Cellnex's purpose:

endless opportunities to bring the world closer through telecom connectivity

The digital revolution has reshaped human connections, enabling the exchange of ideas

that define today's world and will shape the future. Connectivity empowers individuals, which is why Cellnex champions the removal of barriers, whether in rural villages, bustling cities, small countryside schools or global tech corporations.

Creating opportunities for diverse people, cultures and regions to connect is essential to foster new solutions. Collaborating with its customers, Cellnex strives to bridge distances, ensuring equal opportunities for people to connect and contribute to addressing future challenges. The company aims to generate value for society, customers, shareholders and all stakeholders through an ethical approach rooted in tolerance, respect and cooperation and by adhering to Environmental, Social, and Governance (ESG) criteria.

"After defining our “Next Chapter”, our company goal has been to align the strategy and the execution. Thus, allowing us to focus and prioritize our resources on better meeting our clients needs, providing services with operational excellence and have sustainable growth while driving the industry and connectivity of the future."

Vincent Cuvillier Chief Strategy Officer - Cellnex Corporación

Cellnex is Europe’s leading operator of wireless telecommunications infrastructure, born in 2015 as a result of a spin-off from the telecommunications division of Abertis Group. Subsequently, Cellnex went public as an independent company.

With the escalating volume and complexity of mobile communication services and the development of wireless technology in the digital era, there has been a parallel rise in the demand across Europe for robust and efficient network infrastructure. Since the IPO in 2015, Cellnex has experienced significant growth in Europe, growing from 110,830 sites in 2022 to 113,175 sites in 2023, by executing or committing to investments worth c.40€Bn in c.40 deals, driven primarily by:

Throughout this journey Cellnex has stayed true to fundamental principles that make the company both unique and successful: (i) a capability to execute value-creating transactions, (ii) being an independent operator that offers attractive MSAs to multiple anchor tenants, (iii) long-term, strong and stable revenue visibility, (iv) developing an industrial model with a basis for the integrated management of telecommunications infrastructure, (v) country diversification coupled with local adaptation, and (vi) guaranteeing market credibility and following an investment criterion of financial prudence.

This has led Cellnex not only to extend its footprint to new geographical markets, but also to explore new opportunities beyond the tower, particularly in collaboration with clients.The company achieves this by making the majority of its assets and services more attractive to current and new customers by responding to their needs while simultaneously leveraging the company’s current capabilities.

As a telecommunications infrastructure company, Cellnex has demonstrated visionary leadership by proactively capitalising on the TowerCo European consolidation opportunity that emerged in recent years. This was achieved through the development of a resilient, long-term industrial model, enabling the company to maintain a growth-oriented profile within a favourable macro-economic climate.

The mobile telecom industry faces a fast-paced and uncertain context that is characterised by (i) the economic and geopolitical context, (ii) technological advances, (iii) the dynamics of the telecommunications industry, and (iv) the regulatory framework.

