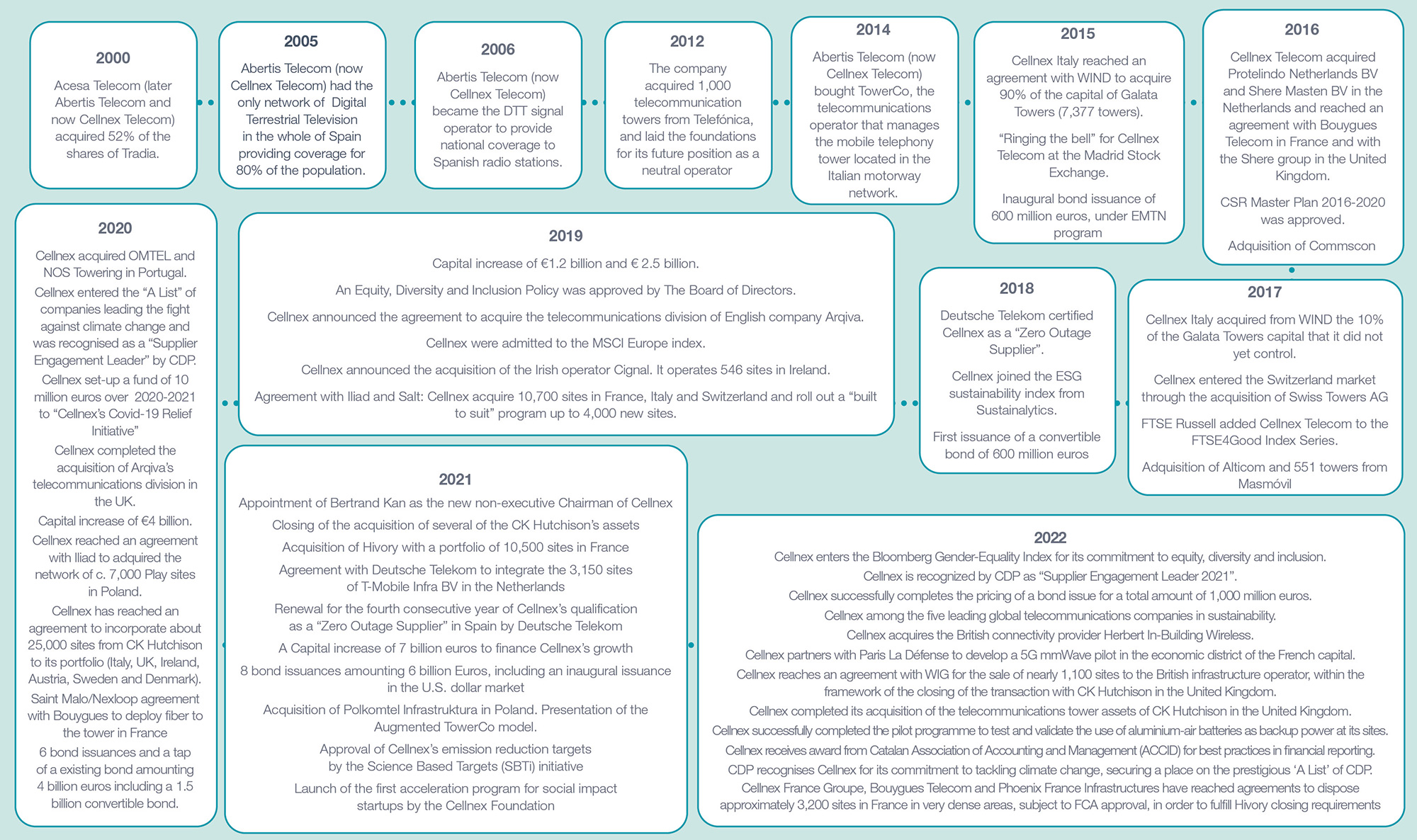

Cellnex is the main neutral1 infrastructure operator for wireless telecommunication in Europe, focused on the neutral and shared management. Cellnex was born in 2015 as the result of a spin-off from the telecommunications division of Abertis Group, and from that point Cellnex went public as an independent company under the name Cellnex Telecom.

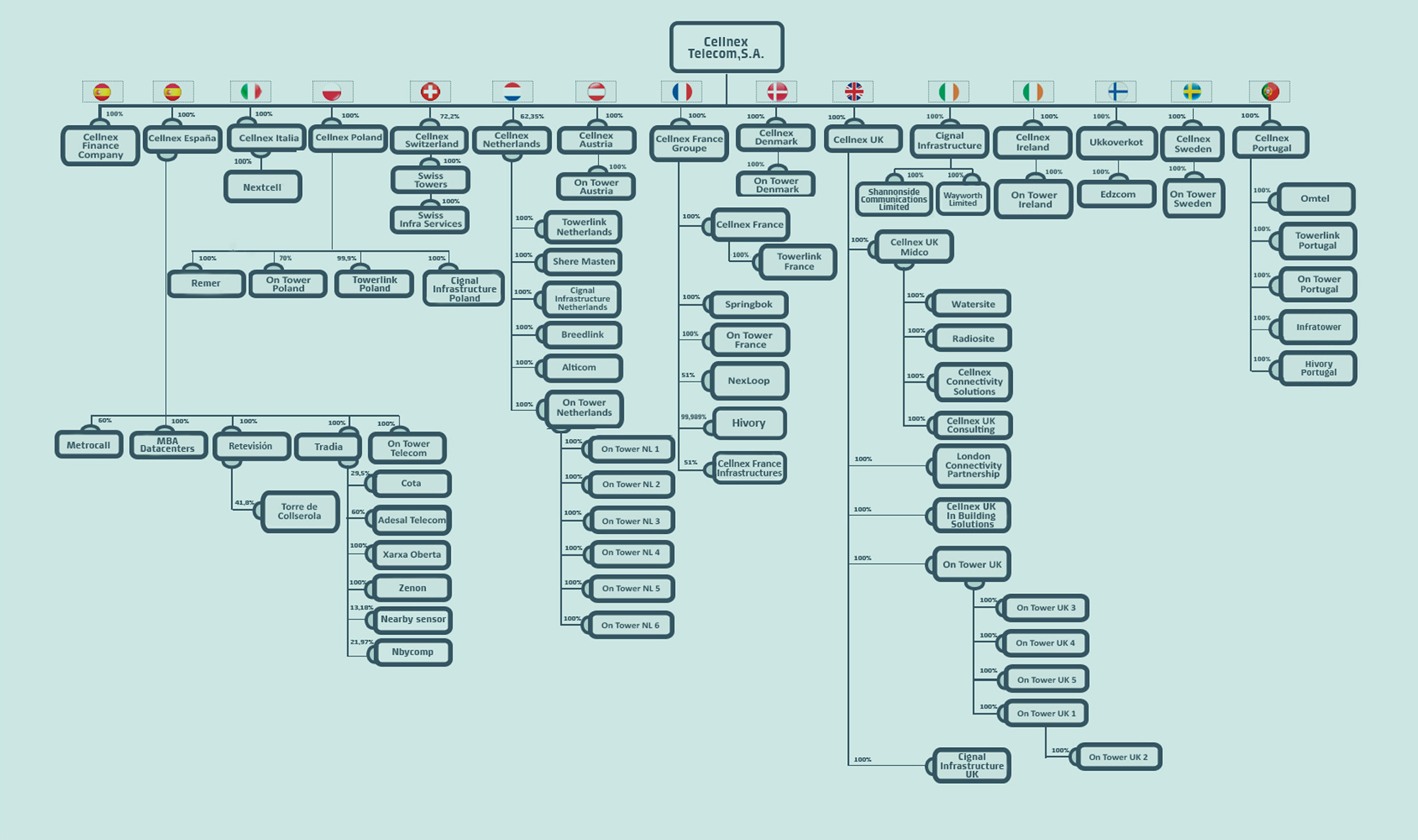

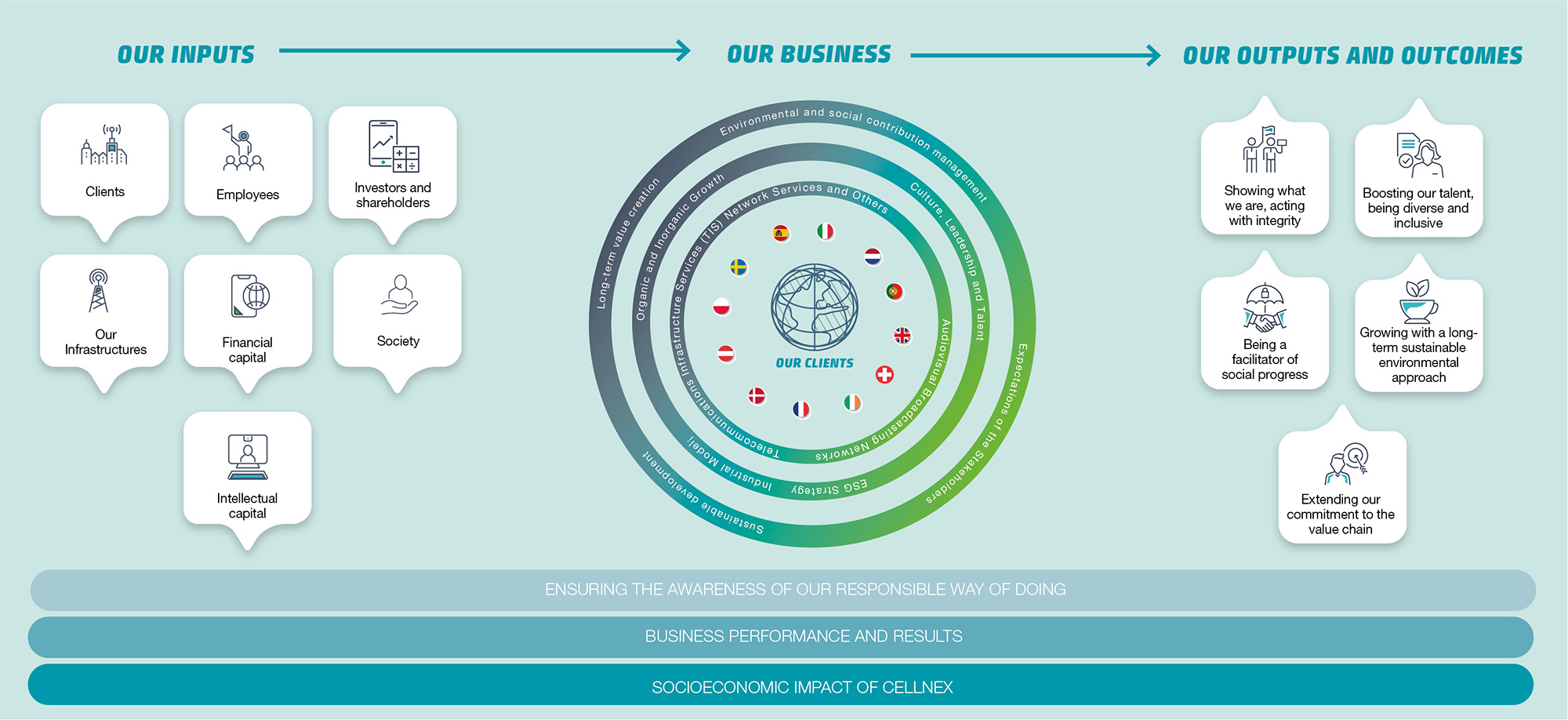

Cellnex Telecom, S.A. (a company listed on the Barcelona, Bilbao, Madrid, and Valencia stock exchanges) is the parent company of a group in which it is the sole shareholder and the majority shareholder of the companies operating in the various business lines and geographical markets. Cellnex offers its customers a suite of solutions and technologies designed to ensure the conditions for reliable top-quality transmission for the wireless dissemination of voice, data, and audiovisual content. The company also delivers innovative connectivity solutions and develops the necessary infrastructure ecosystem for the roll-out of new technologies. Cellnex’s business model focuses on the neutral and shared management of telecommunications infrastructures while strengthening its commitment to sustainability, as Cellnex aims to keep improving in this matter and extend its commitment throughout its value chain and stakeholder groups.

The company is listed on the continuous market of the Spanish stock exchange and is part of the selective IBEX 35 and EuroStoxx 100 indices. It is also present in the main sustainability indices, such as CDP (Carbon Disclosure Project), Sustainalytics, FTSE4Good, and MSCI.

