The year ended on 31 December 2023 highlighted a unique combination of defensive and high-quality structural growth, which was achieved through consistent and sustainable organic growth, a solid financial performance and a tireless focus on integration.

An Alternative Performance Measure (APM) is a financial measure of historical or future financial performance, financial position, or cash flows, other than a financial measure defined or specified in the applicable financial reporting framework.

Cellnex believes that there are certain APMs, used by the Group’s Management in making financial, operational and planning decisions, which provide useful financial information that should be considered in addition to the financial statements prepared in accordance with the applicable accounting regulations (IFRS-EU), in assessing its performance. These APMs are consistent with the main indicators used by the community of analysts and investors in the capital markets.

In accordance with the provisions of the Guide issued by the European Securities and Markets Authority (ESMA), in force since 3 July 2016, on the transparency of Alternative Performance Measures, Cellnex provides below information on the following APMs: Adjusted EBITDA; Adjusted EBITDA Margin; EBITDA after leases ("EBITDAaL"); EBITDAaL Margin; Gross and Net Financial Debt; Capital Expenditures; Net Payment of Interest; Available Liquidity, Recurring Leveraged Free Cash Flow and Free Cash Flow. Please note that during 2023, two new APMs (EBITDAaL and EBITDAaL Margin) have been incorporated and are presented together with the corresponding comparative information for 2022 year-end.

The definition and determination of the aforementioned APMs are disclosed in the accompanying Consolidated Management Report and are therefore validated by the Group auditor (Deloitte). The CNMV also conducted a review of the APMs as at December 2021.

The Company presents comparative financial information from the previous year as detailed in Note 2.e to the accompanying consolidated financial statements.

This relates to the “Operating profit” before “Depreciation, amortisation and results from disposals of fixed assets” and after adding back certain non-recurring expenses (such as donations, redundancy provision, extra compensation and benefit costs, and costs and taxes related to acquisitions, among others), certain non-cash expenses (such as LTIP remuneration and advances to customers).

The Group uses Adjusted EBITDA as an indicator of the operating performance of its business units and it is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders. At the same time, it is important to highlight that Adjusted EBITDA is not a measure adopted in accounting standards and, therefore, should not be considered an alternative to cash flow as an indicator of liquidity. Adjusted EBITDA does not have a standardised meaning and cannot therefore be compared with the Adjusted EBITDA of other companies.

One commonly used metric that is derived from Adjusted EBITDA is Adjusted EBITDA margin, as described below.

As at 31 December 2023 and 2022, respectively, the amounts were as follows:

|

Thousands of euros |

||

|

Adjusted EBITDA |

31 December 2023 |

31 December 2022 |

|

Broadcasting infrastructure |

230,027 |

223,497 |

|

Telecom Infrastructure Services |

3,680,767 |

3,159,629 |

|

Other Network Services |

138,429 |

112,054 |

|

Operating income[3] |

4,049,223 |

3,495,180 |

|

|

|

|

|

Staff costs[4] |

(333,984) |

(270,383) |

|

Repairs and maintenance[5] |

(111,246) |

(91,969) |

|

Utilities |

(366,014) |

(283,085) |

|

General and other services and change in provisions |

(311,272) |

(298,733) |

|

Depreciation, amortisation and results from disposals of fixed assets[6] |

(2,552,635) |

(2,320,694) |

|

Operating profit |

374,072 |

230,316 |

|

|

|

|

|

Depreciation and amortisation |

2,552,635 |

2,320,694 |

|

Non-recurring expenses [7] |

77,724 |

75,983 |

|

Advances to customers |

3,983 |

3,442 |

|

Adjusted operating profit before depreciation and amortisation charge (Adjusted EBITDA) |

3,008,414 |

2,630,435 |

[3] See note 20.a to the accompanying consolidated financial statements.

[4] See note 20.b to the accompanying consolidated financial statements.

[5] See note 20.c to the accompanying consolidated financial statements.

[6] See note 20.e to the accompanying consolidated financial statements.

[7] See note 20.d to the accompanying consolidated financial statements.

Non-recurring and non-cash expenses, as well as advances to customers at 31 December 2023 and 2022 are set out below (see Note 20.d to the accompanying consolidated financial statements):

During 2023, Cellnex carried out relevant investments mainly related to BTS and disposals due to agreed remedies. If all the relevant investments and remedies carried out during 2023 had been completed by 1 January 2023 and had been fully consolidated for the full year ended on 31 December 2023, the Adjusted EBITDA would have amounted to some EUR 3,065 million and the payments of lease instalments in the ordinary course of business would have been approximately EUR 846 million.

Adjusted EBITDA Margin corresponds to Adjusted EBITDA (as defined above), divided by Services (Gross) excluding Utility Fee. Thus, it excludes elements passed through to customers from both expenses and revenues, mostly electricity costs, the utility fee as well as Advances to customers. Please note that the Adjusted EBITDA Margin for the year ended 31 December 2022 has been restated to exclude the Utility Fee from Services (Gross), The Group uses Adjusted EBITDA Margin as an operating performance indicator and it is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders.

Accordingly, the Adjusted EBITDA Margin as at 31 December 2023 and 2022 was 82% and 83%, respectively.

|

|

Thousands of Euros |

|

|

|

31 December 2023 |

31 December 2022 |

|

Services (Gross) (1) |

3,808,059 |

3,251,155 |

|

Utility Fee (1) |

149,290 |

71,257 |

|

Other operating income (1) |

245,147 |

247,467 |

|

Advances to customers (1) |

(3,983) |

(3,442) |

|

Operating income (1) |

4,049,223 |

3,495,180 |

|

Adjusted EBITDA |

3,008,414 |

2,630,435 |

|

Services (Gross ) excluding Utility Fee |

3,658,769 |

3,179,898 |

|

Adjusted EBITDA Margin |

82 % |

83 % |

(1) See note 20.a of the accompanying consolidated financial statements.

EBITDAaL refers to Adjusted EBITDA after leases. It deducts payments of lease instalments in the ordinary course of business to Adjusted EBITDA.

The Company uses EBITDAaL as an operating performance indicator of its business units and is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders. At the same time, it is important to highlight that EBITDAaL is not a measure adopted in accounting standards and, therefore, should not be considered an alternative to cash flow as an indicator of liquidity. EBITDAaL does not have a standardized meaning and, therefore, cannot be compared to the EBITDAaL of other companies.

One commonly used metric that is derived from EBITDAaL is EBITDAaL margin.

|

Thousands of Euros |

||

|

31 December 2023 |

31 December 2022 |

|

|

Adjusted EBITDA |

3,008,414 |

2,630,435 |

|

Payments of lease instalments in the ordinary course of business and interest payments |

(851,469) |

(791,743) |

|

EBITDA after leases(EBITDAaL) |

2,156,945 |

1,838,692 |

EBITDAaL Margin corresponds to EBITDAaL, divided by "Services (Gross) excluding Utility Fee". Thus, it excludes elements passed through to customers from both expenses and revenues, mostly electricity costs, the utility fee, as well as Advances to customers.

The Group uses EBITDAaL Margin as an operating performance indicator and it is widely used as an evaluation metric among analysts, investors, rating agencies and other stakeholders.

|

Thousands of Euros |

||

|

31 December 2023 |

31 December 2022 |

|

|

Service(Gross) (1) |

3,808,059 |

3,251,155 |

|

Utility Fee (1) |

149,290 |

71,257 |

|

Other operating income (1) |

245,147 |

247,467 |

|

Advances to customers (1) |

(3,983) |

(3,442) |

|

Operating income (1) |

4,049,223 |

3,495,180 |

|

EBITDAaL |

2,156,945 |

1,838,692 |

|

Services(Gross) excluding Utility Fee |

3,658,769 |

3,179,898 |

|

EBITDAaL Margin |

59 % |

58 % |

(1) See note 20.a of the accompanying consolidated financial statements.

The Gross Financial Debt corresponds to “Bond issues and other loans”[8], “Loans and credit facilities”[9] and “Lease liabilities”[10], but does not include any debt held by Group companies registered using the equity method of consolidation, “Derivative financial instruments”[11] or “Other financial liabilities”[12]. "Lease liabilities" is calculated as the present value of lease payments payable over the lease term, discounted at the rate implicit or at the incremental borrowing rate.

In line with the above, its value as at 31 December 2023 and 2022, respectively, is as follows:

|

Thousands of euros |

||

|

Gross Financial Debt |

31 December 2023 |

31 December 2022 restated |

|

Bond issues and other loans (Note 15) |

14,303,672 |

14,045,410 |

|

Loans and credit facilities (Note 15) |

4,391,837 |

3,838,178 |

|

Lease liabilities (Note 16) |

2,814,419 |

2,985,855 |

|

Gross financial debt |

21,509,928 |

20,869,443 |

[8] See note 15 to the accompanying consolidated financial statements.

[9] See note 15 to the accompanying consolidated financial statements.

[10] See note 16 to the accompanying consolidated financial statements.

[11] See note 11 to the accompanying consolidated financial statements.

[12] See note 15 to the accompanying consolidated financial statements.

