4 points.

Furthermore, the risk is classified as negligible in five out of the seven categories, indicating practically no risk, and two of them are valued within the low risk category. The only risk which did not improve in relation to the previous year is Human Capital, although it still remains a negligible risk.

In 2023, Cellnex improved its relative performance, going from the fifth (2022) to the first percentile (2023) in relation to the Telecommunication Services Industry.

Additionally, in 2022, 2023, and 2024 Cellnex was awarded the ESG Top-Rated Badge from Sustainalytics, making it one of the top 50 ranked companies in the ESG Risk Ratings universe.

“At Cellnex we see ESG as a constituent element of our company’s strategy, fully embedded in it, and thus we focus on the sustained progress in the series of KPIs that measure our performance as a company and as a team in the ESG arena. The ESG indices are a tool that help us to better assess and grasp how the market perceive our execution. We are happy with the continuous improvement achieved and in 2023 we do feel proud to consolidate our top tier position in the CDP’s ‘A list’, and have joined, as the first towerco in doing so, the selective ‘DJSI Europe."

Toni Brunet

Global Public Affairs Director - Cellnex Corporate

In 2023, Cellnex was included in the DJSI Europe, scored 79 (out of 100) in the 2023 S&P Global Corporate Sustainability Assessment (CSA Score as of 22/12/23), +43 points relative to the sector average, and increased its percentile by one point. Particularly noteworthy is the substantial increase of 10 points in the environmental dimension.

Since 2017, Cellnex has improved its score by +49.1%.

The S&P Global Corporate Sustainability Assessment (CSA) ranges from 0 to 100, where 100 is the best score that can be obtained.

The CSA score determines the companies included in Dow Jones Sustainability Indices (DJSI), which are a family of best-in-class benchmarks for investors who have recognised that sustainable business practices are critical to generating long-term shareholder value and who wish to reflect their sustainability convictions in their investment portfolios. Cellnex participates each year in the CSA as an invited company.

In recent years, the Cellnex Group has progressively improved its score, attaining an overall score of 79 points in 2023 (two points less than 2022, but maintaining the same percentile).

The company has maintained the gap with the Industry best player at 16 points. This result has enabled Cellnex to remain 43 points above the Telecommunication Services sector average and among the top 10% companies in Telecommunication Services (percentile 92).

Regarding the evolution of the score by dimension, in 2023 Cellnex dropped 7 points in the Governance & Economic dimension, with a score of 77, and improved in the Environmental dimension, with a score of 91 (+10 points), while in the Social dimension it dropped two points with a a score of 76 points.

In 2023, Cellnex was recognised by CDP as ‘Supplier Engagement Leader 2022’ for its action combating climate change and its efforts to measure and reduce environmental impact in its supply chain

The CDP is a global standard that uses an independent methodology to assess companies' transparency when disclosing environmental and sustainability matters. CDP awards a score from A to D- based on completeness of reporting, awareness and management of environmental risks, as well as demonstration of good practices associated with green leadership, such as setting serious and ambitious targets. The maximum score that can be achieved is an A, and companies that do not disclose or provide insufficient information are given an F rating.

In 2023, Cellnex obtained an A for the fifth consecutive year, which means that it continues to be a Leadership Company in terms of Climate Change. The score obtained continues to be above the sector average and it is among the 23% of companies that achieved the Leadership level in the Activity Group.

Cellnex’s commitment to sustainability and tackling climate change made it one of the most outstanding high-performing organisations in this index. Of the 18,700 companies that CDP evaluated this year, the telecom company remained on the Climate Change ‘A List’. Through its commitment to the climate, Cellnex is also at the forefront of its sector in terms of transparency and commitment to combating climate change.

In the 2023 assessment Cellnex improved its score in the categories “Value chain engagement” (from B- to A-) and “Energy” (from B to A-). Moreover, Cellnex is positioned higher than in the previous year compared with the industry and global companies, as those scores fell whilst the Cellnex score remained stable.

In 2023, Cellnex was been recognised by CDP as ‘Supplier Engagement Leader 2022’ for its action combating climate change and its efforts to measure and reduce environmental impact in its supply chain. The Group has continued to provide this information as part of the CDP Supply Chain questionnaire 2023.

The FTSE4Good index series are used by investors wishing to incorporate environmental, social and corporate governance factors into their investment selection processes, as the index identifies companies that best manage the risks associated with these factors. They are also used for tracking index funds, for structured financial products and as a benchmark, as well as being used as a framework for assessing corporate commitment and rating corporate governance.