Cellnex’s reference shareholders include GIC, Edizione, TCI, Blackrock, CPP Investments, CriteriaCaixa and Norges Bank.

The Group's organisational structure is as follows.

The Cellnex Group achieved many Milestones during 2022:

January 4: Deutsche Telekom renews Cellnex's rating as "Zero Outage Supplier" for the fifth consecutive year in Spain.

January 26: Cellnex enters the Bloomberg Gender-Equality Index for its commitment to equity, diversity and inclusion.

February 3: Lorin Networks chooses Cellnex infrastructures to install and deploy a national IoT network in Portugal.

February 15: Cellnex is recognized by CDP as "Supplier Engagement Leader 2021" for its action in the fight against climate change and its effort to measure and reduce the environmental impact in its supply chain.

February 25: Cellnex and BT reinforce their partnership in the United Kingdom with a "multi-decade" agreement.

February 28: Cellnex presents the Augmented TowerCo model that makes it a comprehensive connectivity infrastructure operator, at the Mobile World Congress in Barcelona.

March 3: The CMA approves the acquisition of the CK Hutchison sites in the United Kingdom by Cellnex.

March 9: Cellnex and Segula Technologies join forces to make the capabilities of 5G private networks available to the automotive industry. Cellnex will deploy a private 5G network at the Segula test center in Rodgau-Dudenhofen, Germany.

March 21: Cellnex sells 3,200 sites in France to comply with the closing conditions established by the FCA after the purchase of Hivory.

March 30: Cellnex successfully completes the pricing of a bond issue for a total amount of 1.00 billion euros.

April 28: Cellnex holds the Shareholders' Meeting corresponding to the 2021 financial year.

May 5: Cellnex among the five leading global telecommunications companies in sustainability. The company obtains a rating of 14 points in the Sustainalytics ESG Risk Rating.

May 13: The CMA approves and publishes the final commitments related to the acquisition of the CK Hutchison site in the United Kingdom.

June 8: Cellnex and Nokia reinforce their alliance to deploy private networks for companies.

June 9: the Board appoints Ana García Fau as Independent Director. She is the sixth female director out of a total of 11 members, thus exceeding the 50% threshold in terms of gender diversity in the company's highest governing body.

June 15: The UNED awards Cellnex an energy efficiency project based on IoT and Artificial Intelligence technologies.

June 17: the company pays a dividend of 0.01761€ per share charged to reserves.

July 1: The company publishes the Second Environment and Climate Change report, corresponding to the 2021 financial year, in which it has exceeded the green energy and emissions targets set.

September 22: Digi and Cellnex Portugal reach a long-term strategic agreement whereby the mobile operator will deploy 2,000 PoPs (Points of Presence) at Cellnex sites throughout the country, until the end of 2023.

September 23: Cellnex Netherlands provides indoor mobile coverage to Valley, an innovative and sustainable built residential and office complex in Amsterdam.

October 3: Cellnex acquires the British connectivity provider Herbert In-Building Wireless.

October 10: Cellnex and Ferrovial sign an international deal for the joint development of infrastructures that facilitate the adoption of 5G in the construction sector.

October 13: Cellnex partners with Paris La Défense to develop a 5G mmWave pilot in the economic district of the French capital.

October 18: Cellnex obtains the highest rating (A) in the GRESB Infrastructure Public Disclosure, positioning itself as the best valued company in the telecommunications infrastructure sector.

October 19: Cellnex completes a milestone of the integration process in Poland and opens a new headquarters in Warsaw.

October 24: Cellnex reaches an agreement with WIG for the sale of nearly 1,100 sites to the British infrastructure operator, within the framework of the closing of the transaction with CK Hutchison in the United Kingdom.

November 11: Cellnex completed its acquisition of the telecommunications tower assets of CK Hutchison in the United Kingdom. This marks the closing of the last transaction included in the agreements entered into between Cellnex and CK Hutchison in November 2020.

November 18: Axión and Cellnex will implement a new digital network to provide security and emergency mobile communications services for the Andalusia government (Spain).

November 28: Cellnex, in collaboration with the Phinergy company, successfully completed the pilot programme to test and validate the use of aluminium-air batteries as backup power at its sites.

November 30: Cellnex receives award from Catalan Association of Accounting and Management (ACCID) for best practices in financial reporting.

December 9: Cellnex Sweden signed an agreement with Bauhaus to equip two department stores with DAS.

December 13: CDP recognises Cellnex for its commitment to tackling climate change, securing a place on the prestigious ‘A List’ of CDP.

The company integrates Environmental, Social and Governance (ESG) factors into its strategy, measuring and managing its impact on society and the environment in an efficient and responsible way. Cellnex's own value creation model, focusing on the shared management of telecommunications infrastructures, fosters sustainability, efficiency, and responsibility, in the use of the resources with which it works. By building partnerships with its customers, Cellnex enjoys a long-term relationship with them and manages the Company with the long cycle in mind, aware of the principles of ethics, good governance, respect for human rights and dialogue with its stakeholders, which should govern Cellnex's actions.

Due to the success of its business model, Cellnex’s operations have grown exponentially in recent years. A product of this growth has been the expansion of its European presence, increasing operational complexity and widening the scope of products and services offered by the company. With the Group’s main offices in Spain, this growth has resulted in Cellnex having footprint in a total of 12 European countries (Austria, Denmark, France, Ireland, Italy, the Netherlands, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom) with the goal of driving digitalisation and creating a pan-European telecommunications infrastructure platform.

Cellnex has a portfolio of 110,830 sites in the balance and 127,267 if including the ones in the process of completion or with planned roll-outs up to 2030. The resulting total amount of sites, as of 31st December 2022, built or acquired by Cellnex is presented as follows.

|

|

||||||||||||||

Cellnex Austria joined the Group in 2020, as a result of the agreement between Cellnex Group and CK Hutchison. Since its entrance into the Austrian market, Cellnex has become the main independent operator of telecommunication towers in the country. Cellnex Austria operates more than 4,500 telecommunication sites located in urban, peripheral and rural areas throughout Austria. Cellnex Austria provides services ranging from accommodation and co-location to electrical connections, security and alarm detection, among many others. Notably, several dozen Cellnex sites have recently been deployed to provide mobile coverage for the first time to isolated rural towns in areas previously considered dead spots. All of this has been achieved by Cellnex Austria's employees, a team that has years of experience in the sector and provides efficient and quality solutions to customers.

Cellnex Denmark owns more than 1,500 sites throughout Denmark, serving telecommunications operators and technology companies through state-of-the-art telecommunications infrastructure. Cellnex Denmark has been part of the Group since 2020, when HI3G Networks Denmark officially transferred ownership of its towers and sites to Cellnex. Within the next few years, Cellnex Denmark plans to build more than 300 new sites in order to support the deployment of 5G in the country. At the forefront of these efforts is a proactive team of professionals with extensive experience in telecommunications, committed to providing telecommunications infrastructure services for the benefit of all interested parties. This link provides a video of how Cellnex Denmark erected a mast just outside Elsinore.

Cellnex Spain, location of the Cellnex Group’s central offices, has a vast telecommunications infrastructure network in Spain that encompasses around 10,500 operational sites. This extensive network of sites has a broad geographical reach and enables Cellnex Spain to offer services to different types of clients, ranging from mobile operators and broadcasters to administrations, among others.

Cellnex Spain, as a neutral operator, offers services to three customer segments: (i) Operators, (ii) Broadcasters and (iii) Public Administrations and Large Companies. (i) To the Operators, it provides collocation of base stations mainly and connectivity (data transmission), with a high degree of efficiency in the deployment of networks, a high degree of continuity in their locations and is strategically positioned within the Development Area of 5G networks. (ii) Public and private broadcasters entrust the distribution and broadcast of their signal to Cellnex, which has high quality parameters and extensive experience in spectrum management. (iii) Cellnex Spain provides services to state, regional and local public administrations, as well as large companies to provide them with network services such as Mission Critical Private Networks (PPDR, Public Protection and Catastrophe Response) and Critical Business Private Networks, among others services. Operational excellence is the objective in providing service to its customers.

Cellnex in France was founded in July 2016 as part of an initial agreement to purchase more than 500 telecommunication sites from Bouygues Telecom. Cellnex France Group, which in turn is part of the Cellnex Group, is made up of seven companies: Cellnex France, On Tower France, Nexloop France, Springbok Mobility, ITM 1, Hivory and Cellnex France Infrastructure . The vast majority of the sites are located in quality locations in densely populated areas, an ideal situation for the future deployment of 5G. On Tower France, founded in December 2019, currently manages more than 8,000 sites throughout France. Nexloop France was created in May 2020 under a strategic partnership between Bouygues and the Cellnex France Groupe. Nexloop designs, implements, owns, manages, operates and maintains fibre optic infrastructure networks and numerous regional collection sites, as well as marketing services related to these activities. Springbok Mobility, a 100% subsidiary of the Group since 2019, develops and operates dedicated indoor infrastructures for companies and real estate businesses, in existing or planned buildings, under its Mobile Inside global service contract, which is based on ensuring that buildings are 100% connected. Hivory, a recent 2021 acquisition from Altice France and Starlight Holdco, manages the 11,000 sites that principally serve the French mobile phone operator SFR. In total, Cellnex France Group manages more than 24,500 sites. To highlight that France is the only country where Cellnex has three anchor clients (Bouygues, Iliad and SFR) with which it is deploying Build-to-suit programs.

“The closing of the UK part of the acquisition of Hutchinson towers was concluded in November 2022, which followed a lengthy period working with the UK regulator to gain approval. It was a great collaborative effort between Cellnex and Hutchinson corporate and local UK teams, which sets the foundation for a strong relationship in the future”

Paul Stonadge, Commercial Director - Cellnex UK

Cellnex Ireland’s portfolio of sites consists of more than 1,900 sites located throughout the country, including the CK Hutchison sites, for which an agreement was reached in 2020. Cellnex Ireland is focusing primarily on the development and management of fibre infrastructure and tower sites to meet the requirements of the wireless communications industry. Furthermore, Cellnex Ireland is committed to providing the necessary infrastructure to support the improvement and availability of high-speed wireless broadband in rural areas and to help mobile operators address coverage in said communities.

Cellnex Italy has been operating since 2014 and was the group’s first international market outside Spain. Cellnex manages a complex and far-reaching network of high strategic value for mobile telecommunications, as well as for the development of current ultra-fast mobile 4-4.5G networks and new 5G technology, that covers the whole of Italy, with a total of over 21,000 sites. Cellnex Italy provides multiple services in multi-operator mode, a key concept for the development of wireless networks and services, in order to optimize investments and ensure a more rational and efficient use both in terms of operations and the environmental impact of the existing and future network.

Cellnex Netherlands' infrastructure is managed by a capable team of professionals with years of experience within the data centre and telecommunications sector. Main offices are located in Utrecht. Cellnex’s telecommunications infrastructure in the Netherlands consists of antenna masts, rooftops, broadcasting towers and networks, data centers, DAS and Private Network installations and advertising masts strategically located in both urban and rural areas. Cellnex Netherlands joined the company in 2016 following the acquisitions of Protelindo Netherlands BV (in 2016) Shere Masten BV (in 2016) Alticom BV (in 2017) On Tower Netherlands BV (in 2019) Cignal Infrastructure Netherlands BV (originally TMobile Infra BV) (integrated in 2021), Media Gateway (purchased in 2021) and Breedlink BV (in 2022). Cellnex Netherlands manages more than 4,000 sites.

Cellnex has been operating in the UK market since 2016 following the purchase of Shere Group’s assets. In June 2019, Cellnex United Kingdom (UK) acquired the marketing rights of 220 tall towers from BT, and in July 2020 it acquired Arqiva Services Limited. From this acquisition “On Tower UK Limited” was born to be integrated into the current structure of Cellnex UK. Cellnex UK has over 12,000 sites and has access to hundreds of thousands of street-level assets essential for outdoor Small Cells and 5G deployments in dense urban areas. Responsible for leading Cellnex's business in the UK, the management team is committed to developing collaborative partnerships with clients, portfolio partners and stakeholders across the industry, driving innovation and growth, and creating value for everyone in today's connected world.