6. Net Financial Debt

The Net Financial Debt corresponds to "Gross financial debt” less “Cash and cash equivalents”[13] and "Other financial assets"[14]. Together with Gross Financial Debt, the Group uses Net Financial Debt as a measure of its solvency and liquidity as it indicates the current cash and equivalents in relation to its total debt liabilities. One commonly used metric that is derived from Net Financial Debt is "Net Financial Debt / Adjusted EBITDA" which is frequently used by analysts, investors and rating agencies as an indication of financial leverage.

“Net financial debt” at 31 December 2023 and 2022 is as follows:

|

Thousands of euros |

||

|

Net Financial Debt |

31 December 2023 |

31 December 2022 restated |

|

Gross financial debt |

21,509,928 |

20,869,443 |

|

Cash and short term deposits (Note 13.a) |

(1,292,439) |

(1,038,179) |

|

Other financial assets (Note 13.b) |

(115,581) |

(93,242) |

|

Net financial debt |

20,101,908 |

19,738,022 |

[13] See note 13.a to the accompanying consolidated financial statements.

[14] See note 13.b to the accompanying consolidated financial statements.

At 31 December 2023, net financial debt amounted to EUR 20,102 million (EUR 19,738 million in 2022 restated), including a consolidated cash and cash equivalents position of EUR 1,292 million (EUR 1,038 million in 2022) and EUR 116 million of other financial assets (EUR 93 million in 2022).

|

Thousands of euros |

||

|

Net Financial Debt evolution |

31 December 2023 |

31 December 2022 restated |

|

Beginning of Period |

19,738,022 |

14,609,225 |

|

Recurring leveraged free cash flow (1) |

(1,545,381) |

(1,367,925) |

|

Expansion (or organic growth) capital expenditures(1) |

458,193 |

349,553 |

|

Expansion capital expenditures (Build to Suit programs) and Remedies (1) |

936,899 |

2,133,206 |

|

M&A Capital Expenditures (1) |

695,969 |

3,542,589 |

|

Divestments (1) |

(551,109) |

— |

|

Non-Recurrent Items (cash only) (1) |

25,478 |

59,334 |

|

Other Net Cash Out Flows (2) |

59,326 |

(137,129) |

|

Issue of equity instruments, Treasury Shares and Payment of Dividends (3) |

296,349 |

338,842 |

|

Net repayment of other borrowings (4) |

(9,416) |

(1,957) |

|

Change in Lease Liabilities (5) |

(171,436) |

80,093 |

|

Accrued Interest Not Paid and Others (6) |

169,014 |

132,191 |

|

End of Period |

20,101,908 |

19,738,022 |

(1) See footnotes 1 to 12 in heading “Recurring leveraged free cash flow” of the accompanying Consolidated Management Report.

(2) Corresponds to "Other Net Cash Outflows" (see footnote 14 in heading "Recurring Leveraged Free Cash Flow" of the accompanying Consolidated Management Report), excluding other financial assets (€22Mn, see note 13.b to the accompanying Consolidated Financial Statements).

(3) Corresponds to "Issue of equity instruments, Acquisition of Treasury Shares and Dividends paid" in the accompanying Consolidated Statement of Cash Flows for the period ended 31 December 2023, minus the contribution of minority shareholders (€56Mn, see the relevant section in the Consolidated Statement of Changes in Net Equity and Note 14.f to the accompanying Consolidated Financial Statements), corresponding to (i) the net impact of the equity component of the recently repurchased Convertible Bond and the newly issued Convertible Bond and (ii) dividends paid (€40Mn, see Note 14.d. to the accompanying Consolidated Financial Statements).

(4) Corresponds to "Net repayment of other borrowings" (see the relevant section in the Consolidated Statement of Cash Flows for the year ended on 31 December 2023).

(5) Changes in “Lease liabilities” long and short term to the accompanying Consolidated Balance Sheet as of 31 December 2023. See Note 16 to the accompanying consolidated financial statements.

(6) “Accrued interest not paid and others” include, mainly, arrangement expenses accrued, change in interest accrued not paid, convertible bonds accretion and Foreign exchange differences.

Net Payment of Interest corresponds to i) “interest payments on lease liabilities”[15] plus ii) “Net payment of interest (not including interest payments on lease liabilities)” and iii) non-recurring financing costs[16].

The reconciliation of the heading “Net Payment of Interest” from the Consolidated Statement of Cash Flows corresponding to the year ended on 31 December 2023 and 2022, with the “Net financial loss” in the Consolidated Income Statement is as follows:

|

Thousands of euros |

||

|

Net Payment of Interest |

31 December 2023 |

31 December 2022 |

|

Interest Income [17] |

76,445 |

22,519 |

|

Interest Expense [18] |

(884,294) |

(751,478) |

|

Bond & loan interest accrued not paid |

175,581 |

164,621 |

|

Interest accrued in prior year paid in current year |

(159,962) |

(134,998) |

|

Amortised costs – non-cash |

82,682 |

93,913 |

|

Net payment of interest as per the Consolidated Statement of Cashflows |

(709,548) |

(605,423) |

[15] See note 16 to the accompanying consolidated financial statements.

[16] See note 20.d to the accompanying consolidated financial statements.

[17] See note 20.f to the accompanying consolidated financial statements.

[18] See note 20.f to the accompanying consolidated financial statements.

Net payment of interest as per the Consolidated Statement of Cash Flows, which corresponds to i) “interest payments on lease liabilities” for an amount of €327,324 thousand (see Note 16 to the accompanying consolidated financial statements) plus ii) “Net payment of interest" (not including interest payments on lease liabilities) for an amount of €381,111 thousand (see section “Recurring leveraged free cash flow” of the accompanying Consolidated Management Report) and plus iii) non-recurring financing costs (€1,113 thousand, see heading “Recurring leveraged free cash flow” of the accompanying Consolidated Management Report).

The Group considers as Available Liquidity the available cash and available credit lines at year-end closing, as well as other financial assets described in Note 13.b to the accompanying consolidated financial statements.

The breakdown of the available liquidity at 31 December 2023 and 2022 is as follows:

|

Thousands of Euros |

||

|

Liquidity availability |

31 December 2023 |

31 December 2022 |

|

Available in credit facilities |

3,180,218 |

3,344,826 |

|

Cash and cash equivalents[19] |

1,292,439 |

1,038,179 |

|

Other financial assets[20] |

115,581 |

93,242 |

|

Available Liquidity |

4,588,238 |

4,476,247 |

[19] See note 13.a to the accompanying consolidated financial statements.

[20] See note 13.b to the accompanying consolidated financial statements.

The Group considers Capital Expenditures as an important indicator of its operating performance in terms of investment in assets, including their maintenance, organic and build-to-suit expansion, and acquisition. This indicator is widely used in the industry in which the Group operates as an evaluation metric among analysts, investors, rating agencies and other stakeholders.

The Group classifies its capital expenditures in four main categories:

Maintenance capital expenditures

Includes investments in existing tangible or intangible assets, such as investment in infrastructure, equipment and information-technology systems, and are primarily linked to keeping infrastructure, active and passive equipment in good working order. Maintenance Capex also includes network maintenance, such us corrective maintenance (responses to network incidents and preventive inspections, e.g. replacement of air conditioning or electrical equipment), statutory maintenance (mandatory inspections under regulatory obligations, e.g. infrastructure certifications, lightning certifications), network renewal and improvements (renewal of obsolete equipment and assets improvement, e.g. tower reinforcement, battery renewal, phase-out management), continuity plans (specific plans to mitigate risk of infrastructure collapse or failure with existing services or assets not compliant with regulations), re-roofing (solutions to allow landlords' roofing work and avoid service discontinuity or building repairs attributable to Cellnex) as well as other non-network maintenance activities, such us business maintenance (infrastructure adaptations for tenants, upgrades not managed via engineering services, or capex to renew customer contracts without revenue increases), IT systems or repairs and maintenance of offices, as well as engineering services.

Expansion (or organic growth) capital expenditures

Includes adapting sites for new tenants, ground leases (cash advances), and efficiency measures associated with energy and connectivity, and early site adaptation to increase site capacity, and also engineering services. Thus, it corresponds to investments related to business expansion that generates additional recurring leveraged free cash flow (including among other things, decommissioning, adaptation of telecom sites for new tenants, engineering services and prepayments of land leases).

Expansion capital expenditures (build-to-suit programmes) and remedies

Corresponds to committed build-to-suit programmes (consisting of sites, backhaul, backbone, edge computing centres, DAS nodes or any other type of telecommunication infrastructure as well as any advanced payment related to it or further initiatives) and also engineering services that have been contracted with various customers, including any ad-hoc capex required. Cash-in from the disposal of assets (or shares) due to authority bodies' decisions come under this item.

M&A capital expenditures

Corresponds to investments in shareholdings of companies (excluding the amount of deferred payments in business combinations that are payable in subsequent periods) as well as significant investments in acquiring portfolios of sites or land (asset purchases).