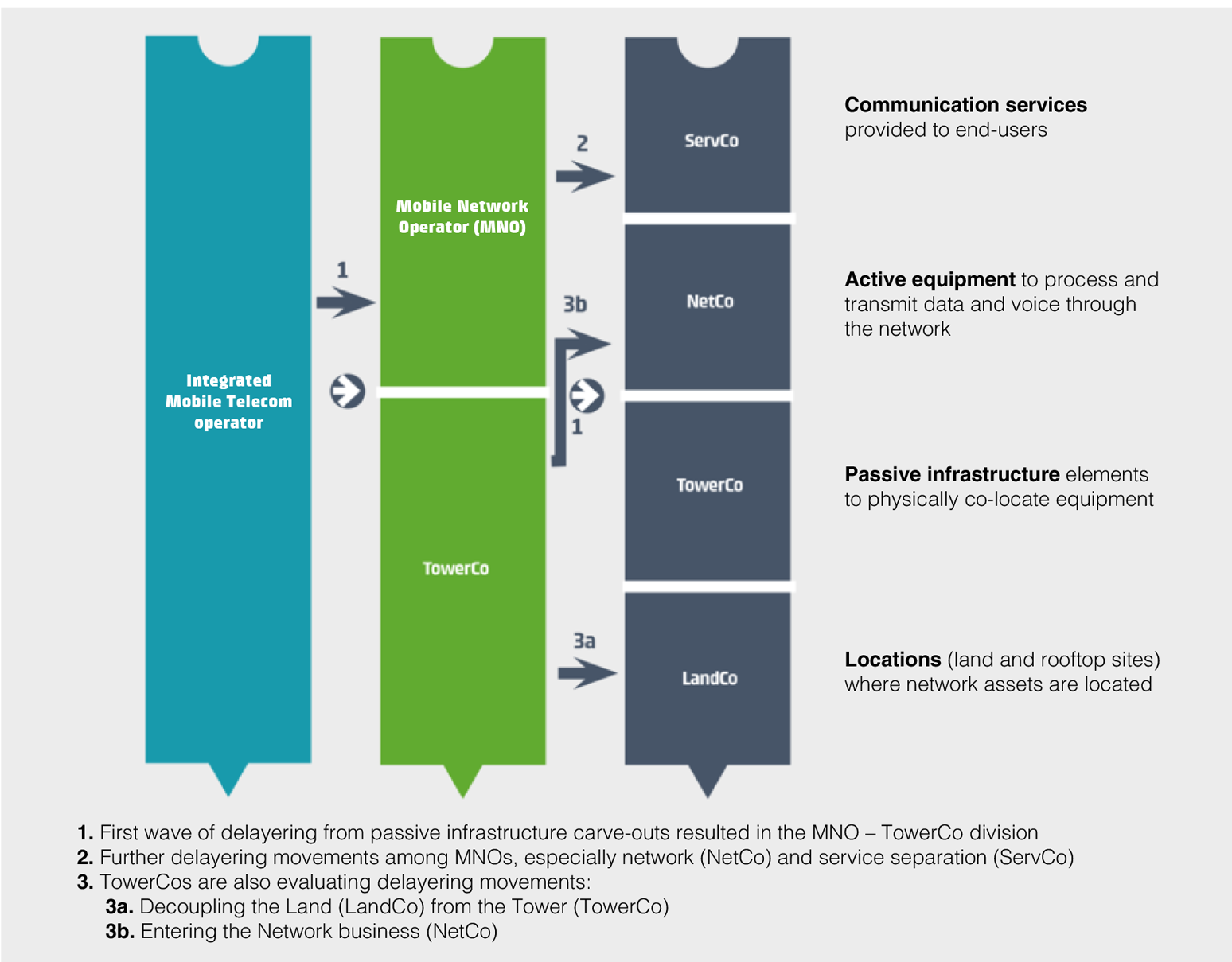

Directly correlated to all these macro trends, further delayering movements have been reshaping the Telecom industry, and predictably, will continue to reshape it by fragmenting the Telecom stack into further layers.

The different nature of each of the layers drives highly differentiated business models, risk profiles and challenges. Cellnex strongly believes that the positioning of each telecom player and stakeholder within this sector evolution will drive its industrial strategy.

In this scenario:

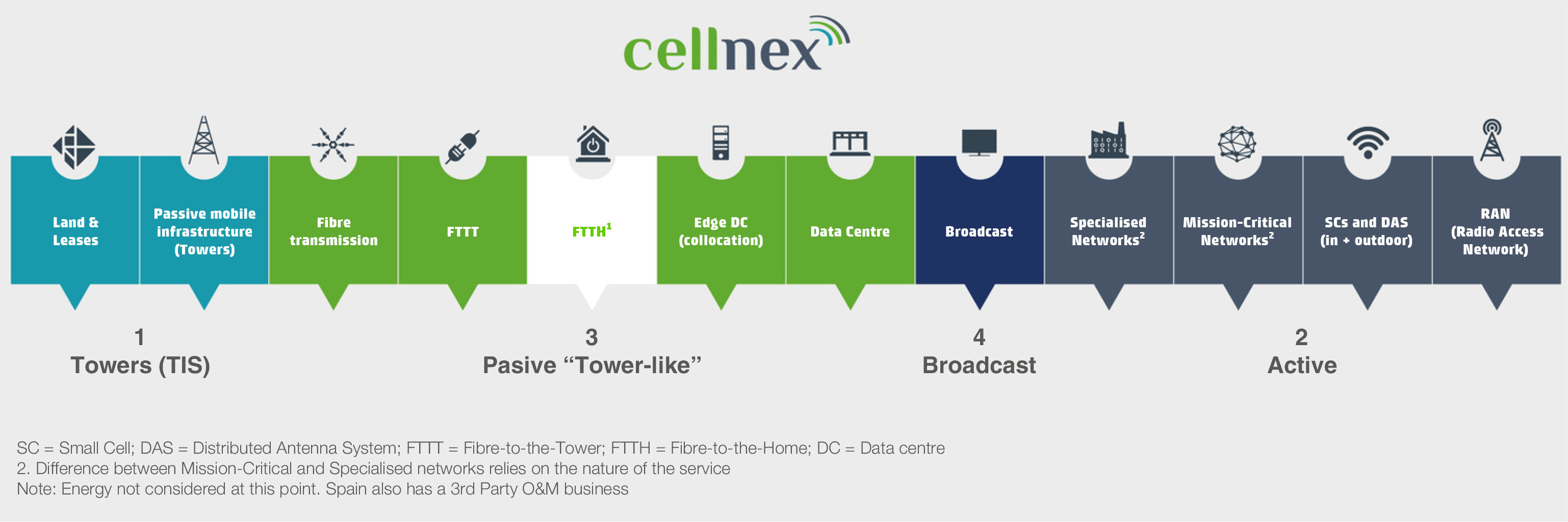

With the fast-evolving telecom landscape and changes in the macro environment, the next step in Cellnex’s story includes the prioritisation of variety of business lines in its portfolio and the geographical footprint in which the company is currently present[1], within four differentiated operational archetypes:

1Cellnex is not present in FTTH.

In general terms, the compounded prioritisation of the various business lines in its portfolio and geographies helps Cellnex rebalance its company profile to look at ‘yield with growth’. This involves using generated cash flow not only for selective growth opportunities while simultaneously delivering on client commitments, but also for strengthening the company’s balance sheet, and remunerating its shareholders

Cellnex considered several factors when prioritising its portfolio, including, but not limited to:

The classification of the business lines resulted in a prioritisation scale of Core, Core+, Selective, and De-prioritised.

Cellnex's industrial strategy will allow the company to make good on its commitments to the market and its customers, and prepare the company for the next business cycle and future industry transformation

Cellnex’s primary focus is:

Further developing efficiency levers, is also a must for a better consolidation of Cellnex’s operations, including additional automation of its business processes in its IT systems, along with reinforcement of the company’s land efficiency programme, among others.

In order to prioritize the value creation for stakeholders, Cellnex is focused on the following key objectives:

Cellnex has already taken steps towards the execution of its strategy:

Cellnex believes that its industrial strategy will allow the company to make good on its commitments to both the market and its customers, and prepare the company for the next business cycle and future industry transformation.