In addition, pursuant to a sale and purchase agreement dated 12 November 2020, Hutchison agreed to sell to Cellnex UK 100% of the share capital of CK Hutchison Networks (UK) Limited. The completion of the CK Hutchison Holdings Transaction in respect of the United Kingdom was subject to the satisfaction or waiver of applicable conditions precedent, including in relation to anti-trust and national security clearances, as required.

The UK transaction between Cellnex and CK Hutchison was formally approved by the CMA on 3 March 2022, subject to the divestment of around 1,100 Cellnex’s existing UK sites which overlap geographically with CK Hutchison sites to be acquired.

Cellnex Telecom announced in Nov 2022 that it has completed its acquisition of the telecommunications tower assets of CK Hutchison in the United Kingdom (which includes interests in or revenues deriving from up to 6,600 sites, once the build-to-suit (“BTS”) programmes are completed), after the Competition and Markets Authority (CMA) accepted final undertakings proposed by Cellnex and CK Hutchison in May this year (Final Undertakings) and following the agreement by Cellnex to transfer approximately 1,100 of Cellnex’s existing sites to the UK telecommunications infrastructure operator Wireless Infrastructure Group (WIG).

“After the first full year with all three entities working together as Cellnex Poland, the integrated atmosphere is felt more than ever. Thanks to all the people involved, their commitment and willingness to help, the cooperation is now very smooth. With this approach, we are ready for new challenges in 2023, knowing that together we can face all of them”

Aureliusz Bochniak, Site Management Director - Cellnex Poland

Following the completion of the transactions with two Polish MNOs (Play and Plus) in 2021, Cellnex companies in Poland operates more than 15,000 sites distributed throughout the country, mainly consisting of towers that provide telecommunications operators and technology companies with state-of-the-art telecommunications infrastructure. In more detail, in October 2020, Cellnex reached an agreement with Iliad to acquire a 60% of the shares in On Tower Poland, i.e. Play’s dedicated subsidiary holding the legal title to Play’s portfolio of towers in Poland. After receiving the green light from the Polish Office for Competition and Consumer Protection, Cellnex completed the transaction on 31 March 2021. In parallel, in February 2021, Cellnex announced a transaction with entities from Cyfrowy Polsat Group, concerning for the acquisition of 99.9% of the shares in Polkomtel Infrastruktura (currently: Towerlink Poland), a subsidiary dedicated to telecommunications infrastructure. This transaction was completed on 8 July 2021. The Polkomtel MSA is following a business model consisting in a long-term revenue that ensures the profitability and return on investment (Capex) executed by Cellnex on behalf of the customer, encouraging investment in the expansion and modernization of client infrastructure and allowing better customer quality services owing to new investments (Capex). The revenue of any year according to the MSA is composed mainly by the addition of the following items: i) a Capex payback (which tend to be 10 years, ii) an industrial margin on the Capex payback iii) an agreed opex required to run the Capex, (iv) electricity pass through, and (v) other opex items. This long term revenue model presents a tariff scheme that allow Cellnex to increase items ii), iii) and v) on year basis following the Polish CPI. Item i) will follow inflation as new capex cycles are considered in the long term revenue model. This business model presents similar characteristics to the BTS programs, as Cellnex is remunerated when Cellnex invests on the new Capex programme agreed with the client. Also, Cellnex i) can share the infrastructure with third parties, ii) has operating leverage, iii) strong backlog and iv) maintenance capex higher to its c. 3% of total Revenues.

Cellnex is the leading independent and neutral telecommunications infrastructure and services operator in Switzerland. Led by a team of experienced industry experts, Cellnex Switzerland manages a broad network of more than 5,400 telecommunications sites across the country. Cellnex Switzerland is made up of the companies Swiss Towers AG and Swiss Infra Services SA. Swiss Towers AG was acquired in 2017 by integration the infrastructure of Sunrise Communications AG. In 2019, Swiss Infra Services SA was created by taking over the infrastructure of Salt Mobile (90%). In the first quarter of 2021, Cellnex (through Cellnex Switzerland AG), entered into an agreement with Matterhorn Telecom SA to acquire 10% of the share capital of Swiss Infra Services SA from Matterhorn, as described in Note 2.h.II of the accompanying consolidated financial statements. Pursuant to this acquisition, Swiss Towers AG held 100% of Swiss Infra as of 31 December 2021.

In the first half of 2019, the Group entered into a long-term industrial alliance with Matterhorn by virtue of which Swiss Towers purchased 90% of the share capital of Swiss Infra.

Cellnex has been operating in the Swedish market since 2021, following the acquisition of CK Hutchison’s assets and the consequent incorporation of On Tower Sweden. Cellnex Sweden has more than 2,800 sites throughout the country and includes everything from 72-meter towers to distributed antenna systems and private networks. This enables the company to offer operators extremely cost-effective and environmentally-friendly installations. Cellnex Sweden provides a full range of services, including the deployment and optimisation of sites, installation services and site operation and maintenance. Cellnex Sweden is an infrastructure co-location partner of the main Swedish wireless operators. The company provides secure and well-maintained sites for mobile, broadcast, IoT, Wi-Fi and fibre operators.

Cellnex Portugal joined the group in 2020 and is made up of Omtel (Omtel, Estruturas de Comunicações, S.A.), On Tower Portugal (On Tower Portugal, S.A.), Towerlink (Towerlink Portugal, S.A.), Infratower (Infratower, S.A.), Cignal Infrastructure and Hivory Porotugal. Towerlink was incorporated to the Group in 2019 and owns and operates a SIGFOX IoT network. In January 2020, Cellnex acquired the full share capital of Omtel, the first independent Portuguese tower company. In September 2020, Cellnex acquired the full share capital of Nos Towering - Gestâo de Torres de Telecomunicaçôes, S.A., which changed its corporate name on that date to On Tower Portugal, S.A. In the last quarter of 2021, Cellnex acquired 100% of the share capital of Infratower S.A., owner of approximately 223 macro-sites and 464 micro-sites (DAS and Small Cells) in Portugal. Through Omtel, On Tower and Infratower, Cellnex owns around 6,400 telecommunications sites located in urban, suburban and rural areas throughout mainland Portugal and the islands of Madeira and Azores. Of these, a few dozen Cellnex sites were deployed to strategic point areas to bring mobile coverage to remote rural areas for the first time. Cellnex has a highly experienced and diversified team in Portugal, totally independent from the telecommunications operators, dedicated to supporting its growth and commitment to service excellence.

In 2022 the following significant events took place regarding corporate operations at Cellnex Group.

Milestones 2022: concluding the operation with Hutchison in the UK and the focus on organic growth with industrial agreements in Cellnex's main markets

In November, Cellnex concluded the agreement with CK Hutchison in the UK (which includes interests in and income derived from up to 6,600 sites, once the BTS Programme has been completed), following approval by the UK’s Competition and Markets Authority (CMA) of the Final Undertakings proposed by Cellnex and CK Hutchison in May, and the agreement to transfer a package of around 1,100 sites to the British telecommunications infrastructures operator Wireless Infrastructure Group (WIG).

This was the last of the set of acquisitions announced in November 2020 and concluded between Cellnex and CK Hutchison in Austria, Denmark, Ireland, Italy, Sweden and the United Kingdom itself, with an overall investment of around EUR 10 billion.

In parallel, the Company has expanded its collaboration with Telefónica in Spain through an industrial agreement that includes the renewal of service contracts linked to 4,500 sites for a period of 30 years. Also in Spain, in the field of broadcasting infrastructures, RTVE awarded Cellnex the broadcasting rights for its radio and television signals for the next five years.

In Portugal, the company has expanded collaboration with NOS, in accordance with the agreements signed in 2020 when it acquired the infrastructure portfolio from the Portuguese operator, and has reached an agreement with Digi through which the mobile operator will deploy 2,000 PoPs (Points of Presence) at Cellnex sites in Portugal.

In the United Kingdom, Cellnex extended the current framework contract for the provision of services with BT through a multi-decade agreement.

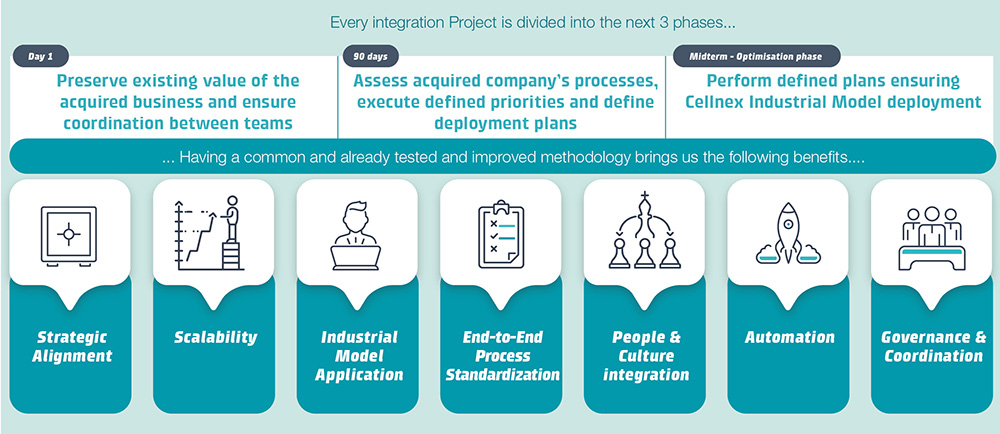

Cellnex has demonstrated its ability to grow and integrate the different Business Units that have been joining the Group. Proof of this are the more than 40 deals executed since 2015 and its presence in 12 countries. Despite the deals carried out, the mission of the integration team remains the same: lead the integration processes to ensure business continuity, optimize synergies and maintain the highest level of team commitment.

Cellnex Integration's team main purpose is to be at Local and Corporate disposal throughout the whole integration, pushing both teams as well as helping and supporting them when needed while ensuring always a clear and transparent communication. With the valuable experience gained with all integrations, Cellnex has defined an Integration Playbook which is evolved year after year and has been implemented and tested successfully in more than 25 integrations (of which 9 of them were managed during 2022).

Using its own and continuously improved methodology, allows Cellnex to preserve the existing value of the acquired businesses and ensure coordination between teams; assess the acquired company’s processes, execute defined priorities and define deployment plans; always ensuring the deployment of the Cellnex Industrial Model.

As a reminder; the integration process begins right after the Pre-closing phase (M&A Deal Group phase) and is divided into three phases: Day 1 phase - whose objective is to preserve the existing value of the acquired business and ensure its business continuity as well as initiate coordination between local and corporate teams; 90 Days phase - where the main integration actions are carried out; and the Optimisation Phase, which consists basically on performing the defined plans while deploying the Cellnex Industrial Model.

During 2021, a series of lessons learned have been identified and included in Playbook 3.0 (which has been applied and used in the 9 Integrations executed during 2022), some examples are stated below.

Cellnex is organised in a way that ensures that the Group is well-prepared for all Integrations (current and future ones): there is a small, dedicated and integration-experienced internal team which is reinforced with external support whenever it is needed. Cellnex has a framework agreement signed that allows an easy expansion of the services when needed. This helps the integration team to calibrate work peaks. Moreover, all Corporate and Country areas are committed and involved in the cases in which a company is acquired in a Country in which Cellnex has already presence, it is Local project team who leads the Integration. Depending on the needs of each Country and acquisition, Corporate team members can support the needs temporary in order to ensure control, give support based on expertise and monitor core processes.

Integration Playbook’s evolution, from 2.0 to 3.0

In 2022 the complexity of the executed (and current) integrations has not diminished and has required a different approach, although the number of current integrations is lower compared to previous years. Information about these projects can be found in the "Significant events in 2022" section. Far from being able to predict the future, with the facts and the macroeconomic information available today, Cellnex wants to ensure its readiness for everything that may come, as well as take the 2023 as a year to assess the Integration degree and maturity of the acquired businesses in recent years, and build jointly the Company that Cellnex wants to build.

Cellnex acquired 60% of PLAY’s telecommunications infrastructure in April 2021, which today constitutes OnTower Sp. z o.o. In June 2021 the company acquired 99.9% of Polkomtel Infrastruktura, part of Polsat Group, which is now part of TowerLink Poland Sp z o.o, managed by Cellnex Poland. Cellnex Poland team includes nowadays around 500 employees (half of them dedicated to design and management of the network roll-out and the other half dedicated at maintaining the network and operations).

Cellnex Poland, which currently owns around 15,500 sites in the country, has inaugurated a new office in Warsaw.