Total capital expenditure for the years ended 31 December 2023 and 2022, including property, plant and equipment, intangible assets, advance payments on land leases, business combinations and divestments, is summarised as follows:

|

Thousands of euros |

||

|

Capital expenditures |

31 December 2023 |

31 December 2022 restated |

|

Maintenance capital expenditures |

138,884 |

107,726 |

|

Expansion (or organic growth) capital expenditures |

458,193 |

349,553 |

|

Expansion capital expenditures (build-to-suit programmes) and remedies |

936,899 |

2,133,206 |

|

Expansion capital expenditures (build-to-suit programmes) |

1,568,330 |

2,282,650 |

|

Remedies (2) |

(631,431) |

(149,444) |

|

M&A capital expenditures |

695,969 |

4,881,163 |

|

Total investment (1) |

2,229,945 |

7,471,648 |

(1) “Total Investment”, amounting to €2,230Mn (€7,472Mn in 2022), corresponds to “Total net cash flow from investment activities” in the accompanying Consolidated Statement of Cash Flows amounting to €1,592Mn (€5,950Mn in 2022), plus i) “Cash and cash equivalents” of the acquired companies in business combinations amounting to €0Mn (€101Mn in 2022, see Note 6 to the accompanying consolidated financial statements); plus ii) "Cash advances to landlords" and "Long-term rights of use to land" amounting to €104Mn (€133Mn in 2022, see Note 16 to the accompanying Consolidated Financial Statements); plus iii) the divestment of a 49% stake in Cellnex Nordics (€551Mn, see Notes 2.h.iv) and 14 to the accompanying Consolidated Financial Statements), plus iv) the payment for the Hutchison UK acquisition through Cellnex Telecom SA shares (€1,237Mn in 2022, see Note 6 to the accompanying consolidated financial statements); minus iv) "Others" amounting to €17Mn (€51Mn in 2022), which includes, mainly, timing effects related to assets purchases and other financial assets amounting to €-22Mn (€-93Mn in 2022, see note 13.b to the accompanying Consolidated Financial Statements), partly offset by the reimbursement of contributions of the initial investment in DIV amounting to €12Mn (€52Mn in 2022, see note 10 to the accompanying Consolidated Financial Statements).

(2) Corresponds to the price in relation to the Divestment Remedy with Phoenix France Infrastructures required by the French Competition Authority ("FCA") in France amounting €631Mn in 2023 (€0Mn in 2022) and WIG in the United Kingdom amounting €0Mn in 2023 (€149Mn in 2022).

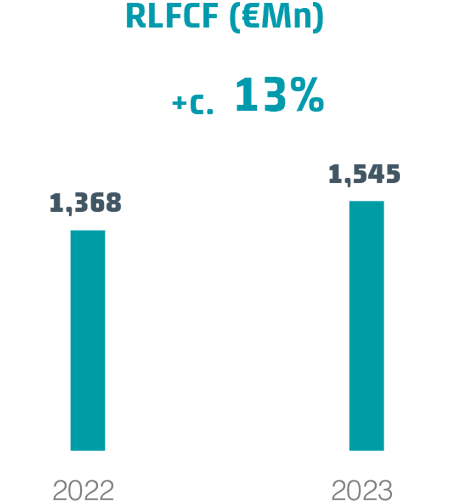

The Group considers Recurring Leveraged Free Cash Flow to be one of the most important indicators of its ability to generate stable and growing cash flows, which allows it to guarantee the creation of value, sustained over time, for its shareholders.

At 31 December 2023 and 2022 the Recurring Leveraged Free Cash Flow ("RLFCF") was calculated as follows:

|

Thousands of euros |

||

|

Recurring Leveraged Free Cash Flow |

31 December 2023 |

31 December 2022 |

|

Adjusted EBITDA (1) |

3,008,414 |

2,630,435 |

|

Payments of lease instalments in the ordinary course of business and interest payments (2) |

(851,469) |

(791,743) |

|

Maintenance capital expenditures (3) |

(138,884) |

(107,726) |

|

Changes in current assets/current liabilities (4) |

18,356 |

(16,803) |

|

Net payment of interest (without including interest payments on lease liabilities) (5) |

(381,111) |

(257,652) |

|

Income tax payment (6) |

(107,988) |

(88,586) |

|

Net dividends to non-controlling interests(7) |

(1,937) |

— |

|

Recurring leveraged free cash flow (RLFCF) |

1,545,381 |

1,367,925 |

|

Expansion (or organic growth) capital expenditures (8) |

(458,193) |

(349,553) |

|

Expansion capital expenditures (Build to Suit programs) and Remedies (9) |

(936,899) |

(2,133,206) |

|

Free Cash Flow |

150,289 |

(1,114,834) |

|

M&A capital expenditures (10) |

(695,969) |

(3,542,589) |

|

Divestments (11) |

551,109 |

— |

|

Non-Recurrent Items (cash only) (12) |

(25,478) |

(59,334) |

|

Net Cash Flow from Financing Activities (13) |

355,974 |

1,784,471 |

|

Other Net Cash Out Flows (14) |

(81,665) |

43,887 |

|

Net Increase of Cash (15) |

254,260 |

(2,888,399) |

(1) Adjusted EBITDA: Profit from operations before D&A (after IFRS 16 adoption) and after adding back (i) certain non-recurring items, such as costs and taxes related to acquisitions (€24Mn), redundancy provision (€30Mn) and donations (€1Mn), and/or (ii) certain non-cash items, such as advances to customers (€4Mn) which include the amortisation of amounts paid for sites to be dismantled and their corresponding dismantling costs, LTIP remuneration (€15Mn) and extra compensation and benefits costs (€7Mn).

(2) Corresponds to i) payments of lease instalments (€524Mn) in the ordinary course of business, excluding non-ordinary lease payments, and; ii) interest payments on lease liabilities (€327Mn). See Note 16 to the accompanying consolidated financial statements.

(3) Maintenance capital expenditures: see definition in section "Alternative Performance Measures".

(4) Changes in current assets/current liabilities (see the relevant section in the Consolidated Statement of Cash Flows for the year ended on 31 December 2023).

(5) Corresponds to the net of “Interest paid” and “interest received” in the accompanying Consolidated Statement of Cash Flows for the year ended on 31 December 2023 (€710Mn), excluding “Interest payments on lease liabilities” (€327Mn) (see Note 16 to the accompanying consolidated financial statements) and non-recurring financing costs (€1Mn, see footnote 13).

(6) Corresponds to “Income Tax received/(paid)” in the accompanying Consolidated Statement of Cash Flows for the year ended on 31 December 2023, excluding €72.6Mn of tax paid as detailed in footnote 14.

(7) Corresponds to the “Dividends to non-controlling interests” as per the Consolidated Statement of Cash Flows.

(8) Investment related to business expansion that generates additional RLFCF, including among others, decommissioning, telecom site adaptation for new tenants, engineering services and prepayments of land leases. Corresponds to cash advances to landlords (€56Mn), efficiency measures associated with energy and connectivity (€24Mn), and others (€378Mn, including early site adaptation to increase the capacity of sites).

(9) Committed Build-to-Suit Programmes and further initiatives (consisting of sites, backhauling, backbone, edge computing centers, DAS nodes or any other type of telecommunication infrastructure, as well as any advanced payment in relation to them). It also includes Engineering Services that have been contractualized with various customers, including any ad-hoc capex eventually required, and cash-in from the disposal of assets (or shares) due to antitrust bodies’ decisions. As of 31 December 2023 includes prepayments in France (see Note 8 to the accompanying Consolidated Financial Statements) in relation to committed Build-to-Suit Programmes, and further initiatives as well as the impact of Remedies (€631Mn, see caption “Capital Expenditures” in the accompanying Consolidated Directors’ Report for the year ended on 31 December 2023).

(10) Corresponds to investments in shareholdings of companies as well as significant investments in acquiring portfolios of sites, land and long-term rights of use of land (asset purchases), after integrating into the consolidated balance sheet mainly the "Cash and cash equivalents" of the acquired business. Mainly corresponds to the acquisition of the remaining minority stake in Poland (the acquisition of Hutchison UK and Iliad minority stakes in France and Poland in 2022).

The amount resulting from (3)+(8)+(9)+(10), hereinafter the “Total Capex” (€2,230Mn), corresponds to “Total Investment” (€2,230Mn, see heading “Capital Expenditures” in the accompanying Consolidated Directors’ Report for the year ended on 31 December 2023) minus the “Cash and cash equivalents” of the acquired companies (€0Mn, see Note 6 to the accompanying consolidated financial statements).

Total Capex (€2,230Mn) also corresponds to “Total net cash flow from investing activities” (€1,592Mn, see the relevant section in the accompanying Consolidated Statement of Cash Flows for the year ended on 31 December 2023) + "Cash advances to landlords" (€56Mn, see footnote 8) and "Long-term rights of use to land" (€48Mn) (see Note 16 to the accompanying Consolidated Financial Statements) + disposal of the 49% stake in Cellnex Nordics (€551Mn, see footnote 11) - Others (€17Mn, which includes, mainly, timing effects related to assets purchases and other financial assets (€22Mn, see note 13.b to the accompanying Consolidated Financial Statements)).