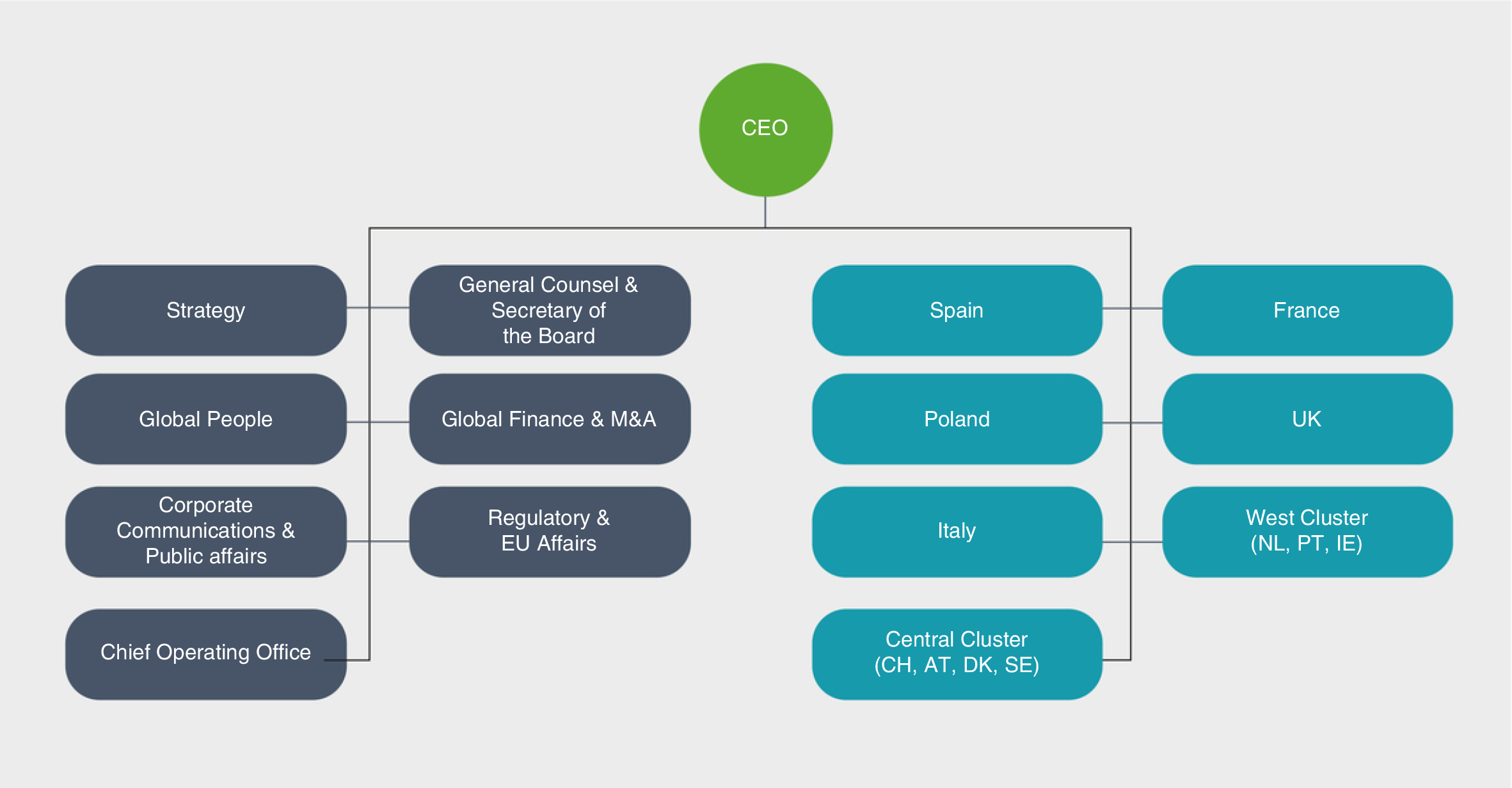

In October 2023, in alignment with its new business strategy, Cellnex presented its new organisational structure, focused on organic growth, operational excellence and the consolidation of the portfolio acquired to date. As a part of this new organisational structure, Cellnex has:

These functions report directly to the CEO and will be part of the Company’s Executive Committee, together with the General Counsel and Vice-Secretary of the Board, the CFO, the Group People Director and the Corporate Communications & Public Affairs Director. Country and Cluster CEOs who report directly to Cellnex's CEO are also part of the Group’s Executive Committee.

Additionally, during the year, various Cellnex countries have been organised into "clusters". This new reorganisation aims to make the structure leaner and more efficient and therefore improve its ways of working, share best practices across the Cluster and foster a single common culture. The support functions that provide services to the business will benefit from this new organisation, generating efficiencies and leveraging capabilities across the cluster.

Looking forward, Cellnex’s industrial model is adopting a simpler integration model to the current focus on optimisation. This framework not only enables consistent operations but also contributes significantly to streamlining and optimising processes throughout the organisation – improving the services offered to customers and the daily lives of employees while ensuring value creation for all stakeholders and a positive impact on the environment and society.

The Cellnex Industrial Model:

Before starting...

We use our own and third-party cookies for analytical purposes and to show you personalized advertising based on a profile prepared from your browsing habits (for example, pages visited). Click HERE for more information. You can accept all cookies by pressing the "Accept" button or configure or reject their use by pressing the "Configure" button.

ACCEPT AND CONTINUE Configure cookies