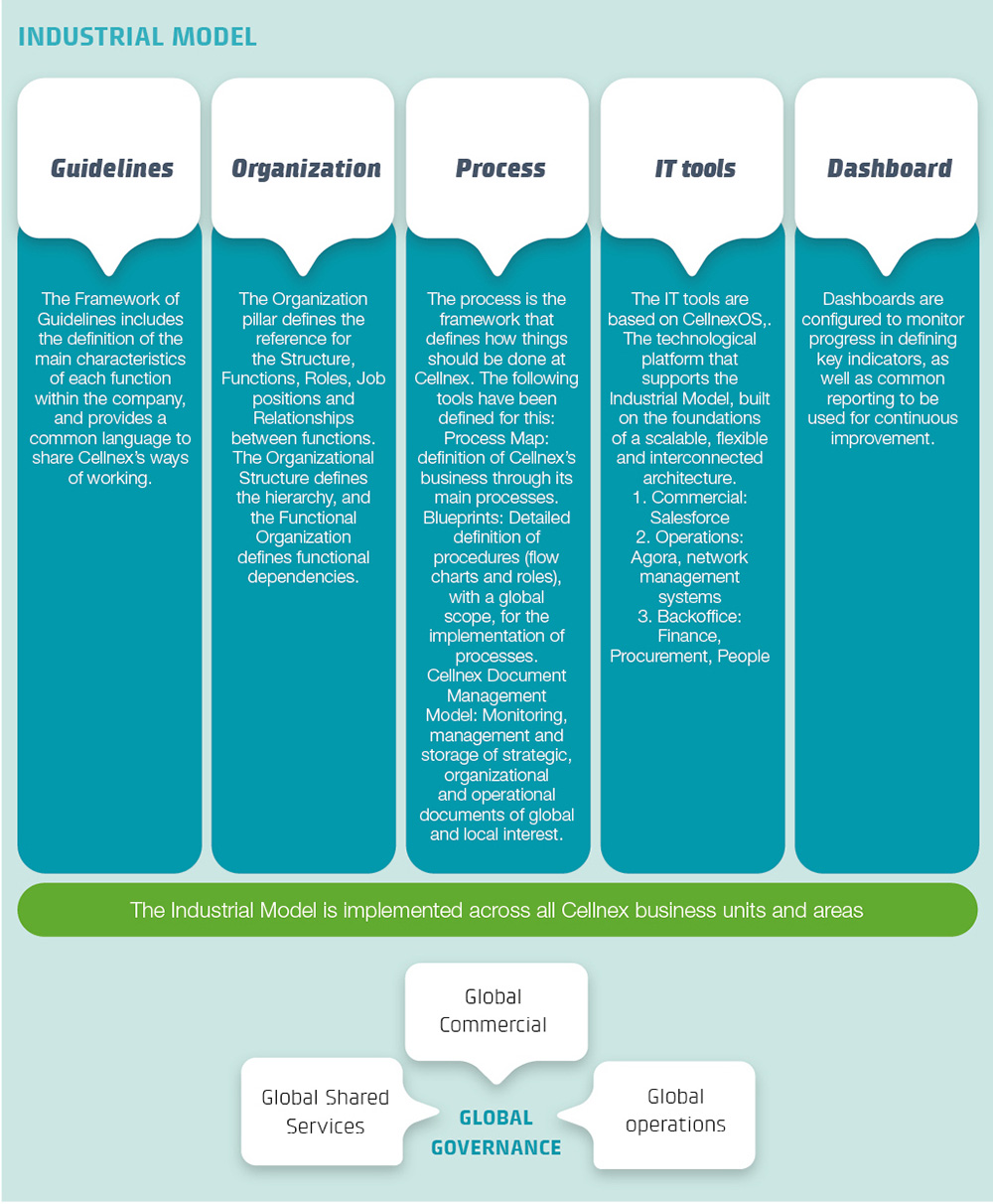

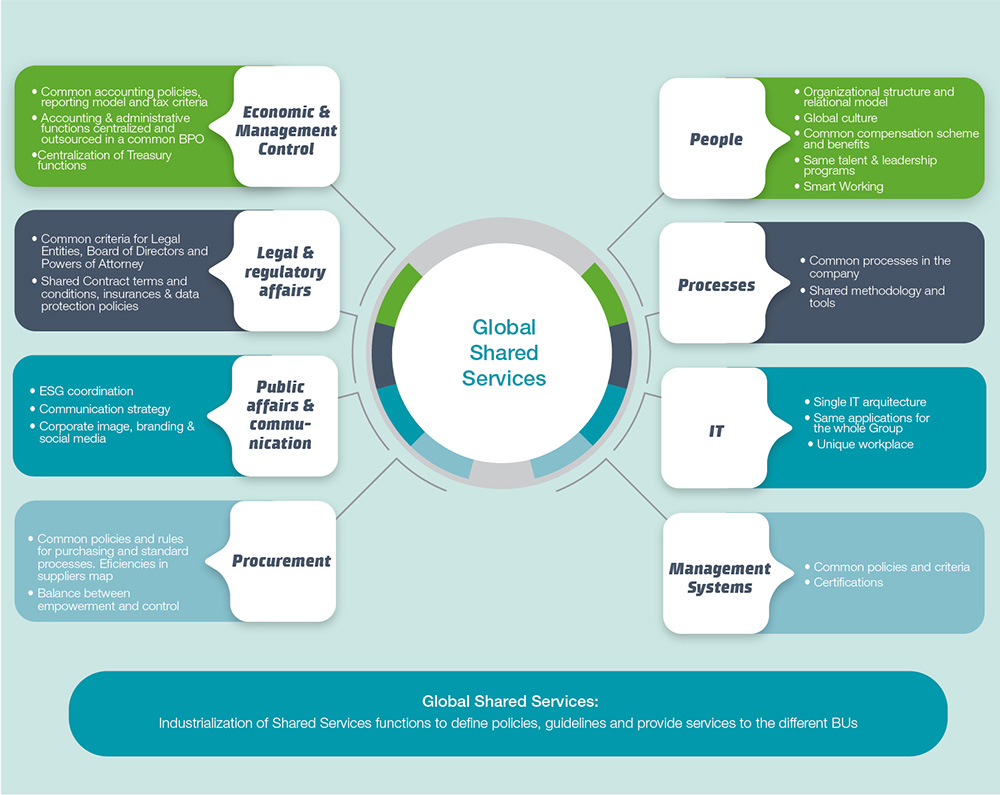

The Cellnex Industrial Model consists of a common way of working, that is replicable, scalable, homogeneous and that allows rapid growth, but not proportional in costs or consumption of resources. Therefore, the Cellnex Industrial Model is the key tool for supporting the Cellnex strategy and ensuring sustainable and scalable growth, as the Industrial Model is deployed both through integration projects of new acquisitions, as well as through value creation and/or continuous improvement projects.

The Cellnex Industrial Model is supervised by Cellnex's Senior Management at corporate and country levels (Global Governance), through a common Management Model for monitoring the strategy, objectives and results, and as a support for making the appropriate decisions in this regard. To that end, a scalable standard organizational structure has been formally defined for all Business Units, embodying basic general functions. The Cellnex Industrial Model has a matrix structure to facilitate a joint work between corporate departments and countries, combining a global and local vision. Consequently, in each country the various departments report to the Managing Director, who, in return, reports to the Deputy CEO; and have a functional relationship with the corresponding Corporate departments.

The Industrial Model is implemented through the following five elements and evolves for each department according to its needs.

Cellnex has the necessary levers to guarantee the expected response to the business strategy and provide the necessary capacities to support growth and business transformation. To this end, Cellnex has developed a series of projects associated with the definition of the industrial model of a company function and/or a specific pillar of the function, such as Agora, Billing Industrial Model, and Active Network.

Agora is the technological support (IT tool) for the Industrial Model of Operations for the TIS Business Line. Agora supports the following Operations features:

Agora's objective is to facilitate the use of the Cellnex Industrial Model in these areas with a system that is:

Agora is currently fully or partially deployed in France, Italy, Switzerland, the United Kingdom, and Portugal. During the year 2022, a technological update of the platform has been carried out, and during the 2023 it is planned to continue completing the use in the countries that already use it as well as incorporating new countries.

In 2022, an analysis of the current billing model has been carried out for the whole group. All pillars of the industrial model were considered on the analysis. This project has been led by the Global Commercial team with the support of Operations, Finance and the Organization and Processes team to obtain an end-to-end vision of the model. The objective of this analysis was to identify opportunities to improve the model and redefine it considering:

Once the assessment phase has been completed, a new phase of the project will begin to:

With the integration of Polkomtel Infrastruktura in Poland, in addition to the purchase of the passive infrastructure, Cellnex has also acquired the Radio Access and Transmission network. Being the first purchase of this type of infrastructure, Cellnex Poland, with the collaboration of the Corporate teams, is working on the definition of the Active Network Model.

In addition, the development of this model aims to be the basis of the Cellnex Industrial Model for future countries where this line of business can be developed.

In an interview with Executive Digest on "The New Challenges of Leadership" Nuno Carvalhosa, Managing Director of Cellnex Portugal, shared his vision on the opportunities and challenges from the current economic, financial, and geopolitical tensions. Nuno Carvalhosa argued that "our strong growth requires us to make considerable efforts in order to integrate and consolidate the various transactions carried out. At the same time, we have been investing massively in adapting our existing infrastructures and building new ones to enable the acceleration of the 5G growth in Portugal." In this regard it was highlighted the importance of companies operating with a strong sense of agility and flexibility in adapting to the current circumstances, while fostering a work culture that offers employees a strong sense of purpose, fulfilment, and growth prospects for their careers.

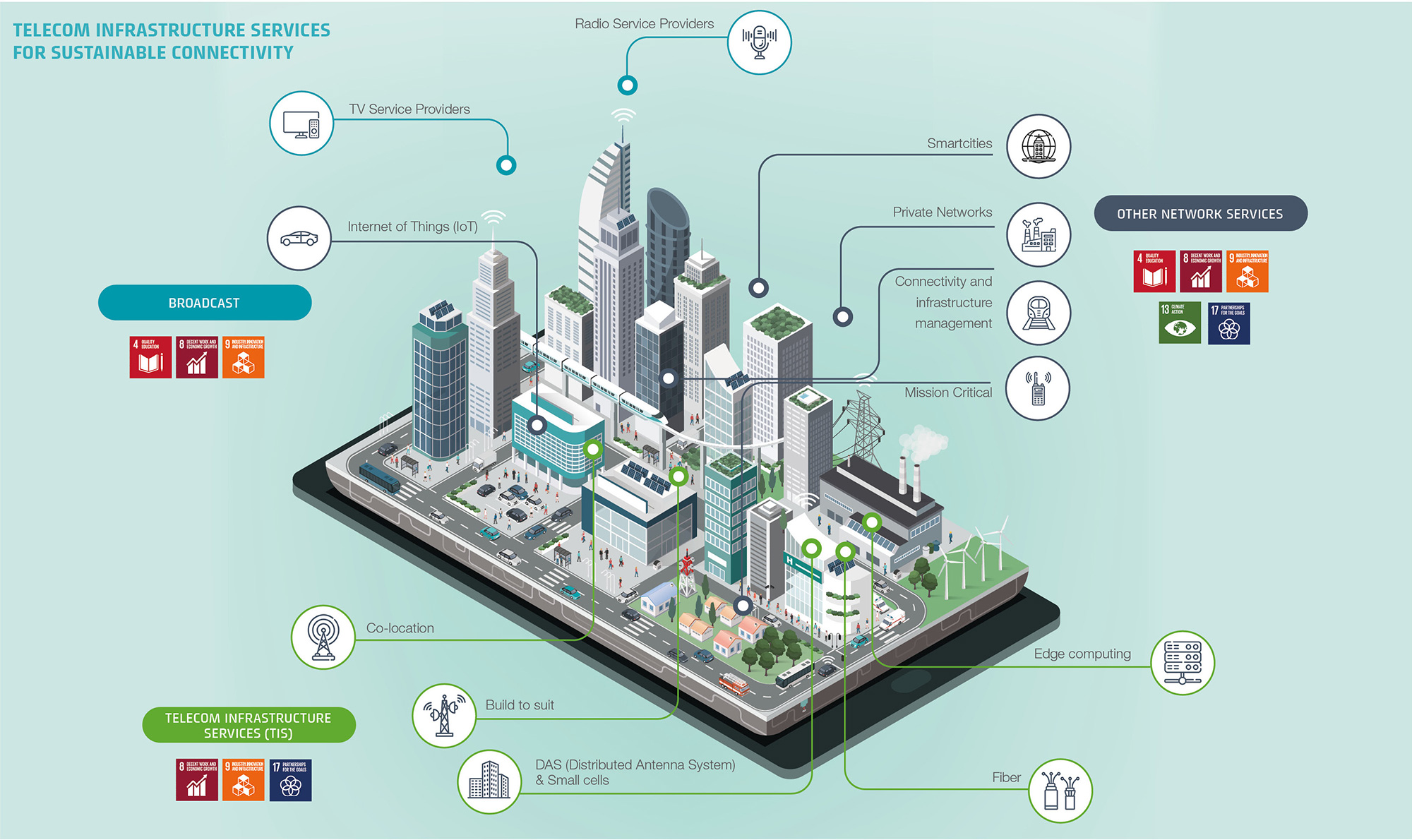

Cellnex offers its clients telecom infrastructure services for sustainable connectivity so that customers do not have to manage the infrastructures and networks over which their systems operate. Cellnex neutral host nature makes its model the most efficient possible, as Cellnex develops multi-operator sites which means decreasing costs to its clients, increasing sustainability to telecom and connectivity ecosystem, and rapidly meeting all stakeholders’ expectations as services are quickly deployed. In this regard, Cellnex sites are the option of choice for the Mobile Network Operators (MNOs) as well as other telcos and operators for sustainable connectivity.