(11) Divestment in shareholdings of companies corresponding to the disposal of the 49% stake in Cellnex Nordics (Sweden and Denmark). Please, see Note 2.h) to the accompanying Consolidated Financial Statements.

(12) Corresponds to costs and taxes related to acquisitions (€24Mn) and Donations (€1Mn) (see footnote 1).

(13) Corresponds to “Total net cash flow from financing activities” (€206Mn, see the relevant section in the accompanying Consolidated Statement of Cash Flows for the year ended on 31 December 2023), minus: i) payments of lease instalments in the ordinary course of business (€524Mn, see footnote 2), ii) Cash advances to landlords (€56Mn) (see footnote 8), iii) long-term rights of use of land (€48Mn, see footnote 10), and iv) Dividends to non-controlling interests (€2Mn, see footnote 7), plus: i) others (€68Mn), mainly corresponding to the contribution of minority shareholders (€56Mn, see the relevant section in the Consolidated Statement of Changes in Net Equity), and non-recurring financing costs (€1Mn, see heading "Net Payment of Interest").

(14) Mainly corresponds to €72.6Mn of tax paid (see see footnote 6), derived from (i) the one-off tax payment upon the execution of the Divestment Remedy relating to the Hivory Acquisition (see Note 7 to the accompanying consolidated financial statements), and (ii) the advanced Spanish Corporate Income Tax payment relating to the disposal of 49% stake in Cellnex Nordics (see Note 14.f to the accompanying consolidated financial statements), which is based on accounting rather than taxable profits. With the filing of the 2023 Spanish Corporate Income Tax return in July 2024, such advanced payment shall be fully recovered (see Note 18.b to the accompanying consolidated financial statements).

(15) “Net (decrease)/increase in cash and cash equivalents from continuing operations” (see the relevant section in the accompanying Consolidated Statement of Cash Flow for the year ended on 31 December 2023).

Free Cash Flow is defined as RLFCF after deducting BTS Capex (that includes cash-in from Remedies) and Expansion Capex (and Engineering Services Capex should the latter be reported under a dedicated Capex line).

|

Thousands of euros |

||

|

Free Cash Flow |

31 December 2023 |

31 December 2022 |

|

Recurring leveraged free cash flow (RLFCF) |

1,545,381 |

1,367,925 |

|

Expansion capital expenditures (build-to-suit programmes) and Remedies |

(936,899) |

(2,133,206) |

|

Expansion (or organic growth) capital expenditures |

(458,193) |

(349,553) |

|

Free Cash Flow |

150,289 |

(1,114,834) |

Operating Income for the year ended in December 2023, by country and type of service, can be broken down as follows: Spain accounted for EUR 611 million (of which i) Telecom Infrastructure Services ("TIS") accounted for EUR 252 million – EUR 198 million colocations and DAS, EUR 8 million Engineering Services, EUR 44 million pass-through and EUR 3 million data centres, ii) Broadcasting Infrastructure EUR 230 million and iii) Other Network Services EUR 129 million), while fibre revenues reported both at Telecom Infrastructure Services and Other Network Services amounted to EUR 43 million), Italy accounted for EUR 797 million (of which i) Telecom Infrastructure Services ("TIS") accounted for EUR 794 million – EUR 618 co-locations and DAS, EUR 11 million Engineering Services and EUR 165 million pass-through and ii) Other Network Services EUR 3 million), France accounted for EUR 795 million (entirely from Telecom Infrastructure Services – EUR 630 million co-locations and DAS, EUR 84 million Engineering Services, EUR 19 million pass-through, EUR 29 million data centres and EUR 33 million fibre) and the rest of Europe accounted for EUR 1,848 million (of which, Telecom Infrastructure Services accounted for EUR 1,841 million – EUR 1,516 million co-locations and DAS, EUR 152 million Engineering Services the largest contributors being the i) UK with EUR 98 million, ii) Switzerland with EUR 20 million, iii) Poland with EUR 17 million and iv) Portugal with EUR 12 million, EUR 167 million pass-through, EUR 6 million data centres and EUR 0.1 million fibre and Other Network Services for EUR 7 million). The Operating Income breakdown in 2022 was: Spain EUR 566 million (of which, Telecom Infrastructure Services accounted for EUR 234 million, EUR 179 million co-locations and DAS, EUR 6 million Engineering Services, EUR 47 million pass-through and EUR 2 million data centres, Broadcasting Infrastructure for EUR 223 million and Other Network Services for EUR 109 million, while fibre revenues reported both at Telecom Infrastructure Services and Other Network Services amounted to EUR 35 million), Italy amounted to EUR 735 million (entirely from Telecom Infrastructure Services – EUR 567 million co-locations and DAS, EUR 22 million Engineering Services and EUR 146 million pass-through), France amounted to EUR 749 million (entirely from Telecom Infrastructure Services – EUR 607 million co-locations and DAS, EUR 97 million Engineering Services, EUR12 million pass-through, EUR 18 million data centres and EUR 15 million fibre –) and Rest of Europe amounted to EUR 1,446 million (of which, Telecom Infrastructure Services accounted for EUR 1,444 million – EUR 1,185 million co-locations and DAS, EUR 143 million Engineering Services, the largest contributors being the UK with EUR 92 million, Switzerland with EUR 19 million, Poland with EUR 15 million and Portugal with EUR 12 million, EUR 111 million pass-through, EUR 5 million data centres and EUR 0.4 million fibre and Other Network Services for EUR 2 million).

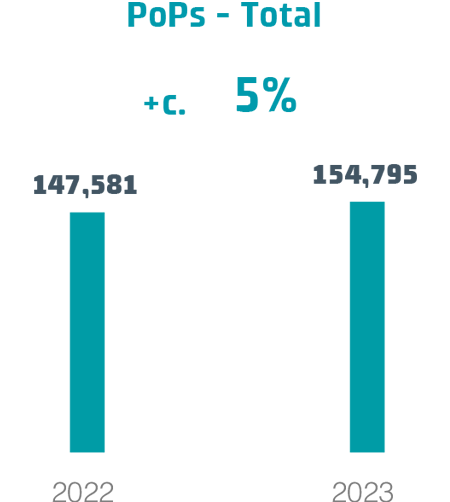

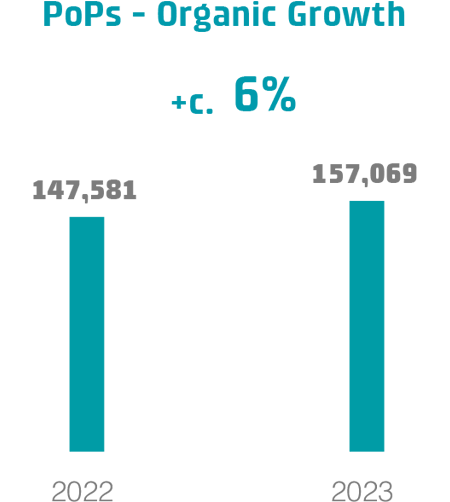

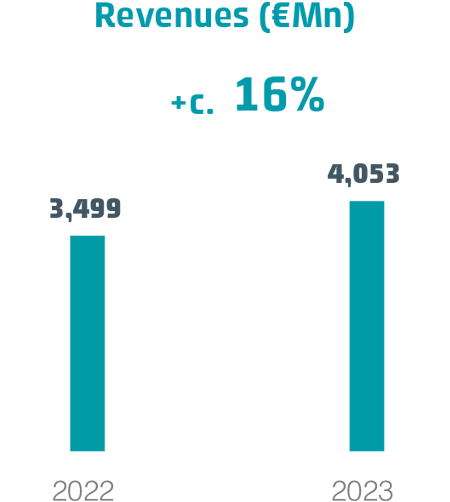

Operating Income for the year ended on 31 December 2023 was EUR 4,049 million, which represents a 16% increase over the 2022 year-end. This increase was mainly due to the twelve month consolidation in 2023 of the business combination carried out during second half of 2022, in relation to the Hutchison United Kingdom Acquisition (please see Note 6 of the 2022 Consolidated Financial Statements).