In terms of overall ESG rating, Cellnex maintained the score of 4.3 in 2023, remaining in the percentile rank 100 for the Telecommunications sector. Note that Cellnex’s score is above the sub-sector average (mobile telecommunications) and industry average (telecommunications) by +1 points and +1.3 points respectively.

Cellnex maintained its score for all dimensions with a maximum score in Governance (5 out of 5). The highest scores were achieved in: Human Rights & Community, Labour Standards, Anti-Corruption, Corporate Governance, and Tax Transparency.

Each year, MSCI identifies 35 key issues for each industry in order to measure the intersection between a company's core business and the Group's resilience to long-term ESG risks. These key issues are weighted according to MSCI's mapping framework on a scale of 0-10, and the Group's final score is adjusted on the basis of overall industry performance and assigned a letter grade based on an AAA-CCC scale. The AAA rating is the best that can be obtained.

Cellnex upheld its MSCI ESG Rating in 2022, securing an A status. However, in 2023 Cellnex upgraded its rating from A to AA - only 29% of companies in the Telecommunications Services sector having obtained this score. Cellnex continues to stand out for its leadership in Environment within telecommunications services, obtaining the highest achievable score (10/10).

The Bloomberg Gender-Equality Index (GEI) is the global reference index that measures gender equality across five pillars: female leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, anti-sexual harassment policies, and pro-women brand.

Cellnex was included in this index for the first time in 2022 and has consolidated its position in 2023. The Group has been selected as one of 485 companies across 45 countries and regions to join the 2023 Bloomberg Gender-Equality Index, a modified market capitalisation-weighted index that aims to track the performance of public companies committed to transparency in gender-data reporting.

The Bloomberg Gender-Equality Index recognises Cellnex's commitment to advancing gender equality in the labour market by rolling out policies and initiatives to promote women's professional careers and greater female representation in the organisation.

In terms of performance, Cellnex improved its score by 4.3 points, obtaining an overall score of 77.73 points (73.40 points in 2022).

GRESB

Cellnex Netherlands achieved the maximum score of 100 points and Cellnex Switzerland achieved 85

The GRESB Public Disclosure Level assesses the alignment of listed real-estate companies with GRESB infrastructure asset assessment. The public disclosure level provides information on the ESG disclosure activities of GRESB participants and non-participants and provides investors with information that is not currently captured in the GRESB Infrastructure Asset Assessment. The rating is based on an A-E scale, where A is the best achievable score.

For the third consecutive year, Cellnex is proving its ongoing commitment to transparency in sustainability issues and now ranks as the best valued company in the telecommunications infrastructure sector in the GRESB Infrastructure Public Disclosure 2023.

For the third consecutive year, the company has maintained its position in group “A”, the highest level, compared to the sector average, which remains at “C”. In 2021, Cellnex achieved first place, becoming the best positioned company in the telecommunications infrastructure ranking, rising from “B” to “A”. This year, the company increased its score by 1 point over the previous year, achieving 86 points out of 100.

Furthermore, on 2 October, Cellnex Netherlands achieved the maximum score of 100 points and 5 stars in the GRESB 2023 Assessment, solidifying its position as the sector leader for 2023. Switzerland achieved 85, also improving its performance compared to the previous year.

Standard Ethics is a self-regulated sustainability rating agency that issues non-financial sustainability ratings. The rating scale goes from EEE (max) to F (min), where a classification of “EE-” or above indicates compliance.

Cellnex has been a member of the SE Spanish Index since 2017. In early 2023, Standard Ethics upgraded Cellnex’s Corporate Standard Ethics Rating (SER) to “EE” from the previous rating of “EE-”, with a Positive Outlook.

Cellnex has improved its rating from 40 to 81, entering the Top 1 of companies evaluated by Ecovadis. Cellnex continues to stand out for its leadership in Environment with outstanding sustainability results (90/100).

The Vigeo indexes are composed of listed companies and are ranked according to an assessment of their ESG performance. In 2021 Cellnex Group increased its overall ESG score for the third consecutive year, achieving a score of 60 (c.+33%). In 2022 and 2023, there was no update for Cellnex assessment

Before starting...

We use our own and third-party cookies for analytical purposes and to show you personalized advertising based on a profile prepared from your browsing habits (for example, pages visited). Click HERE for more information. You can accept all cookies by pressing the "Accept" button or configure or reject their use by pressing the "Configure" button.

ACCEPT AND CONTINUE Configure cookies