Cellnex range of services are aimed at ensuring the conditions for reliable and high-quality transmission for both fibre and wireless telecommunications. The services provided by Cellnex are:

|

90.4% Telecom Infrastructure Services (TIS) |

6.4% Broadcasting Networks |

3.2% Network Services and others |

|

|

|

Although the main service is Telecom Infrastructure Services, Cellnex offers other types of services in the different countries in which it is present, as presented below.

In this regard, the portfolio of services provided by Cellnex can be marketed in all the countries where the company is present, always complying with the market regulations and particular regulations of each country.

Finally, asset buy back options can be exercised in case of an explicit breach by a Group company of the contractual obligations under services level agreements with its customers (“SLAs”) or if a change of control clause included in any of the Group’s material contracts is triggered. These asset buy back options will be executed at a price below fair market valuation.

Policies are developed to ensure the availability of services throughout the value chain, from the engineering and design phase, the implementation of the technical solutions, up to the Service Assurance by the network operation and maintenance:

The services are provided continuously 24 hours a day, 7 days a week, with continuous technical staff present at the service control centre, as well as staff from the Technical Units area and the different levels of escalation, so there are no periods of inactivity.

Cellnex operates in 147,581 Point of Presence (PoPs), has a portfolio of 110,830 sites, including BTS committed deployments and is committed to the development of new generation networks. A summary of the portfolio of Telecommunications Infrastructure Services sites as for December 31, 2022, is presented below. The Cellnex data centres have been set upper floor, compact and modular, so they can always be set up according to the latest technology and fine-tune based on individual specific requirements.

|

Framework Agreement |

Project |

Nº of Sites acquired |

Beginning of the contract |

Initial Terms + Renewals (1) |

|

Telefónica |

Babel (Renewed, see detail footnote 18) |

1,000 |

2012 |

10+10+5 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta I (Renewed, see detail footnote 18) |

1,211 |

2013 |

10+10+5 (Telefónica) |

|

|

|

|

|

Until 2030+8 (Yoigo) |

|

Telefónica |

Volta II (Renewed, see detail footnote 18) |

530 |

2014 |

10+10+5 |

|

Business combination |

TowerCo Acquisition |

321 |

2014 |

Until 2038 |

|

Telefónica and Yoigo (Xfera Móviles) |

Volta III (Renewed, see detail footnote 18) |

113 |

2014 |

10+10+5 (Telefonica) Until 2030+8 (Yoigo) |

|

Telefónica |

Volta Extended I (Renewed, see detail footnote 18) |

1,090 |

2014 |

10+10+5 |

|

Neosky |

Neosky |

10 |

2014 |

10+10+5 |

|

Telefónica |

Volta Extended II (Renewed, see detail footnote 18) |

300 |

2015 |

10+10+5 |

|

Business combination |

Galata Acquisition |

7,869 |

2015 |

15+15 (Wind) (2) |

|

Business combination |

Protelindo Acquisition |

261 |

2012 |

+15 (KPN) |

|

2016 |

+12 (T-Mobile) |

|||

|

Bouygues |

Asset purchase |

5,004 |

2016 - 2017 |

20+5+5+5 / 25+5+5 (3) |

|

41 |

2018 |

20+5 (3) |

||

|

Business combination |

Shere Group Acquisition |

1,099 |

2011 |

+15 (KPN) |

|

2015 |

+10 (T-Mobile) |

|||

|

2015 |

+15 (Tele2) |

|||

|

Business combination |

On Tower Italia Acquisition |

11 |

2014 |

9+9 (Wind) |

|

2015 |

9+9 (Vodafone) |

|||

|

K2W |

Asset purchase |

32 |

2017 |

Various |

|

Business combination |

Swiss Towers Acquisition |

2,239 |

2017 |

20+10+10 (Sunrise Telecommunications) (4) |

|

320 |

2019 |

20+10+10 (Sunrise Telecommunications) (4) |

||

|

Business combination |

Infracapital Alticom subgroup Acquisition |

30 |

2017 |

Various |

|

Others Spain |

Asset purchase |

45 |

2017 |

15+10 |

|

36 |

2018 |

15+10 |

||

|

375 |

2018 |

20+10 |

||

|

Masmovil Spain |

Asset purchase |

551 |

2017 |

18+3 |

|

85 |

2018 |

6+7 |

||

|

Linkem |

Asset purchase |

426 |

2018 |

10+10 |

|

Business combination |

TMI Acquisition |

3 |

2018 |

Various |

|

Business combination |

Sintel Acquisition |

15 |

2018 |

Various |

|

Business combination |

BRT Tower Acquisition |

30 |

2018 |

Various |

|

Business combination |

DFA Acquisition |

9 |

2018 |

Various |

|

Business combination |

Video Press Acquisition |

8 |

2019 |

Various |

|

Business combination |

On Tower Netherlands Acquisition |

114 |

2019 |

7 (5) |

|

Business combination |

Swiss Infra Acquisition |

2,862 |

2019 |

20+10 (6) |

|

Business combination |

Cignal Acquisition |

762 |

2019 |

20 (7) |

|

Business combination |

Business unit from Iliad Italia, S.p.A. |

3,269 |

2019 |

20+10 (6) |

|

Business combination |

On Tower France Acquisition |

8,407 |

2019 |

20+10 (6) |

|

Orange Spain |

Asset purchase |

1,500 |

2019 |

10+10+1 (8) |

|

Business combination |

Omtel Acquisition |

3,366 |

2018 |

20+5 (9) |

|

687 |

2021 |

20+5+5+5 (17) |

||

|

102 |

2022 |

20+5+5+5 (17) |

||

|

Business combination |

Arqiva Acquisition |

6,455 |

2020 |

10+1+1+4 (MBNL/EE) (10) |

|

2014 |

2024 (CTIL) (10) |

|||

|

Business combination |

NOS Towering Acquisition |

2243 |

2020 |

15+15 (11) |

|

Business combination |

Hutchison Austria Acquisition |

4,529 |

2020 |

15+15+5 (12) |

|

Business combination |

Hutchison Ireland Acquisition |

1,159 |

2020 |

15+15+5 (12) |

|

Business combination |

Hutchison Denmark Acquisition |

1,563 |

2020 |

15+15+5 (12) |

|

Business combination |

Small M&A |

9 |

2020 |

Various |

|

Business combination |

Hutchison Sweden Acquisition |

2,864 |

2021 |

15+15+5 (12) |

|

Business combination |

T-Mobile Infra Acquisition |

3,137 |

2021 |

15+10 (13) |

|

Business combination |

On Tower Poland Acquisition |

8,227 |

2021 |

20+10 (14) |

|

Business combination |

Hutchison Italy Acquisition |

9,289 |

2021 |

15+15+5 (12) |

|

Business combination |

Polkomtel Acquisition |

7,071 |

2021 |

25+15 (15) |

|

Business combination |

Hivory Acquisiton |

11,146 |

2021 |

18+5+5+5 (16) |

|

Business combination |

Iaso Acquisition |

5 |

2021 |

Various |

|

Business combination |

Hutchison UK Acquisition |

5,393 |

2022 |

15+15+5 (12) |

|

Shared with broadcasting business |

|

1,682 |

|

|

|

Others |

|

232 |

|

|

|

Telefónica (Renewal) |

Tranche I |

1,543 |

2022 |

13+10+7 (18) |

|

Telefónica (Renewal) |

Tranche II |

1,450 |

2022 |

10+10+10 (18) |

|

Telefónica (Renewal) |

Tranche III |

1,400 |

2022 |

7+10+10+3 (18) |

(1) Renewals: most of these contracts have clauses prohibiting partial cancellation and can therefore be cancelled only for the entire portfolio of sites (typically termed “all or nothing” clauses), and some of them have pre agreed pricing (positive/negative).

(2) The initial term of the MSA with Wind is 15 years, to be extended for an additional 15-year period (previously confirmed), on an “all-or-nothing” basis. The fees under the MSA with Wind are 80% CPI-linked, taking into consideration that the increase shall not exceed 3% per year, without having a minimum in case it is 0%. After the initial term, the fee could have +5%/-15% adjustment.

(3) In accordance with the agreements reached with Bouygues during 2016 – 2020, at 31 December 2022 Cellnex had committed to acquire and build up to up to 5,300 sites that will be gradually transferred to Cellnex until 2030 (see Note 8 of the accompanying consolidated financial statements). Of the proceeding 5,300 sites, a total of 1,877 sites have been transferred to Cellnex as of 31 December 2022 (as detailed in the previous table). Note that all Bouygues transactions, like most of the BTS programmes Cellnex has in place with other MNOs, have a common characteristic “up to” as Bouygues does not have the obligation to reach the highest number of sites. During 2016 – 2017 have been signed different MSA’s with Bouygues in accordance with the different transactions completed (Glénan, Belle-Ille, Noirmoutier). All MSAs have an initial term of 20/25 years with subsequent renewable three/two 5-year periods, on an “all-or-nothing” basis. In relation to the MSA signed with Bouygues in 2018 (Quiberon transaction) the initial term is 20 years with subsequent renewable 5-year periods (undefined maturity). The contracts with customers are linked to a fixed escalator of 2%, except for Nexloop which is 1%.

(4) The MSA with Sunrise have an initial term of 20 years, to be automatically extended for 10-year periods, on an all-or-nothing basis, with undefined maturity. The contracts with customers are index-linked to the CPI, taking into consideration that the increase has no maximum per year, and the decrease cannot be less than 0%.

(5) Contracts with customers are index-linked to the CPI and have an average duration of approximately seven years to be automatically extended (undefined maturity).

(6) The MSAs with Iliad and Salt have an initial term of 20 years, to be automatically extended for 10-year periods, on an all-or-nothing basis, with undefined maturity. The contracts with customers are linked to a fixed escalator of 1%.

(7) Contracts with customers are index-linked to the CPI, have an average duration of c.20 years and a significant probability of renewal due to the portfolio’s strong commercial appeal and limited overlap with third party sites.

(8) Orange Spain is the main customer of this portfolio of telecom sites, with which Cellnex has signed an inflation-linked Master Lease Agreement for an initial period of 10 years that can be extended by one subsequent period of 10 years and subsequent automatic one-year periods, on an “all-or-nothing” basis.

(9) The initial term of the Omtel MSA is 20 years, subject to automatic extensions for additional five-year periods, unless cancelled, on an “all-or-nothing” basis, with undefined maturity. The fees under the Omtel MSA are CPI-linked, taking into consideration that the increase shall not exceed 2% per year and the decrease cannot be less than 0%.

(10) The initial term of the MSA with MBNL and EE is 10 years with three extension rights. The duration of the MSA with CTIL is until 2024 at least two years before, extension to be discussed. This MSA is index-linked to the CPI.