Operating Income from Telecom Infrastructure Services income increased by 16% to EUR 3,681 million, due to both the organic growth achieved and the business combination performed during 2022 in the UK, as detailed above. The Group provides its customers in Telecom Infrastructure Services with coverage-related services and access to the Group’s telecom or broadcasting infrastructures for MNOs to co-locate their equipment on the Group’s infrastructure, offering additional services that allow MNOs to rationalise their networks and optimise costs, through the dismantling of duplicate infrastructure (decommissioning) and building new infrastructure (build-to-suit) on strategic sites that can offer service to one or more MNOs. These services have the aim of completing the deployment of 4G and 5G in the future, reducing areas with no signal coverage and extending network densification. The Group acts as a neutral operator for MNOs (for example, by not having one or more MNOs as a significant shareholder represented on the Board of Directors or other governance bodies) and other telecom operators who generally require full access to network infrastructure in order to provide services to end users. The Group acts as a multi-infrastructure operator. Its customers are responsible for the individual communication equipment hosted on the Group’s telecom and broadcasting infrastructure. Telecom Infrastructure Services are generated from a number of sources: i) annual base fee from telecommunications customers (both anchor and secondary tenants), ii) escalators or inflation as the annual update of the base fee and, iii) New co-locations and Associated revenues (which include new third-party co-locations as well as further initiatives carried out in the period such as special connectivity projects, indoor connectivity solutions based on DAS, mobile edge computing, fibre backhauling, site configuration changes as a result of 5G rollout and Engineering Services as well as housing services to broadcasters outside of Spain). The perimeter, therefore the number of tenants, may also be increased as a result of both acquisitions and executing BTS programmes. The foreseeable new technological requirements linked to 5G along with other ordinary maintenance services such as investment in infrastructure, equipment and information technology systems, generally at the request of its customers, will translate into asset investment commitments in the coming years. In this context, the Group carries out engineering services, consisting of works and studies such as adaptation, engineering and design services as well as Installation Services at the request of its customers, which represent a separate income stream and performance obligation. Engineering services carried out in Cellnex infrastructure are invoiced and accrued when the customer's request is finalised and collected in accordance with each customer agreement with certain margin28. Also, Engineering services can be deployed under the heading of Capex Recovery which are carried out, invoiced, accrued and collected over several years with a certain margin28. The costs incurred in relation to these services, that will be classified as capital expenditures, can be an internal expense or otherwise outsourced and the revenue in relation to these services is generally recognised when the capital expense is incurred. The margin [21] is significantly lower than the Adjusted EBITDA margin of the Group, tending to be a mid-single-digit percentage. In terms of engineering services, when a new PoP is installed, the following concepts are usually involved: As-built drawings, strength calculation, reports (electro, static, EMF...), joint site survey, site adequacy, energy meter installation, access cards and keys or tower/mast modifications. On the other hand, installation services are a type of engineering services carried out mainly in Cellnex' infrastructure, accrued as projects progress, invoiced and collected in accordance with certain milestones. If the project is finalised and rejected by the customer, the cost is reclassified as an expense. Installation services include the installation of customers' equipment on site, such as installation of antennae, microwave equipment or remote radio units. The total amount of revenues associated with these engineering services during 2023was EUR 254Mn (EUR 267Mn during 2022). The total amount of capital expenditures incurred related to engineering services during 2023 is disclosed in Note 8 to the accompanying consolidated financial statements. Until 2022, Engineering services were considered within the BTS programmes disclosed to the market: various acquisition business plans have contractualised engineering services. From 2023 onwards, if more engineering services are required, the capital expenditures associated with the projects will be reported within Expansion Capex or Maintenance Capex, depending on its nature and magnitude, and, if required, as a new capex line. Some of this capex devoted to engineering services, especially in the UK, can be advances of capex to be recovered through future engineering services revenues as well as the corresponding margin (Capex Recovery).

The Group generally receives monthly payments from customers, payable under long-term contracts (which in the case of anchor customers have long or undefined maturities with automatic extensions, unless cancelled). The annual payments vary considerably depending upon numerous factors, including, but not limited to, the infrastructure location, the number and type of customer’s equipment on the infrastructure, ground space required by the customer, customer ratio, equipment at the infrastructure and remaining infrastructure capacity. The main costs typically include related services (which are primarily fixed, with annual cost escalations) such as energy and ground costs, property taxes and repairs and maintenance. The majority of the land and rooftops where the Group’s infrastructures are located, are operated and managed via lease contracts, sub-lease contracts or other types of contracts with third parties. In general, MNOs handle the maintenance of their own equipment under their responsibility, although in some cases they may subcontract to the Group the maintenance of their equipment as a separate and additional service.

In the context of 5G and its forecasted growth, Cellnex will continue expanding its presence in greenfield projects or "tower-adjacent assets" that are playing a key role in the 5G world such as; optical fibre, edge computing centres, RAN sharing or private networks, among others. Cellnex is committed to preserving its business model but also might expand into adjacent assets along its value chain and under the same tower economics (i.e., a B2B business model with limited churn risk, deep industrial rationale within the telecommunications ecosystem, with anchor tenants securing the majority of the expected future cash flows of projects, long term contracts with fixed fees that are CPI-linked or have a fixed escalator and ability to market infrastructure to third parties).

As disclosed in the January-September 2022 results presentation, the Group is currently evaluating a number of opportunities related to: i) supporting MNOs to improve their networks and increase coverage requiring RAN Sharing, FTTT, data centres , ii) enhancing public sector coverage in rural areas, providing mobile broadband connectivity through metropolitan transport systems, inter-city communications and motorway and railway environments, and improving public safety connectivity, iii) building private networks for enterprises in order to maximise industry uses. Cellnex estimates an aggregate pipeline of approximately EUR 11 billion, always subject to the achievement of Investment Grade and in accordance with its strict financial criteria.

Furthermore, those future agreements might allow Cellnex to offer additional services to existing partners with a gradual deployment, that is always commensurate with the next chapter of the Cellnex equity story.

The Group has extensive experience in DAS network solutions. The Group has deployed approximately 9,678 DAS nodes, with a customer ratio of three MNOs per infrastructure, in venues such as stadiums, skyscrapers, shopping malls, dense outdoor areas, airports, underground lines and railway stations. DAS is a network of spatially distributed antennae connected to a common source, thus providing wireless service within a specific geographical area. The system can support a wide variety of technologies and frequencies, obviously including 2G, 3G, 4G and 5G in the future. The Group works as a true neutral host, together with the MNOs, in order to provide the optimal solution for the increasing need for coverage and densification in complex scenarios. The Group manages the complete life cycle of the solution: infrastructure acquisition, design, installation, commissioning, O&M, supervision and service quality assurance. The Group also operates the active network equipment for the DAS nodes that the Group manages.

The Group is also developing capabilities in fibre to the tower and edge computing centres infrastructure, in order to offer its customers the data-processing capacity distributed in the network, without which the potential of 5G could not be realised. For instance, in 2017 the Group acquired Alticom, a Dutch company that owns a portfolio of sites which has data centres, in 2018 and 2019 Cellnex signed an agreement to build 88 and acquire 62 edge computing centres for Bouygues Telecom and in 2020 it extended the scope to build another 90 sites with those characteristics with Bouygues Telecom in the context of the fibre co-investment deal to roll-out a transport network (backhaul and backbone) connecting all key elements of the telecom network of Bouygues Telecom over optical fibre. Also in Cellnex Netherlands, co-location to broadcasters and also broadcasting services can be provided to customers. Please note that all revenue from Cellnex Netherlands is classified as TIS.

In general, the Group’s service contracts for co-location services with anchor customers have an initial non-cancellable term of 10 to 20 years, with multiple renewal terms (which in the case of anchor customers have long or undefined maturities with automatic extensions, unless cancelled, with "all or nothing" clauses), and payments that are typically revised based on an inflationary index like the consumer price index (CPI) or on fixed escalators. The Group’s customer contracts have historically had a high renewal rate. In this regard, the Telefónica contract, the first anchor customer that reached its initial term, has been successfully renewed. Contracts in place with Telefónica and Wind Tre may be subject to change in terms of the fees being applied at the time of a renewal, within a predefined range taking into account the last annual fee (which reflects the cumulative inflation of the full initial term), that in the case of Telefónica ranges from -5% to +5% (applicable after the initial period and the first two extension periods have elapsed) and from -15% to +5% for Wind Tre.

Operating Income from the Broadcasting Infrastructure business amounted to EUR 230 million, which represents a 3% increase compared with 2022 year-end. This business segment consists of the distribution and transmission of TV and radio signals as well as the O&M of broadcasting networks, the provision of connectivity for media content, OTT broadcasting services and other services, all of them in Spain. The provision of these services requires unique high-mast infrastructure that, in most cases, only the Group owns, substantial spectrum management know-how, and the ability to comply with very stringent service levels. In Spain, the Group covers more than 99% of the population with DTT and radio of the broadcast infrastructure, which is a portfolio larger than all of its competitors combined. The Group’s broadcasting infrastructure segment is characterised by predictable, recurrent and stable cash flows as well as in-depth technical know-how that allows the Group to provide consulting services. The Group classifies the services that it provides to its customers as a broadcast network operator in three groups: (i) Digital TV, (ii) Radio and (iii) Other broadcasting services. The Group’s customers within the broadcasting infrastructure segment include all national and most regional and local TV broadcasters as well as leading radio station operators in Spain. Some of the key customers for DTT services include Atresmedia, CTTI, Mediaset España, Net Televisión, Veo Televisión and RTVE. The DTT broadcasting contracts have no volume risk, but do feature stable and visible pricing of MUXs, compliance with applicable regulations and attractive indexation terms. The main features of the Group’s DTT broadcasting contracts are: medium-term contracts with high renewal rates, no volume risk, stable and visible pricing, and generally a high degree of indexation to the CPI that allows the Group to cover increases in operational costs where the CPI is positive (except for the RTVE contract that was renewed in 2023 with the same fees but with no annual escalator, while other nationwide broadcasters have indexing to the CPI capped at 3% when inflation stands at or below 5% and at 4% when inflation stands above 5%), as the decrease cannot be less than 0%. Note that Cellnex completed a general cycle of renewing contracts with customers in the broadcasting field, although in recent years the relative weight of this segment has decreased significantly. The strategy in this business segment is to maintain its strong market position while capturing potential organic growth. Cellnex plans to maintain its leading position in the Spanish national digital TV sector (in which it is the sole operator of national TV MUXs) by leveraging its technical knowledge of infrastructure and network infrastructure, its market understanding and the technical expertise of its staff. A significant portion of the contracts of the Group with these customers are inflation-linked, taking into consideration that the decrease cannot be less than 0%. In the past, the Group has experienced a high rate of renewal for the contracts in this business segment, although there can be price pressure from customers when renegotiating contracts. The Group plans to continue working closely with regulatory authorities in relation to technological developments in both the TV and radio broadcasting markets and to leverage its existing infrastructure and customer relationships to obtain business in adjacent areas where it benefits from competitive advantages.