(11) The NOS Towering MLA have an initial duration of 15 years, to be automatically extended for additional 15-year periods, on an “all-or-nothing” basis, with undefined maturity. The fees under the NOS Towering MLA will be CPI-linked, taking into consideration that the increase shall not exceed 2% per year and the decrease cannot be less than 0%.

(12) The initial term of each CK Hutchison Continental Europe MSA is 15 years, with possible extensions for a further 15-year period and subsequent 5-year periods, on an “all-or-nothing” basis (same duration for all countries). The fees under the CK Hutchison Continental Europe MSA are CPI-linked, taking into consideration that the increase shall not exceed 2.25% per year and the decrease cannot be less than 0%.

(13) Initial term of 15 years + subsequent automatic renewals of 10 year periods (all or nothing, undefined maturity basis). The fees under the T-Mobile Infra MLA are CPI-linked, taking into consideration that the increase shall not exceed 3.5% per year and the decrease cannot be less than 0%.

(14) Initial term of 20 years to be automatically extended for subsequent 10 year periods (on an all or nothing basis). The fees agreed in the Iliad Poland MSA are annually adjusted in accordance with the Polish CPI provided that the increase shall not exceed 4% per year, without having a minimum in case it is 0%.

(15) 25 years with automatic 15 year renewals.

(16) 18 years with automatic 5 year renewals. All-or-nothing renewal clause, undefined maturity. The contracts with customers are linked to a fixed escalator of 2%.

(17) MSA with 20 years + automatic 5 year renewals. All-or-nothing renewal clause, undefined maturity. The fees under the Omtel MSA are CPI-linked, taking into consideration that the increase shall not exceed 2% per year and the decrease cannot be less than 0%

(18) All Telefónica contracts as an anchor tenant have been renewed and unified under one single MLA. The new MLA is CPI- linked without cap and with floor at 0%. Likewise, in each tranche and once the initial period and first two extensions have elapsed, the price may be revised by a +5%/-5%.

"It was with great satisfaction that we saw the tenancy ratio on our towers increasing almost as much in the last 3 years, since Cellnex entered the market, as in the previous 3 decades, and it will increase significantly further with the existing agreements. It fills us with pride to see Cellnex playing a central role in fostering the digital connectivity in Portugal"

Joao Cardosa, Country Commercial Director - Cellnex Portugal

Cellnex Portugal and Digi reached a nationwide strategic long-term agreement comprising the roll-out of 2,000 PoPs (Points of Presence) until the end of 2023. This agreement demonstrates the effort of Cellnex Portugal in supporting both incumbents and new market entrants to provide the best possible mobile communications coverage and quality of service throughout Portugal.

Cellnex Site Share solution enables Mobile Network Operators (MNOs) to develop and grow their networks, cost-effectively and efficiently, as Site Share allows MNO to place their radio base stations on Cellnex managed structures and sites in return for an annual license fee. This service involves adapting sites for new co-locations or multiple network modifications required by the operators (installation of new technologies, equipment changes, upgrades...). The objective is to meet and improve the SLAs (service level agreements) offered by Cellnex, which are of two main types: The delivery time SLA, when an Operator requests a new shelter or a network modification to carry it out with the highest quality and in the agreed time or better; and the Operation and Maintenance (O&M) SLA to provide the services with the agreed continuity and service level, and to work proactively in their improvement.

Moreover, Cellnex offers a diversity of topography from dense-urban and suburban to rural locations, including an unrivalled selection of high and privilege positioned sites, enabling its customers to extend its coverage to fill gaps, increase density of PoPs and enabling them to expand to new spectrum bands.

In 2022 Cellnex Spain has acquired the company bitNAP, a company that develops co-location, connectivity and interconnection services for operators from a data center of more than 3,000m2 located in Barcelona.

Also, wherever a new telecommunications site is required, Cellnex’s built-to-suit service will build on demand. In this sense, Cellnex will develop brand new, high quality, shareable infrastructures, taking care of everything: from the site location search, the permits and landlord agreements management, the site and tower construction to the connection to the power grid. The sites are available in a range of heights from 15m to more than 50m, and the site will be tailored to customer requirements and to the environmental regulations.

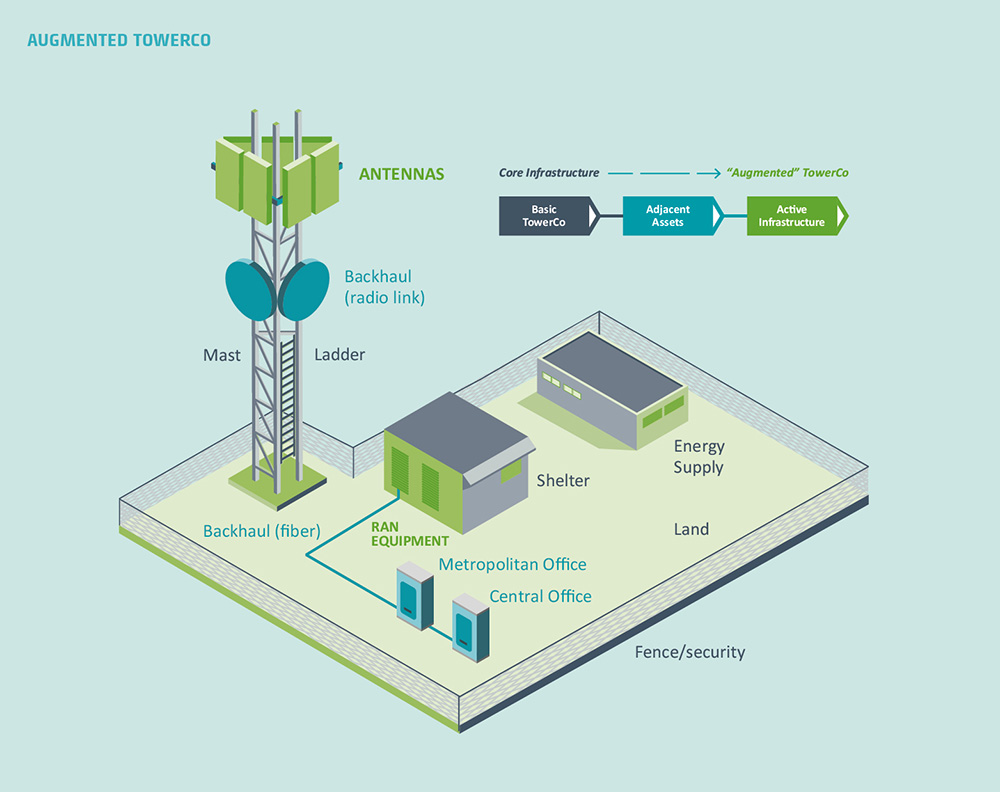

During 2022 Cellnex has been working on the concept of "The augmented TowerCo", a model aimed at supporting customers in defining, implementing, operating and maintaining infrastructures and assets adjacent to towers, including active equipment. These adjacent assets include distributed antenna systems (DAS) and Small Cells, which are key to increase the network coverage levels and capacity; fibre-to-the-tower (FTTT), to expand data transmission capacity; and edge data centres and edge computing, key to ensure the low latencies (response times) crucial for the delivery of critical applications and processes. The augmented TowerCo model is based on the company’s know-how and expertise in end-to-end services.

Cellnex UK and BT plc have agreed to enhance their current MSSA (Master Site Services Agreement), due to end in 2030,with a multi-decade partnership agreement. As part of the deal, BT may choose to extend the MSSA on an “all or nothing basis” for further renewal periods, giving both parties long-term certainty and strengthening their relationship.

Small Cells and Distributed Antenna Systems (DAS) are systems aimed to increase the network coverage and capacity, by extending the mobile operators coverage, mainly in indoor and in outdoor highly crowded areas, where the signal level and capacity of existing mobile operators base stations don't reach the required levels of service. Instead of providing coverage with high power base stations, Cellnex provides tailored coverage with a system of distributed radios and antennas. This allows outstanding mobile connectivity to spots where large numbers of users are concentrated, such as stadiums, skyscrapers, shopping malls, crowded outdoor areas or airports. These solutions also provide excellent coverage to underground places like tunnels, car parks or railway stations. In addition, DAS and Small Cells are one of the base infrastructures from which the new 5G communication standard will be deployed.

The acquisition will expand Cellnex UK’s indoor connectivity business and sees the creation of a new Cellnex company, Cellnex UK In-Building Solutions (CUKIS), which will be led by Tim Loynes, HiBW’s current Director. The creation of CUKIS will further strengthen Cellnex UK’s current indoor connectivity business.

Thanks to DAS solutions applied by Cellnex Italia, the first 6 stations of the M4 (Blue Line) inaugurated on November 26th 2022 are equipped with a network of mini-antennas (DAS) to guarantee WINDTRE and iliad users a stable and high-performance 4G and 5G Ready mobile connection.

The same DAS technological solution will also be deployed in the additional 2 stations to be opened by the first half of 2023, as well as in the next 13 stations to be completed by 2024.

Ensuring stable and high-performance mobile coverage in the public transport network is one of the key factors in transforming a city, and its transport network, into a smart city. Thanks to the agreement between Cellnex Italia and M4, the company managing Line 4 as well as its design and construction, WINDTRE and iliad users will be able to have a dedicated 4G mobile coverage, with a 5G-Ready infrastructure soon to be activated, on the first 6 stations of the Blue Line of the Milan subway. The 6 stops inaugurated in November 2022, for a total of 5km of route, connect Linate Airport with Piazzale Dateo.

Cellnex Sweden has signed an agreement with German hardware and DIY chain Bauhaus to provide mobile coverage inside its shops in the Nordic country. Bauhaus wants to be at the forefront of innovation and customer experience and has trusted Cellnex Sweden for the design, installation, start-up and operation of multi-operator distributed antenna systems (DAS) which, once deployed in the shops, will make it easier for customers to use their mobile phones to call, browse, manage their payments with digital solutions, and access the websites of members of the Bauhaus customer club in a fast and seamless way.

The collaboration project between both companies has started in the Bauhaus department stores located in Sundsvall and Löddeköpinge in Sweden, but it is expected that it can be extended to other stores of the chain in the Nordic country.

“This project is a first step in our mobile edge computing strategy with a local breakout capability, allowing certain applications such as live streaming and content replay to be made available to fans at the stadium without having to go onto the internet (i.e. mobile core), further improving customer experience with low, stable latency whilst increasing security and reducing back haul bandwidth in real-time content delivery”

Eduardo Fichmann, Global Innovation & Product Strategy Director - Cellnex Corporate

Cellnex has installed a Distributed Antenna System (DAS) at the Real Betis Balompié football club's Benito Villamarín Stadium to provide all spectators at the match with optimal mobile coverage, even when its maximum 60,000 spectators capacity is reached. To this end, Cellnex has teamed up with specialized partners to roll out and test an application that can offer fans a unique experience through their mobile phones. This is an innovative real-time edge streaming video, with eight cameras, which allows viewers to enjoy a live audiovisual experience on their mobile phones, on the pitch that complements the match experience. This connectivity infrastructure, will turn Benito Villamarín Stadium into a Smart Stadium.