Operating Income from the Other Network Services segment increased its income by 23%, to EUR 138 million. The Group classifies the type of services that it provides in this segment in five groups: connectivity services, mission-critical and private network ("MC&PN") services, O&M, urban telecom infrastructure and optical fibre. "Connectivity services" include connectivity between different nodes of the telecommunication networks (backhaul) of the Group’s customers and/or connectivity with its customers’ premises (enterprise leased lines), using radio-links, fibre or satellite. The Group also provides specialised leased lines to telecom operators such as MNOs or FNOs, public administrations, and small and medium-sized enterprises as well as companies in rural areas of Spain offering high-speed connectivity. Under "MC&PN services", the Group operates seven regional and two municipal TETRA networks in Spain which are critical for the communication needs of regional governments and municipalities where the networks are located and a highly reliable Global Maritime Distress and Safety System (GMDSS) for the Maritime Rescue Service for the Safety of Life at Sea, which provides communication services to ships in distress and hazardous situations in the coastal areas around Spain. Under "O&M" the Group manages and operates infrastructure (as opposed to outsourcing it to third parties) and provides maintenance services for customer equipment and infrastructure to the Group’s customers (other than its broadcasting customers that are serviced by the Broadcasting Infrastructure segment). Through urban telecom infrastructure, the Group provides communications networks for smart cities and specific solutions for efficient resource and service management in cities. Under "optical fibre" the Group uses optical fibre to connect its, or its customers’, infrastructure (macro cells, DAS and Small Cells) and edge-computing facilities. When the main customer of such business is the public administration, rather than an MNO, this business is reported under the Other Network Services business segment. The Group’s main customers for its connectivity services are BT, Orange Spain, COLT, and Vodafone. Connectivity contracts usually have an initial term of three years and the fees charged are linked to the number of circuits deployed and the capacity used. Please note that, like Broadcasting Infrastructure, Other Network Services are provided in Spain only.

The transactions performed during the previous years, especially in the Telecom Infrastructure Services business segment, helped boost operating income and operating profit, the latter also being impacted by the measures to improve efficiency and optimise operating costs. Regarding land, which is the most important cost item, the Group makes cash advances, which are prepayments to landlords related to specific long-term contracts that allow Cellnex to reduce its annual recurring payments and extend the duration of the contracts, basically in order to obtaining efficiencies.The cash advances to landlords and long-term right of use lands executed during the year ended on 31 December 2023 amounts to EUR 103,998 thousand (EUR 132,708 thousand in 2022), and approximately c.8% of this cash advances are covering a lease period of 10 years or less (approximately 6% in 2022).

In line with the increase in operating income, Adjusted EBITDA was 14% higher than at the 2022 year-end, reflecting the Group’s capacity to generate cash flows on a continuous basis.

In this previous context of intense growth, the “Depreciation, amortisation and results from disposals of fixed assets” expense has increased substantially, by 10% compared to the 2022 year-end, as a result of the higher fixed assets (property, plant and equipment, and intangible assets) in the accompanying consolidated balance sheet, following the business combination undertaken during the second half of 2022.

Moreover, the net financial loss increased by 11%, derived largely from the new bond issuances and credit facility disposals carried out during 2023 and2022 year end.

Therefore, the net loss attributable to the parent company on 31 December 2023 amounted to EUR 297 million due to the substantial effect of higher amortisations and financial costs associated with the intense investment effort carried out during the previous years, and the consequent geographical footprint expansion, as mentioned above. Thus, as detailed in the Annual Results Presentation, the Group expects to continue experiencing a net loss attributable to the Parent company in the coming quarters.

Total assets at 31 December 2023 stood at EUR 44,365 million, a 1% increase compared with the 2022 year-end, due mainly due to both the investments carried out during 2023, offset by the amortisation of the intangible and tangible fixed assets, as well as the divestment of sites in France in accordance with the Divestment Remedy required by the FCA in the Hivory Acquisition (see Note 7 to the accompanying Consolidated Financial Statements). Around 82% of total assets concern property, plant and equipment and other intangible assets, in line with the nature of the Group’s business related to the management of terrestrial telecommunications infrastructure.

Thus, total investments made in 2023 amounted to EUR 2,230 million, mainly related to business expansion that generates additional Recurring Leveraged Free Cash Flow (including decommissioning, telecom site adaptation for new tenants and prepayments of land leases), as well as expansion capital expenditures related to committed build-to-suit programmes and engineering services with various clients (see Note 8 to the accompanying consolidated financial statements). Moreover, over this period the Group has also invested in maintaining its infrastructure and equipment, keeping sites in good working order, which is key to maintaining a high level of service.

Consolidated net equity at 31 December 2023 stood at EUR 15,147 million, in line with the 2022 year-end. During 2023, the Group has carried out some equity transactions with minority interests. In Poland, Cellnex acquired an additional 30% stakel of On Tower Poland, after which the Group now holds a 100% shareholding in this subsidiary. In addition, Cellnex completed the divestment of a 49% stake in Cellnex Nordics, which owns the Group business in Sweden and Denmark. Consequently, as a result of this transaction, the Group did not modify the controlling position in Cellnex Nordics (see Note 2.h to the accompanying consolidated financial statements).

In relation to bank borrowings and bond issues, the Cellnex debt structure is marked by flexibility, low cost and high average life, and the 76% at a fixed interest rate. During 2023 the Group has issued a new convertible bond for an amount of EUR 1,000 million, and has also repurchased the outstanding amount of EUR 800 million convertible bonds due 2026.

The Group's net financial debt as at 31 December 2023 stood at EUR 20,102 million compared with EUR 19,738 million at the end of 2022 (restated). Likewise, on 31 December 2023, Cellnex had access to immediate liquidity (cash & undrawn debt) to the tune of approximately EUR 4.6 billion (EUR 4.5 billion at the end of 2022).

+6.4% new PoPs vs. FY 2022 and strong progress on BTS programs

Regarding the Corporate Rating, at 31 December 2023, Cellnex maintained a long-term “BBB-” (Investment Grade) with stable outlook according to the international credit rating agency Fitch Ratings Ltd as confirmed by a report issued on 7 February 2024 and a long-term “BB+” with positive outlook according to the international credit rating agency Standard & Poor’s Financial Services LLC as confirmed by a report issued on 29 November 2023.

[21] Margin = (Revenues - Capex) / Revenues

Organic growth impact on Recurrent Levered Free Cash Flow c.21%.

Recurring Leveraged Free Cash Flow (please see section Milestones and Key Figures for 2023 of this Annual Integrated Report) organic growth generation in the year ended 31 December 2023 amounted to 254 million euros (please see full year 2023 results presentation), driven by a number of contributors: i) BTS programme execution (approximately 104 million euros), ii) escalators or inflation (approximately 67 million euros), iii) Operating expenses, ground lease efficiencies and synergies (approximately 20 million euros) and, iv) New co-locations and associated revenues (approximately 63 million euros). Management has taken account of the following assumptions:

Please see Note 17 to the accompanying Consolidated Financial Statements.

Please see Note 4 to the accompanying Consolidated Financial Statements.

Cellnex’s borrowing is represented by a combination of loans, credit facilities and bond issues. At 31 December 2023, the total limit of loans and credit facilities available was EUR 7,553,300 thousand (EUR 7,178,743 thousand as at 31 December 2022), of which EUR 3,958,010 thousand in credit facilities and EUR 3,595,290 thousand in loans (EUR 3,885,213 thousand in credit facilities and EUR 3,293,530 thousand in loans as at 31 December 2022).

|

Thousands of euros |

||||||

|

Notional as of 31 December 2023 (*) |

Notional as of 31 December 2022 (*) |

|||||

|

Limit |

Drawn |

Undrawn |

Limit |

Drawn |

Undrawn |

|

|

Bond issues and other loans |

14,428,249 |

14,428,249 |

— |

14,215,194 |

14,215,194 |

— |

|

Loans and credit facilities |

7,553,300 |

4,373,082 |

3,180,218 |

7,178,743 |

3,833,917 |

3,344,826 |

|

Total |

21,981,549 |

18,801,331 |

3,180,218 |

21,393,937 |

18,049,111 |

3,344,826 |

(1) Without including the “Lease liabilities” heading of the accompanying consolidated financial statements.

(*) These items include the notional value of each heading, and are not the gross or net value of the heading. See “Borrowings by maturity” of the Note 15 to the accompanying consolidated financial statements.

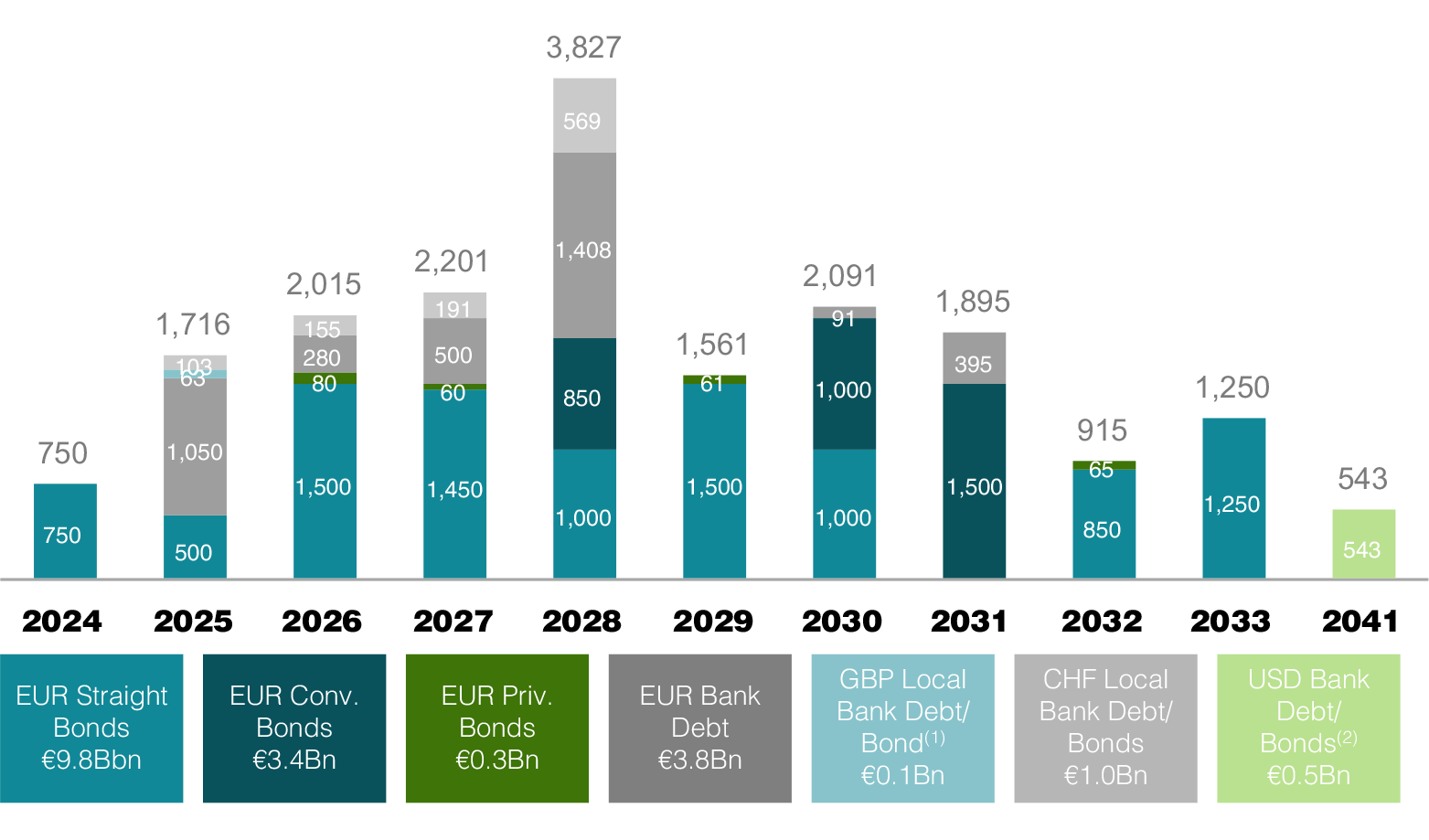

The following graph sets out Cellnex’s notional contractual obligations in relation to borrowings as at 31 December 2023 (EUR million):

Key highlights

(1) Includes EUR bonds swapped to GBP.; (2) Includes USD bonds swapped to EUR. (3) Corresponds to Notional Debt.

In accordance with the financial policy approved by the Board of Directors, the Group prioritises securing sources of financing at Parent Company level. The aim of this policy is to secure financing at a lower cost and longer maturities while diversifying its funding sources. In addition, this encourages access to capital markets and allows greater flexibility in financing contracts to promote the Group’s growth strategy.

The Cellnex Group’s Tax Policy, approved in July 2021 by its Board of Directors, establishes the fundamental guidelines governing the decisions and actions of the Cellnex Group in tax matters, in line with the basic principle of regulatory compliance, i.e. due compliance with the tax obligations which the Group is required to meet in each of the countries and territories where it does business, fostering cooperative relationships with tax administrations based on the duties of transparency, good faith and loyalty, and mutual trust. The policy is applicable to all Group entities and, consequently, is intended to be followed by the employees.

This Tax Policy reinforces and updates the first Group Tax Strategy approved in 2016.

It should be noted that Group’s Tax Policy establishes, among other things, its commitment to pay any applicable taxes in all countries in which it operates and the alignment of its taxation with the effective performance of economic activities and value generation. As a consequence of this principle, the Cellnex Group is present in the territories where it operates purely for business reasons. Additionally, the Group’s Tax Policy prohibits operating in territories considered as tax havens under Spanish law or included in the "European Union's black list of non-cooperative tax jurisdictions" in order to evade tax obligations which would otherwise be applicable. In this regard, the Cellnex Group companies are entities incorporated in European countries that are not listed as countries or territories classified as such.

In July 2021, the Board of Directors approved a new Fiscal Control and Risk Management Standard that establishes a three-lines-of-defense model:

The first line is comprised of the heads of various business and organisational units, including the Global Tax Department itself, to the extent that they own the different processes that may lead to fiscal risk and, therefore, are responsible for executing the controls assigned to them.

As the second line, ensuring the proper functioning of the Fiscal Control and Risk Management System and the adequate compliance with fiscal policies, monitoring action plans, controlling the evolution of fiscal risks, etc., Cellnex has the Tax Compliance Committee.

Finally, the third line of defense is responsible for the evaluation and assurance of the effectiveness and efficiency of the internal control systems, risk management, and governance systems and processes implemented in the fiscal risk domain. The head of this line of defense is Internal Audit. Additionally, to achieve these objectives and have a reliable, better, and more accurate model, the Fiscal Risk Management and Control System has been reviewed every year in accordance with the model's life cycle, which is based on five key stages: Identification, Assessment, Definition of Responses, Monitoring, and Continuous Improvement.

The Tax Compliance Committee reports to the Audit and Risk Management Committee and to the Board of Directors. Regarding the fiscal risk management process in the Cellnex Group, it is a continuous cycle based on five key phases (Identification, Assessment, Definition of Response, Monitoring, and Continuous Improvement). Finally, compliance with fiscal governance is assessed through the establishment of periodic controls on the various heads of different business and organisational units. In the event of detecting incidents in these controls, action plans are agreed upon.

To guarantee the proper functioning, supervision and effectiveness of the Tax Control Framework, in July 2021 the Board of Directors approved the incorporation of the Tax Compliance Committee. This new body reports to the Audit and Risk Management Committee and is structured as a collegiate body made up of a chairperson, three members and a technical secretary (the latter with no voting rights). While the three members belong to the Cellnex Group, the chairperson is an independent tax expert with extensive and recognised standing in the tax field.

The Tax Compliance Committee is required to promote and assess the correct implementation and efficacy of the Cellnex Tax Risks Control and Management System, and to enable the prevention, detection, management and mitigation of tax risks.

To do so, the Tax Compliance Committee supervises the planning and implementation of the processes and procedures necessary to meet the established requirements of the Tax Risks Control and Management System, which must be reviewed and controlled periodically, and ensures that tax compliance objectives are being met.

Furthermore, Cellnex Telecom, through its Ethics and Compliance Committee, provides all its employees and stakeholders with the Whistleblowing Channel. This is a communication tool that allows individuals to report, in a confidential and anonymous manner, irregularities, whether tax-related or in any other area, of potential significance observed within the companies that make up the Group.

In the case of tax-related communications, these are forwarded to the Tax Compliance Committee for analysis and resolution. In the year 2022, the operation of this mechanism was adjusted to comply with the provisions of Directive (EU) 2019/137 of the European Parliament and of the Council, dated October 23, 2019, regarding the protection of persons reporting breaches of Union law (Whistleblowing Directive), and it was outsourced to provide more guarantees to the pillars of confidentiality and anonymity.

Cellnex is fully committed to transparency in tax matters and to fostering a relationship with tax authorities based on the principles of mutual trust, good faith, transparency, collaboration and loyalty, and has been recognised as one of the top IBEX-35 companies in terms of tax transparency by Fundación Haz in its annual report "Contribución y Transparencia 2022", being awarded the top three-star rating.