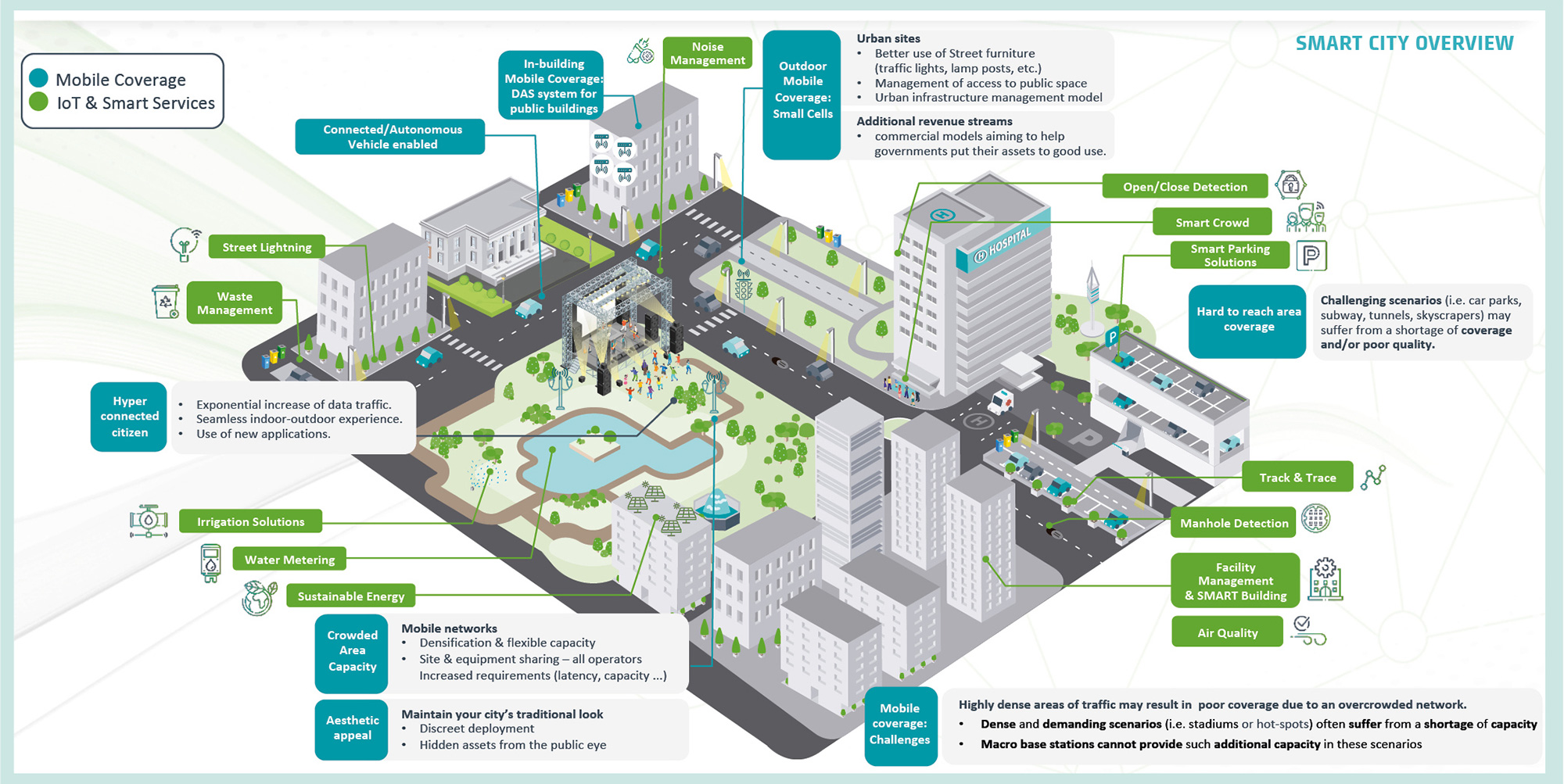

Cellnex offers integrated and adaptable solutions to develop a connected society and make the Smart concept a tangible reality in both urban and rural areas. These include: Mission Critical Private Networks (MCPN) services, Business Critical Private Networks (BCPN) services, connectivity services, Operation and Maintenance services and IoT and Smart City services.

Cellnex is one of the leading operators of broadcasting infrastructures in Europe. In its high tower sites Cellnex host main TV and radio broadcasters, from where it transmits TV and radio signals to all homes and users. Thanks to the defined operation processes and to the high reliability of the infrastructure in its sites Cellnex can guarantee the stringent high levels of availability required by its clients.

Cellnex Spain has circa 3,000 sites that transmit Digital Terrestrial Television (DTT) and radio signals. It is leading the innovation of the DTT platform in Spain: better quality and hybrid services and Mobility. Cellnex has led the evolution of the broadcast quality to Ultra High Definition (UHD). In collaboration with Radio Televisión Española (RTVE), Cellnex has broadcasted the World Cup in Qatar in UHD (4K and HDR image and Dolby sound). Cellnex is providing to the main Spanish TV broadcasters the LOVEStv platform using HbbTV (Hybrid broadcast broadband TV), this service is combining broadcast television and broadband capabilities to provide the viewer with a better, more flexible and high quality TV experience delivered through Digital Terrestrial Television. During past MWC 2022, Cellnex participated in a full end-to-end live streaming demonstration using 5G Broadcast, delivering content to smartphone devices and showcas-ting broadcast/multicast capabilities over 5G. For radio services, Cellnex offers FM and digital radio broadcasting (DAB).

In this sense, some of the outstanding projects of 2022 carried out by Cellnex Spain are the execution of the extension with RTVE (the state-owned public corporation of radio and television service) for DTT and FM services by the period of one year, and the concession of the contract for the supply and maintenance of Andorra Telecom's DTT stations. In addition, customers continue to trust in Cellnex for the renewals and extensions of their contracts, thanks to the operational excellence that Cellnex has been demonstrating, both in DTT and in radio during the many years of commercial relationship.some of the outstanding projects of 2022 carried out by Cellnex Spain are the execution of the extension with RTVE (the state-owned public corporation of radio and television service) for DTT and FM services by the period of five years, and the concession of the contract for the supply and maintenance of Andorra Telecom's DTT stations. In addition, customers continue to trust in Cellnex for the renewals and extensions of their contracts, thanks to the operational excellence that Cellnex has been demonstrating, both in DTT and in radio during the many years of commercial relationship.

The project validated the usefulness of 5G private networks for multi-camera contributions. In this way, La Xarxa and betevé used the 5G network implemented for the Catalunya Project by Cellnex, Lenovo and Masmovil, to simultaneously contribute and edit multiple live television camera signals in the cloud using the TVU Networks solution.

Mission Critical Private Networks (MCPN) services

Mission Critical Private Networks (MCPN) are networks for Security and Emergency forces that are provided with very high availability and communications security. Mission critical communications are networks that must comply with advanced services specifications and must provide a secure and resilient mobile voice, data and video service platform to address these needs. In this sense, Cellnex provides professional radio communication systems for public safety authorities complying all mission critical communications requirements from the network design and engineering to the end-to-end operation and maintenance service.

"Austria has gained a strong player in the field of IOT: Drei Austria is currently rolling out a nationwide LoRaWAN network. OnTower Austria, a subsidiary of Cellenx SA. provides the necessary passive infrastructure and is therefore an important enabler for this future-oriented service.The team of Drei Austria and OnTower work hand in hand during the implementation."

Josef Künz, Global Head of Operations - Cellnex AustriaDuring 2022, customers have renewed the Critical Mission Networks with Cellnex Spain, from which services are provided to more than 100,000 users of security and emergency forces (police, firefighters, etc.). Is worth highlighting that the contract for the comprehensive management of mission-critical communications for emergency and security corps in Catalunya (RESCAT) have been renewed for a period of 5 years with the Generalitat de Catalunya, in Valencia (COMDES) has been extended for one year more, and the LINCE project, the security and emergency network in Andalusia (the largest DMR technology network in Europe), has been awarded to Cellnex Spain.

Private networks

Private wireless network technology enables users and customers to integrate machines and people across a wide range of applications and usage scenarios in diverse industrial and business critical domains as in manufacturing, supply chain, transportation and energy, where is key assuring high degrees of security as is an isolated and dedicated network and also the allowance of network and services self-configuration and management.

Wireless connectivity provides employees with data and insight whilst on the move, real time insight into operational processes, allows for the wireless control of moving objects and vehicles, and for the permanent extraction and logging of sensor and status information from processes and assets. For the tightest, most controlled performances for critical business processes, Cellnex offers the option to establish a genuinely private network with all elements and control in the hands of the enterprise itself.

Cellnex, through its business unit EDZCOM, has launched a partnership with the automotive branch of SEGULA Technologies to offer its automotive customers a private 5G network capabilities. As part of the collaboration, Cellnex will deploy a Private 5G Network at the Segula’s German test center located in Rodgau-Dudenhofen, bringing high mobility due to very low latency, as well as a dedicated spectrum, strong security and data confidentiality.

IoT and Smart Services

Being ‘smart’ indicates the building or premises dispose of wireless –and wired– infrastructures and the associated devices and sensors that allow the infrastructure to ‘think’ and act all by itself, optimising its performance and characteristics for the usage it is intended for. These infrastructures are Internet of Things (IoT) based; a network where an internet is used to connect countless numbers of electronic systems, computers, sensors and action devices (‘things’).

IoT is expected to rapidly increase to enhance our daily world with ‘smart’ and autonomous environments. Cellnex operates IoT networks, deployed either at a local or national level, in order to offer smart services to its clients.

Cellnex Portugal and Lorin Networks reached an agreement to deploy an IoT (Internet of Things) network based on LoRaWAN technology in Cellnex infrastructures in Portugal. IoT networks allow for the installation of a range of oriented solutions not only to improve connectivity in essential sectors of activity, such as agriculture or transport and industry, but also to the acceleration and development of smart cities, for example, through intelligent sensor services capable of monitoring various kinds of consumption in real time.

Cellnex Ireland, in collaboration with Bigbelly, a world leader in smart waste and recycling solutions for public spaces, has repurposed litter bins and equipped them for connectivity. The litter bins that Bigbelly has distributed around the Irish capital are solar-powered and include smart services such as usage alerts to speed up collection. With the arrival of Cellnex, these bins house an infrastructure of small cells (small embedded antennas) to improve connectivity in the city and Internet of Things (IoT) applications. Antennas have also been installed in smart streetlights and lamp posts, where the infrastructure remains hidden and installation permits are faster and easier to obtain. The project, a pioneer in Europe, taps into the new concept of universalising telecommunications services as a result of the pandemic.

UNED (National University of Distance Education) has awarded Cellnex a project to optimise the energy efficiency of the air-conditioning and lighting systems of its university campuses through Internet of Things (IoT) technology. The objective is to reduce and optimise energy consumption, especially in empty spaces, maintaining pre-comfort conditions that, in turn, avoid cost overruns by reducing or raising the temperatures of spaces when unoccupied and also avoiding too drastic differences between occupied and unoccupied spaces that prevent them being kept at optimal levels. Cellnex is to equip UNED university campuses with sensors to enable remote data collection and monitoring for real-time control of lighting and air-conditioning systems, thereby cutting energy consumption.

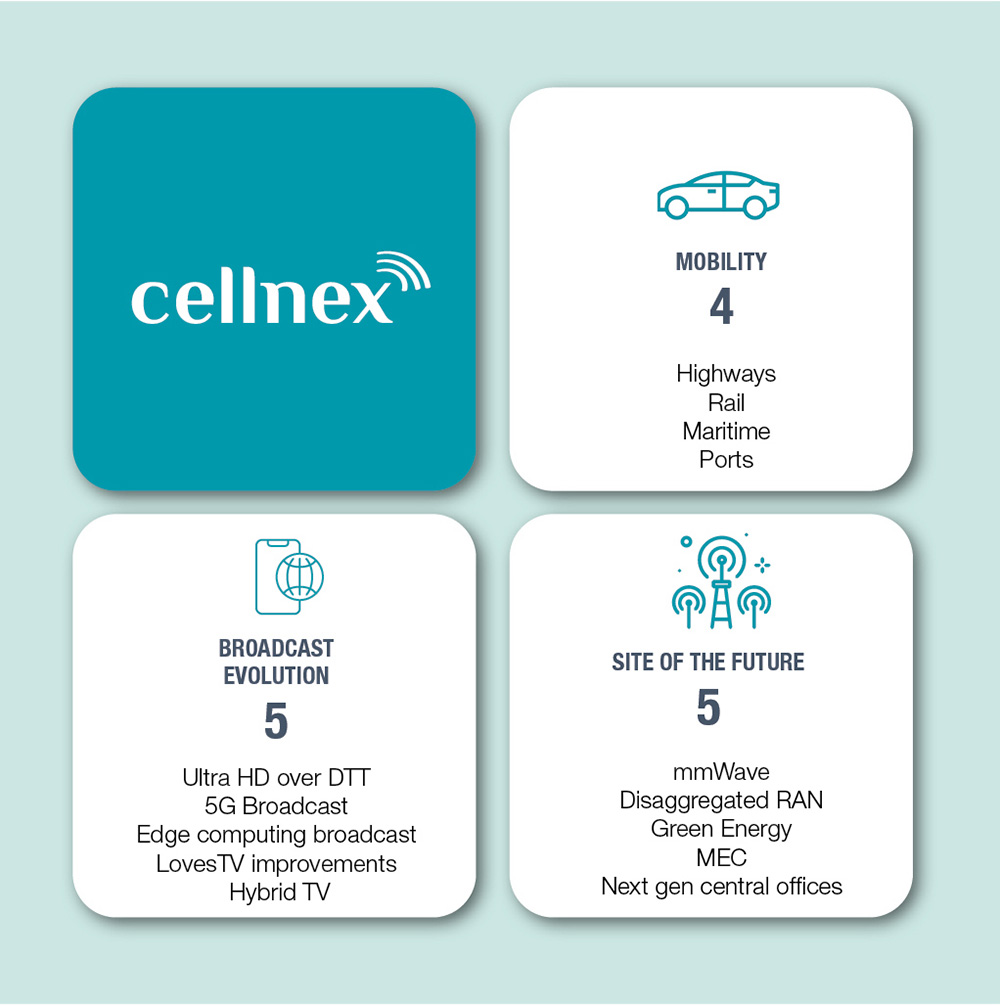

Innovation at Cellnex is led by the Product Strategy and Innovation Department, which is responsible for the following three areas of work:

These areas of work focus on the development of three main types of projects, which are the communications for connected and intelligent infrastructure (e.g. highways, railways, maritime, ports) (Mobility), broadcast and media services (Broadcast evolution) and infrastructure for the future of telecom communications (Site of the future).