In particular, and with regard to Spain, in September 2020, the Board of Directors of Cellnex Telecom, SA approved its adoption of the Code of Good Tax Practice of the Spanish Tax Authorities. In line with the principles of cooperative relationship with the Tax Authorities and transparency provided for in the Group’s Tax Policy, in 2023 the Cellnex Group submitted the Tax Transparency Report for the year 2022 (in 2021 and 2022, the Tax Transparency Reports for 2020 and 2021, respectively, were also submitted), (see the list of entities that have submitted the Tax Transparency Report). Although submission is not compulsory for entities or groups adopting the Code, the Group considered that the submission of this report was essential to forge a strong two-way relationship with the Spanish tax authorities.

Furthermore, looking at other territories where the Group has a presence, in September 2021 a Senior Accounting Officer was appointed for certain UK entities of the Group, with the main duties of adopting reasonable steps to ensure that the Group establishes and maintains appropriate tax accounting arrangements. Additionally, the Senior Accounting Officer must monitor the arrangements and identify and remedy or report any aspects in which these fall short of the requirement.

As a consequence of the having deployed a Tax Risk Control and Management System allowing the Group to manage taxes under the best quality standards, the Group considers that no significant impacts derived from a different interpretation of the law will be revealed during the course of tax inspections or litigations.

See Section 18 of the Consolidated Financial Statements for further information regarding tax inspections and litigations.

Cellnex is also sensitive to and aware of its responsibility for the economic development of the territories in which it operates, helping to create economic value by paying taxes, both on its own account and those collected from third parties. Accordingly, it makes a substantial effort and pays close attention to fulfilling its tax obligations, in accordance with the applicable rules in each territory.

Following the OECD's cash basis methodology, Cellnex's total tax contribution in its normal course of business in 2023 was EUR 465 million (EUR 513 million in 2022). Own taxes are those borne by the Group and those of third parties are those that are collected and paid to the various tax authorities on behalf of such third parties, and therefore do not represent a cost for the Group.

|

CELLNEX TAX CONTRIBUTION (millions of euros) |

||||||

|

|

31 December 2023 |

31 December 2022 |

||||

|

|

Own taxes(1) |

Tax collected from third parties(2) |

Total |

Own taxes(1) |

Tax collected from third parties (2) |

Total |

|

Spain |

109 |

98 |

207 |

37 |

75 |

112 |

|

Italy |

10 |

63 |

73 |

25 |

73 |

98 |

|

France |

74 |

(55) |

19 |

30 |

42 |

72 |

|

Netherlands |

5 |

20 |

25 |

11 |

20 |

31 |

|

United Kingdom |

15 |

10 |

25 |

40 |

35 |

75 |

|

Switzerland |

13 |

8 |

21 |

9 |

7 |

16 |

|

Ireland |

3 |

12 |

15 |

4 |

9 |

13 |

|

Portugal |

7 |

5 |

12 |

2 |

18 |

20 |

|

Austria |

0.5 |

0.7 |

1.2 |

0 |

3 |

3 |

|

Sweden |

1 |

6 |

7 |

5 |

7 |

12 |

|

Denmark |

0 |

7 |

7 |

0 |

2 |

2 |

|

Poland |

31 |

22 |

53 |

28 |

31 |

59 |

|

Total |

269 |

197 |

465 |

191 |

322 |

513 |

(1) Includes taxes that incur an actual cost for the Group (basically includes payments of income tax, local taxes, various rates and employers' social security contributions).

(2) Includes taxes that do not affect the result, but are collected by Cellnex on behalf of the tax authorities or are paid on behalf of third parties (they basically include the net value-added tax, with deductions from employees and third parties and employees' social security contributions).

The reconciliation of the heading “Income Tax Payment” from the Consolidated Statement of Cash Flows for the year ended on 31 December 2023 and 2022, with “Income tax” in the Consolidated Income Statement is as follows:

|

Thousands of euros |

||

|

Income tax payment |

31 December 2023 |

31 December 2022 |

|

Current tax expense[22] |

(135,270) |

(24,358) |

|

Payment of income tax prior year |

(14,669) |

(22,164) |

|

Receivable of income tax prior year |

35,725 |

9,143 |

|

Income tax (receivable)/payable |

(57,108) |

2,790 |

|

Non-recurring Income tax paid[23] |

— |

(7,342) |

|

Others |

(9,272) |

(53,997) |

|

Payment of income tax as per the Consolidated Statement of Cashflows |

(180,594) |

(95,928) |

[22] See note 18.b to the accompanying consolidated financial statements.

[23] See note 18.b, section "The reverse merger transaction" to the accompanying consolidated financial statements.

The breakdown of income tax payments by country for the 2023 financial year is as follows:

|

BREAKDOWN OF THE INCOME TAX PAYMENT BY COUNTRY (millions of euros) |

||||||||||

|

|

2023 |

2022 |

||||||||

|

|

Income from sales to third parties |

Income from intra-group operations with other tax jurisdictions |

Tangible assets other than cash and cash equivalent |

Corporate income tax accrued on gains/losses |

Corporate income tax paid |

Income from sales to third parties |

Income from intra-group operations with other tax jurisdictions |

Tangible assets other than cash and cash equivalent |

Corporate income tax accrued on gains/losses |

Corporate income tax paid |

|

Austria |

613 |

0 |

831 |

(43) |

— |

79 |

2 |

226 |

8 |

_ |

|

Denmark |

797 |

1 |

1,716 |

16 |

— |

36 |

2 |

87 |

3 |

— |

|

France |

794 |

— |

5,000 |

38 |

68 |

749 |

5 |

4,571 |

48 |

21 |

|

Ireland |

166 |

— |

258 |

8 |

2 |

57 |

2 |

193 |

(2) |

3 |

|

Italy |

142 |

1 |

146 |

9 |

1 |

735 |

1 |

1,605 |

13 |

9 |

|

Netherlands |

63 |

— |

— |

— |

7 |

130 |

5 |

148 |

(32) |

10 |

|

Poland |

659 |

— |

1,139 |

57 |

9 |

413 |

— |

1,234 |

3 |

7 |

|

Portugal |

149 |

— |

550 |

5 |

6 |

129 |

4 |

516 |

2 |

1 |

|

Spain |

83 |

73 |

257 |

3 |

80 |

567 |

96 |

887 |

14 |

9 |

|

Sweden |

60 |

0 |

157 |

2 |

1 |

56 |

1 |

142 |

6 |

5 |

|

Switzerland |

38 |

2 |

94 |

2 |

12 |

158 |

5 |

228 |

(6) |

9 |

|

UK |

485 |

1 |

1,519 |

24 |

(7) |

386 |

9 |

861 |

133 |

15 |

|

Total |

4,049 |

78 |

11,667 |

121 |

181 |

3,498 |

132 |

10,695 |

190 |

89 |

As part of the commitment to sustainability, Cellnex has designed a Sustainability-Linked Financing Framework to reinforce the role of sustainability as an integral part of the Group’s funding process.

The Framework is aligned with best practices as described by the International Capital Market Association’s (“ICMA”) Sustainability-Linked Bond Principles (“SLBP”) 2020 and the Loan Market Association’s (“LMA”) Sustainability-Linked Loan Principles 2021 (“SLLP”) and will also provide investors with further insights into Cellnex's sustainability strategy and commitments.

Cellnex’s Sustainability-Linked Financing Framework aims to cover any upcoming sustainability-linked financings, whether through Sustainability-Linked Bonds, Sustainability-Linked Convertible Bonds, Sustainability-Linked Loans or other debt instruments such as credit facilities and derivatives, whose financial characteristics are linked with sustainability performance targets. All Sustainability-Linked financing instruments will be referred to collectively as sustainability-linked financings.

The Framework has been reviewed by Sustainalytics, providers of Second Party Opinions (SPO) which considers it to be aligned with the International Capital Markets Association's Sustainable Bond Principles 2020 and the Loan Market Association's Sustainable Lending Principles 2023.

Cellnex has selected two environmental KPIs and one social KPI, which are core, relevant and material to its business and industry and are aligned with its ESG Strategy.

During the year ended at 31 December 2023 , the Group structured EUR 4.3Bn (EUR 3.4Bn as at 31 December 2022) in facilities linked to the Sustainability Framework for 5 years with two of the indicators included in the Framework. (see note 15).

The most up-to-date information on ESG financing programmes is available in the "Debt programmes" section of the corporate website. Additionally, Annex 8. Sustainable finance includes detailed information on the performance of the KPIs.

|

Indicator |

Description |

Status 2023 |

Target 2025 |

Target 2030 |

|

KPI 1a |

Reduction in Scope 1, 2 and 3 from fuel and energy-related activities GHG emissions |

(83)% |

(45)% |

(70)% |

|

KPI 1b |

Reduction of absolute Scope 3 GHG emissions from purchased goods and services, and from capital goods |

(14)% |

(21)% |

_ |

|

KPI 2 |

Annual sourcing of renewable electricity |

77% |

100% |

_ |

|

KPI 3 |