In line with this commitment to innovation and technology improvement, Cellnex is investing EUR 4.17 million in the development, testing and launch of new innovative products and solutions in the countries in which Cellnex operates. The main projects developed are presented as follows.

Parlem Telecom together with Cellnex Spain, Lenovo and Red.es, presented a technological solution that will serve to transform the e-commerce of local shops and offer the user a real shopping experience virtually equivalent to the face-to-face shopping that could be experienced in any market or shop.

In 2022, the first use case of the 5G pilot in Catalonia was presented at the Boqueria Market (Barcelona, Spain) to shop online with augmented reality and in real time for products from the merchants of this iconic and famous Barcelona market. In the future, this will make it possible to make purchases from anywhere in the world, making it an immersive shopping experience in which the user will feel as if they were in the shop itself.

Cellnex UK has been selected for grant funding as part of the Department of Digital, Culture, Media and Sport’s Future Radio Access Network Competition (FRANC). The grant will go towards funding a Cellnex UK-led consortium of industry partners that is developing a new software-based platform to create a testbed for both public and private 5G cellular networks deployed in the centre of Bristol as well as providing backhaul over the LEO-Satellite Constellation. The £35 million competition is designed to fund innovative R&D projects to develop Open RAN technology across the UK.

The O-RANOS project will create an architectural blueprint to accelerate development and reduce costs of new product offerings and create new business models for both private and public 5G networks. It plans to demonstrate Open RAN backhaul over a number of transmission methods, including the world’s first demonstration over OneWeb’s LEO-Satellite Constellation, which will extend Open RAN intelligence to the transport network and pave the way for backhaul convergence.

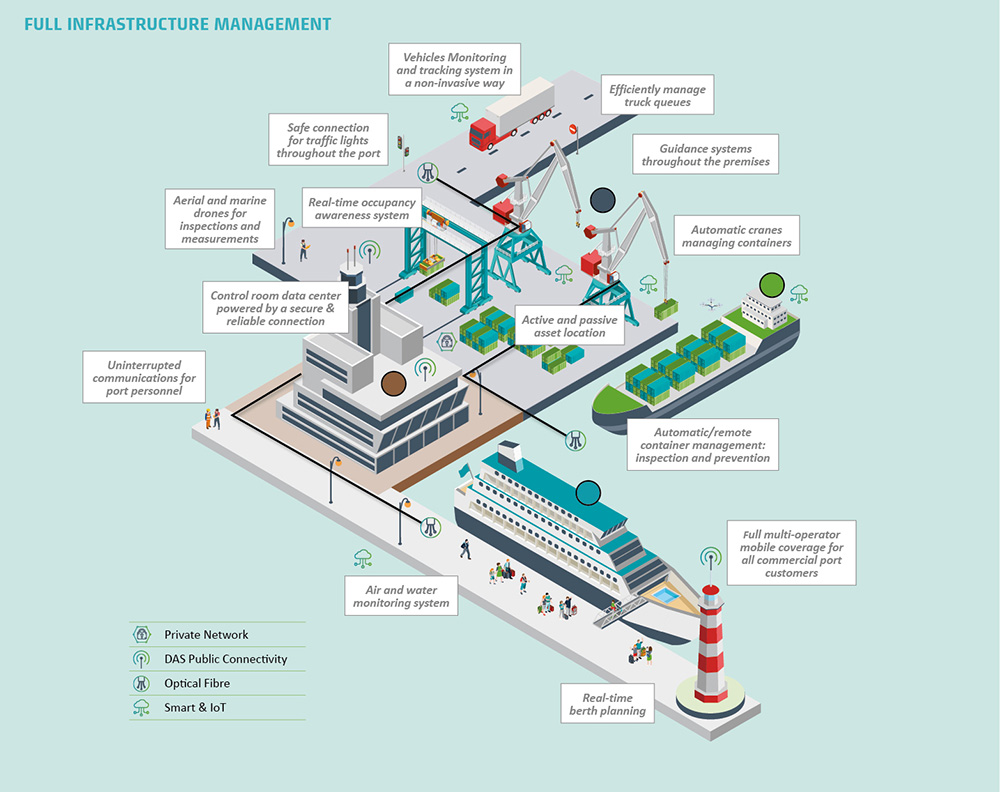

Cellnex contributed to port infrastructures digitalization with the project PORTWIN. Within the scope of this project, the company deployed a network in the frequencies from 2,370 MHz to 2,390 MHz (the n40 band), a frequency band that the Spanish spectrum regulator has recently assigned and reserved to deploy mobile networks for business and industrial use.

The 5G network in the Port of Valencia is standalone (SA), which makes it possible to use all the advantages of the fifth generation of mobile communications, namely ultra-reliable, low-latency communications which provide security, consistency and real-time operation. In addition, massive connectivity between devices ensures that up-to-date sensor information is available at all times.

Ship information is collected in real time using civilian radars based on ultra wideband (UWB) technology. This information, transmitted through the 5G private network reaches the local computing system (edge computing), where complex mathematical algorithms process the signals received in real time. The end result facilitates optimal decision-making for port managers, ensuring maximum safety during berthing manoeuvres.

The bidirectional holographic solution validated by 5G Catalunya made it possible to volumetrically capture the image of a speaker at a remote point and reproduce it in 3D elsewhere via streaming across a private 5G network. The advantages of the innovative 5G technology (high speed and low latency) allow for an immersive two-way video and audio communication experience.

The volumetric system that is used to capture and broadcast the 3D image guarantees nearly real contact with the interlocutor, while the 5G network allows for virtually immediate bidirectional interaction between both remote points, with minimal latency.

The role of Cellnex was providing the 5G access network infrastructure with stand-alone configuration to enable the required streaming connection between both remote points to roll out this demonstration.

Cellnex France has been selected by Paris La Défense as partner to run a 5G mmWave (26Ghz) trial at the heart of this emblematic business district. This project has a two objectives: firstly, to test the feasibility of a neutral host model allowing the sharing of antennas and infrastructures; and secondly, to experiment with new use cases leveraging very-high-speed 26 GHz 5G deployed in La Défense district.

By deploying the small cell infrastructure, that will guarantee unprecedented speeds, Cellnex and Paris La Défense plan to turn La Défense esplanade into a unique playground and experimental area for companies wishing to test use cases.Alongside these experiments open to innovative companies in the field of connectivity, the appeal of deploying 5G mmWave (26 GHz) in Paris La Défense is also to demonstrate the relevance of the neutral host model. A model that guarantees efficient and effective wireless deployment by sharing antennas and infrastructure.

Parvis de La Défense 2021 © Paris La Défense - Sabrina Budon

Parvis de La Défense 2021 © Paris La Défense - Sabrina Budon

Cellnex has been awarded by the European Commission of six projects (4 deployment projects and 2 feasibility studies) to boost 5G infrastructure in European transport corridors, thus benefiting EU citizens and the industry. The deployment projects will cover two cross-border corridors connecting Spain with France and two corridors connecting Spain with Portugal. In addition, the studies include the connection between Italy and Austria and the EUMOB project with Abertis.

The main objective of these projects, which are part of the European Commission's Digital Connecting Europe Facility (CEF-2) programme, is to provide high-quality and uninterrupted 5G connectivity for road safety services, and offer connectivity services to vehicle users and passengers along these corridors. To this end, Cellnex will deploy 34 new telecommunications sites (including DAS in tunnels), in which it plans to work with mobile operators based on its neutral host model, complemented by a V2X communications infrastructure and edge computing nodes to provide connectivity. 5G along the more than 1,400 km of these four cross-border corridors.

The COVID-19 crisis has meant a great disruption in public health, economic and social terms and for its synchronous impact worldwide. This is a disruption such as we have not seen in the past 100 years, precisely because of its global scope, not even during wartime. At the same time though, as a society, digitalisation and connectivity have provided the antidote that has mitigated the impact of this crisis. It is still too early to draw conclusions about what we will have learned and what will be left when we come out of this crisis. Nonetheless, a certainly inescapable fact is the acceleration of digitalisation in our daily lives.

Over the past three years, this has highlighted the need to maintain connectivity, as we all depend on technology to obtain information, observe social distancing, stay in touch with loved ones, and work from home. The maintenance and continuity of Cellnex Group's business has therefore been critical throughout the course of this worldwide pandemic.

Cellnex Group has more than 110,500 infrastructures (towers and communication nodes) throughout Europe that provide mobile network communication, television and radio broadcasting, dedicated communication networks for security and emergency services, and communication and security within the maritime rescue network, among other things. Cellnex connects more than 338 million people in Europe.

Right from the outset of the crisis caused by the COVID-19 pandemic, Cellnex Group has deployed its contingency and business continuity plans in the countries in which it operates. The Group’s main goal has been to preserve the security and availability of the services it provides while also ensuring the strictest protection measures for its employees and co-workers. Furthermore, under the umbrella of the “Cellnex COVID-19 Relief Initiative”, the Group maintains several lines of cooperation to the tune of €10 million with NGOs and various hospitals that are helping to minimise the health, economic, and social impact derived from the pandemic.

In this regard, even though national COVID-19 measures were not as strict throughout 2022, Cellnex professionals continued to work on contingency plans to ensure the proper functioning of telecommunications infrastructures, which in turn has ensured round-the-clock continuity of uninterrupted services throughout the entire COVID-19 pandemic. A specific Global Contingency Plan was drawn up in order to guarantee the continuity of critical services and a Global Crisis Committee, in addition to local crisis committees (which report periodically to the global committee), were set up to monitor the contingency plan and take action based on the current situation.

A number of engineers and technicians, grouped in the Service Operation Center (SOC), are in charge of basic tasks to ensure that services keep operating, with permanent 24/7 assistance, while continuously assessing the state of the networks, data transmission, the operation of DTT and digital radio, and the IT security of Cellnex facilities.

In Spain, the main support centre is the Network Operation Center (NOC), which for security reasons is split across two sites (Madrid and Barcelona). This is a surveillance centre, similar to that of air traffic controllers or large transport networks, which safeguards the services of the network managed by Cellnex in broadcasting activities (DTT television, digital radio, and multimedia services, such as streaming), its own network (self -provisioning services for its own television signal, for example) and third-party network services, for fiber or radio customers, with more than 10,400 sites in Spain.

There are other services that also require uninterrupted communications to which Cellnex has to give very high guarantees of continuity. One of the most important is the Global Maritime Distress and Safety System. This is an essential service to aid maritime navigation. Cellnex provides maritime coverage from its towers from which weather forecasts and navigational warnings are broadcasted, distress calls are received and ships can communicate directly with Salvamento Marítimo.

Cellnex Poland participated in the European Economic Congress in Katowice during which the Director of Transformation and Public Affairs of Cellnex Poland commented through a video interview for the editorial office of SuperBiznes, where the Director of Transformation and Public Affairs of Cellnex Poland commented that “The increase in telecom traffic during the pandemic has stimulated the necessary investments to increase the capacity of telecommunication networks. Consumers have invested in better service packages, better telecommunications deals. We are seeing a positive trend for consumers to appreciate better quality services, for which they can pay more, which also translates into investment opportunities for operators. Thanks to the involvement of companies like Cellnex, who have taken on the burden of investing in shared telecom infrastructure, the cost and risk of expanding this infrastructure is coming down, so this bodes very well for the future when it comes to further development of wireless networks in Poland”.